Is Atkore (ATKR) a Buy?

Atkore is currently a Buy at a current price of $143.56. The stock is estimated to be undervalued at $120 per share and overvalued at $180 per share.

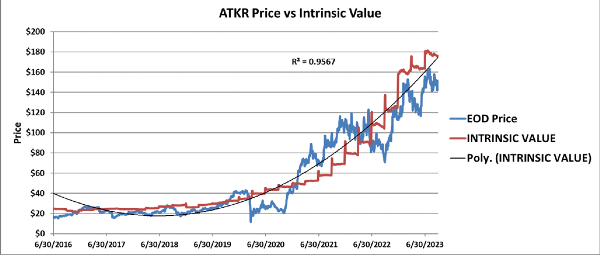

The stock has grown its intrinsic value over the last five years with consistent earnings growth and book value growth. Consistently high return on equity (ROE), an attribute used to screen for value stocks has made this stock highly sought after by value investors.

The current intrinsic value of the stock sits around $175 per share. The market has been trading ATKR below its intrinsic value due to trepidation around its earnings growth. If earnings growth slows, expect the company’s intrinsic value and stock price to fall.

What is the target price for Atkore stock?

The Atkore’s target price for Q4 2023 stands at $175 per share, or its current intrinsic value. This is a 22% increase from its current price of $143.

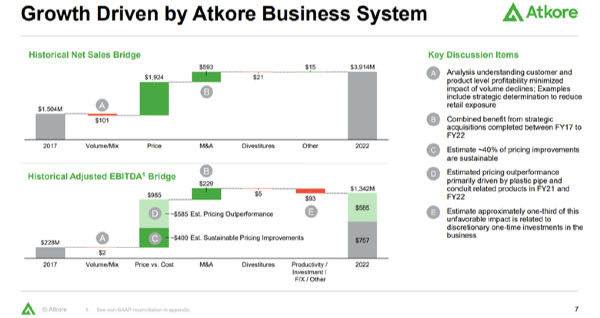

The price of Atkore has been following the company’s intrinsic value closely. Earnings growth needs to continue to meet this price target. Much of the company’s EBITDA growth has been made through price outperformance in FY21 and FY22. If these improvements are unsustainable, then there is potential for a shock in earnings coming.

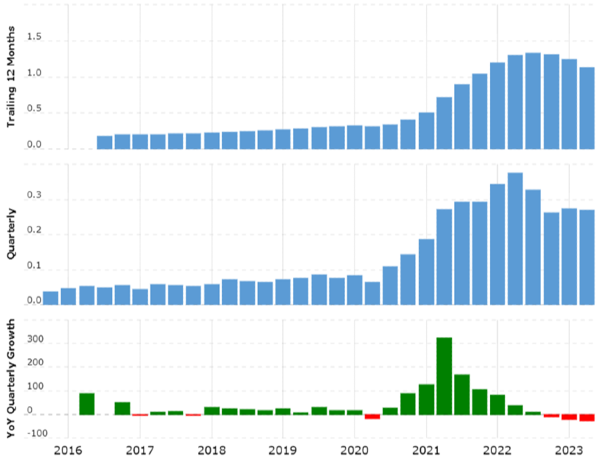

You can see this windfall fading away when you look at historical EBITDA:

With price improvements already made with its existing lines, Atkore will need to drive continued performance through more acquisitions and organic sales growth. Atkore expects their HDPE products (high-density polyethylene) to fuel growth in the coming quarters.

Is Atkore a good investment?

Atkore is a great investment for value investors to monitor. The company is a top pick on magic formula investing since Atkore has a solid return on capital and price to enterprise value ratio.

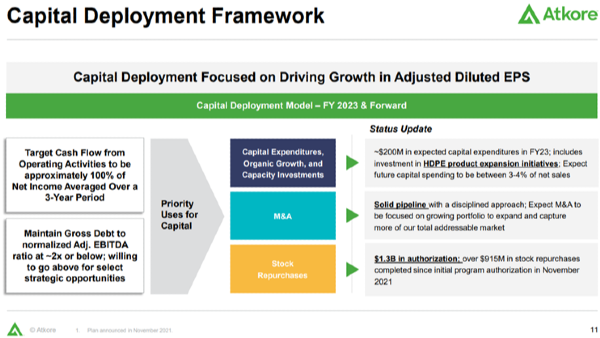

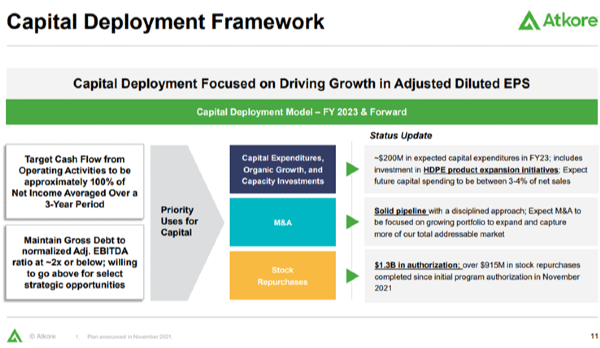

Atkore has had solid earnings performance and is using these retained earnings for strategic acquisitions and capacity investments. One of the biggest initiatives is their push into HDPE products. The company believes there is an opportunity in the HDPE product market and is prioritizing capital for these investments. The next priority is strategic acquisitions. The company notes they have a “solid pipeline” of opportunities.

Finally, if there are no other good investment opportunities, then the company still has $400 million authorized for stock repurchases of a total $1.3 billion authorized in 2021.

What kind of company is Atkore?

Atkore sits in the industrial sector as a manufacturing company that manages two main segments:

- Electrical Components

- Safety and Infrastructure

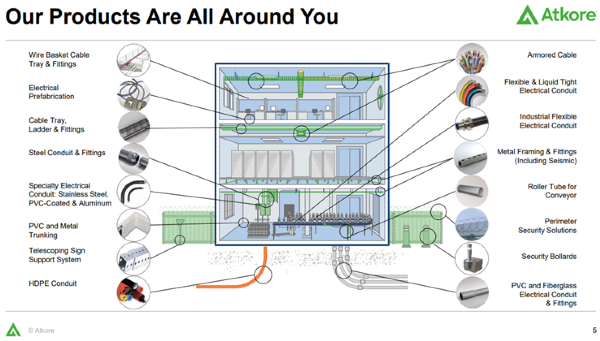

Atkore has great products that are critical in electrical and digital infrastructure. Atkore’s products are found all around you in the home, office, and facility.

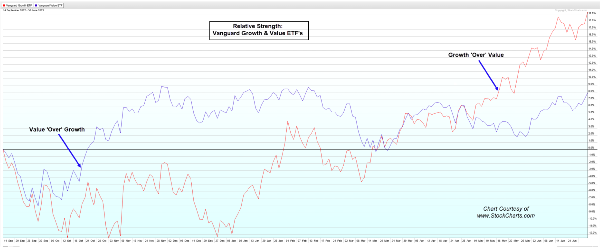

Is at Atkore a Value Stock or Growth Stock?

Atkore Inc. has seen tremendous growth since ATKR’s IPO in 2016. This growth is very rapid, but as an industrial company, it’s constrained by the physical limitations of acquiring new manufacturing facilities and building new facilities. This is in contrast with technology companies, whose earnings could rapidly grow and are only constrained by customer acquisition.

In this regard, Atkore can be analyzed using value investing strategies. Atkore’s intrinsic value has increased over the last few years, but this increase isn’t rapid relative to technology stocks and its growth isn’t erratic.

What is the competitive advantage of Atkore?

Atkore is the premier manufacturer and distributor of electrical systems components and security system components. The company’s products support six unique markets:

- Non-residential

- Electric Power

- Data Centers and Telecom

- Water

- Transportation

- Solar

Their products have been specialized for a variety of niche markets. For non-residential, Atkore provides electric conduit specialized for healthcare and security products specialized for government buildings and highways.

The company is open to listening to their customers, allowing them to customize products for the needs of the food industry. Atkore builds products that meet the food industry’s cleanliness standards.

Atkore is a leading manufacturer of Unistrut and power-strut, and you can liken the manufacturer to the “Lego maker” for electrical conduit systems.

What is the intrinsic value of ATKR?

The intrinsic value of Atkore sits at $175 in Q4 2023. A chunk of that intrinsic value is provided by the company’s robust book value, which sits at $37.12 per share. The book value of ATKR has consistently grown for the last nine years, proving that the Atkore management team is reinvesting retained earnings and avoiding wasteful acquisitions and ventures.

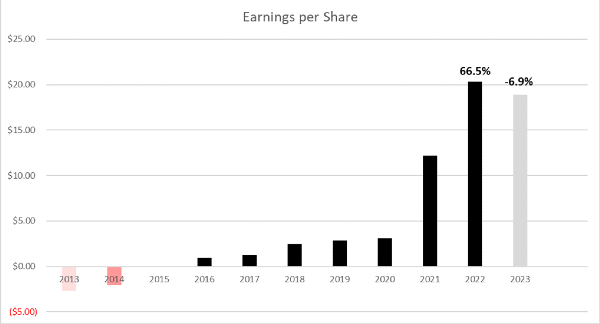

The bulk of the intrinsic value is from the company’s earnings and earnings growth potential. Atkore’s trailing twelve-month earnings per share sits at $17.50. Atkore’s earnings growth is an astonishing 66% year-over-year; however, this is a median value of its growth since its IPO in 2016. Growth has currently stabilized at a 12% growth rate in the past few years.

The price per share of Atkore has followed the company’s estimated intrinsic value closely, though the market currently is placing a risk factor on the company’s price.

Though it’s impossible to predict why the market has placed a risk factor on Atkore’s stock, there may be a hint when you look at the previous time a risk factor was placed on Atkore. This was in 2020, during the Covid-19 crisis. The market may suspect that domestic infrastructure growth will stall which will affect Atkore regardless of their efforts.

What is the Earnings Forecast for Atkore?

Atkore’s management was bullish for Q4 2023 and raised EPS guidance.

The 2023 outlook for earnings per share increased to a range of $18.90 to $19.30 per share. This would mean that this year’s earnings fell versus the previous year’s earnings but grew versus 2021 earnings. This would be a 6.9% decrease from 2022, but still a 55% increase from 2021.

ATKR earnings each year. 2023 earnings predicted based on management guidance.

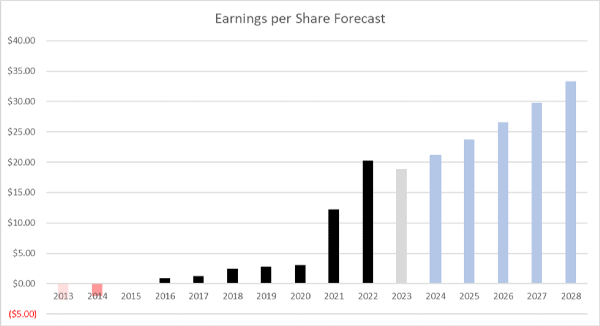

Earnings growth, on average, will likely be 12% in the next few years. Earnings have had significant growth in recent years, but due to Atkore being in the industrial sector it may have limited choices on future acquisitions and organic growth. But thanks to share buybacks and consistent cashflow, stock buybacks should be enough to propel earnings growth for the next couple of years.

Atkore’s earnings per share estimates. The light blue represents predicted earnings per share for the next five years at a 12% growth rate.

How Good is Atkore’s ROE?

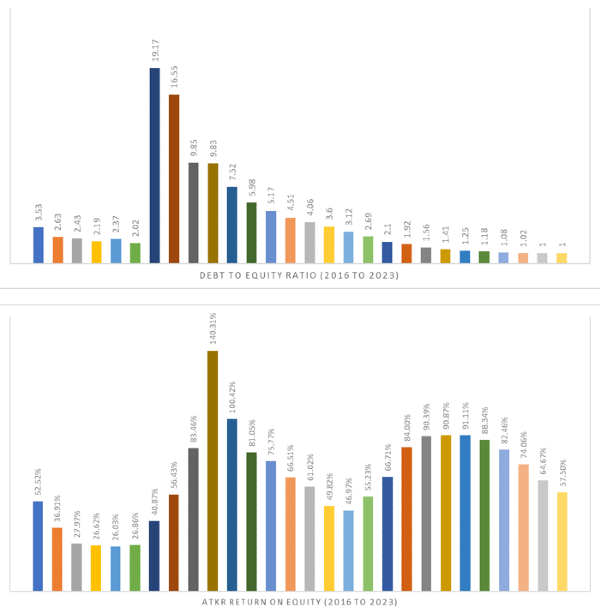

Atkore’s return on equity sits at a high 57.5%. Atkore has profited greatly from acquiring businesses and generating income to pay down past debt used for these acquisitions. Atkore boasts they have a disciplined approach to capital deployment, and the numbers show it.

Atkore’s debt to equity ratio was very high from 2017 to 2020 as they used debt to acquire businesses. These acquisitions proved to be profitable as the company was able to keep their debt-to-equity ratio low. As earnings increased, the company paid off debt. As of 2022, the company’s debt to equity ratio sits at 1.0. This is in stark contrast to a debt-to-equity ratio of 19.17 in 2018.

Return on equity shown side-by-side with debt-to-equity. High return on equity has pulled down the debt-to-equity ratio with effective use of cash flow.

Atkore expects to expand their HDPE products in the coming year to capture more of this addressable market. As proven in previous years, Atkore also has potential acquisitions in the pipeline.

ATKR Stock Forecast

Atkore has a consistent growth projection thanks to its continued intrinsic value growth. Though risky to use polynomial trend lines, this trend line is realistically the best model that correlates with Atkore’s historical intrinsic value. An order two polynomial model placed on Atkore’s intrinsic value has an astonishing 95% correlation!

This model will likely work for the next five years as the company has set itself up as a must-have supplier of infrastructure components. This growth will be driven by continued acquisitions and stock buyback, which should drive growth in the foreseeable future.

Past the next five years, Atkore may have further opportunities internationally. Atkore has a presence in:

- North America

- Europe (with a focused presence in the UK)

- China

- Australia and New Zealand

Future growth in Asia and Africa could see another boom as Atkore’s products are critical to growth.

ATKR stock forecast 2025

Atkore Inc. has the potential to hit a $275 intrinsic value sometime in 2025. As the price follows intrinsic value closely, the stock price will likely be around $250 to $300. The question in 2025 will be where the next decade of growth will come from. While international markets are promising, Atkore may add a new vertical product mix that compliments its conduit and security businesses. However, if the market senses these new enterprises lack the favorable return found with Atkore’s current acquisitions, the market may give Atkore’s price a risk factor in 2025.

There is also the possibility of a slowdown. If Atkore cannot continue to find new markets for acquisition, or make bad acquisitions in a new market vertical, the company’s growth may slow down, causing them to consider a possible dividend. If that happens, the price of Atkore will likely stagnate as capital is released as dividends to their investors.

ATKR 5-year forecast

Atkore Inc. has the potential to hit an intrinsic value of $425 by 2028. This would give a price range from $375 to $475. At the current price levels, this would give an annual return of 42%. At this price, the market cap of Atkore would reach $17 Billion. This market cap feels very reasonable in the next five years. Right now, the company’s market cap sits at $5.18 Billion.

As the company is generating healthy cashflows, there is a potential for further stock buybacks in the coming five years. The current outstanding shares sit at 40 million shares. This has decreased from a high of 63 million shares in 2017. With the potential for further share buybacks, the price will continue to go up as demand for the stock stays high thanks to the company’s own share buybacks.

ATKR stock news and headlines

The majority of Atkore’s headlines relevant to investors came in 2022 as they continued to acquire more businesses to complement their infrastructure portfolio.

In November, Atkore Inc. announced the acquisition of Elite Polymer Solutions for $91.6 million. Before that, in August of 2022, the company also acquired Cascade Poly Pipe & Conduit and Northwest Polymers to add to its portfolio of HDPE conduit.

Per the announcement, they noted that Northwest Polymers is a leading recycler of PVC, HDPE and other plastics and a strategic supply partner to Cascade and other manufacturers in the region.

Thanks to this focus on recycling, its likely why Atkore was recognized by Newsweek as one the greenest companies going into 2024

Trading Atkore

Due to Atkore’s accelerating intrinsic value, short-term trading is volatile, which may be interesting to day traders. However, if the stock’s price falls too far from its intrinsic value, it’s likely not good to hold a short position on Atkore. Atkore’s price has followed its intrinsic value closely. Pair this with the company’s continuing buyback plan, and it’s likely not a good idea to hold a short position past a few weeks. This suggests that swings trades in Atkore should not be bearish unless the price unnecessarily climbs significantly above its intrinsic value.

This will likely not happen as the company has enough cash to unintentionally keep the stock’s price close to intrinsic value. This may unintentionally occur because if the stock price goes too high, the company will hold off buying back stock until the stock price resets.

Support, Risk & Stop-loss for Atkore International Group stock

Thanks to the company’s buyback program, expect Atkore’s stock price to follow its intrinsic value for the foreseeable future. Since the market is placing a risk factor above $175, a stop-loss above this price for 2023 will likely be good when trading the stock on the bullish side.

The stock will likely see support if prices decrease. Even during a black swan event that is independent of the company, the price will likely see support at a price around $105. Even day traders should avoid bearish positions at these low values.

When trading Atkore, expect a bias toward price increases. The company has a publicly known buyback program ongoing. Any bearish positions may be clobbered by trading on the behalf of Atkore.

Final Thoughts

Atkore is an intriguing stock to analyze. It is well liked by institutional investors and value investors due to its high return on equity and consistent earnings growth. This company was a top find using the “magic formula method”.

This stock has a lot of potential and could potentially be a $20 billion market cap company by the end of the decade. Keep an eye on how successful its acquisitions are. Earnings growth should continue thanks to strong acquisitions and strong organic growth within its current portfolio of companies.

I/we have a position in an asset mentioned

Is Atkore (ATKR) a Buy?

Atkore is currently a Buy at a current price of $143.56. The stock is estimated to be undervalued at $120 per share and overvalued at $180 per share.

The stock has grown its intrinsic value over the last five years with consistent earnings growth and book value growth. Consistently high return on equity (ROE), an attribute used to screen for value stocks has made this stock highly sought after by value investors.

The current intrinsic value of the stock sits around $175 per share. The market has been trading ATKR below its intrinsic value due to trepidation around its earnings growth. If earnings growth slows, expect the company’s intrinsic value and stock price to fall.

What is the target price for Atkore stock?

The Atkore’s target price for Q4 2023 stands at $175 per share, or its current intrinsic value. This is a 22% increase from its current price of $143.

The price of Atkore has been following the company’s intrinsic value closely. Earnings growth needs to continue to meet this price target. Much of the company’s EBITDA growth has been made through price outperformance in FY21 and FY22. If these improvements are unsustainable, then there is potential for a shock in earnings coming.

You can see this windfall fading away when you look at historical EBITDA:

Source: macrotrends.net

With price improvements already made with its existing lines, Atkore will need to drive continued performance through more acquisitions and organic sales growth. Atkore expects their HDPE products (high-density polyethylene) to fuel growth in the coming quarters.

Is Atkore a good investment?

Atkore is a great investment for value investors to monitor. The company is a top pick on magic formula investing since Atkore has a solid return on capital and price to enterprise value ratio.

Atkore has had solid earnings performance and is using these retained earnings for strategic acquisitions and capacity investments. One of the biggest initiatives is their push into HDPE products. The company believes there is an opportunity in the HDPE product market and is prioritizing capital for these investments. The next priority is strategic acquisitions. The company notes they have a “solid pipeline” of opportunities.

Finally, if there are no other good investment opportunities, then the company still has $400 million authorized for stock repurchases of a total $1.3 billion authorized in 2021.

Source: Atkore September 2023 Investor Presentation

What kind of company is Atkore?

Atkore sits in the industrial sector as a manufacturing company that manages two main segments:

Atkore has great products that are critical in electrical and digital infrastructure. Atkore’s products are found all around you in the home, office, and facility.

Source: Atkore September 2023 Investor Presentation

Is at Atkore a Value Stock or Growth Stock?

Atkore Inc. has seen tremendous growth since ATKR’s IPO in 2016. This growth is very rapid, but as an industrial company, it’s constrained by the physical limitations of acquiring new manufacturing facilities and building new facilities. This is in contrast with technology companies, whose earnings could rapidly grow and are only constrained by customer acquisition.

In this regard, Atkore can be analyzed using value investing strategies. Atkore’s intrinsic value has increased over the last few years, but this increase isn’t rapid relative to technology stocks and its growth isn’t erratic.

Atkore estimated intrinsic value versus its price at end of market close.

What is the competitive advantage of Atkore?

Atkore is the premier manufacturer and distributor of electrical systems components and security system components. The company’s products support six unique markets:

Their products have been specialized for a variety of niche markets. For non-residential, Atkore provides electric conduit specialized for healthcare and security products specialized for government buildings and highways.

The company is open to listening to their customers, allowing them to customize products for the needs of the food industry. Atkore builds products that meet the food industry’s cleanliness standards.

Atkore is a leading manufacturer of Unistrut and power-strut, and you can liken the manufacturer to the “Lego maker” for electrical conduit systems.

What is the intrinsic value of ATKR?

The intrinsic value of Atkore sits at $175 in Q4 2023. A chunk of that intrinsic value is provided by the company’s robust book value, which sits at $37.12 per share. The book value of ATKR has consistently grown for the last nine years, proving that the Atkore management team is reinvesting retained earnings and avoiding wasteful acquisitions and ventures.

The bulk of the intrinsic value is from the company’s earnings and earnings growth potential. Atkore’s trailing twelve-month earnings per share sits at $17.50. Atkore’s earnings growth is an astonishing 66% year-over-year; however, this is a median value of its growth since its IPO in 2016. Growth has currently stabilized at a 12% growth rate in the past few years.

The price per share of Atkore has followed the company’s estimated intrinsic value closely, though the market currently is placing a risk factor on the company’s price. Though it’s impossible to predict why the market has placed a risk factor on Atkore’s stock, there may be a hint when you look at the previous time a risk factor was placed on Atkore. This was in 2020, during the Covid-19 crisis. The market may suspect that domestic infrastructure growth will stall which will affect Atkore regardless of their efforts.

What is the Earnings Forecast for Atkore?

Atkore’s management was bullish for Q4 2023 and raised EPS guidance.

Source: Atkore Q3 2023 Presentation

The 2023 outlook for earnings per share increased to a range of $18.90 to $19.30 per share. This would mean that this year’s earnings fell versus the previous year’s earnings but grew versus 2021 earnings. This would be a 6.9% decrease from 2022, but still a 55% increase from 2021.

ATKR earnings each year. 2023 earnings predicted based on management guidance.

Earnings growth, on average, will likely be 12% in the next few years. Earnings have had significant growth in recent years, but due to Atkore being in the industrial sector it may have limited choices on future acquisitions and organic growth. But thanks to share buybacks and consistent cashflow, stock buybacks should be enough to propel earnings growth for the next couple of years.

Atkore’s earnings per share estimates. The light blue represents predicted earnings per share for the next five years at a 12% growth rate.

How Good is Atkore’s ROE?

Atkore’s return on equity sits at a high 57.5%. Atkore has profited greatly from acquiring businesses and generating income to pay down past debt used for these acquisitions. Atkore boasts they have a disciplined approach to capital deployment, and the numbers show it.

Atkore’s debt to equity ratio was very high from 2017 to 2020 as they used debt to acquire businesses. These acquisitions proved to be profitable as the company was able to keep their debt-to-equity ratio low. As earnings increased, the company paid off debt. As of 2022, the company’s debt to equity ratio sits at 1.0. This is in stark contrast to a debt-to-equity ratio of 19.17 in 2018.

Return on equity shown side-by-side with debt-to-equity. High return on equity has pulled down the debt-to-equity ratio with effective use of cash flow.

Atkore expects to expand their HDPE products in the coming year to capture more of this addressable market. As proven in previous years, Atkore also has potential acquisitions in the pipeline.

Source: Atkore Q3 2023 Presentation

ATKR Stock Forecast

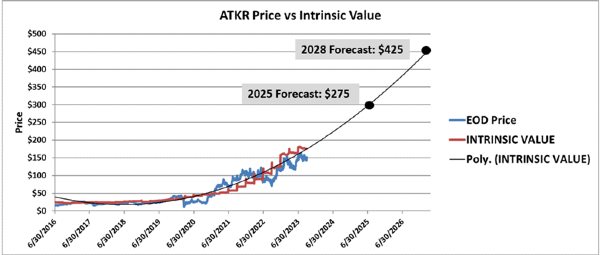

Atkore has a consistent growth projection thanks to its continued intrinsic value growth. Though risky to use polynomial trend lines, this trend line is realistically the best model that correlates with Atkore’s historical intrinsic value. An order two polynomial model placed on Atkore’s intrinsic value has an astonishing 95% correlation!

This model will likely work for the next five years as the company has set itself up as a must-have supplier of infrastructure components. This growth will be driven by continued acquisitions and stock buyback, which should drive growth in the foreseeable future.

Past the next five years, Atkore may have further opportunities internationally. Atkore has a presence in:

Future growth in Asia and Africa could see another boom as Atkore’s products are critical to growth.

ATKR stock forecast 2025

Atkore Inc. has the potential to hit a $275 intrinsic value sometime in 2025. As the price follows intrinsic value closely, the stock price will likely be around $250 to $300. The question in 2025 will be where the next decade of growth will come from. While international markets are promising, Atkore may add a new vertical product mix that compliments its conduit and security businesses. However, if the market senses these new enterprises lack the favorable return found with Atkore’s current acquisitions, the market may give Atkore’s price a risk factor in 2025.

There is also the possibility of a slowdown. If Atkore cannot continue to find new markets for acquisition, or make bad acquisitions in a new market vertical, the company’s growth may slow down, causing them to consider a possible dividend. If that happens, the price of Atkore will likely stagnate as capital is released as dividends to their investors.

ATKR 5-year forecast

Atkore Inc. has the potential to hit an intrinsic value of $425 by 2028. This would give a price range from $375 to $475. At the current price levels, this would give an annual return of 42%. At this price, the market cap of Atkore would reach $17 Billion. This market cap feels very reasonable in the next five years. Right now, the company’s market cap sits at $5.18 Billion.

As the company is generating healthy cashflows, there is a potential for further stock buybacks in the coming five years. The current outstanding shares sit at 40 million shares. This has decreased from a high of 63 million shares in 2017. With the potential for further share buybacks, the price will continue to go up as demand for the stock stays high thanks to the company’s own share buybacks.

ATKR stock news and headlines

The majority of Atkore’s headlines relevant to investors came in 2022 as they continued to acquire more businesses to complement their infrastructure portfolio. In November, Atkore Inc. announced the acquisition of Elite Polymer Solutions for $91.6 million. Before that, in August of 2022, the company also acquired Cascade Poly Pipe & Conduit and Northwest Polymers to add to its portfolio of HDPE conduit. Per the announcement, they noted that Northwest Polymers is a leading recycler of PVC, HDPE and other plastics and a strategic supply partner to Cascade and other manufacturers in the region.

Thanks to this focus on recycling, its likely why Atkore was recognized by Newsweek as one the greenest companies going into 2024

Trading Atkore

Due to Atkore’s accelerating intrinsic value, short-term trading is volatile, which may be interesting to day traders. However, if the stock’s price falls too far from its intrinsic value, it’s likely not good to hold a short position on Atkore. Atkore’s price has followed its intrinsic value closely. Pair this with the company’s continuing buyback plan, and it’s likely not a good idea to hold a short position past a few weeks. This suggests that swings trades in Atkore should not be bearish unless the price unnecessarily climbs significantly above its intrinsic value.

This will likely not happen as the company has enough cash to unintentionally keep the stock’s price close to intrinsic value. This may unintentionally occur because if the stock price goes too high, the company will hold off buying back stock until the stock price resets.

Support, Risk & Stop-loss for Atkore International Group stock

Thanks to the company’s buyback program, expect Atkore’s stock price to follow its intrinsic value for the foreseeable future. Since the market is placing a risk factor above $175, a stop-loss above this price for 2023 will likely be good when trading the stock on the bullish side.

The stock will likely see support if prices decrease. Even during a black swan event that is independent of the company, the price will likely see support at a price around $105. Even day traders should avoid bearish positions at these low values.

When trading Atkore, expect a bias toward price increases. The company has a publicly known buyback program ongoing. Any bearish positions may be clobbered by trading on the behalf of Atkore.

Final Thoughts

Atkore is an intriguing stock to analyze. It is well liked by institutional investors and value investors due to its high return on equity and consistent earnings growth. This company was a top find using the “magic formula method”.

This stock has a lot of potential and could potentially be a $20 billion market cap company by the end of the decade. Keep an eye on how successful its acquisitions are. Earnings growth should continue thanks to strong acquisitions and strong organic growth within its current portfolio of companies.

I/we have a position in an asset mentioned