Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

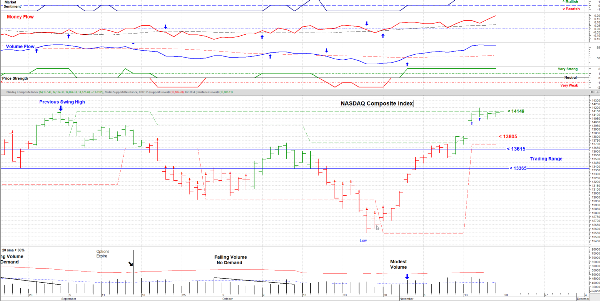

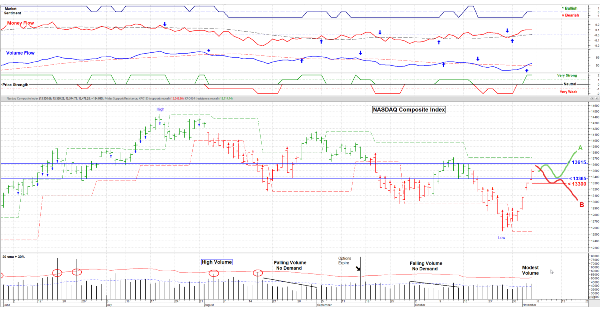

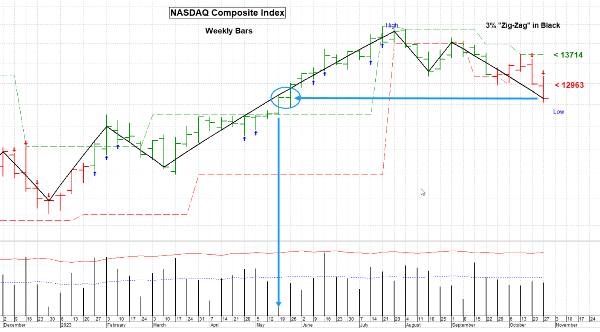

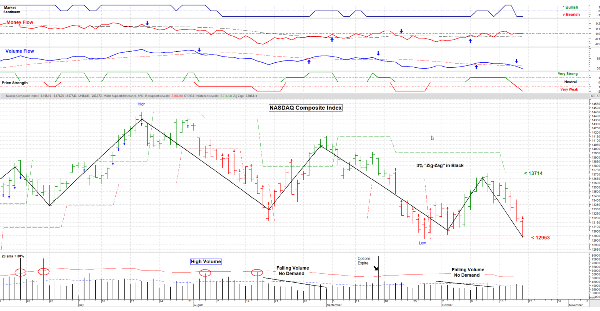

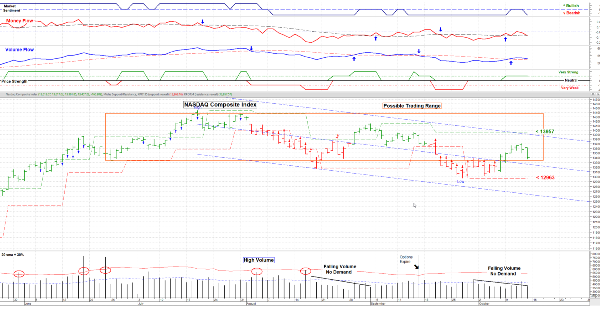

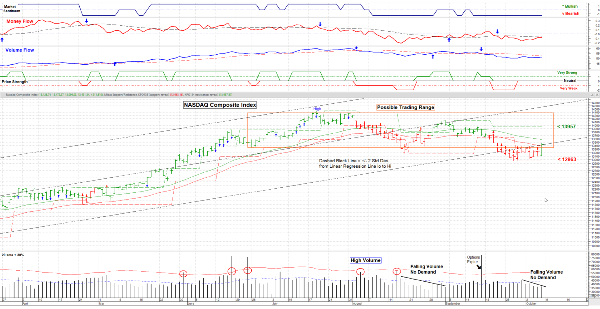

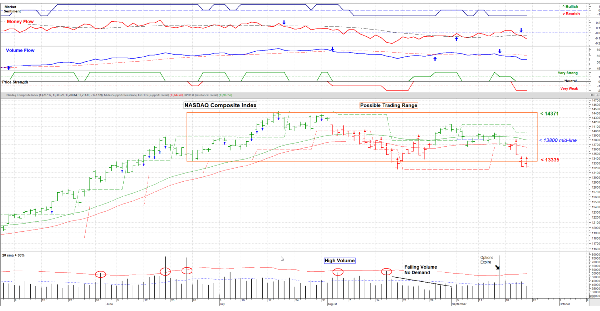

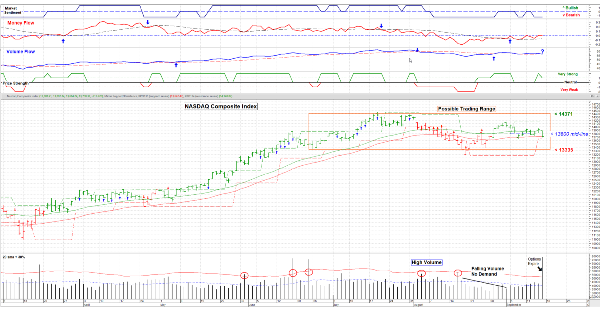

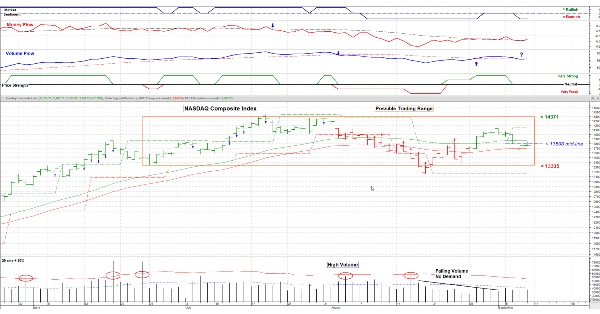

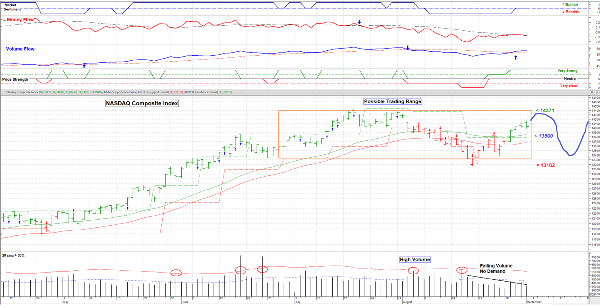

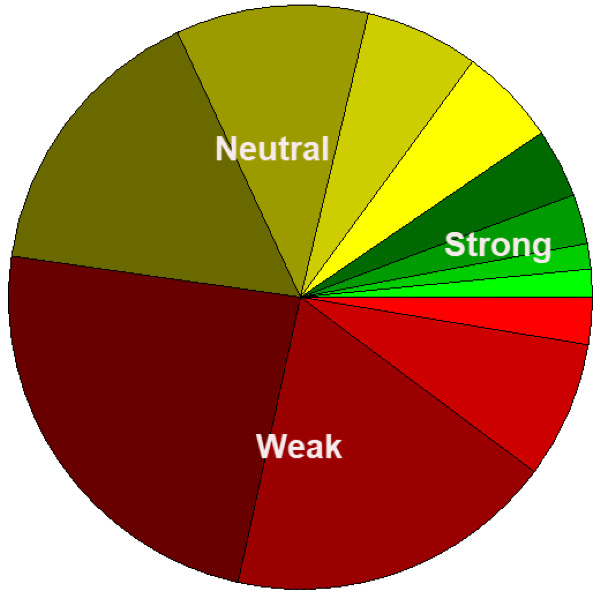

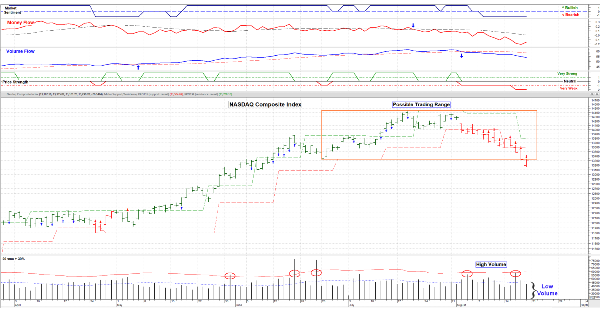

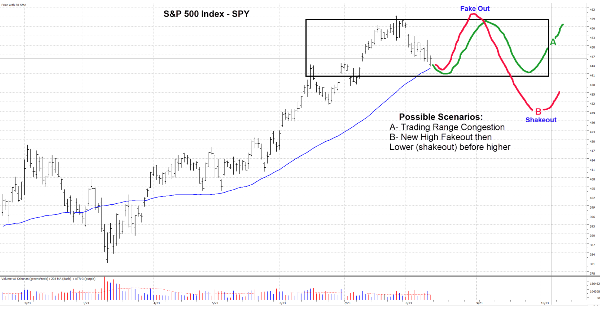

November 17, 2023 – A good week for the market, especially after Monday. Positive economic news will do it, as folks are reacting more toward lower expected rates early next year and (most of all) lower inflation. But . . . . This week Walmart (the nations largest retailer) and some select Tech stocks were guiding earnings lower next quarter due to signs of slowing consumer demand. Corporate spending is also guiding lower.

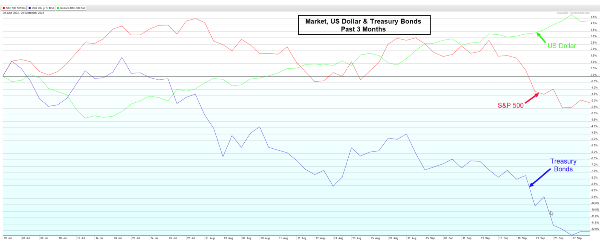

The market was helped a bunch with a lower US Dollar (bullish) and Treasury Bonds going higher (lower interest rates).

What could happen next? Reports of “Black Friday” sales. And that may be the most important piece of consumer data of all. Stay tuned.

In the meantime, this market is at an important resistance level; back at the swing peak of early September of this year. I’m slowly scaling into this market; it sure would be nice to see a break above on volume. I think that we’ll likely get that IF the Friday sales data is positive. We’ll see.

The Short-Term Sector table is shown at: www.Special-Risk.net

Wishing all (in the US) a very Happy Thanksgiving. ……….. Tom …………..