Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

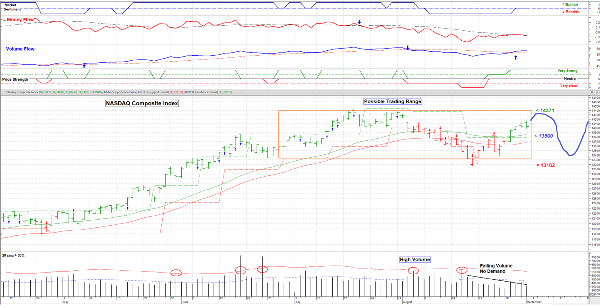

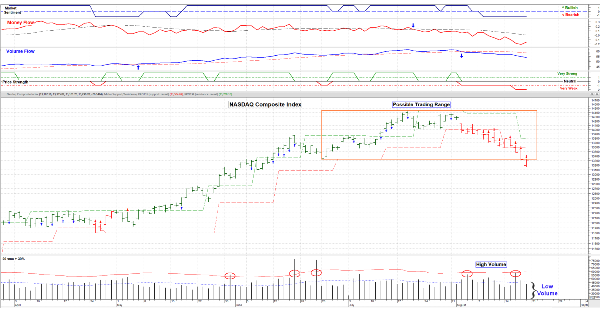

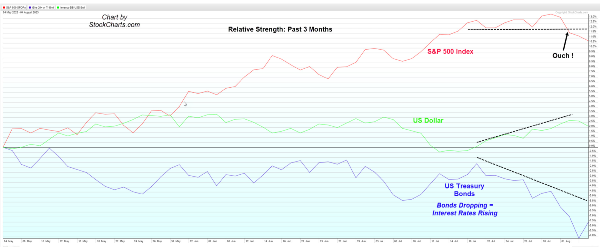

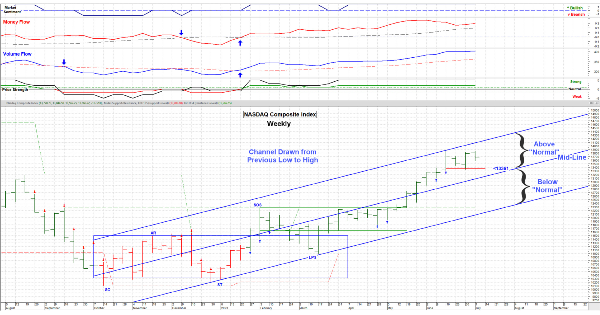

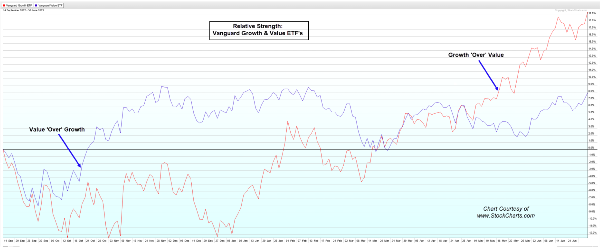

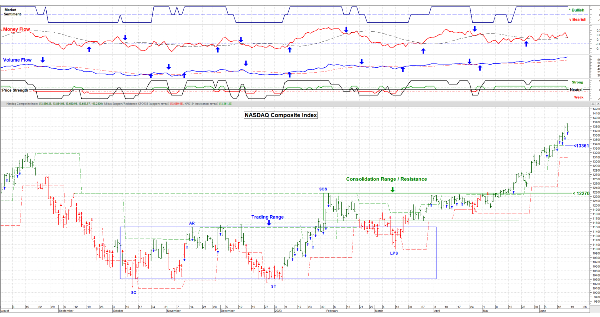

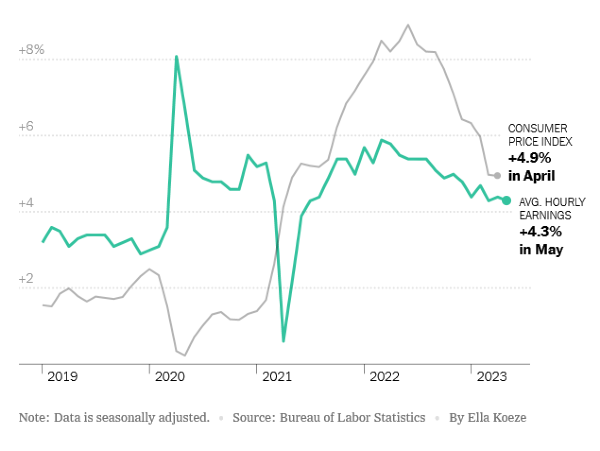

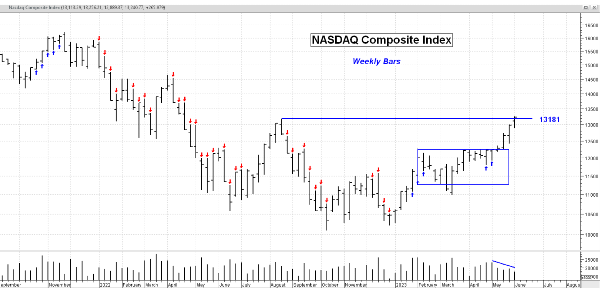

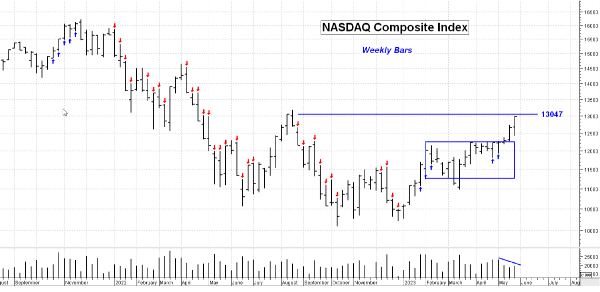

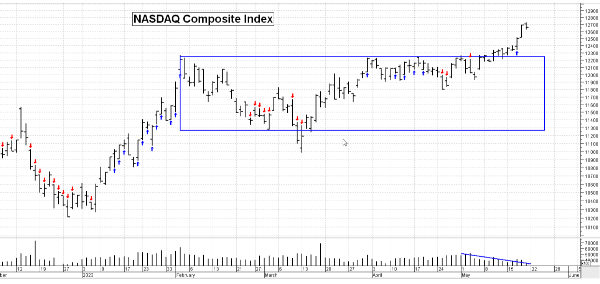

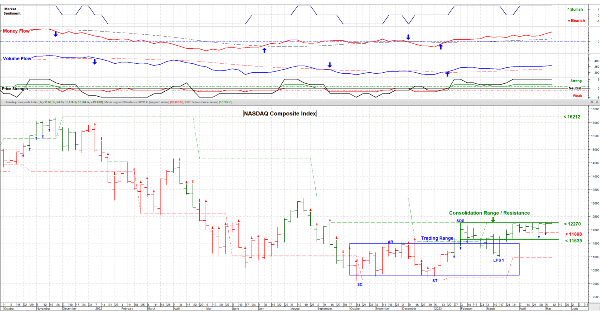

September 1, 2023 An interesting week driven by news and hope. The US Dollar dropped into Wednesday and the market rallied (as typical), then the $ strengthen late in the week. The result was early day strength then weakness late in the day on Thursday and Friday. Now the pre-holiday volume was low as usual so next week should be interesting to see what follow through happens in both the Dollar and the market.

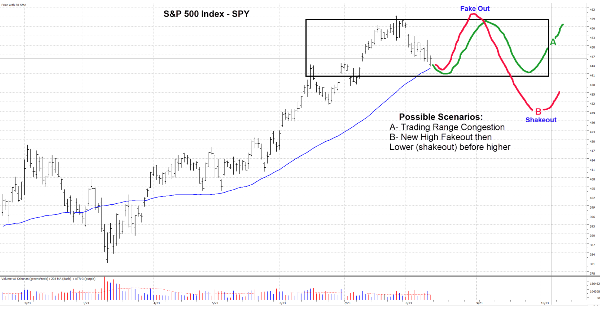

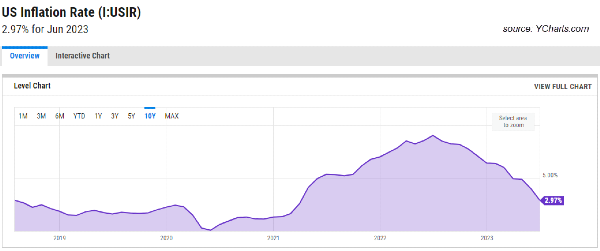

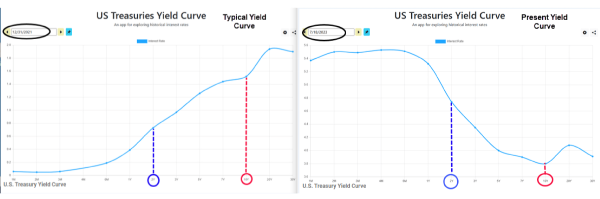

I’m thinking folks don’t want to be left behind so the good news in the form of a cooling labor market (unemployment up slightly and number of new jobs lower) will help fuel the “Soft Landing” theory. And that idea appears to be holding true, but trouble may be on the horizon in the form of Congress. The question is whether the MAGA Republicans will hold the economy hostage to get their way. The specter of the debt rises again! Prepare for a bunch of political grandstanding over the next 3-4 weeks, and that will shake the markets.

That’s why my primary feeling is that we will stay in a broad trading range until the 3rd quarter earnings push it one way or another. The end of the quarter is not that far away, so hang on. I’m expecting a bumpy ride, then better sailing into the end of 2023. This environment is tough for investors and great for traders.

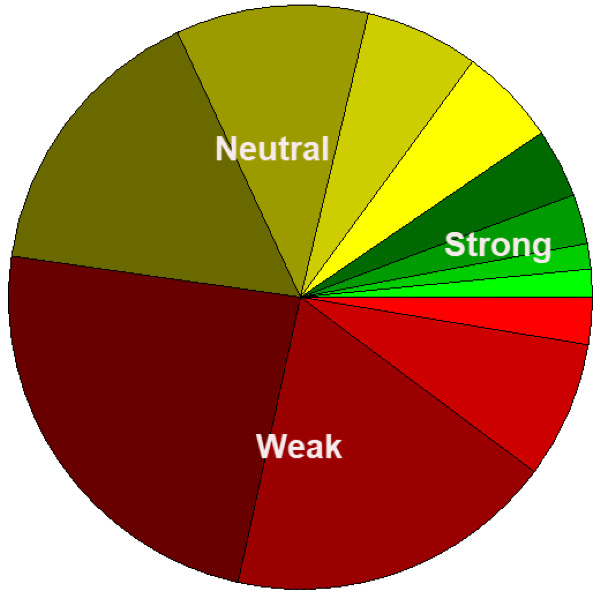

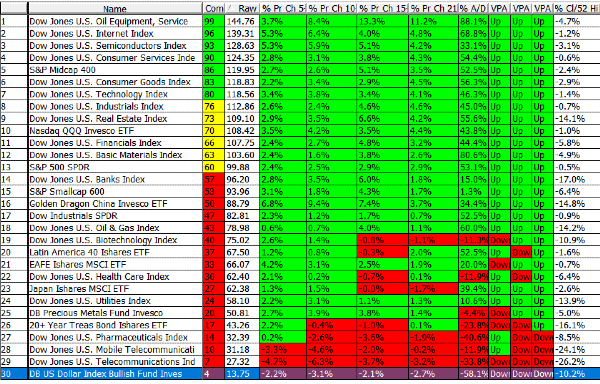

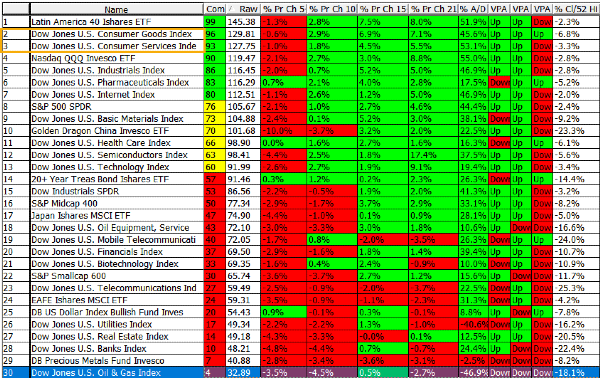

The Short Term Sector Strength table is shown at: www.Special-Risk.net

Right now I’m about half invested and half Cash and cautious. Short term looks OK, but ‘issues’ later next week. In any case . . . have a good week. …………. Tom …………..

Price chart by MetaStock; table by www.HighGrowthStock.com. Used with permission.