The Top Electric Utilities in the U.S. and Their Dividend Yield

- 1). American Electric Power Company (AEP) – 3.60%

- 2). NextEra Energy (NEE) – 2.37%

- 3). Duke Energy Corporation (DUK) – 4.43%

- 4). Dominion Energy (D) – 4.01%

- 5). The Southern Company (SO) – 2.72%

- 6). Exelon (EXC) – 3.60%

- 7). National Grid PLC (NGG) – 6.33%

- 8). Sempra Energy (SRE) – 3.24%

- 9). Entergy (ETR) – 3.91%

- 10). NRG Energy (NRG) – 3.26%

- 11). Edison International (EIX) – 4.88%

- 12). AES Corporation (AES) – 2.71%

- 13). PPL Corporation (PPL) – 3.54%

- 14). CenterPoint Energy (CNP) – 2.67%

What are the best electric utility stocks to buy?

- 5-Year APR – 3.45% (8th)

- Volatility – 1.47% (1st)

- Drawdown – -32.91% (1st)

- Total States - 11 (3rd)

- Total Customers – 5.5 million (9th)

- Dividend – 3.60% (6th)

American Electric Power grabs the top spot thanks to its low volatility, healthy dividend, and consistent price appreciation. So what makes AEP different from the other utilities? It looks like the difference comes down to the vision they see for AEP and committing to that vision. Their commitment to stakeholders is focused on stability and sustainability. Also, after reviewing numerous analyst presentations and company history, one commitment stands out on AEP’s analyst presentation:

“Active Management of the AEP Portfolio with the Primary Objective to De-risk and Simplify Our Business”

This may sound like a cookie-cutter response, but looking at other utility companies, you can see that a utility’s business can get cluttered with a mix of transmission, natural gas, consulting, and electricity generation. The company’s sell of their Kentucky Operations looks to be in line with their commitment to renewable energy while the capital from the sell will be used to bolster their transmission business.

As AEP’s analyst presentation points out:

“AEP is a pure play regulated utility”

They are focused on operational stability, power generation, power transmission, and renewable energy.

- 5-Year APR – 17.90% (2nd)

- Volatility – 1.67% (6th)

- Drawdown – -35.63% (3rd)

- Total States - 14 (2nd)

- Total Customers – 12 million (3rd)

- Dividend – 2.37% (14th)

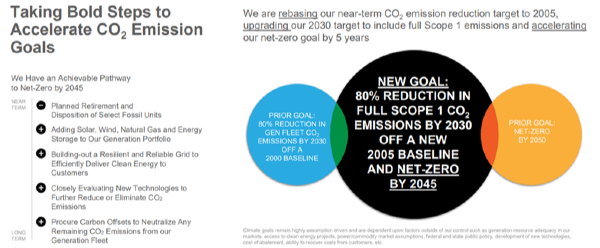

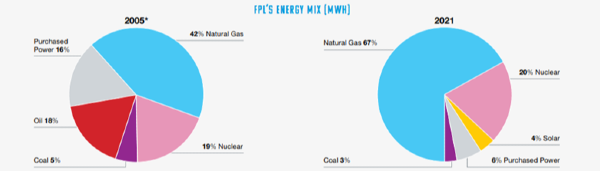

NextEra Energy stands out for its dedication to sustainable energy and its easy reporting for fixed income investors

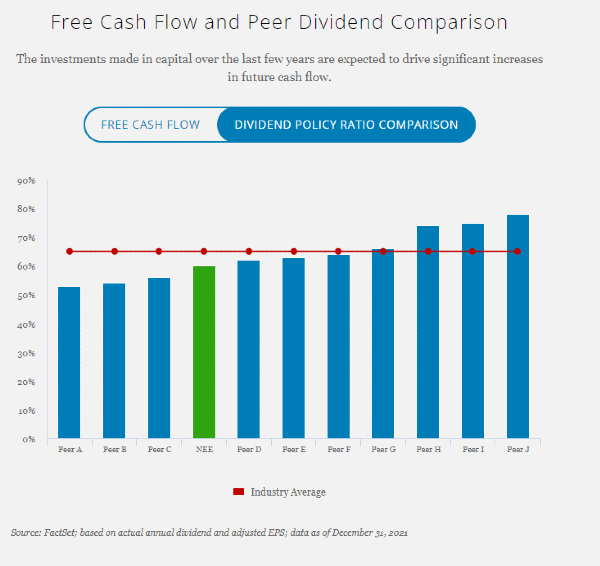

NextEra has proven they have pushed to renewable energies as seen in the energy mix below. Since you cannot be sure how purchased power was generated, NextEra has pushed down purchased power by 10%. They have eliminated oil and replaced it with natural gas and have now incorporated Solar power at a significant percentage.

There investor relations is unique with a whole page dedicated to income investor relations.

Their dividend policy is clearly shown in the page and compared to their industry peers. This shows a clear sign that they provide what their stakeholders are looking for:

- 5-Year APR – 0.67% (9th)

- Volatility – 1.50% (2nd)

- Drawdown – -37.37% (4th)

- Total States - 6 (7th)

- Total Customers – 8.2 million (6th)

- Dividend – 4.43% (3rd)

Duke Energy comes in at 3rd place by having low price volatility and a high dividend. Its 5-year APR is stagnant at 0.67% but it has a silver-lining in that it’s not negative. Duke Energy’s dividend policy states:

“The company remains committed to annual growth in the dividend, subject to the discretion and approval of the Board of Directors. Duke Energy's long-term dividend payout ratio target is between 65 and 75%.”

This is slightly higher than AEP’s dividend policy of roughly 60% and may partially be a causation of its stock price stagnation as capital projects do not have a high funding rate. Looking at capital projects, Duke Energy spent ~$10 billion on capital expenditure in 2021. This cost was offset by its issuance of $11 Billion in debt.

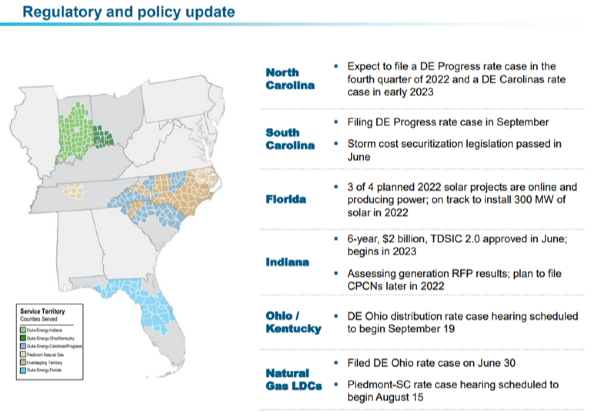

Duke energy emphasized their regulatory and management update with a State-by-State rundown in their earnings presentation:

Duke Energy looks to be on top of both State and Federal regulatory policies and their focus on renewable energies.

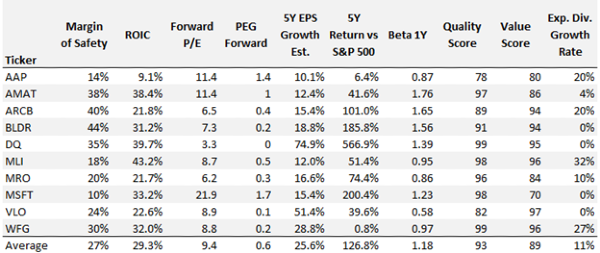

Comparing the rest of the Electric Companies

You can see our comparison for the best electric utility companies down in this chart:

Source: See references

How We Objectively Ranked These Electric Stocks

We ranked the top Electric Utility Companies by six criteria, similar to our article on water utility companies. Our six criteria are:

- 5-year annual percentage return (APR) – We expect Utilities to grow steadily over long spans of time. If they do not, then their dividend is negated by a drop in share price.

- 5-year volatility – standard deviation - Standard deviation measures the spread of daily changes in stock price. Investors are looking for stability when they invest in Utilities. Wide swings in price indicate price volatility and investor uncertainty.

- 5-year volatility – Draw Down - Drawdown is the largest drop a stock has fallen from a localized peak. This is the worst-case scenario loss you would have endured in the last 5 years. Investors expect smaller drawdowns from safe stocks.

- Revenue Diversity – States Utility Operates in - Utilities face regulations from different governing bodies. By operating in multiple locations, the Utility can diversify risk from State specific regulations. Some Utilities have additional regulation diversification by operating outside of the United States; however, we did not take countries into account as other countries have risks outside of just regulation including nationalization of the Utility, government acquisition of shareholder stocks, and governmental interference in Utility operation.

- Revenue Diversity – Total Customers Served - Utilities face different outages due to weather events, transmission projects, and problems at power generation plants. By having more customers, the Utility can diversify these risks across different regions.

- Dividend Rate of Return - Dividend return is of critical importance to investor using utilities to generate income. If you’re looking for the best dividend stocks, check out our top dividend stocks list

How to find the best electric utility stocks?

To find more insight on electric utility stocks, check out our top utility stock page. Our top utility stock page uses a more advance criteria system to find the top stock analysis from our platform. Our algorithms conduct performance, volatility and diversification checks on all of our stock analysts to showcase only the best utility stocks.

Need more information on utilities? Check out these helpful articles:

Is the Power Sector a Good Investment?

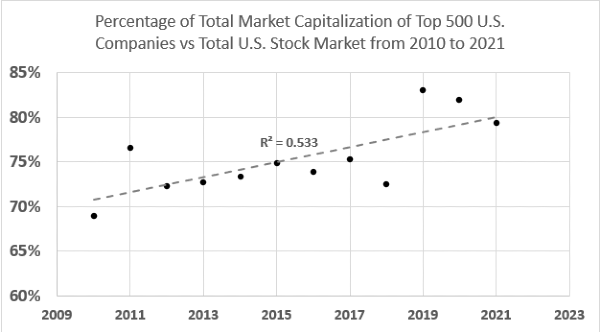

The power sector is a great place to invest as an income investor. When comparing utilities to the broader market, utilities have objectively lower draw downs and volatility. Investing in the power sector has its drawbacks as the broader market has performed better in the last 10 years versus utilities.

Why are Power Stocks Growing?

After analyzing these multiple companies, certain power stocks are growing because:

- They are managing their dividend policy. A good policy keeps some cash for capital projects while still providing stakeholders consistent income.

- They are investing in renewable energies, reducing exposure to more volatile energy markets like coal, oil, and natural gas.

- They have a strong focus within their company on their core business.

- During market sell-offs, investors are moving into more stable utilities.

Can you buy stocks in electricity?

When you invest in electricity, you can invest in electricity power providers or in products that use electrical power. Electric vehicles are the most common electrical product investors search for. Historically though, investing in electricity is associated with utilities that provide electricity.

What are Electric Utility Stocks?

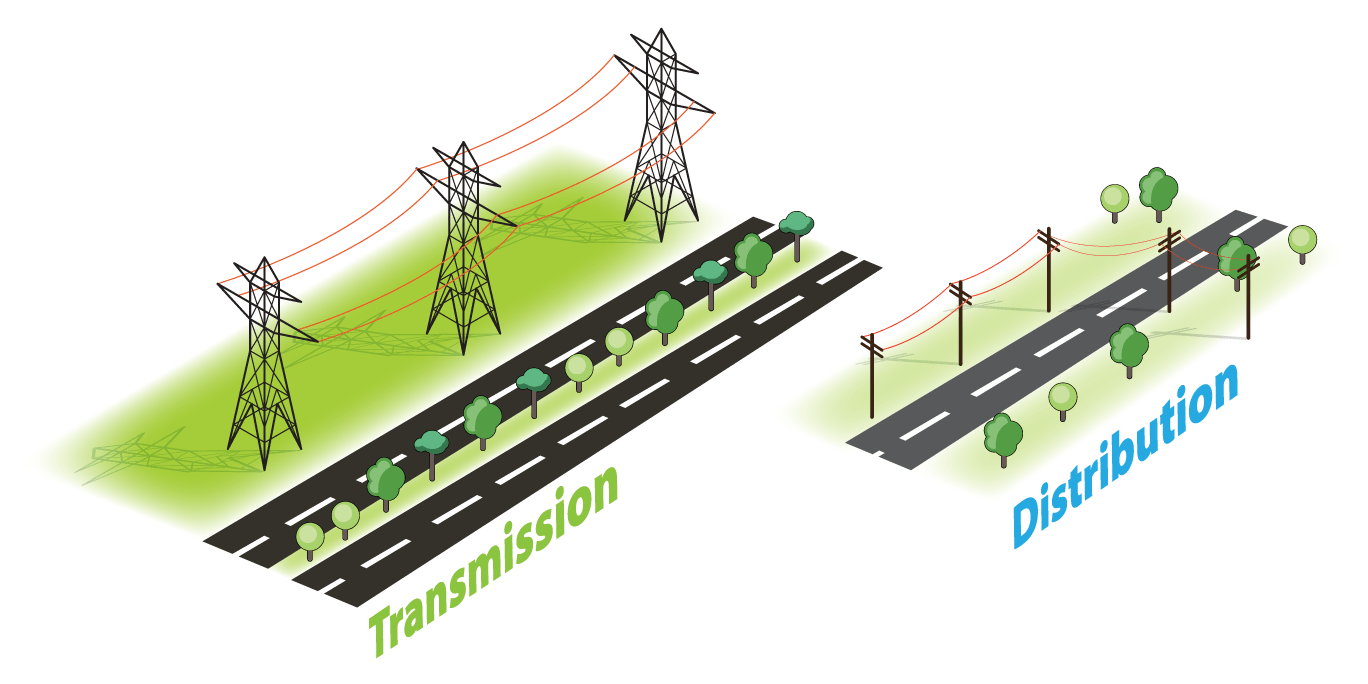

Electric utilities provide electricity to businesses, residents, and government institutions like military bases. Providing electricity is a multi-step process. Some utilities own a part of this process or another process like natural gas or water. Sempra Energy, for example, is heavily diversified into the transmission of natural gas.

Providing electric is fulfilled in three parts

- Power Distribution – Power distribution lines bring electricity to the end-user. A step-down voltage transformer is used to lower the voltage that is coming into the end user. The utility company that owns the power distribution also manages customers. They work with businesses to fulfill electrical hookup needs. They also manage the payment for electricity from the end-user.

References

The Top Electric Utilities in the U.S. and Their Dividend Yield

What are the best electric utility stocks to buy?

1). American Electric Power (AEP)

“Active Management of the AEP Portfolio with the Primary Objective to De-risk and Simplify Our Business”

Source: AEP Analyst Presentation, slide 13

This may sound like a cookie-cutter response, but looking at other utility companies, you can see that a utility’s business can get cluttered with a mix of transmission, natural gas, consulting, and electricity generation. The company’s sell of their Kentucky Operations looks to be in line with their commitment to renewable energy while the capital from the sell will be used to bolster their transmission business. As AEP’s analyst presentation points out:

“AEP is a pure play regulated utility”

They are focused on operational stability, power generation, power transmission, and renewable energy.

Source: AEP Analyst Presentation, Slide 7

2).NextEra Energy (NEE)

NextEra Energy stands out for its dedication to sustainable energy and its easy reporting for fixed income investors

NextEra has proven they have pushed to renewable energies as seen in the energy mix below. Since you cannot be sure how purchased power was generated, NextEra has pushed down purchased power by 10%. They have eliminated oil and replaced it with natural gas and have now incorporated Solar power at a significant percentage.

There investor relations is unique with a whole page dedicated to income investor relations.

Their dividend policy is clearly shown in the page and compared to their industry peers. This shows a clear sign that they provide what their stakeholders are looking for:

Source: NextEra Energy Fixed Income Investors Relations

3). Duke Energy (DUK)

Duke Energy comes in at 3rd place by having low price volatility and a high dividend. Its 5-year APR is stagnant at 0.67% but it has a silver-lining in that it’s not negative. Duke Energy’s dividend policy states:

“The company remains committed to annual growth in the dividend, subject to the discretion and approval of the Board of Directors. Duke Energy's long-term dividend payout ratio target is between 65 and 75%.”

This is slightly higher than AEP’s dividend policy of roughly 60% and may partially be a causation of its stock price stagnation as capital projects do not have a high funding rate. Looking at capital projects, Duke Energy spent ~$10 billion on capital expenditure in 2021. This cost was offset by its issuance of $11 Billion in debt. Duke energy emphasized their regulatory and management update with a State-by-State rundown in their earnings presentation:

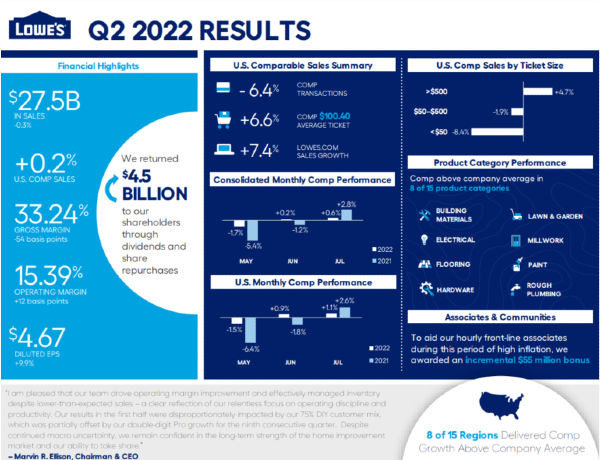

Source: Duke Energy Q2 Earnings Presentation

Duke Energy looks to be on top of both State and Federal regulatory policies and their focus on renewable energies.

Comparing the rest of the Electric Companies

You can see our comparison for the best electric utility companies down in this chart:

Source: See references

How We Objectively Ranked These Electric Stocks

We ranked the top Electric Utility Companies by six criteria, similar to our article on water utility companies. Our six criteria are:

How to find the best electric utility stocks?

To find more insight on electric utility stocks, check out our top utility stock page. Our top utility stock page uses a more advance criteria system to find the top stock analysis from our platform. Our algorithms conduct performance, volatility and diversification checks on all of our stock analysts to showcase only the best utility stocks. Need more information on utilities? Check out these helpful articles:

Is the Power Sector a Good Investment?

The power sector is a great place to invest as an income investor. When comparing utilities to the broader market, utilities have objectively lower draw downs and volatility. Investing in the power sector has its drawbacks as the broader market has performed better in the last 10 years versus utilities.

Why are Power Stocks Growing?

After analyzing these multiple companies, certain power stocks are growing because:

Can you buy stocks in electricity?

When you invest in electricity, you can invest in electricity power providers or in products that use electrical power. Electric vehicles are the most common electrical product investors search for. Historically though, investing in electricity is associated with utilities that provide electricity.

What are Electric Utility Stocks?

Electric utilities provide electricity to businesses, residents, and government institutions like military bases. Providing electricity is a multi-step process. Some utilities own a part of this process or another process like natural gas or water. Sempra Energy, for example, is heavily diversified into the transmission of natural gas. Providing electric is fulfilled in three parts

Source: atcllc.com

Source: ysgsolar.com

References