UiPath (NYSE: PATH) has been a rollercoaster for investors over the past year. Initially rated as a buy, the stock has underperformed significantly, leaving many to question its long-term potential. Despite facing several challenges, UiPath shows glimmers of hope with notable improvements in cash flow and operational margins. Here’s a comprehensive look at why the stock has struggled and whether it remains a buy in 2025.

Why Has UiPath Underperformed?

The root of UiPath’s struggles lies in its decelerating revenue growth. In its most recent quarter, the company’s revenue grew by just 9%, dipping below double digits for the first time. This is a stark contrast to the over 20% year-over-year growth it was achieving just two years ago. The slowdown has raised concerns among investors, especially with competition in the automation and AI space intensifying.

Adding to the skepticism is leadership uncertainty. After a brief stint with an external CEO, UiPath’s founder has resumed the role, raising doubts about the company’s long-term strategic direction. Investors generally dislike unplanned leadership changes, and this back-and-forth has only amplified concerns.

A Silver Lining: Cash Flow and Margins

Despite its challenges, UiPath has made significant strides in profitability. Its operating margin has improved to -3%, a drastic turnaround from -40% just a couple of years ago. Additionally, its cash flow from operations has surged to 23%, marking a pivotal shift to being cash flow positive. This reduces the company’s risk profile, as it no longer needs to rely on external funding to sustain operations.

UiPath’s improving return on invested capital (ROIC) also highlights its operational efficiency. While still negative at -4.8%, the metric has seen substantial progress and signals that the company is heading in the right direction.

The Tale of Valuation

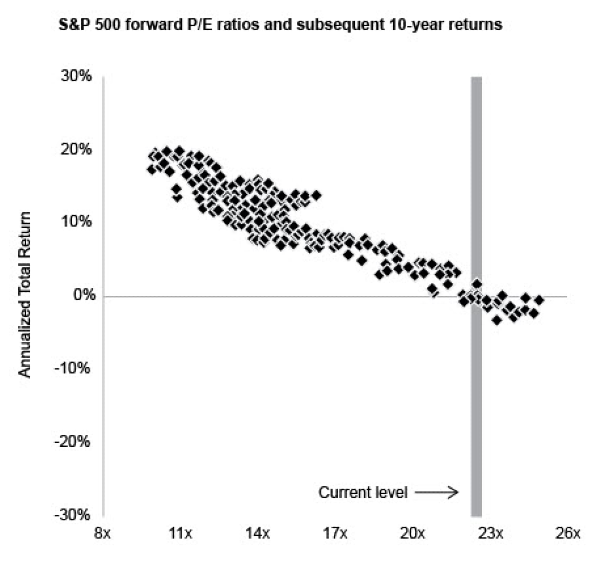

From a valuation perspective, UiPath presents an intriguing opportunity. The stock is currently trading at a price-to-free-cash-flow ratio of 22 and a forward price-to-earnings ratio of 21—its lowest valuation in the past three years. A discounted cash flow (DCF) analysis places UiPath’s intrinsic value at $20 per share, compared to its current market price of $12, suggesting it is undervalued.

However, the possibility of UiPath becoming a value trap—a stock that appears cheap but continues to underperform due to declining prospects—is a risk investors must weigh carefully.

The Path Forward: Risks and Opportunities

UiPath operates in a highly competitive market where advancements in artificial intelligence could either enhance or erode its value proposition. The company must demonstrate its ability to stay ahead by leveraging AI and improving the utility of its automation services. If successful, it could capitalize on the growing demand for solutions that simplify business processes and reduce labor reliance.

Final Recommendation: Reiterating the Buy Rating

While UiPath faces higher-than-average risks, the stock’s improved financial health and discounted valuation make it a compelling, albeit risky, buy. For investors with a long-term horizon and a tolerance for volatility, UiPath offers the potential for significant upside if it can navigate its challenges effectively.

https://youtu.be/TNRoc7CwNFM?si=4WTLGBtyjwD4hitZ

UiPath (NYSE: PATH) has been a rollercoaster for investors over the past year. Initially rated as a buy, the stock has underperformed significantly, leaving many to question its long-term potential. Despite facing several challenges, UiPath shows glimmers of hope with notable improvements in cash flow and operational margins. Here’s a comprehensive look at why the stock has struggled and whether it remains a buy in 2025.

Why Has UiPath Underperformed?

The root of UiPath’s struggles lies in its decelerating revenue growth. In its most recent quarter, the company’s revenue grew by just 9%, dipping below double digits for the first time. This is a stark contrast to the over 20% year-over-year growth it was achieving just two years ago. The slowdown has raised concerns among investors, especially with competition in the automation and AI space intensifying.

Adding to the skepticism is leadership uncertainty. After a brief stint with an external CEO, UiPath’s founder has resumed the role, raising doubts about the company’s long-term strategic direction. Investors generally dislike unplanned leadership changes, and this back-and-forth has only amplified concerns.

A Silver Lining: Cash Flow and Margins

Despite its challenges, UiPath has made significant strides in profitability. Its operating margin has improved to -3%, a drastic turnaround from -40% just a couple of years ago. Additionally, its cash flow from operations has surged to 23%, marking a pivotal shift to being cash flow positive. This reduces the company’s risk profile, as it no longer needs to rely on external funding to sustain operations.

UiPath’s improving return on invested capital (ROIC) also highlights its operational efficiency. While still negative at -4.8%, the metric has seen substantial progress and signals that the company is heading in the right direction.

The Tale of Valuation

From a valuation perspective, UiPath presents an intriguing opportunity. The stock is currently trading at a price-to-free-cash-flow ratio of 22 and a forward price-to-earnings ratio of 21—its lowest valuation in the past three years. A discounted cash flow (DCF) analysis places UiPath’s intrinsic value at $20 per share, compared to its current market price of $12, suggesting it is undervalued.

However, the possibility of UiPath becoming a value trap—a stock that appears cheap but continues to underperform due to declining prospects—is a risk investors must weigh carefully.

The Path Forward: Risks and Opportunities

UiPath operates in a highly competitive market where advancements in artificial intelligence could either enhance or erode its value proposition. The company must demonstrate its ability to stay ahead by leveraging AI and improving the utility of its automation services. If successful, it could capitalize on the growing demand for solutions that simplify business processes and reduce labor reliance.

Final Recommendation: Reiterating the Buy Rating

While UiPath faces higher-than-average risks, the stock’s improved financial health and discounted valuation make it a compelling, albeit risky, buy. For investors with a long-term horizon and a tolerance for volatility, UiPath offers the potential for significant upside if it can navigate its challenges effectively.

https://youtu.be/TNRoc7CwNFM?si=4WTLGBtyjwD4hitZ