Oct. 13, 2023 – OK . . I got a few responses to my question last week about whether to continue this blog. That’s “OK” but not exactly great. Since I want to spend more time on research and less on communicating general market thoughts I’ll continue, but take “A Step Back”. That is, instead of “religiously” publishing every week (no matter what), I’ll put out my thoughts when it looks like something significant is, or may happen. In that way it should make better use of my time and yours too. The best way to see if there anything new is to subscribe to new posts. That way you’ll get an e-mail notification. Hopefully this makes sense . . . . in any case . . . . you can’t “beat the price”. 😊

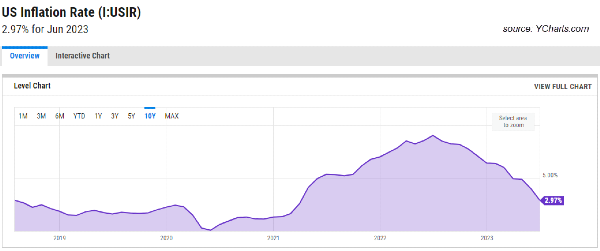

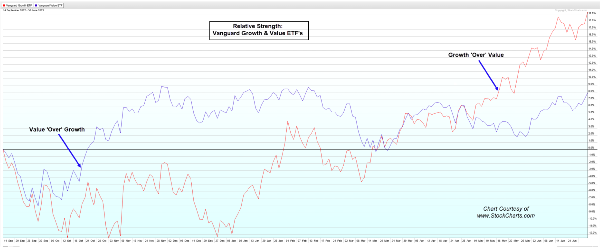

On we go. Last week major Wall Street banks reported earnings for the 3rd quarter. Earnings were up, driven mostly by higher interest rates (those that they charge). But the number of delinquent loans is starting to increase. Perhaps storm clouds of a recession or at least a slowdown. The Consumer Price Index (CPI) remains hot, down a little, but still high. Inflation continues to look “sticky”. Overall market liquidity is reduced due to the high bond issuance as investor put money to “work” in bonds and not equities.

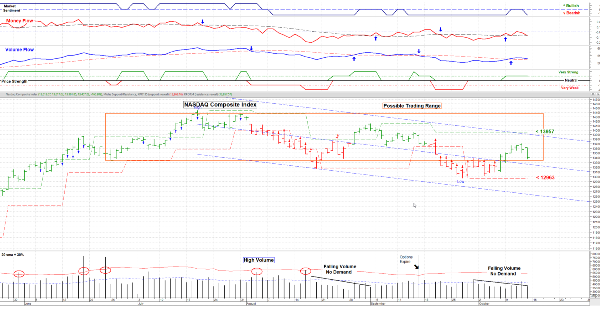

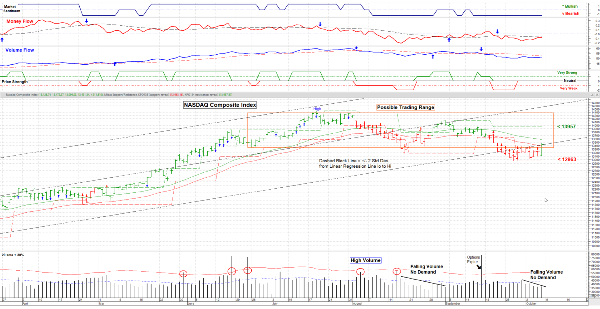

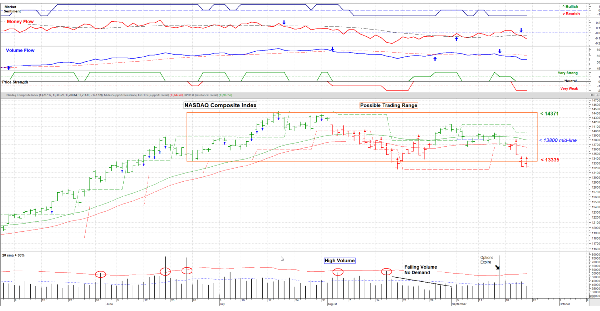

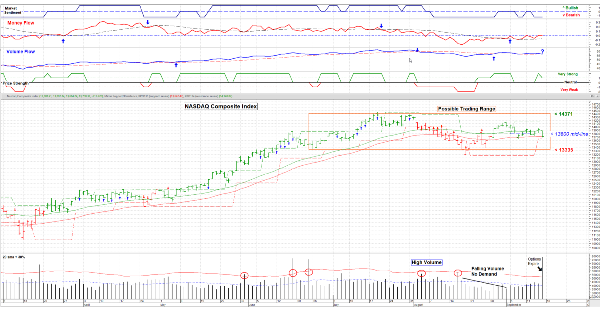

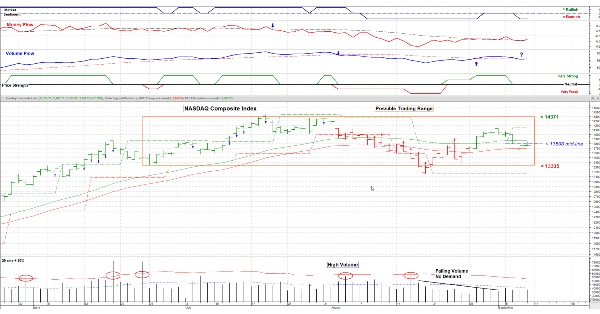

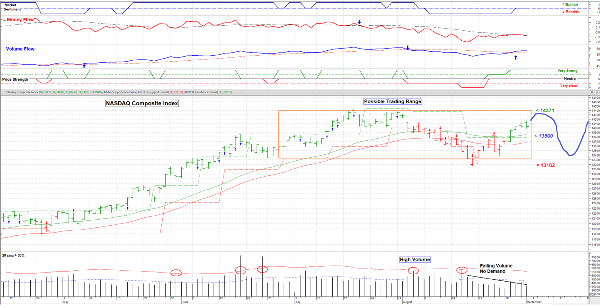

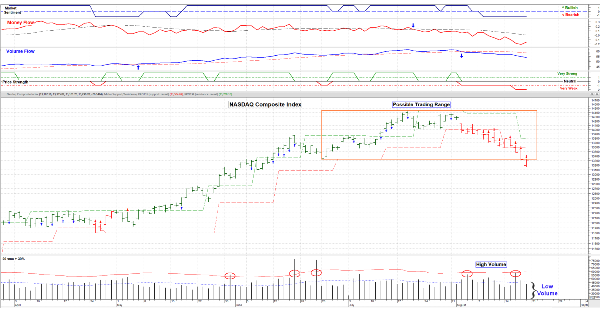

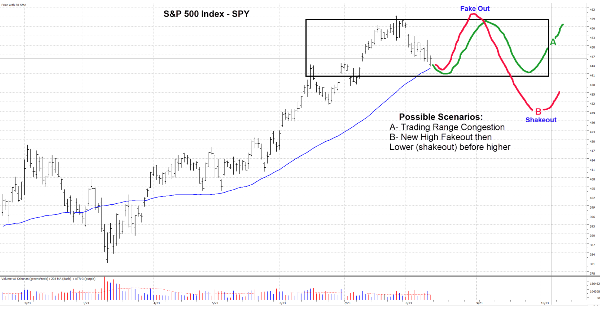

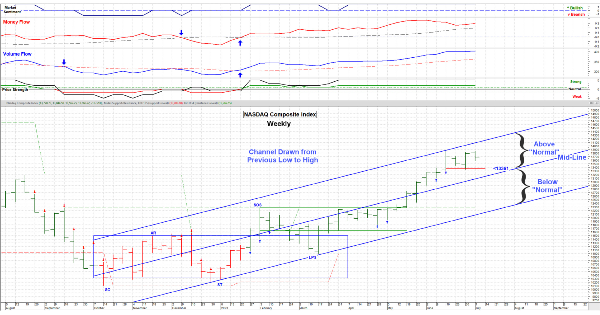

We got back into the Trading Zone and usually, the market “should be” positive going into the end of the year. The problem is: Hamas / Israel, Ukraine / Russia, weakness in China and (dare I say) the Republicans in Congress. These are all major obstacles to a higher market. (I note that China is selling US Treasury Bonds to get Dollars to prop up the Yan.) A lot of head winds in the coming month.

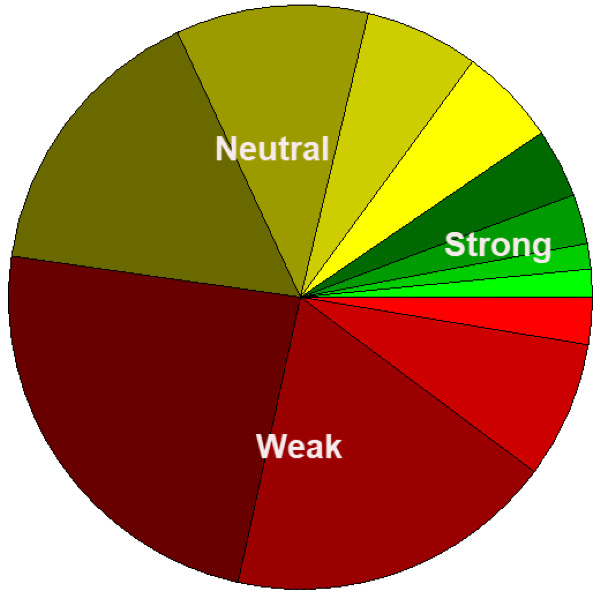

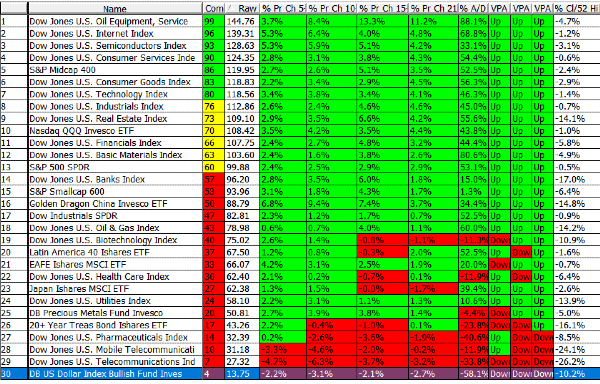

The only sector doing OK is Energy.

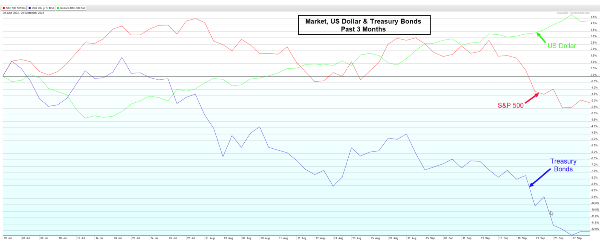

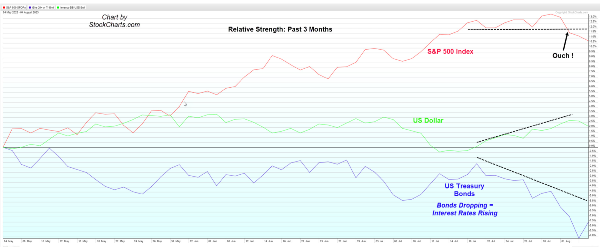

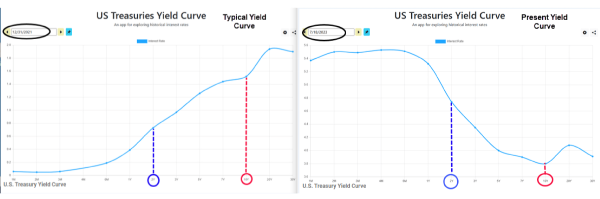

I remain heavy in Cash. If Congress shuts down the government, US loans will be rated lower, our interest rate rise and it will cost more for everyone to borrow. That’s not the way to “lower the deficit”; just say’in. Hopefully some 8-12 Republican Congress people figure this ECON 101 fact out soon. * (Yes, this sounds like an editorial, but it is also fact. Heck . . they can’t even agree on a leader.)* Watch the US $ and the T-Bonds. They will be a clue as to strength or weakness. (High $ is Bearish, as is Lower Bonds; higher rates.)

In the meantime, have a good week and be careful of a news whip-saw. It’s coming. As always, take small initial positions, you can always add to them if they prove correct. Cheers. ……… Tom ……….

Oct. 13, 2023 – OK . . I got a few responses to my question last week about whether to continue this blog. That’s “OK” but not exactly great. Since I want to spend more time on research and less on communicating general market thoughts I’ll continue, but take “A Step Back”. That is, instead of “religiously” publishing every week (no matter what), I’ll put out my thoughts when it looks like something significant is, or may happen. In that way it should make better use of my time and yours too. The best way to see if there anything new is to subscribe to new posts. That way you’ll get an e-mail notification. Hopefully this makes sense . . . . in any case . . . . you can’t “beat the price”. 😊

On we go. Last week major Wall Street banks reported earnings for the 3rd quarter. Earnings were up, driven mostly by higher interest rates (those that they charge). But the number of delinquent loans is starting to increase. Perhaps storm clouds of a recession or at least a slowdown. The Consumer Price Index (CPI) remains hot, down a little, but still high. Inflation continues to look “sticky”. Overall market liquidity is reduced due to the high bond issuance as investor put money to “work” in bonds and not equities.

We got back into the Trading Zone and usually, the market “should be” positive going into the end of the year. The problem is: Hamas / Israel, Ukraine / Russia, weakness in China and (dare I say) the Republicans in Congress. These are all major obstacles to a higher market. (I note that China is selling US Treasury Bonds to get Dollars to prop up the Yan.) A lot of head winds in the coming month. The only sector doing OK is Energy.

I remain heavy in Cash. If Congress shuts down the government, US loans will be rated lower, our interest rate rise and it will cost more for everyone to borrow. That’s not the way to “lower the deficit”; just say’in. Hopefully some 8-12 Republican Congress people figure this ECON 101 fact out soon. * (Yes, this sounds like an editorial, but it is also fact. Heck . . they can’t even agree on a leader.)* Watch the US $ and the T-Bonds. They will be a clue as to strength or weakness. (High $ is Bearish, as is Lower Bonds; higher rates.)

In the meantime, have a good week and be careful of a news whip-saw. It’s coming. As always, take small initial positions, you can always add to them if they prove correct. Cheers. ……… Tom ……….