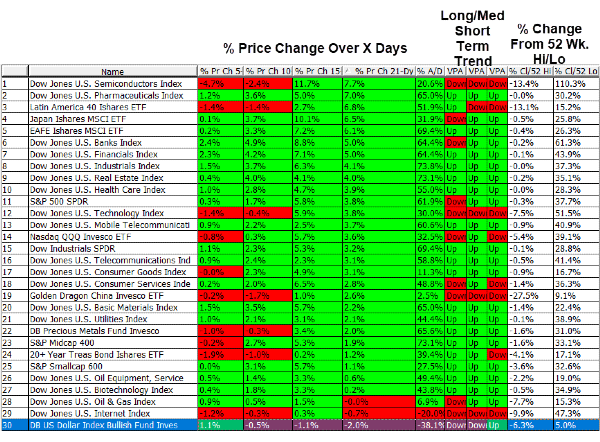

We kicked off September in style! The stock market finally dropped for the week. The S&P 500 finished down 3.91% and is now well below 5,500. We have continued to remain busy despite the decrease. We are always looking for stocks to buy and documenting our journey to Financial Freedom on our Youtube Channel. In this Diplomats Weekly Roundup, we will share with you the content we produced this week so you do not miss any of the action!

Dividend Stock Showdown: 2 high Yielding Pharmaceutical Stocks

Link to Video: Click Here

Release Date: September 7, 2024

Lanny has owned 3 dividend stocks for over a decade. Each of

THREE STOCKS THAT COULD RETIRE YOU!

Link to Video: Click Here

Release Date: September 5, 2024

Lanny has owned 3 dividend stocks for over a decade. The 3 stocks that are owned have grown immensely due to stock appreciation, dividend reinvestment, and dividend growth. Yes, he has benefitted from every dividend investors perfect scenario. With gains that are over 100% for each, he is sharing why these 3 stocks (2 of which are Dividend Aristocrats) are dividend stocks that he could retire on. Hopefully, this inspires you to begin your investing journey NOW and let the power of compounding do its trick.

5 Dividend Stocks that are beating the S&P 500 in 2024

Link to Video: Click Here

Release Date: September 3, 2024

The S&P 500 is on fire in 2024.

We don’t have to tell any of you. The stock market was up over 18% when this video was released. When the stock market booms, people tend to shy away from dividend stocks. They don’t produce massive gains like the AI stocks, tech stocks, or the other trendy stock at the moment….OR DO THEY?! This video features 5 dividend stocks that are beating the S&P 500 and deliver better than market returns to shareholders. Ep 13: Intel’s Shocking News, The $1 Trillion Club & Lanny’s 5 Favorite Wrestlers of ALL TIME!

Link to Video: Click Here

Release Date: September 2, 2024

We release a podcast style video every Monday that is very casual. The goal is to discuss major news stories, random dividend topics, or even viewer submitted questions. In this episode, we discussed Intel’s disastrous announcement that it is considering strategic alternatives, Berkshire Hathaway crossing $1T market cap, the death of Dollar Stores, and Lanny’s Top 5 wrestlers of all time!

$50,000 in Dividend Income…! 🤯 Long-Term Dividend Investing can create THIS Passive Income Stream!

Link to Video: Click Here

Release Date: September 1, 2024

Lanny and his wife are closing in on a huge dividend investing milestone. They are closing in on $50,000 in dividend income. After 10+ years of hard work, extreme frugality, and relentless investing, they are on the doorsteps of $50,000 in passive income. The video breaks down the totals by account type and he shares a target achievement date.

Thank you all for the support over the years. If you have any video suggestions or topics you would like us to cover, just let us know! We want to make sure that we are helping you achieve your goals and dreams as well!

-Lanny and Bert, the Dividend Diplomats

We kicked off September in style! The stock market finally dropped for the week. The S&P 500 finished down 3.91% and is now well below 5,500. We have continued to remain busy despite the decrease. We are always looking for stocks to buy and documenting our journey to Financial Freedom on our Youtube Channel. In this Diplomats Weekly Roundup, we will share with you the content we produced this week so you do not miss any of the action!

Dividend Stock Showdown: 2 high Yielding Pharmaceutical Stocks

Link to Video: Click Here

Release Date: September 7, 2024

Lanny has owned 3 dividend stocks for over a decade. Each of

THREE STOCKS THAT COULD RETIRE YOU!

Link to Video: Click Here

Release Date: September 5, 2024

Lanny has owned 3 dividend stocks for over a decade. The 3 stocks that are owned have grown immensely due to stock appreciation, dividend reinvestment, and dividend growth. Yes, he has benefitted from every dividend investors perfect scenario. With gains that are over 100% for each, he is sharing why these 3 stocks (2 of which are Dividend Aristocrats) are dividend stocks that he could retire on. Hopefully, this inspires you to begin your investing journey NOW and let the power of compounding do its trick.

5 Dividend Stocks that are beating the S&P 500 in 2024

Link to Video: Click Here

Release Date: September 3, 2024

The S&P 500 is on fire in 2024.

We don’t have to tell any of you. The stock market was up over 18% when this video was released. When the stock market booms, people tend to shy away from dividend stocks. They don’t produce massive gains like the AI stocks, tech stocks, or the other trendy stock at the moment….OR DO THEY?! This video features 5 dividend stocks that are beating the S&P 500 and deliver better than market returns to shareholders. Ep 13: Intel’s Shocking News, The $1 Trillion Club & Lanny’s 5 Favorite Wrestlers of ALL TIME!

Link to Video: Click Here

Release Date: September 2, 2024

We release a podcast style video every Monday that is very casual. The goal is to discuss major news stories, random dividend topics, or even viewer submitted questions. In this episode, we discussed Intel’s disastrous announcement that it is considering strategic alternatives, Berkshire Hathaway crossing $1T market cap, the death of Dollar Stores, and Lanny’s Top 5 wrestlers of all time!

$50,000 in Dividend Income…! 🤯 Long-Term Dividend Investing can create THIS Passive Income Stream!

Link to Video: Click Here

Release Date: September 1, 2024

Lanny and his wife are closing in on a huge dividend investing milestone. They are closing in on $50,000 in dividend income. After 10+ years of hard work, extreme frugality, and relentless investing, they are on the doorsteps of $50,000 in passive income. The video breaks down the totals by account type and he shares a target achievement date.

Thank you all for the support over the years. If you have any video suggestions or topics you would like us to cover, just let us know! We want to make sure that we are helping you achieve your goals and dreams as well!

-Lanny and Bert, the Dividend Diplomats

Originally Posted on Dividend Diplomats