Sea Limited (NYSE: SE) has been an investor favorite, demonstrating remarkable stock price appreciation over the past two years. Initially recommended as a buy around $30 per share, the stock has surged to over $143—a near 5x increase. While the company’s growth story remains compelling, the recent rally raises questions about its current valuation and whether it’s still a good buy at this price point. Let’s dive into the financials, performance metrics, and future prospects of C Limited to determine its investment outlook.

Strong Revenue Growth Drives Performance

One of the primary drivers of Sea Limited’s stock price surge has been its re-acceleration of revenue growth. After experiencing a deceleration in 2023, the company has delivered consecutive quarters of improving revenue growth. This "second derivative" growth—an increase in the rate of revenue growth—is a positive sign that often attracts investor attention.

In tandem with revenue growth, Sea Limited has successfully shifted its focus toward profitability. Operating margins have climbed from -5% in early 2022 to 1.94% today, marking a significant turnaround. This demonstrates the management team’s ability to execute on its strategy of balancing growth with profitability, a crucial factor for long-term success.

Cash Flow and Profitability Metrics Shine

Sea Limited’s cash flow from operations has also shown notable improvement. Currently sitting at 16%, up from 15% in 2022, this metric highlights the company’s ability to convert revenue into operating cash flow. Unlike operating margins, cash flow from operations excludes non-cash expenses such as stock-based compensation and depreciation, providing a clearer view of the company’s financial health.

The company’s return on invested capital (ROIC) has also been on the upswing, albeit from a low base. Improving from -240% to 1% over the past few years, this metric indicates Sea Limited’s increasing efficiency in generating profits from its investments. While the current ROIC is lower than its weighted average cost of capital (WACC) of 12.3%, the trend is encouraging for long-term investors.

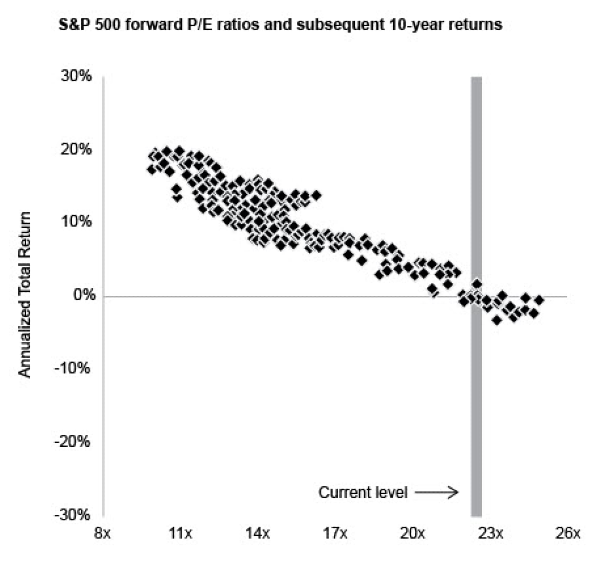

Valuation: A Potential Concern

At its current price of $143 per share, Sea Limited is trading at a forward price-to-earnings (P/E) ratio of 29 and a price-to-free-cash-flow (P/FCF) ratio of 34. For a capital-intensive business reliant on e-commerce and logistics, these valuations are relatively fair but leave little room for error. Moreover, geopolitical factors and the stock’s non-U.S. origin have led to a valuation discount, reflecting investor caution amid rising tariffs and geopolitical tensions.

Using a discounted cash flow (DCF) valuation, the company’s intrinsic value is estimated at $51 per share, significantly below its market price. While Sea Limited boasts $8 billion in cash and short-term investments against $4.4 billion in debt, its valuation metrics suggest that much of its future growth may already be priced in.

Challenges Ahead

Despite its impressive growth and improving financials, Sea Limited faces several risks:

- Capital-intensive model: E-commerce and logistics require substantial investment, limiting the company’s ability to achieve sky-high valuations seen in software-based businesses.

- Geopolitical factors: As a Southeast Asian company, Sea Limited is subject to market discounts due to geopolitical uncertainties.

- Valuation pressure: The rapid share price increase raises concerns about whether the stock can sustain its momentum.

Final Recommendation: Borderline Buy

Sea Limited remains a compelling long-term growth story, thanks to its accelerating revenue growth, expanding margins, and improving cash flow metrics. However, its current valuation and macroeconomic headwinds suggest caution. The stock is being downgraded to a borderline buy, reflecting a more measured outlook.

Investors interested in Sea Limited should weigh the risks of its elevated valuation against its strong growth prospects. While it remains an attractive option for those with a long investment horizon, a near-term pullback could provide a better entry point.

https://youtu.be/XLCw4eiBTDY?si=RcF2v7sS_XW97VGV

Sea Limited (NYSE: SE) has been an investor favorite, demonstrating remarkable stock price appreciation over the past two years. Initially recommended as a buy around $30 per share, the stock has surged to over $143—a near 5x increase. While the company’s growth story remains compelling, the recent rally raises questions about its current valuation and whether it’s still a good buy at this price point. Let’s dive into the financials, performance metrics, and future prospects of C Limited to determine its investment outlook.

Strong Revenue Growth Drives Performance

One of the primary drivers of Sea Limited’s stock price surge has been its re-acceleration of revenue growth. After experiencing a deceleration in 2023, the company has delivered consecutive quarters of improving revenue growth. This "second derivative" growth—an increase in the rate of revenue growth—is a positive sign that often attracts investor attention.

In tandem with revenue growth, Sea Limited has successfully shifted its focus toward profitability. Operating margins have climbed from -5% in early 2022 to 1.94% today, marking a significant turnaround. This demonstrates the management team’s ability to execute on its strategy of balancing growth with profitability, a crucial factor for long-term success.

Cash Flow and Profitability Metrics Shine

Sea Limited’s cash flow from operations has also shown notable improvement. Currently sitting at 16%, up from 15% in 2022, this metric highlights the company’s ability to convert revenue into operating cash flow. Unlike operating margins, cash flow from operations excludes non-cash expenses such as stock-based compensation and depreciation, providing a clearer view of the company’s financial health.

The company’s return on invested capital (ROIC) has also been on the upswing, albeit from a low base. Improving from -240% to 1% over the past few years, this metric indicates Sea Limited’s increasing efficiency in generating profits from its investments. While the current ROIC is lower than its weighted average cost of capital (WACC) of 12.3%, the trend is encouraging for long-term investors.

Valuation: A Potential Concern

At its current price of $143 per share, Sea Limited is trading at a forward price-to-earnings (P/E) ratio of 29 and a price-to-free-cash-flow (P/FCF) ratio of 34. For a capital-intensive business reliant on e-commerce and logistics, these valuations are relatively fair but leave little room for error. Moreover, geopolitical factors and the stock’s non-U.S. origin have led to a valuation discount, reflecting investor caution amid rising tariffs and geopolitical tensions.

Using a discounted cash flow (DCF) valuation, the company’s intrinsic value is estimated at $51 per share, significantly below its market price. While Sea Limited boasts $8 billion in cash and short-term investments against $4.4 billion in debt, its valuation metrics suggest that much of its future growth may already be priced in.

Challenges Ahead

Despite its impressive growth and improving financials, Sea Limited faces several risks:

Final Recommendation: Borderline Buy

Sea Limited remains a compelling long-term growth story, thanks to its accelerating revenue growth, expanding margins, and improving cash flow metrics. However, its current valuation and macroeconomic headwinds suggest caution. The stock is being downgraded to a borderline buy, reflecting a more measured outlook.

Investors interested in Sea Limited should weigh the risks of its elevated valuation against its strong growth prospects. While it remains an attractive option for those with a long investment horizon, a near-term pullback could provide a better entry point.

https://youtu.be/XLCw4eiBTDY?si=RcF2v7sS_XW97VGV