What Are StockBossUp’s Core Features

StockBossUp is designed to make investing clearer, smarter, and more community‑driven. Every core feature works toward a simple mission: help new investors learn from proven performers while giving top investors the spotlight they deserve.

At the heart of the platform is our Investor Achievement System — a performance‑based ranking engine that identifies the most successful stock pickers on StockBossUp. When an investor consistently delivers strong, data‑driven stock ratings, we elevate their voice across the platform so more people can benefit from their insight.

The result is a win‑win ecosystem: top investors gain greater visibility for their best ideas, and new investors discover high‑quality stock picks they can trust as they build their portfolios.

How to Share a Stock Rating on StockBossUp

Read More: Getting Started with StockBossUp

Sharing your stock insights on StockBossUp is simple, flexible, and designed to help your ideas reach the right audience. You can rate a stock in three different ways:

- Quick Add

- Stock Post

- Stock Article

1. Quick Add: The Fastest Way to Rate a Stock

Whenever you spot a stock idea on the platform, you’ll see a plus (+) icon next to it. Tap it to instantly add the stock to your watchlist—your rating will automatically match the rating from the original post. It’s the easiest way to participate and keep track of ideas that catch your attention.

2. Stock Posts: Share Your Take in Seconds

Creating a stock post takes just a few steps:

- Search for the stock you want to rate

- Choose your rating (buy, neutral, or sell)

- Add your insight or reasoning

You can enhance your post with tags, images, and YouTube videos to make your analysis more compelling.

Your performance matters too. If you rate a stock a buy and it rises, your post gets boosted in the feed and your investor ranking improves. The same happens if you rate a stock a sell and it drops. Strong calls get rewarded.

3. Stock Articles: Publish Deep-Dive Analysis

For more detailed insights, you can write a full stock article. Just select “Write Article” from the menu. Articles let you:

- Add a cover image and description

- Use markdown for structured formatting like emphasis, lists, and tables

- Include multiple images, YouTube videos, and supporting links

Articles are perfect for long-form research, storytelling, or showcasing your expertise.

Track Your Performance in the Smart Watchlist

All your stock ratings live inside your Smart Watchlist, where you can see how your picks are performing and compare your results with the rest of the community. It’s your personal dashboard for growth, accountability, and bragging rights.

How Investor Achievements Amplify Your Voice on StockBossUp

Read More: Every Investor Achievement and How to Get it

Investor achievements are more than badges—they’re the engine that powers visibility, credibility, and high‑quality conversation across StockBossUp.

As you earn achievements, your reach expands both on and off the platform. This system is our practical, data‑driven way of making sure the strongest, most reliable stock ideas rise to the top where new investors can easily find them.

Investor achievements also shape the tone of the community. Because achievements are earned through long‑term, consistent, gains‑driven stock ratings, they naturally encourage thoughtful analysis over hype. The more you deliver solid insights, the more the system boosts your ideas—creating a feedback loop that elevates quality and filters out noise.

In short, investor achievements help surface the best stock ideas, reward the investors who produce them, and keep the entire conversation focused on what truly matters: performance, consistency, and real investing skill.

Smart Watchlist

The Smart Watchlist on StockBossUp is your personalized command center for tracking investments and discovering stronger stock ideas. As you add stocks, the platform automatically updates your feed with recommendations that complement your portfolio—helping you diversify, find better alternatives, and stay aligned with your long‑term investing goals.

But this watchlist goes far beyond simple tracking. It records every stock rating you’ve made and calculates your estimated annual percentage return, giving you a clear picture of how your ideas are performing. You’ll also see how your results stack up against the entire StockBossUp community.

And when your watchlist performs well, you earn Investor Achievements — powerful boosts that increase the visibility of your stock posts and articles. Strong performance doesn’t just grow your portfolio; it grows your influence across the platform.

Stock Feed

The Stock Feed is your personalized stream of high‑quality investment ideas. It highlights insights from top investors, your financial friends, and stocks that can strengthen your watchlist performance. As your interests evolve, the feed adapts—making sure you always see ideas that match your goals and investing style.

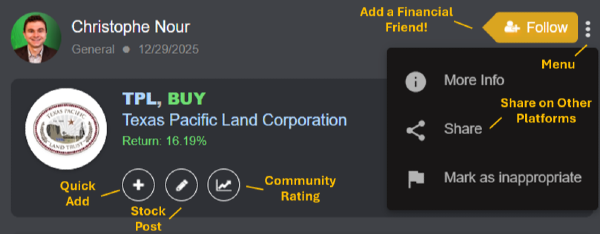

Each post in the feed is packed with ways to engage:

- Tap the plus (+) to quick‑add a stock to your watchlist

- Use the pencil icon to create your own stock post

- Check the chart icon to see how top investors feel about the stock

- Follow an investor to add a new financial friend

- Share posts across your social platforms to spread great ideas

The Stock Feed keeps you connected, informed, and inspired—one smart idea at a time.

Portfolio Doctor

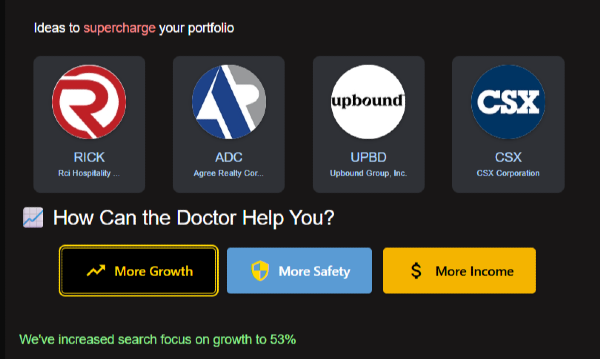

The Portfolio Doctor is your go‑to tool for discovering stocks that match your personal investment goals. Whether you're aiming for growth, income, stability, or a blend of all three, the Portfolio Doctor helps you uncover community‑backed ideas tailored to your strategy.

Simply choose the goal you want to focus on, and the Portfolio Doctor instantly surfaces stock suggestions aligned with that objective. Each time you refine your selection, the recommendations become even more targeted—helping you build a portfolio that reflects your priorities and strengthens your long‑term performance.

It’s a smarter, faster way to find the right stocks for the results you want.

Financial Friends

Read More: How to Follow Financial Friends

Following another member on StockBossUp instantly turns them into a Financial Friend—a trusted voice whose insights you can track, learn from, and compare with your own. It’s one of the most powerful ways to stay connected to the investors who matter most to you.

When you add a Financial Friend, you unlock valuable features:

- A ranked list of all your financial friends

- Full access to their current stock ratings

- A quick view of their latest posts and articles

For investing groups, this feature creates a shared space to compare performance, spark better conversations, and learn from each other’s strengths. Members can adjust their portfolios based on the top performers in the group, making collaboration both fun and productive.

For new investors, Financial Friends offer something even more important: clarity. You can follow your favorite investors and get an honest, performance‑based look at their stock ideas. It’s a simple way to build confidence and start investing with insights that genuinely support your long‑term wealth.

Top Stock List

Read More: Top Stock Lists you can Reach with Investor Achievements

StockBossUp’s Top Stock Lists are built on performance—not opinions. Instead of relying on an editorial board, a detached analyst, or a random voice online, every list is powered by real, data‑driven stock ratings from the community.

When you browse a Top Stock List, you’re seeing the strongest ideas within that specific category, backed by the investors who consistently deliver results. Categories span market cap, industry sectors, and popular investing themes like dividends, value, and more.

These lists surface the investment ideas that have proven themselves—so you can spend less time guessing and more time investing with confidence.

Stock Ratings

Stock Ratings on StockBossUp give you a clear, data‑driven snapshot of how top investors view any stock on the platform. When you click a stock’s name, symbol, or image, you’ll land on the Stock Rating screen, where all the buy and sell ratings from our highest‑performing investors are combined into one easy‑to‑understand score.

Each rating includes the detailed analysis behind those calls, giving you the context you need to dig deeper and make informed decisions. It’s a powerful way to see how experienced investors interpret the stock’s potential—before you commit your money.

Before making your next investment, check the stock’s rating on StockBossUp to ensure you’re backed by trusted insight and real performance data.

SBU100

The SBU100 is StockBossUp’s commitment to transparency, honesty, and real performance. Instead of relying on theories or back‑tested models, the SBU100 reflects the actual, forward‑looking stock ideas chosen most frequently by the top investors in our community.

This community‑driven index updates in real time, giving you a clear, unfiltered view of how the collective wisdom of high‑performing investors stacks up against the market. We display the SBU100 performance side‑by‑side with the S&P 500—mirroring how you would experience returns if you invested in the index yourself.

See the SBU100 performance side-by-side with the S&P 500

Because the SBU100 is built from the strongest ideas on the platform, it reinforces our mission: surface the best stock analysis in your feed and across the entire community. It’s a living benchmark of what our top investors truly believe in, powered by real decisions and real results.

Final Thoughts

StockBossUp brings together the tools, insights, and community support that modern investors need to grow with confidence. Every feature—from the Smart Watchlist to Investor Achievements—works toward a single purpose: helping you discover high‑quality stock ideas backed by real performance, not hype.

Whether you're just starting your investing journey or sharpening an already strong strategy, StockBossUp gives you a clearer path forward. You can learn from top investors, track your progress, share your insights, and build a portfolio aligned with your goals—all within a community that values transparency, consistency, and long‑term success.

At the end of the day, great investing isn’t about guessing. It’s about learning from proven ideas, making informed decisions, and surrounding yourself with people who elevate your thinking. StockBossUp is here to make that journey easier, smarter, and far more rewarding.

What Are StockBossUp’s Core Features

StockBossUp is designed to make investing clearer, smarter, and more community‑driven. Every core feature works toward a simple mission: help new investors learn from proven performers while giving top investors the spotlight they deserve.

At the heart of the platform is our Investor Achievement System — a performance‑based ranking engine that identifies the most successful stock pickers on StockBossUp. When an investor consistently delivers strong, data‑driven stock ratings, we elevate their voice across the platform so more people can benefit from their insight.

The result is a win‑win ecosystem: top investors gain greater visibility for their best ideas, and new investors discover high‑quality stock picks they can trust as they build their portfolios.

How to Share a Stock Rating on StockBossUp

Sharing your stock insights on StockBossUp is simple, flexible, and designed to help your ideas reach the right audience. You can rate a stock in three different ways:

1. Quick Add: The Fastest Way to Rate a Stock

Whenever you spot a stock idea on the platform, you’ll see a plus (+) icon next to it. Tap it to instantly add the stock to your watchlist—your rating will automatically match the rating from the original post. It’s the easiest way to participate and keep track of ideas that catch your attention.

2. Stock Posts: Share Your Take in Seconds

Creating a stock post takes just a few steps:

You can enhance your post with tags, images, and YouTube videos to make your analysis more compelling.

Your performance matters too. If you rate a stock a buy and it rises, your post gets boosted in the feed and your investor ranking improves. The same happens if you rate a stock a sell and it drops. Strong calls get rewarded.

3. Stock Articles: Publish Deep-Dive Analysis

For more detailed insights, you can write a full stock article. Just select “Write Article” from the menu. Articles let you:

Articles are perfect for long-form research, storytelling, or showcasing your expertise.

Track Your Performance in the Smart Watchlist

All your stock ratings live inside your Smart Watchlist, where you can see how your picks are performing and compare your results with the rest of the community. It’s your personal dashboard for growth, accountability, and bragging rights.

How Investor Achievements Amplify Your Voice on StockBossUp

Investor achievements are more than badges—they’re the engine that powers visibility, credibility, and high‑quality conversation across StockBossUp.

As you earn achievements, your reach expands both on and off the platform. This system is our practical, data‑driven way of making sure the strongest, most reliable stock ideas rise to the top where new investors can easily find them.

Investor achievements also shape the tone of the community. Because achievements are earned through long‑term, consistent, gains‑driven stock ratings, they naturally encourage thoughtful analysis over hype. The more you deliver solid insights, the more the system boosts your ideas—creating a feedback loop that elevates quality and filters out noise.

In short, investor achievements help surface the best stock ideas, reward the investors who produce them, and keep the entire conversation focused on what truly matters: performance, consistency, and real investing skill.

Smart Watchlist

The Smart Watchlist on StockBossUp is your personalized command center for tracking investments and discovering stronger stock ideas. As you add stocks, the platform automatically updates your feed with recommendations that complement your portfolio—helping you diversify, find better alternatives, and stay aligned with your long‑term investing goals.

But this watchlist goes far beyond simple tracking. It records every stock rating you’ve made and calculates your estimated annual percentage return, giving you a clear picture of how your ideas are performing. You’ll also see how your results stack up against the entire StockBossUp community.

And when your watchlist performs well, you earn Investor Achievements — powerful boosts that increase the visibility of your stock posts and articles. Strong performance doesn’t just grow your portfolio; it grows your influence across the platform.

Stock Feed

The Stock Feed is your personalized stream of high‑quality investment ideas. It highlights insights from top investors, your financial friends, and stocks that can strengthen your watchlist performance. As your interests evolve, the feed adapts—making sure you always see ideas that match your goals and investing style.

Each post in the feed is packed with ways to engage:

The Stock Feed keeps you connected, informed, and inspired—one smart idea at a time.

Portfolio Doctor

The Portfolio Doctor is your go‑to tool for discovering stocks that match your personal investment goals. Whether you're aiming for growth, income, stability, or a blend of all three, the Portfolio Doctor helps you uncover community‑backed ideas tailored to your strategy.

Simply choose the goal you want to focus on, and the Portfolio Doctor instantly surfaces stock suggestions aligned with that objective. Each time you refine your selection, the recommendations become even more targeted—helping you build a portfolio that reflects your priorities and strengthens your long‑term performance.

It’s a smarter, faster way to find the right stocks for the results you want.

Financial Friends

Following another member on StockBossUp instantly turns them into a Financial Friend—a trusted voice whose insights you can track, learn from, and compare with your own. It’s one of the most powerful ways to stay connected to the investors who matter most to you.

When you add a Financial Friend, you unlock valuable features:

For investing groups, this feature creates a shared space to compare performance, spark better conversations, and learn from each other’s strengths. Members can adjust their portfolios based on the top performers in the group, making collaboration both fun and productive.

For new investors, Financial Friends offer something even more important: clarity. You can follow your favorite investors and get an honest, performance‑based look at their stock ideas. It’s a simple way to build confidence and start investing with insights that genuinely support your long‑term wealth.

Top Stock List

Read More: Top Stock Lists you can Reach with Investor Achievements

StockBossUp’s Top Stock Lists are built on performance—not opinions. Instead of relying on an editorial board, a detached analyst, or a random voice online, every list is powered by real, data‑driven stock ratings from the community.

When you browse a Top Stock List, you’re seeing the strongest ideas within that specific category, backed by the investors who consistently deliver results. Categories span market cap, industry sectors, and popular investing themes like dividends, value, and more.

These lists surface the investment ideas that have proven themselves—so you can spend less time guessing and more time investing with confidence.

Stock Ratings

Stock Ratings on StockBossUp give you a clear, data‑driven snapshot of how top investors view any stock on the platform. When you click a stock’s name, symbol, or image, you’ll land on the Stock Rating screen, where all the buy and sell ratings from our highest‑performing investors are combined into one easy‑to‑understand score.

Each rating includes the detailed analysis behind those calls, giving you the context you need to dig deeper and make informed decisions. It’s a powerful way to see how experienced investors interpret the stock’s potential—before you commit your money.

Before making your next investment, check the stock’s rating on StockBossUp to ensure you’re backed by trusted insight and real performance data.

SBU100

The SBU100 is StockBossUp’s commitment to transparency, honesty, and real performance. Instead of relying on theories or back‑tested models, the SBU100 reflects the actual, forward‑looking stock ideas chosen most frequently by the top investors in our community.

This community‑driven index updates in real time, giving you a clear, unfiltered view of how the collective wisdom of high‑performing investors stacks up against the market. We display the SBU100 performance side‑by‑side with the S&P 500—mirroring how you would experience returns if you invested in the index yourself.

Because the SBU100 is built from the strongest ideas on the platform, it reinforces our mission: surface the best stock analysis in your feed and across the entire community. It’s a living benchmark of what our top investors truly believe in, powered by real decisions and real results.

Final Thoughts

StockBossUp brings together the tools, insights, and community support that modern investors need to grow with confidence. Every feature—from the Smart Watchlist to Investor Achievements—works toward a single purpose: helping you discover high‑quality stock ideas backed by real performance, not hype.

Whether you're just starting your investing journey or sharpening an already strong strategy, StockBossUp gives you a clearer path forward. You can learn from top investors, track your progress, share your insights, and build a portfolio aligned with your goals—all within a community that values transparency, consistency, and long‑term success.

At the end of the day, great investing isn’t about guessing. It’s about learning from proven ideas, making informed decisions, and surrounding yourself with people who elevate your thinking. StockBossUp is here to make that journey easier, smarter, and far more rewarding.