Is JP Morgan Chase (JPM) a Buy?

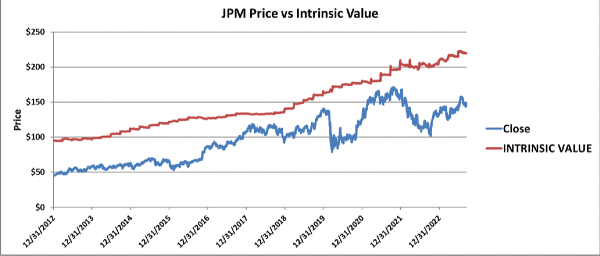

JPM is a buy as of Q3 2023. The estimated 2-year return from the recent price is 21.8%. The stock is estimated to be undervalued at $130 and overvalued at $190.

The quality of the company, which has been shown through its leadership and results, makes it a potential candidate to use a dollar-cost average strategy. This is due to a consistent growth in intrinsic value spurned by consistent earnings and book value growth.

JPM Intrinsic Value

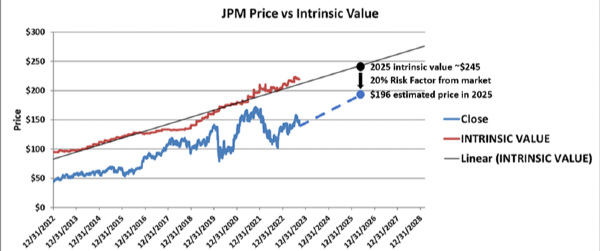

JP Morgan’s intrinsic value is estimated to be $219.54. The market has placed a significant risk factor on JPM since 2009. This risk factor keeps JPM’s stock price 20% below intrinsic value.

JPM Future Earnings

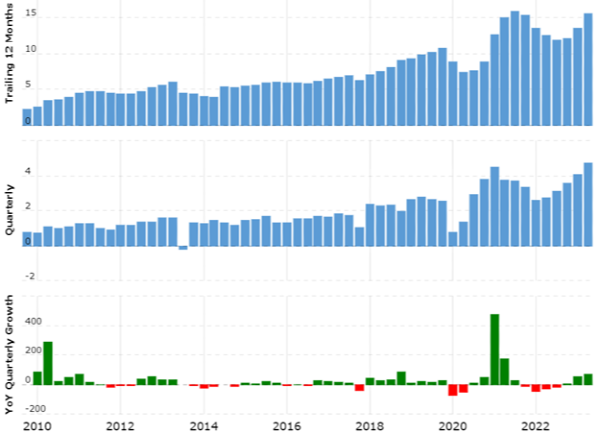

Future earnings look strong with no expectation that earnings will slow. The board of directors are confident enough in their earnings to increase the dividend to $1.05 per share in Q4. This is up 5% from last quarter.

In Q2 2023, ROTCE (return on average tangible common shareholders’ equity) hit 25%. The bank was able to surpass its investor day 2022 goal of 17% in the previous quarter Q2. This is a sign that the bank is effectively using their equity to create returns.

On the second quarter conference call, analysts asked if JPM would consider conducting stock buybacks in the future. The executive team said this was unlikely. This makes sense, as if the firm can make a 25% return on equity, it means they are finding effective ways of using the capital they are generating.

Source: macrotrends.net, historical EPS of JPM.

Interestingly, their previous quarter result of $4.75 EPS was an all-time record for the firm, with the previous record set post-pandemic in Q1 2021 of $4.50 EPS.

JPM Book Value

Book value per share stands at an incredible $98.11 per share. Tangible book value per share increased to $79.90 per share. Revenue and earnings were healthy from the buyout of First Republic, so intangible assets from Goodwill shouldn’t be a significant future write off on book value.

The fortress balance sheet was relatively unchanged quarter over quarter. In general, a fortress balance sheet has good levels of cash and other assets with low debts to accommodate sudden shocks to the business.

Learn more: The basics of a fortress balance sheet

JPM Risk Factor

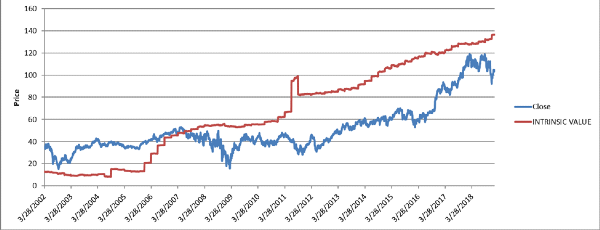

Since the 2009 financial crisis, the markets have placed on banks a risk factor that has continued to this day. This can clearly be seen when you compare JPM’s price versus its intrinsic value before and after the 2009 financial crisis. In 2007, JP Morgan Chase enjoyed a premium given to it by the market. The premium jutted down after 2009 into a risk factor which has been consistent to this day.

Is JPM Undervalued?

JP Morgan is trading below its current fair market value. The stock is not fully undervalued; however, due to its continued growth and appreciating intrinsic value, the price is estimated to grow 21.8% in the next two years. The stock is likely to be undervalued if the price falls to $140 per share. At this price, it would be 36% below its intrinsic value. In the last decade, the bank’s price has always appreciated in the following 2-year period when its price is 36% below intrinsic value.

Why is J.P. Morgan a Good Stock to Buy?

One of JP Morgan’s biggest benefit is a “too big to fail” status as the country’s largest bank by market capitalization. JP Morgan is significantly intertwined with the financing of the U.S. economy and abroad.

The bank’s focus on a “fortress balance sheet” has created a strong culture of risk management at the bank. The management of risk is ultimately the role of banks. Highlighting the “fortress balance sheet”, and hence risk management, on page 5 of their earnings presentation showcases a strong focus on risk management.

Currently, the bank believes it can absorb $494 billion in losses.

JPM Stock Forecast

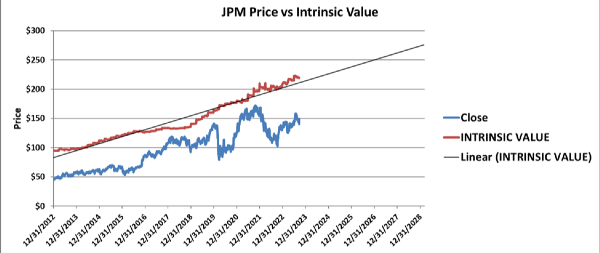

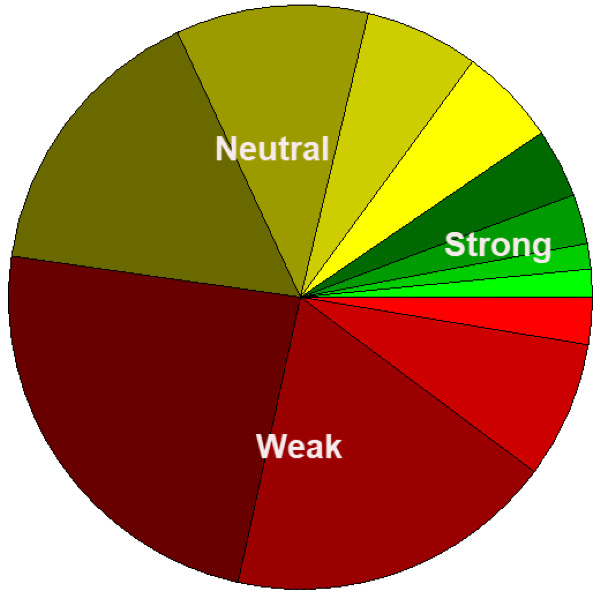

The intrinsic value of JP Morgan & Chase has continued to grow linearly for the last decade, and as of the current quarter there are no risks on the horizon that may change this trajectory.

The philosophy of JP Morgan seems to indicate that JPM will not see significant growth in the next decade, but they will have consistent growth. The bank will forego riskier ventures to maintain its consistent ROTCE (return on average tangible common shareholders’ equity) and healthy fortress balance sheet.

The market also doesn’t want to give the banking sector any premium on their intrinsic value and instead keeps a steady risk factor on the banking sector. This risk factor may be prevalent due to fundamental regulatory changes after the 2009 financial crisis such as banks simply unable to lend as much of their deposits as they were before the crisis. Or the risk factor is simply the whole market uncomfortable with banks after the bailouts during the financial crisis.

What is the Future Outlook for JPM Stock?

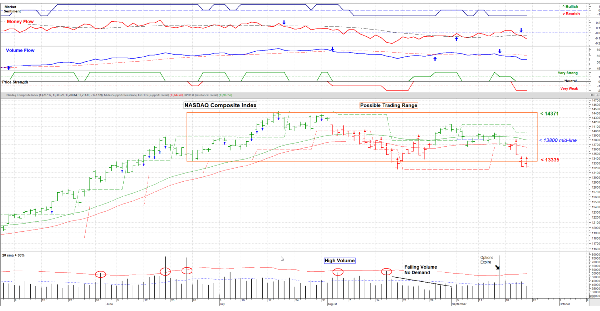

Since the stock’s intrinsic value has no reason to deviate from its trajectory, and the market continues giving the stock a risk factor, expect the stock’s price to continue to wane and wax +/-$50 per share with a consistent linear growth upwards for the next decade.

Do not expect accelerated growth for JP Morgan Chase as any acceleration will likely be dampened by one or all of the following:

- The company’s risk tolerance will not tolerate exceptional risk; hence, the bank does not want to invest in high growth ventures. High growth ventures are typically riskier.

- The bank is increasing its dividend, which will offset some potential for reinvestments or buyouts.

- The bank has been very successful with its “fortress balance sheet” approach. It will not want to disrupt the fortress with excessively risky assets in its portfolio.

- The most recent shocks to the bank’s price came when Covid-19 hit and when the Fed again hiked interest rates to slow inflation. Both shocks came from external sources and not from any fundamental changes to JP Morgan Chase.

JPM 2-Year Stock Price Prediction for 2025

JP Morgan Chase is trending towards a 2025 intrinsic value of $245. The market has consistently priced JPM below its intrinsic value ever since the financial crisis by ~20%. Hence, we forecast a 2-year stock price of $196. Expect variation of roughly $50 from that price on the low side depending on volatility in the overall U.S. economy.

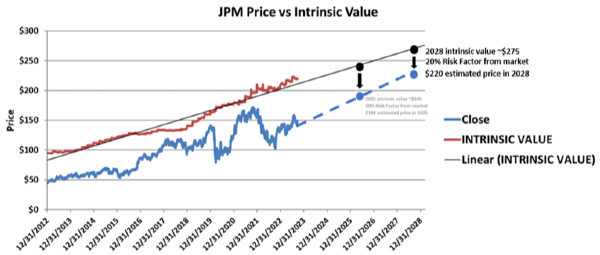

What is the Five-Year Forecast for JP Morgan Chase Stock?

If JPM continues to grow at a steady pace, intrinsic value should reach ~$275 by 2028. With an expected market risk factor of 20%, the stock price of JPM will be about $220. The price will continue to have a $50 variance, most likely to the low side. This variance is again dependent on the U.S. economy and other outside factors.

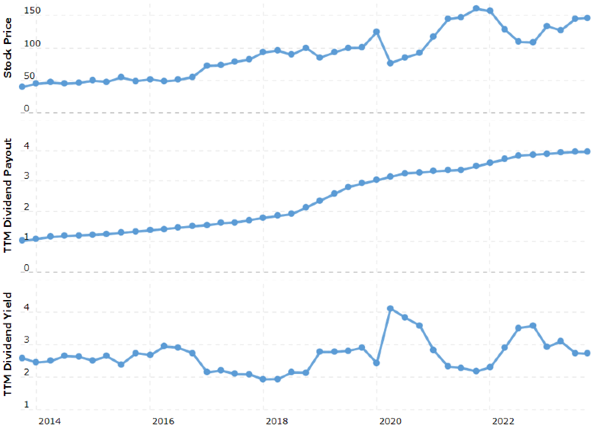

Note, dividend payouts will likely also increase at a steady rate over that same period, like it has in the previous 10-year period.

Source: macrotrends.net

I/we have a position in an asset mentioned

Is JP Morgan Chase (JPM) a Buy?

JPM is a buy as of Q3 2023. The estimated 2-year return from the recent price is 21.8%. The stock is estimated to be undervalued at $130 and overvalued at $190.

The quality of the company, which has been shown through its leadership and results, makes it a potential candidate to use a dollar-cost average strategy. This is due to a consistent growth in intrinsic value spurned by consistent earnings and book value growth.

JPM Intrinsic Value

JP Morgan’s intrinsic value is estimated to be $219.54. The market has placed a significant risk factor on JPM since 2009. This risk factor keeps JPM’s stock price 20% below intrinsic value.

JPM Future Earnings

Future earnings look strong with no expectation that earnings will slow. The board of directors are confident enough in their earnings to increase the dividend to $1.05 per share in Q4. This is up 5% from last quarter.

In Q2 2023, ROTCE (return on average tangible common shareholders’ equity) hit 25%. The bank was able to surpass its investor day 2022 goal of 17% in the previous quarter Q2. This is a sign that the bank is effectively using their equity to create returns.

On the second quarter conference call, analysts asked if JPM would consider conducting stock buybacks in the future. The executive team said this was unlikely. This makes sense, as if the firm can make a 25% return on equity, it means they are finding effective ways of using the capital they are generating.

Source: macrotrends.net, historical EPS of JPM.

Interestingly, their previous quarter result of $4.75 EPS was an all-time record for the firm, with the previous record set post-pandemic in Q1 2021 of $4.50 EPS.

JPM Book Value

Book value per share stands at an incredible $98.11 per share. Tangible book value per share increased to $79.90 per share. Revenue and earnings were healthy from the buyout of First Republic, so intangible assets from Goodwill shouldn’t be a significant future write off on book value.

The fortress balance sheet was relatively unchanged quarter over quarter. In general, a fortress balance sheet has good levels of cash and other assets with low debts to accommodate sudden shocks to the business.

JPM Risk Factor

Since the 2009 financial crisis, the markets have placed on banks a risk factor that has continued to this day. This can clearly be seen when you compare JPM’s price versus its intrinsic value before and after the 2009 financial crisis. In 2007, JP Morgan Chase enjoyed a premium given to it by the market. The premium jutted down after 2009 into a risk factor which has been consistent to this day.

Is JPM Undervalued?

JP Morgan is trading below its current fair market value. The stock is not fully undervalued; however, due to its continued growth and appreciating intrinsic value, the price is estimated to grow 21.8% in the next two years. The stock is likely to be undervalued if the price falls to $140 per share. At this price, it would be 36% below its intrinsic value. In the last decade, the bank’s price has always appreciated in the following 2-year period when its price is 36% below intrinsic value.

Why is J.P. Morgan a Good Stock to Buy?

One of JP Morgan’s biggest benefit is a “too big to fail” status as the country’s largest bank by market capitalization. JP Morgan is significantly intertwined with the financing of the U.S. economy and abroad.

The bank’s focus on a “fortress balance sheet” has created a strong culture of risk management at the bank. The management of risk is ultimately the role of banks. Highlighting the “fortress balance sheet”, and hence risk management, on page 5 of their earnings presentation showcases a strong focus on risk management.

Currently, the bank believes it can absorb $494 billion in losses.

JPM Stock Forecast

The intrinsic value of JP Morgan & Chase has continued to grow linearly for the last decade, and as of the current quarter there are no risks on the horizon that may change this trajectory.

The philosophy of JP Morgan seems to indicate that JPM will not see significant growth in the next decade, but they will have consistent growth. The bank will forego riskier ventures to maintain its consistent ROTCE (return on average tangible common shareholders’ equity) and healthy fortress balance sheet.

The market also doesn’t want to give the banking sector any premium on their intrinsic value and instead keeps a steady risk factor on the banking sector. This risk factor may be prevalent due to fundamental regulatory changes after the 2009 financial crisis such as banks simply unable to lend as much of their deposits as they were before the crisis. Or the risk factor is simply the whole market uncomfortable with banks after the bailouts during the financial crisis.

What is the Future Outlook for JPM Stock?

Since the stock’s intrinsic value has no reason to deviate from its trajectory, and the market continues giving the stock a risk factor, expect the stock’s price to continue to wane and wax +/-$50 per share with a consistent linear growth upwards for the next decade.

Do not expect accelerated growth for JP Morgan Chase as any acceleration will likely be dampened by one or all of the following:

JPM 2-Year Stock Price Prediction for 2025

JP Morgan Chase is trending towards a 2025 intrinsic value of $245. The market has consistently priced JPM below its intrinsic value ever since the financial crisis by ~20%. Hence, we forecast a 2-year stock price of $196. Expect variation of roughly $50 from that price on the low side depending on volatility in the overall U.S. economy.

What is the Five-Year Forecast for JP Morgan Chase Stock?

If JPM continues to grow at a steady pace, intrinsic value should reach ~$275 by 2028. With an expected market risk factor of 20%, the stock price of JPM will be about $220. The price will continue to have a $50 variance, most likely to the low side. This variance is again dependent on the U.S. economy and other outside factors. Note, dividend payouts will likely also increase at a steady rate over that same period, like it has in the previous 10-year period.

Source: macrotrends.net

I/we have a position in an asset mentioned