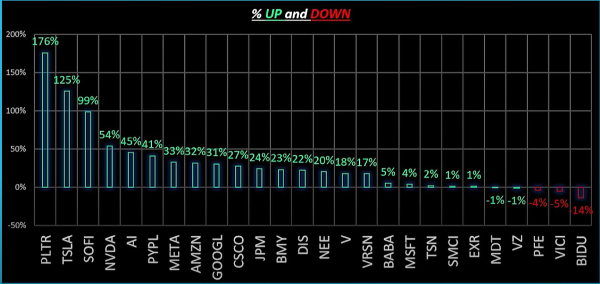

The S&P 500 has had a tough week, with losses across the board. Analyzing these companies reveals that the majority are trading well above their 5-year average valuations. Today, we present four quality stocks to buy, focusing on their margin of safety and current target prices. We'll start with S&P Global.

S&P Global Overview

S&P Global offers financial information, analytics, and credit ratings, helping businesses, investors, and governments make informed decisions. Their services cover a broad range of sectors including finance, economics, and strategic decision-making worldwide.

Company Performance

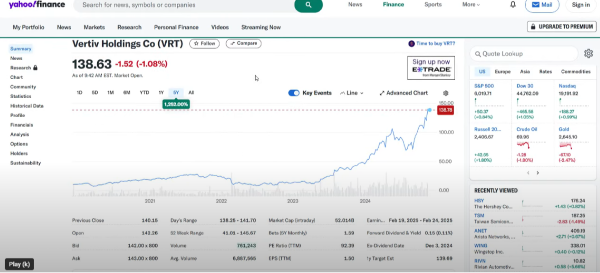

Over the last year, S&P Global's stock has risen by about 11%. Looking at a broader timeline, they've significantly outperformed the S&P 500 over the past decade, with a 433% increase. Currently, the stock is trading around the midpoint of its 52-week range, and it holds a double buy rating from reputable sources like Seeking Alpha and Wall Street. While the company's dividend stands lower at around 75%, their earnings growth prospects are strong, with a 75% track record of beating quarterly earnings estimates and positive earnings per share (EPS) projections for December 2025.

Valuation and Grading

When comparing S&P Global's current P/E ratio of 28.6 to its 5-year average of 30.1, it indicates a reasonable valuation. However, compared to the sector average of 12, the company trades at a premium of 67%. Despite this, their high quality justifies some of the premium.

Grading Breakdown

- Valuation: F

- Growth: A

- Profitability: A

Their revenue growth at above 12% year-on-year and profitability metrics (69% gross margin and 26% bottom line) contribute to strong overall performance.

Institutional Aspects

Institutional investors hold around 87% of S&P Global's shares, with sales over the past year totaling $6.2 billion and buying activity at $8.5 billion, demonstrating strong confidence in the company's prospects.

Valuation Overview

Using a discounted cash flow (DCF) model, the intrinsic value of S&P Global is estimated at $533, indicating an approximate 10% upside. This value can vary with different growth rate assumptions, highlighting the importance of doing your own due diligence.

Key Takeaways

- Strong Market Position: S&P Global is the leader in credit ratings and financial data analytics with a diversified revenue stream.

- Solid Growth: Their steady growth, strong brand recognition, and profitability metrics justify the premium.

- Market Sensitivity: The company is influenced by economic downturns, regulatory changes, and market volatility.

- Regulatory Risks: Valuation concerns and competition from other financial information providers like Moody's and Bloomberg need to be considered.

Considering a margin of safety, S&P Global is a stock to watch with a buy signal around the $453 mark. Dollar-cost averaging might be a strategy to reduce risk given market uncertainties.

Always remember to do your own research and never solely rely on external ratings for investment decisions. What are your thoughts on S&P Global and its prospects? We'd love to hear your insights in the comments below!

https://youtu.be/igNgOm-N7eU?si=nYQNitrtZm8Fn4e4

The S&P 500 has had a tough week, with losses across the board. Analyzing these companies reveals that the majority are trading well above their 5-year average valuations. Today, we present four quality stocks to buy, focusing on their margin of safety and current target prices. We'll start with S&P Global.

S&P Global Overview

S&P Global offers financial information, analytics, and credit ratings, helping businesses, investors, and governments make informed decisions. Their services cover a broad range of sectors including finance, economics, and strategic decision-making worldwide.

Company Performance

Over the last year, S&P Global's stock has risen by about 11%. Looking at a broader timeline, they've significantly outperformed the S&P 500 over the past decade, with a 433% increase. Currently, the stock is trading around the midpoint of its 52-week range, and it holds a double buy rating from reputable sources like Seeking Alpha and Wall Street. While the company's dividend stands lower at around 75%, their earnings growth prospects are strong, with a 75% track record of beating quarterly earnings estimates and positive earnings per share (EPS) projections for December 2025.

Valuation and Grading

When comparing S&P Global's current P/E ratio of 28.6 to its 5-year average of 30.1, it indicates a reasonable valuation. However, compared to the sector average of 12, the company trades at a premium of 67%. Despite this, their high quality justifies some of the premium.

Grading Breakdown

Their revenue growth at above 12% year-on-year and profitability metrics (69% gross margin and 26% bottom line) contribute to strong overall performance.

Institutional Aspects

Institutional investors hold around 87% of S&P Global's shares, with sales over the past year totaling $6.2 billion and buying activity at $8.5 billion, demonstrating strong confidence in the company's prospects.

Valuation Overview

Using a discounted cash flow (DCF) model, the intrinsic value of S&P Global is estimated at $533, indicating an approximate 10% upside. This value can vary with different growth rate assumptions, highlighting the importance of doing your own due diligence.

Key Takeaways

Considering a margin of safety, S&P Global is a stock to watch with a buy signal around the $453 mark. Dollar-cost averaging might be a strategy to reduce risk given market uncertainties.

Always remember to do your own research and never solely rely on external ratings for investment decisions. What are your thoughts on S&P Global and its prospects? We'd love to hear your insights in the comments below!

https://youtu.be/igNgOm-N7eU?si=nYQNitrtZm8Fn4e4