Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

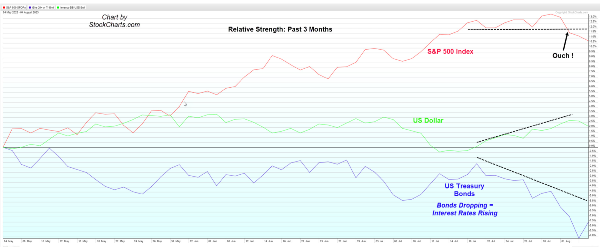

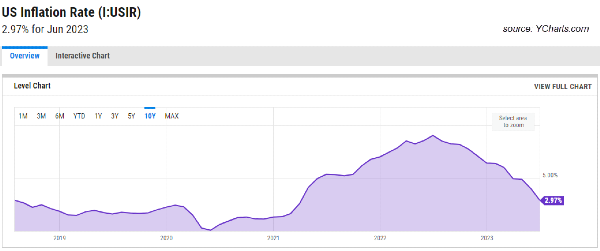

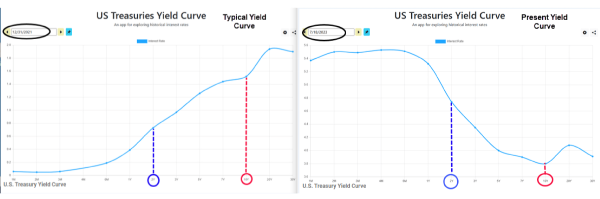

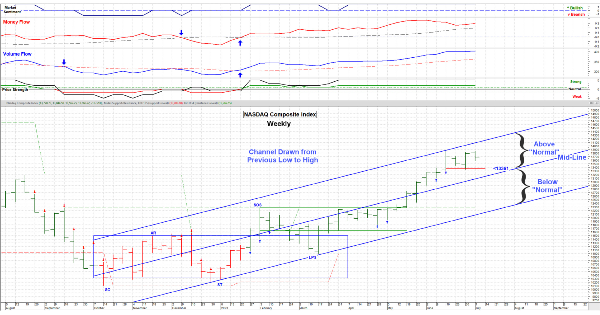

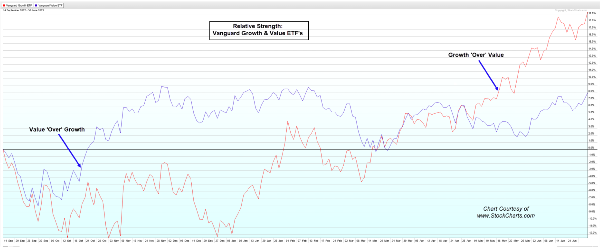

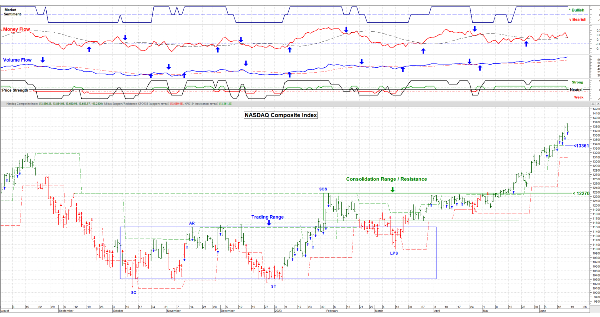

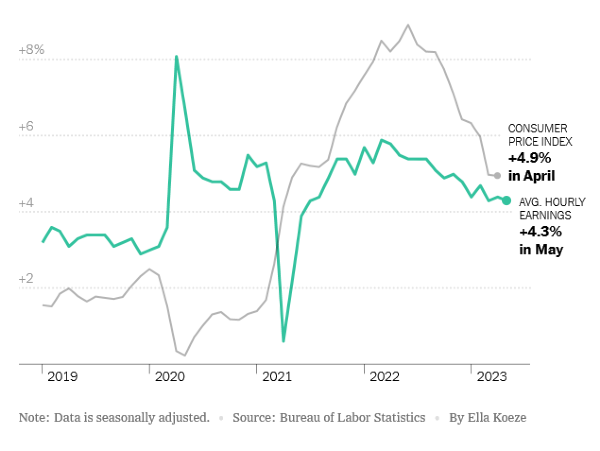

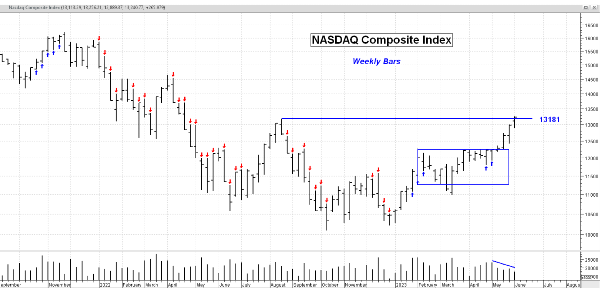

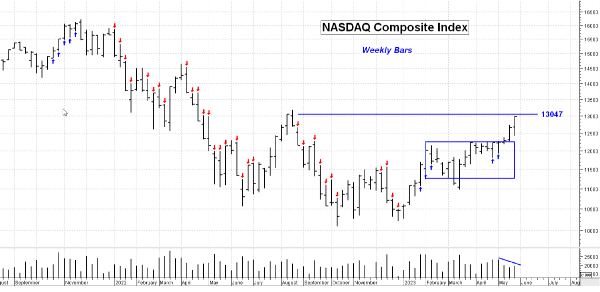

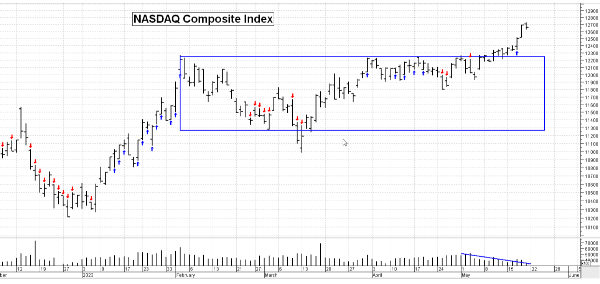

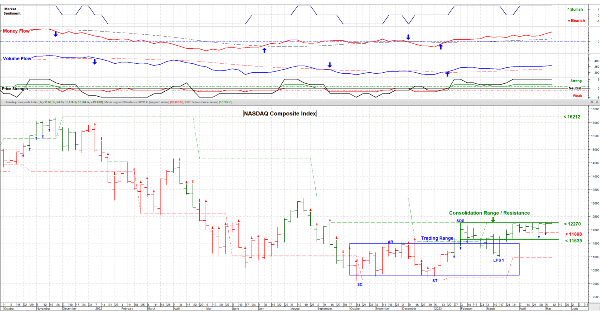

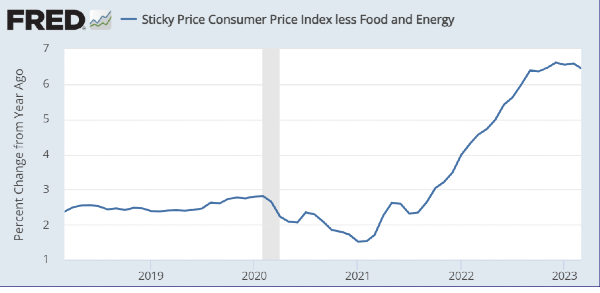

August 4, 2023 – So who cares about the US Dollar and US Bond prices? The US stock market; that’s who. My anticipated market stumble likely started this week with Japan saying they would allow their interest rates to float* (i.e. go higher); and that killed the carry trade. Then Fitch announced it would drop the rating on US debt from AAA to AA+ (because of “political discourse” and increasing debt). That’s all it took. The market really likes low interest (higher bond prices) and a “normal” to weak US dollar (better for exports & global competition).

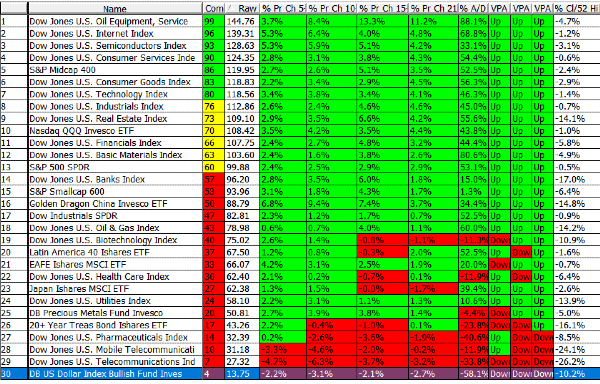

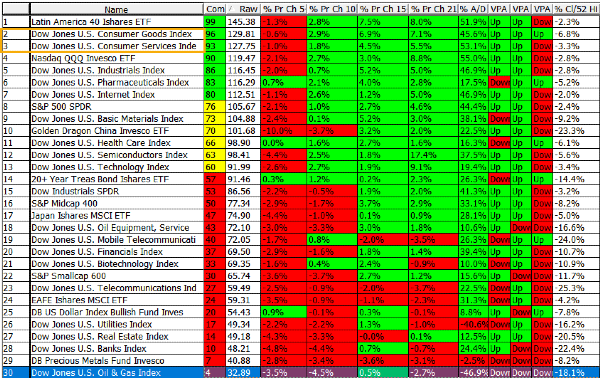

What about earnings this week? Generally pretty good, with about 55% of the reports so far being better than estimates. Apple and Qualcom did have some issues, but Amazon seems to be firing on all cylinders. Seasonality in this part of the year is poor, so I will not be surprised if August and early September are more back & forth; we need to consolidate recent gains. The Price / Earnings ratio for the S&P 500 is at 19.57 (forward earnings) compared to the 25 year average of 16.78, so this market is not “cheap” by historic standards. I should mention that oil is up and that doesn’t help either. Take a look at the Short Term Sector Strength table and you’ll see a number of Energy sectors up toward the top. * (shown at www.Special-Risk.net)*

So that’s ‘bout it for now. The next 4-6 weeks will likely slow down unless something big and unexpected happens (always a possibility). Have a good week. ……….. Tom …………