Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

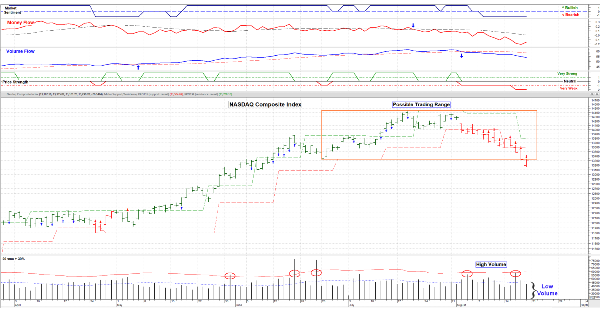

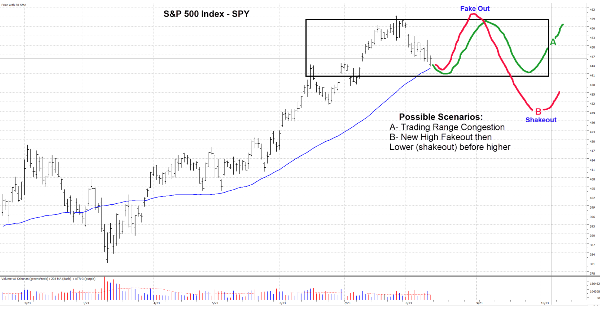

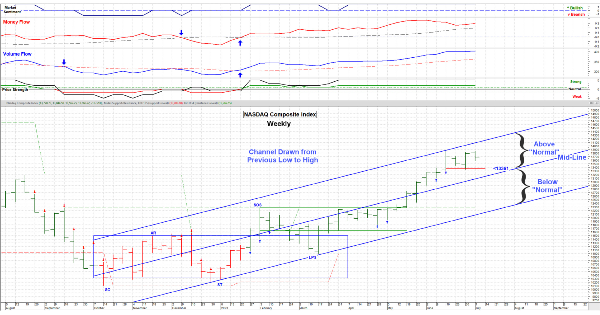

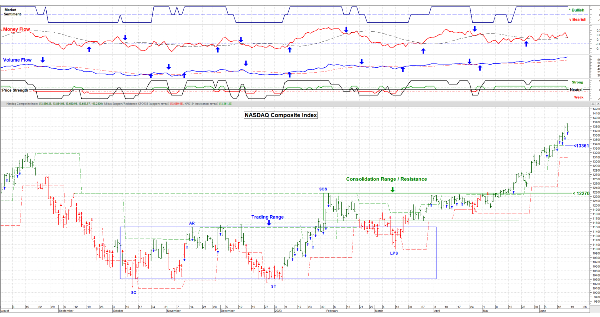

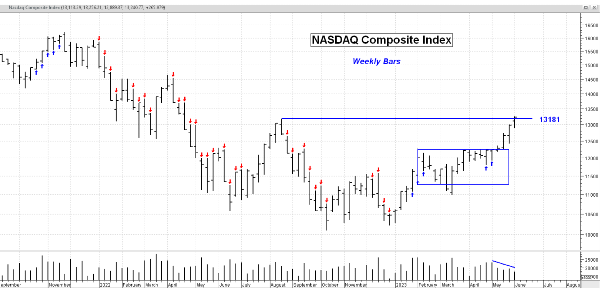

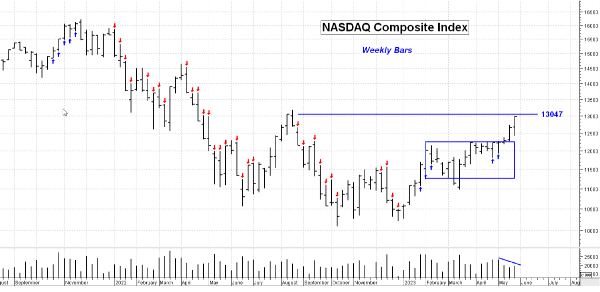

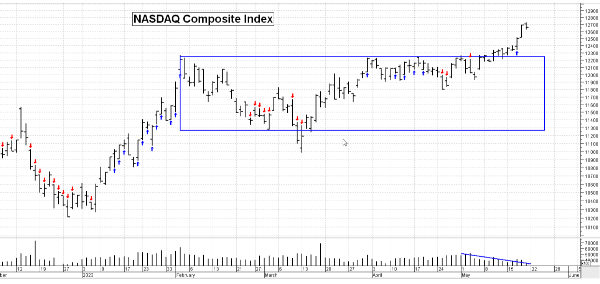

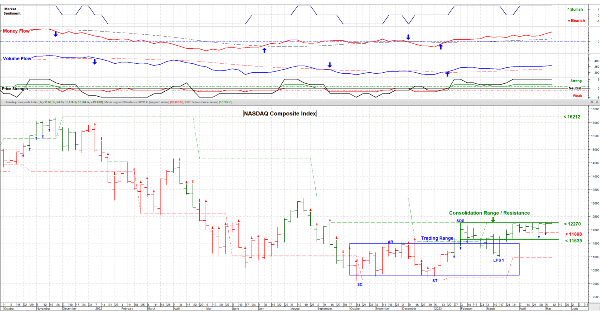

August 18, 2023 – Is the correction done yet? Perhaps for the time being, but I’m not entirely sure that we don’t get an “all clear bounce” up followed by another lower low (a “Fake Out” rally). It’s entirely possible, and typical, that we establish a trading range (orange rectangle) and stay in that range for a while too.

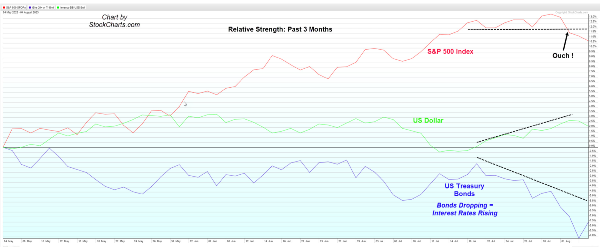

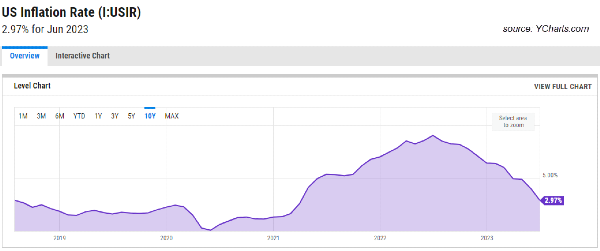

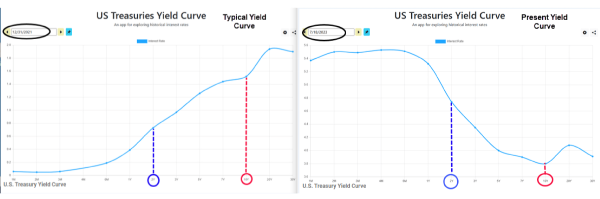

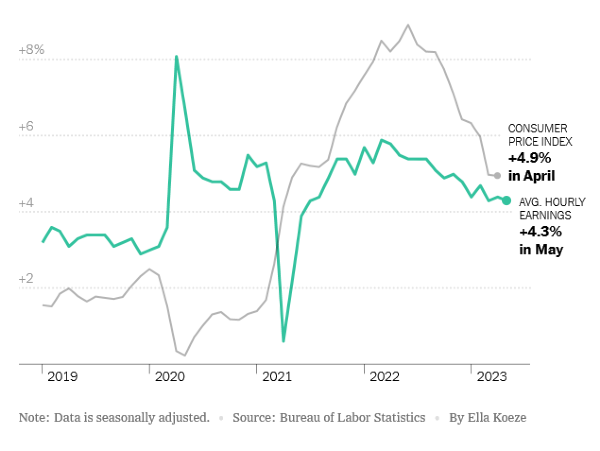

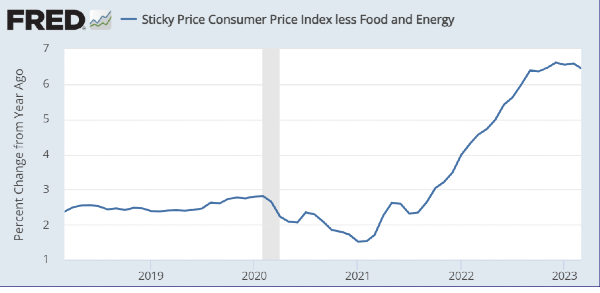

What’s encouraging is the rather low volume on Friday, especially since it was an options expiration Friday. A fair amount of Put options were unwound and that may account for the rebound on price toward the late afternoon before the market close. In any case a correction was overdue and I’m not expecting it to morph into a market top. It’s good to take a step back and see where we are economy wise: Job picture- strong, consumer spending- strong, production- fairly strong, inflation- lower . . . all positive signs and not recessionary. On the caution side: interest rates are edging up and the annual Jackson Hole Conference (i.e. FED speak) is coming up next week.

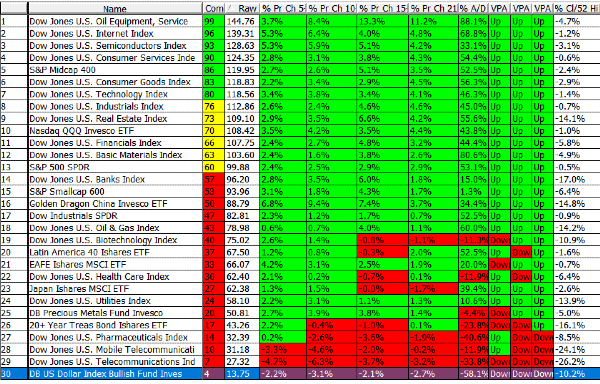

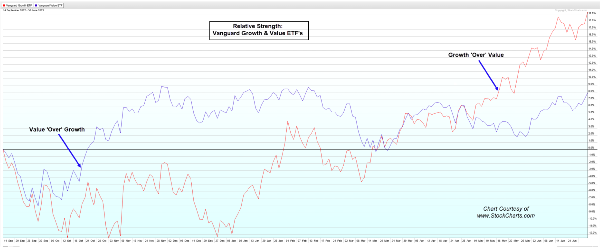

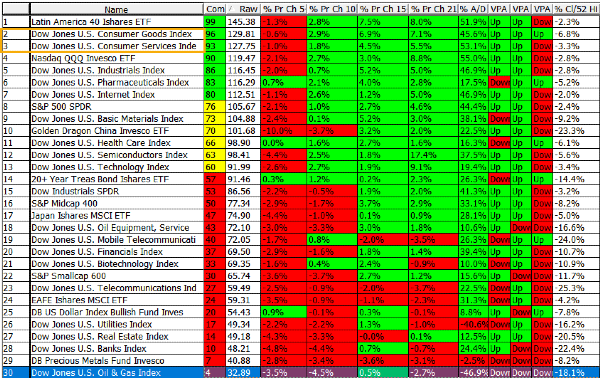

The market is valued rather high and there remains concern about earnings going forward so intuitional investors are on edge; it’s not a low-risk / cheap market. Positive comments by Powell & Co. could fuel a move higher if folks redevelop a FOMO (Fear Of Missing Out) approach. Talk about a soft landing (a.k.a. no recession) will certainly be brought up. Let’s see how the FED speakers handle that one. The Short-Term Sector Strength table shows the current areas of market weakness – (Table at www.Special-Risk.net)

I have taken some “money off the table” as a precaution, though redeployment is what I’m looking for. Have a Good Week. ………….. Tom ………….