Sound investments

don't happen alone

Find your crew, build teams, compete in VS MODE, and identify investment trends in our evergrowing investment ecosystem. You aren't on an island anymore, and our community is here to help you make informed decisions in a complex world.

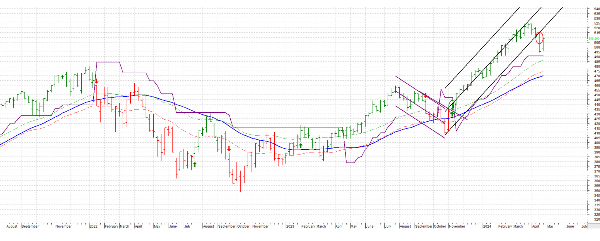

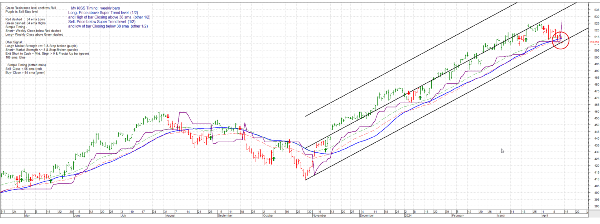

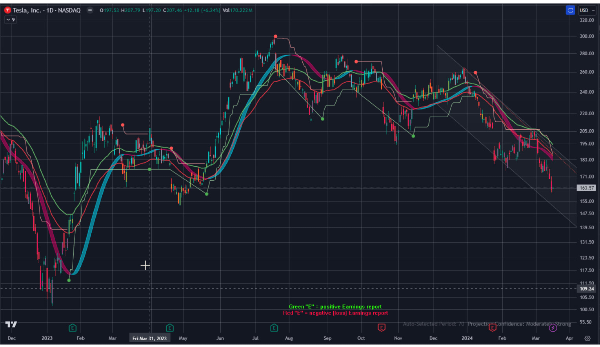

The graph shows the overall trend of the market on the S&P 500 Index. I’ve circled (in red and green) the points where my primary signals have aligned to show a likely change in trend. As you can imagine, we are “heavy in Cash” currently, but our High Yield and Income models are doing very well.

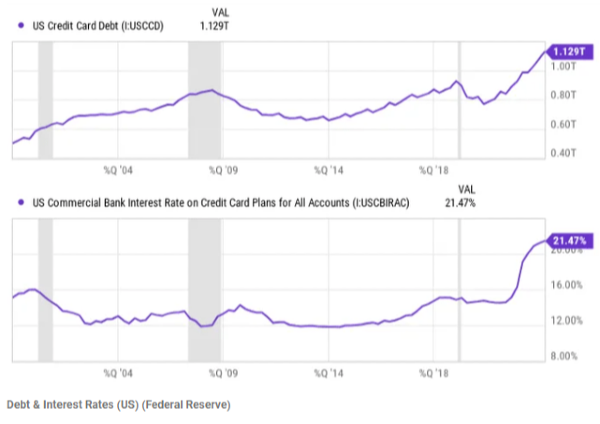

This market was “priced for perfection” with investors predicting continued rapid economic growth and hence earnings to increase. Multiple interest rate cuts were assumed and reflected in the prices, but disappointment brought things back to reality and the market is now (I believe) in a mild correction. Such a correction is actually very typical after a prolonged run in the stock market. I am not anticipating a recession or major correction, but a minor one.