The materials you should invest in will depend on your investment goals.

For example, if you’re young and you’re looking to grow your wealth, invest in rare earth elements. These materials are being used in rapidly growing industries like Electric Vehicles.

If you want growth, but want to avoid speculation, industrial ores and constructions material is likely to be your approach.

If your goal is dividend growth and income, you’ll want sustainable materials for traditional industries. This would include timber and fertilizers.

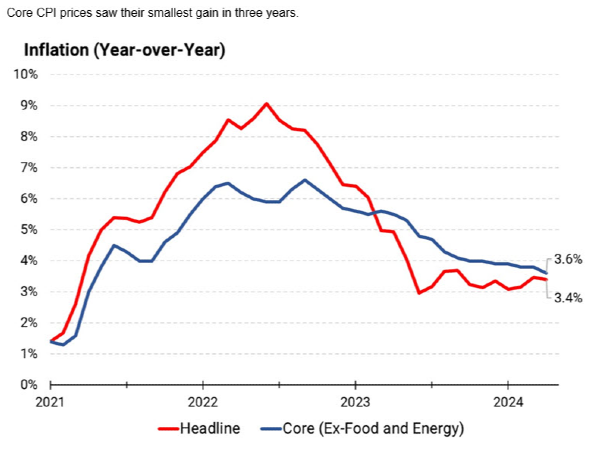

If your goal is to maintain your wealth and minimize the effects of inflation, investing in precious metals will likely be your best approach. Precious metals are used as a storage of wealth as there is a limit of precious metals you can mine on Earth. Typically, precious metals cannot be synthesized in an industrial process.

As you can see, there are many materials you can invest in and the one you choose should match your investment goals. In this article, we’ll walk through in detail what each material sub-sector is, how it should be used in your portfolio, and which stocks give you exposure to that material sub-sector.

Rare Earth Elements

On the speculative side of the investment scale, rare earth elements are a volatile investment due to the materials used in advanced technologies that continue to push demand higher, while geopolitical uncertainty can send jolts through the supply chain.

Rare earth elements are not really rare as they are more abundant than copper; however, the materials are spread thin across the crust. To obtain usable amounts of rare elements, large quantities of raw ore must be processed. This heavy processing leads to the distinction of “rare”.

Rare earth elements are mostly mined in China, with 60% of the rare earth mining production. Myanmar is another large producer of rare earth metals at roughly 10% of the total supply. With Myanmar currently unstable after a 2021 coup and ongoing geopolitical unrest between China and the U.S., the supply of rare earth elements can be heavily impacted by geopolitical events.

Overall, this mix of low production, high demand, and geopolitical uncertainty makes investing in rare earth elements a speculative opportunity.

Use for Rare Earth Elements

Rare Earth Elements are used for numerous processes and technologies in our modern civilization.

We rely on rare earths to color our smartphone screens, fluoresce to signal authenticity in euro banknotes and relay signals through fiber-optic cables across the seafloor. They are also essential for building some of the world’s strongest and most reliable magnets. They generate sound waves in your headphones, boost digital information through space and shift the trajectories of heat-seeking missiles. Rare earths are also driving the growth of green technologies, such as wind energy and electric vehicles, and may even give rise to new components for quantum computers. – Stephen Boyd, a synthetic chemist and independent consultant.

Rare earth elements play a role in the most significant modern technologies today.

- Permanent Magnets: Rare earth magnets (neodymium and samarium-cobalt) are crucial for electric motors, wind turbines, and headphones.

- Luminescent Materials: Rare earths are used in fluorescent lighting, LED displays, and color TVs. Europium, for instance, enhances red phosphors in screens1.

- Catalysts: Cerium is employed in catalytic converters to reduce emissions from vehicles.

- Metallurgy: Rare earths improve the properties of steel, aluminum, and other alloys.

- Batteries: Rare earth elements are used in rechargeable batteries, including those in hybrid and electric vehicles.

- Phosphors and Pigments: Rare earths create vibrant colors in displays, lasers, and even euro banknotes.

- Nuclear Industry: Gadolinium is used in control rods for nuclear reactors.

- Medicine: Lutetium-177 is used in targeted cancer therapy.

- Quantum Computers: Rare earths may play a role in developing components for quantum computers.

Best Way to Invest in Rare Earth Elements

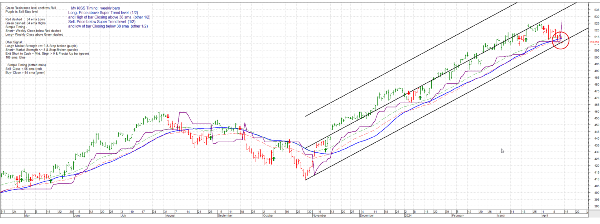

Companies that are pure-plays in mining rare earth elements are more volatile and speculative than the rest of the stock market. The beta of some of the larger mining companies range from 1.22 to 2.28. This means that many of these rare earth element companies will rise and fall roughly twice as fast as the general market.

Knowing that these companies are significantly more speculative, it’s important to conduct significantly more research in these companies before investing. To gain exposure to rare earth elements, you can use a rare earth element ETF. If you are not willing to put in time to research these stocks, investing in an ETF will gain you exposure to the rare earth element mining megatrend occurring thanks to spiking demand for the materials in multiple technological sectors.

Rare Earth Element ETFs

Here are some of the largest rare earth element ETFs:

Stocks with Exposure to Rare Earth Elements

Industrial Metals and Ore

For growth investing and less speculation, metals and ores would be the material categories to choose from. This category is very broad and encompasses I wide variety of materials used in a spectrum of industries. These include aerospace, vehicles, and building construction to name just a few examples. Some of these metals, like titanium, can be affected by geopolitics due their deposits in countries like Russia; however, for the most part, these materials are more common in mining versus the rare earth elements.

What are Industrial Metals used for?

Iron Ore

Iron ore is used in construction, manufacturing, and transportation. Iron is the basic material for steel which is used for a variety of purposes thanks to its engineering strength properties when alloyed with carbon.

Aluminum

Mined from the material bauxite, aluminum is used for beverage cans, various manufactured components in radars, airplanes, and defense components. It’s also used in construction and packaging.

Graphene

Known for its exceptional strength, electrical conductivity, and flexibility. Graphene is used in batteries, supercapacitors, sensors, and composite materials.

Lithium

Key component in lithium-ion batteries. The material can be found in electric vehicles, portable electronics, and energy storage.

Titanium

Titanium is a Lightweight, corrosion-resistant metal. It also has great strength and creep properties, making it ideal in a variety of aircraft components. Titanium’s properties make it useful in medical implants, and sports equipment.

Copper

Essential for electrical wiring, plumbing, and electronics.

Best Way to Invest in Industrial Metals

Most industrial metals companies have betas that are near 1.00, meaning that they typically trend with the market. This is not perfect, BHP Group’s recent 5-month beta was 0.88, and industrial metal companies tend to act like growth stocks, so they would fit perfectly in a growth portfolio or dividend growth portfolio.

Stocks with Exposure to Industrial Metals

- BHP Group (BHP): A leading global natural resources company that mines copper, iron ore, nickel, metallurgical coal, and potash. The company is a large-cap stock with a market cap of $150 Billion with a beta of 0.88.

- Freeport-McMoRan (FCX): A major copper miner with strong growth potential. The company engages in the mining of mineral properties in North America, South America, and Indonesia. It primarily explores for copper, gold, molybdenum, silver, and other metals. Freeport-McMoran is a large cap stock with a market cap currently at $70 Billion and a beta of 1.96.

- Teck Resources (TECK): A diversified natural resources company with a focus on copper. The company operates through Steelmaking Coal, Copper, Zinc, and Energy segments. Its principal products include copper, zinc, steelmaking coal, and blended bitumen. The company also produces lead, silver, and molybdenum. Teck resources is a mid-cap stock with a market capitalization of $25 billion and a beta of 1.39.

- Southern Copper (NYSE: SCCO): The largest holder of reported copper reserves globally. The company is a large cap stock at a market capitalization of $84 billion and a beta of 1.24.

- Rio Tinto (NYSE: RIO): A diversified mining company producing aluminum, copper, and iron ore. Rio Tinto is a large cap stock with a market cap of $109 billion and a beta of 0.65.

Precious Metals

Precious metals such as gold, silver, platinum, and palladium are used in many economic sectors but are most known by investors for their ability to store value. In theory, when government issued currencies lose value due to inflation, precious metals should be a hedge against this degradation in value.

Due to the metal’s scarcity and the inability for these metals to be created in an industrial setting, these metals have culturally stored value for centuries. Most coinage prior to modern times were made of precious metals. This historical context adds to their perceived value.

This scarcity ensures that precious metals maintain value over time. Thanks to the durability of these metals, meaning they are resistant to corrosion, tarnish, and wear, these metals do not degrade easily, which has historically helped them maintain value for their owners.

But these metals have practical applications too. Gold is used in electronics, dentistry, and in aerospace components. Silver is also used in electronics as well as in solar panels. Platinum and Palladium are metals used in catalytic converters for vehicles.

Use for Precious Metals

From an investing standpoint, precious metals are by far most well known for their storage of value. However, their uses extend far beyond the limits of investments.

Gold

Gold is the poster child as a storage of value; however, only 19% of gold is used as a storage of value. For example, the U.S. holds over 8000 tons of gold in reserves. Jewelry makes up 78% of gold used annually, making jewelry the most popular way of using gold. The remaining gold is used in a variety of manufacturing processes.

Due to gold’s resistance and durability, it’s used in circuit boards, connectors, and electrical switches. Thanks to golds biocompatibility, it’s also used in dentistry for crowns, bridges and implants. Gold is being researched for use in medical imaging and is used in medical devices. Gold plating is used in medical devices for stents, pacemakers, dental implants, battery casings, and suture rings.

Silver

Besides its uses in jewelry, silver is also used in the electronics industry due to its high conductivity. Silver is used in the medical field for wound dressings and medical devices thanks to silver’s antimicrobial properties. Also due to silver’s antimicrobial properties, the metal is used for water filtration and food packaging.

Platinum and Palladium

These precious metals are used in jet engines and aerospace components due to their high melting points and resistance to extreme conditions. They are also used in electrical contacts, sensors, and catalytic converters.

Best Way to Invest in Precious Metals

Precious metals are used as a hedge against inflation, market recessions, and market uncertainty. Precious metals historically, but not always, will trend inversely to the stock market. This holds true for SPDR Gold ETF (GLD). The beta for this gold ETF is 0.12. This beta shows that gold does not follow the market proportionally when it rises or falls. Hence why institutional investors will use gold as a hedge when the stock market is volatile.

Stocks with Exposure to Precious Metals

Precious Metals Mining Stocks

- Barrick Gold (GOLD) is a major gold mining company with global operations.

- Hecla Mining (HL) is focused on silver, gold, and other base metals.

- Kinross Gold (KGC) is engaged in gold mining and exploration.

- Pan American Silver (PAAS) is a leading silver producer.

- Sibanye Stillwater (SBSW) is a diversified mining company with exposure to platinum, palladium, and gold.

- SSR Mining (SSRM) is involved in gold and silver mining.

- VanEck Gold Miners ETF (GDX) is an exchange-traded fund that tracks gold mining companies.

- Precious Metal Companies Streaming Companies**

- Wheaton Precious Metals (WPM) is a streaming company that provides financing to mining companies in exchange for a share of their future production. It benefits from the upside of gold and silver mines without directly mining them.

- Franco-Nevada Corporation (FNV) is a royalty and streaming company that provides financing to mining operations in exchange for a share of their future production. It focuses on gold, silver, and other precious metals.

- Royal Gold, Inc. (RGLD): RGLD is another royalty and streaming company that has interests in various precious metals projects. It doesn’t directly mine metals but benefits from their production.

Gold ETFs

- SPDR Gold Shares (GLD): With an AUM of $58.5 billion and an expense ratio of 0.40%, GLD is the largest and most liquid gold ETF. It provides direct exposure to the price of gold by holding physical gold bullion in secure vaults.

- iShares Gold Trust (IAU): Similar to GLD, IAU also invests directly in gold. It has an AUM of $28.5 billion and a lower expense ratio of 0.25%.

- VanEck Vectors Gold Miners ETF (GDX): GDX focuses on gold mining stocks rather than physical gold. It has an AUM of $12.7 billion and an expense ratio of 0.51%.

- VanEck Vectors Junior Gold Miners ETF (GDXJ): GDXJ targets smaller gold mining companies. Its AUM stands at $4.0 billion, with an expense ratio of 0.52%.

- SPDR Gold MiniShares Trust (GLDM): GLDM is a smaller gold ETF with an AUM of $6.3 billion. It offers exposure to gold at a low expense ratio of 0.10%.

Construction Materials

This is a wide sub-sector of materials but are mainly materials used for construction like housing, commercial buildings, roads, and landscaping. The construction industry relies on a wide range of materials to build structures, from residential homes to commercial buildings and infrastructure projects. These materials include wood, cement, aggregates, metals, bricks, concrete, clay, and more. Concrete, in particular, stands out as the most widely used construction material globally

Investors should consider the life cycle of a building, including construction, maintenance, and disposal costs. This plays into the cyclical nature of the construction materials subsector.

What are Construction Metals used for?

Concrete, Brick, and Stone

- Concrete: Formed by mixing cement, aggregates (like gravel), and water. Used for foundations, walls, and pavements.

- Brick: Made from clay or concrete. Used for walls, facades, and fireplaces.

- Stone: Natural material (granite, marble, limestone). Used for cladding, countertops, and landscaping.

- Glass and Ceramics*

- Glass: Transparent material used for windows, doors, and decorative panels.

- Ceramics: Includes tiles, porcelain, and pottery. Used for flooring, walls, and sanitary fixtures.

Best Way to Invest in Construction Materials

Due to the cyclical nature of the construction industry, construction material investments tend to act like cyclical stocks.

Stocks with Exposure to Construction Materials

Concrete

Brick

While there aren’t pure-play brick companies, you can consider companies that produce construction materials, including bricks:

- Boral Limited (BLD): BLD manufactures bricks, roofing materials, and other construction products. It operates globally and has a diverse product portfolio.

Stone

- Granite Construction Incorporated (GVA): GVA is involved in heavy civil construction, including infrastructure projects that use natural stone.

- Cemex, S.A.B. de C.V. (CX): While primarily a cement company, CX also deals with aggregates and concrete. Aggregates include crushed stone and sand, which are essential for construction projects.

Fertilizers

Fertilizers add nutrients to soil to enhance its fertility and promote plant growth. They provide essential materials that plants need for healthy development.

The major nutrients provided by fertilizer are Nitrogen (N), phosphorus (P), and potassium (K). Nitrogen supports leafy growth, phosphorus aids in root development, and potassium contributes to overall plant health.

There are other elements that support plant growth including Calcium (Ca), magnesium (Mg), and sulfur (S) are secondary nutrients. These play vital roles in plant metabolism and structure.

In much smaller amounts, micronutrients such as boron, copper, iron, manganese, zinc, chlorine, and cobalt can be found beneficially in fertilizer.

Best Way to Invest in Fertilizers

Fertilizer companies will be affected by farming mega-cycles. When investing in fertilizers, investors need to be cognizant of this cycle. Management at large companies like Agco Group monitor the farming mega-cycle carefully to manage their own capital strategies.

Stocks with Exposure to Fertilizer materials

Mosaic Inc. (MOS) – Mosaic is the largest U.S. producer of fertilizer. mosaic is a global leader in the crop nutrient industry — the only company with the ability to produce and deliver two vital crop nutrients, phosphate and potash, on a massive scale.

CF Industries(CF) - CF Industries Holdings, Inc., together with its subsidiaries, engages in the manufacture and sale of hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and other industrial activities in North America, Europe, and internationally.

Corteva (CTVA) - Offers chemicals and seeds in the agriculture business. It operates through two segments, Seed and Crop Protection. The Seed segment develops and supplies advanced germplasm and traits that produce optimum yield for farms. It offers trait technologies that enhance resistance to weather, disease, insects, and herbicides used to control weeds, as well as food and nutritional characteristics.

FMC Corporation – As an agricultural sciences company, FMC Provides biofertilizer solutions. These solutions include crop protection, plant health, and professional pest and turf management products. It develops, markets, and sells crop protection chemicals that includes insecticides, herbicides, and fungicides; and biologicals, crop nutrition, and seed treatment products,

American Vanguard Corporation(AVD) - Specializes in agrochemicals and delivery systems. The company manufactures, and markets specialty chemicals for agricultural, commercial, and consumer uses in the United States and internationally. It manufactures and formulates chemicals, including insecticides, fungicides, herbicides, soil health, plant nutrition, molluscicides, growth regulators, soil fumigants, and biorationals in liquid, powder, and granular forms for crops, turf and ornamental plants, and human and animal health protection.

CVR Partners (UAN) – CVR Partners is a growth-oriented company focused on producing nitrogen fertilizer to help serve the needs of a growing population.

Forestry Materials

Though forest materials go beyond lumber, it is lumber that is the most common forest product. It’s used for building houses, furniture, and various structures.

The next largest product is paper and Pulp. These products include newspapers, books, packaging materials, and stationery.

Wood-Based Panels is another product segment inside forestry products. These include plywood, particleboard, and fiberboard. They’re used in construction, furniture, and cabinetry.

Though more of an energy source, wood Pellets is another forest material. Pellets are a renewable energy source that is used for heating and energy production,

Finally, forest-Based Chemicals are Extracted from wood. These chemicals are used in adhesives, paints, and pharmaceuticals.

Best Way to Invest in Forestry Materials

Like fertilizer stocks, investments in forestry may rise and fall cyclically. This is due to the cyclical nature of construction which takes up the majority of the forestry products in terms of timber. The construction mega-cycle, like the farming-cycle, is a multi-year cycle of rise and fall in demand.

Stocks with Exposure to Forestry Material

Rayonier Inc. (RYN) – Though technically a real estate company, Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand. As of December 31, 2023, Rayonier owned or leased under long-term agreements approximately 2.7 million acres of timberlands located in the U.S. South (1.85 million acres), U.S. Pacific Northwest (418,000 acres) and New Zealand (421,000 acres).

- Beta (5Y Monthly): 0.85

- Market Cap: $4.6B (Small Cap Stock)

Weyerhaeuser Co. (WY) – Technically another real estate company, Weyerhaeuser Company is one of the world's largest private owners of timberlands, began operations in 1900.

- Beta (5Y Monthly): 1.55

- Market Cap: $26.3B (Mid Cap Stock)

PotlatchDeltic Corporation (PCH) - potlatchdeltic is a leading real estate investment trust (reit) that owns 1.8 million acres of timberlands in alabama, arkansas, idaho, louisiana, minnesota and mississippi.

- Beta (5Y Monthly): 1.20

- Market Cap: $3.3B (Small Cap Stock)

West Fraser Timber Co. Ltd. (WFG) - West Fraser Timber Co. Ltd., a diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

- Beta (5Y Monthly): 1.65

- Market Cap: $8.4B (Small Cap Stock)

UFP Industries, Inc. (UFPI) - UFP Industries, Inc., through its subsidiaries, designs, manufactures, and markets wood and non-wood composites, and other materials in North America, Europe, Asia, and Australia. It operates through Retail, Packaging, and Construction segments.

- Beta (5Y Monthly): 1.45

- Market Cap (intraday): $7.331B (Small Cap Stock)

iShares Global Timber & Forestry ETF (WOOD) - The iShares Global Timber & Forestry ETF seeks to track the investment results of an index composed of global equities in or related to the timber and forestry industry.

Industrial Chemicals and Gases

The industrial chemical and gas industry is a critical sector that provides essential materials for a wide range of applications, from manufacturing to healthcare.

Industrial chemicals encompass a wide variety of substances used in numerous processes and products. They are the workhorses of the manufacturing world, playing a crucial role in creating everything from the plastic components in your smartphone to the detergent that cleans your clothes.

For instance, sulfuric acid is a powerhouse in the industry, involved in making fertilizers to feed crops and batteries to power vehicles. Then there’s ethylene, a key ingredient in plastics, which shapes countless items we use daily. Nitrogen, a seemingly simple gas, is essential for making steel strong and preserving the freshness of the food we eat.

These chemicals are not just ingredients; they’re also tools. They can clean, preserve, and transform materials in ways that allow for innovation and efficiency in production. The industrial chemical industry contributes to a vast array of products that support our modern lifestyle.

Industrial gases encompass a variety of substances that are manufactured for use across different industries. They include elemental gases like nitrogen and oxygen, as well as noble gases such as argon and helium. Additionally, compounds like carbon dioxide and acetylene are also classified under industrial gases. These gases are integral to sectors ranging from healthcare and food to electronics and aerospace, where they serve various purposes including refrigeration, welding, and as medical anesthetics

How to Invest in Industrial Chemicals and gases

This material sub-sector is heavily influenced by the industrial sector. View them as growth stocks with dividend potential. These stocks tend to follow the market, like the industrial sector, and are not influenced by other mega-cycles like construction or farming.

These stocks are great dividend growth stocks. Linde PLC has grown their dividend and stock value consistently over decades

Stocks with exposure to Industrial Chemicals and Gas

Air Products & Chemicals (APD) is a global leader in industrial gases and chemicals, serving customers across industries like electronics, food and beverage, manufacturing, and more. They are also at the forefront of clean energy technologies, including hydrogen fuel and carbon capture.

Dow Inc. (DOW) has a history dating back to 1897. Dow is a major chemical producer with a diverse product portfolio that includes coatings, plastics, and silicones.

Celanese Corporation (CE) is a technology and specialty materials company that manufactures a wide range of chemical products used in various industries, from automotive to medical applications.

Huntsman Corporation (HUN) is known for its innovation in the chemical industry, producing a variety of chemical products for markets such as automotive, construction, and textiles.

The Bottom Line

The basic materials industry caters to various other sectors including manufacturing, agriculture, and technology. Materials are also used for different investing strategies. Precious metals help investors hedge against the market while many timber stocks are managed similarly to a real estate fund.

The materials sector has a wide range of options for different investment strategies. From the speculative nature of rare earth elements to the income strategies around timber production, an investor looking through material stocks has a lot of directions to go.

The materials you should invest in will depend on your investment goals.

For example, if you’re young and you’re looking to grow your wealth, invest in rare earth elements. These materials are being used in rapidly growing industries like Electric Vehicles.

If you want growth, but want to avoid speculation, industrial ores and constructions material is likely to be your approach.

If your goal is dividend growth and income, you’ll want sustainable materials for traditional industries. This would include timber and fertilizers.

If your goal is to maintain your wealth and minimize the effects of inflation, investing in precious metals will likely be your best approach. Precious metals are used as a storage of wealth as there is a limit of precious metals you can mine on Earth. Typically, precious metals cannot be synthesized in an industrial process. As you can see, there are many materials you can invest in and the one you choose should match your investment goals. In this article, we’ll walk through in detail what each material sub-sector is, how it should be used in your portfolio, and which stocks give you exposure to that material sub-sector.

Rare Earth Elements

On the speculative side of the investment scale, rare earth elements are a volatile investment due to the materials used in advanced technologies that continue to push demand higher, while geopolitical uncertainty can send jolts through the supply chain.

Rare earth elements are not really rare as they are more abundant than copper; however, the materials are spread thin across the crust. To obtain usable amounts of rare elements, large quantities of raw ore must be processed. This heavy processing leads to the distinction of “rare”.

Rare earth elements are mostly mined in China, with 60% of the rare earth mining production. Myanmar is another large producer of rare earth metals at roughly 10% of the total supply. With Myanmar currently unstable after a 2021 coup and ongoing geopolitical unrest between China and the U.S., the supply of rare earth elements can be heavily impacted by geopolitical events.

Overall, this mix of low production, high demand, and geopolitical uncertainty makes investing in rare earth elements a speculative opportunity.

Use for Rare Earth Elements

Rare Earth Elements are used for numerous processes and technologies in our modern civilization.

Rare earth elements play a role in the most significant modern technologies today.

Best Way to Invest in Rare Earth Elements

Companies that are pure-plays in mining rare earth elements are more volatile and speculative than the rest of the stock market. The beta of some of the larger mining companies range from 1.22 to 2.28. This means that many of these rare earth element companies will rise and fall roughly twice as fast as the general market. Knowing that these companies are significantly more speculative, it’s important to conduct significantly more research in these companies before investing. To gain exposure to rare earth elements, you can use a rare earth element ETF. If you are not willing to put in time to research these stocks, investing in an ETF will gain you exposure to the rare earth element mining megatrend occurring thanks to spiking demand for the materials in multiple technological sectors.

Rare Earth Element ETFs

Here are some of the largest rare earth element ETFs:

Stocks with Exposure to Rare Earth Elements

Industrial Metals and Ore

For growth investing and less speculation, metals and ores would be the material categories to choose from. This category is very broad and encompasses I wide variety of materials used in a spectrum of industries. These include aerospace, vehicles, and building construction to name just a few examples. Some of these metals, like titanium, can be affected by geopolitics due their deposits in countries like Russia; however, for the most part, these materials are more common in mining versus the rare earth elements.

What are Industrial Metals used for?

Iron Ore Iron ore is used in construction, manufacturing, and transportation. Iron is the basic material for steel which is used for a variety of purposes thanks to its engineering strength properties when alloyed with carbon.

Aluminum Mined from the material bauxite, aluminum is used for beverage cans, various manufactured components in radars, airplanes, and defense components. It’s also used in construction and packaging.

Graphene Known for its exceptional strength, electrical conductivity, and flexibility. Graphene is used in batteries, supercapacitors, sensors, and composite materials.

Lithium Key component in lithium-ion batteries. The material can be found in electric vehicles, portable electronics, and energy storage.

Titanium Titanium is a Lightweight, corrosion-resistant metal. It also has great strength and creep properties, making it ideal in a variety of aircraft components. Titanium’s properties make it useful in medical implants, and sports equipment.

Copper Essential for electrical wiring, plumbing, and electronics.

Best Way to Invest in Industrial Metals

Most industrial metals companies have betas that are near 1.00, meaning that they typically trend with the market. This is not perfect, BHP Group’s recent 5-month beta was 0.88, and industrial metal companies tend to act like growth stocks, so they would fit perfectly in a growth portfolio or dividend growth portfolio.

Stocks with Exposure to Industrial Metals

Precious Metals

Precious metals such as gold, silver, platinum, and palladium are used in many economic sectors but are most known by investors for their ability to store value. In theory, when government issued currencies lose value due to inflation, precious metals should be a hedge against this degradation in value.

Due to the metal’s scarcity and the inability for these metals to be created in an industrial setting, these metals have culturally stored value for centuries. Most coinage prior to modern times were made of precious metals. This historical context adds to their perceived value.

This scarcity ensures that precious metals maintain value over time. Thanks to the durability of these metals, meaning they are resistant to corrosion, tarnish, and wear, these metals do not degrade easily, which has historically helped them maintain value for their owners.

But these metals have practical applications too. Gold is used in electronics, dentistry, and in aerospace components. Silver is also used in electronics as well as in solar panels. Platinum and Palladium are metals used in catalytic converters for vehicles.

Use for Precious Metals

From an investing standpoint, precious metals are by far most well known for their storage of value. However, their uses extend far beyond the limits of investments.

Gold Gold is the poster child as a storage of value; however, only 19% of gold is used as a storage of value. For example, the U.S. holds over 8000 tons of gold in reserves. Jewelry makes up 78% of gold used annually, making jewelry the most popular way of using gold. The remaining gold is used in a variety of manufacturing processes. Due to gold’s resistance and durability, it’s used in circuit boards, connectors, and electrical switches. Thanks to golds biocompatibility, it’s also used in dentistry for crowns, bridges and implants. Gold is being researched for use in medical imaging and is used in medical devices. Gold plating is used in medical devices for stents, pacemakers, dental implants, battery casings, and suture rings.

Silver Besides its uses in jewelry, silver is also used in the electronics industry due to its high conductivity. Silver is used in the medical field for wound dressings and medical devices thanks to silver’s antimicrobial properties. Also due to silver’s antimicrobial properties, the metal is used for water filtration and food packaging.

Platinum and Palladium These precious metals are used in jet engines and aerospace components due to their high melting points and resistance to extreme conditions. They are also used in electrical contacts, sensors, and catalytic converters.

Best Way to Invest in Precious Metals

Precious metals are used as a hedge against inflation, market recessions, and market uncertainty. Precious metals historically, but not always, will trend inversely to the stock market. This holds true for SPDR Gold ETF (GLD). The beta for this gold ETF is 0.12. This beta shows that gold does not follow the market proportionally when it rises or falls. Hence why institutional investors will use gold as a hedge when the stock market is volatile.

Stocks with Exposure to Precious Metals

Precious Metals Mining Stocks

Gold ETFs

Construction Materials

This is a wide sub-sector of materials but are mainly materials used for construction like housing, commercial buildings, roads, and landscaping. The construction industry relies on a wide range of materials to build structures, from residential homes to commercial buildings and infrastructure projects. These materials include wood, cement, aggregates, metals, bricks, concrete, clay, and more. Concrete, in particular, stands out as the most widely used construction material globally Investors should consider the life cycle of a building, including construction, maintenance, and disposal costs. This plays into the cyclical nature of the construction materials subsector.

What are Construction Metals used for?

Concrete, Brick, and Stone

Best Way to Invest in Construction Materials

Due to the cyclical nature of the construction industry, construction material investments tend to act like cyclical stocks.

Stocks with Exposure to Construction Materials

Concrete

Brick While there aren’t pure-play brick companies, you can consider companies that produce construction materials, including bricks:

Stone

Fertilizers

Fertilizers add nutrients to soil to enhance its fertility and promote plant growth. They provide essential materials that plants need for healthy development. The major nutrients provided by fertilizer are Nitrogen (N), phosphorus (P), and potassium (K). Nitrogen supports leafy growth, phosphorus aids in root development, and potassium contributes to overall plant health. There are other elements that support plant growth including Calcium (Ca), magnesium (Mg), and sulfur (S) are secondary nutrients. These play vital roles in plant metabolism and structure. In much smaller amounts, micronutrients such as boron, copper, iron, manganese, zinc, chlorine, and cobalt can be found beneficially in fertilizer.

Best Way to Invest in Fertilizers

Fertilizer companies will be affected by farming mega-cycles. When investing in fertilizers, investors need to be cognizant of this cycle. Management at large companies like Agco Group monitor the farming mega-cycle carefully to manage their own capital strategies.

Stocks with Exposure to Fertilizer materials

Mosaic Inc. (MOS) – Mosaic is the largest U.S. producer of fertilizer. mosaic is a global leader in the crop nutrient industry — the only company with the ability to produce and deliver two vital crop nutrients, phosphate and potash, on a massive scale.

CF Industries(CF) - CF Industries Holdings, Inc., together with its subsidiaries, engages in the manufacture and sale of hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and other industrial activities in North America, Europe, and internationally.

Corteva (CTVA) - Offers chemicals and seeds in the agriculture business. It operates through two segments, Seed and Crop Protection. The Seed segment develops and supplies advanced germplasm and traits that produce optimum yield for farms. It offers trait technologies that enhance resistance to weather, disease, insects, and herbicides used to control weeds, as well as food and nutritional characteristics.

FMC Corporation – As an agricultural sciences company, FMC Provides biofertilizer solutions. These solutions include crop protection, plant health, and professional pest and turf management products. It develops, markets, and sells crop protection chemicals that includes insecticides, herbicides, and fungicides; and biologicals, crop nutrition, and seed treatment products,

American Vanguard Corporation(AVD) - Specializes in agrochemicals and delivery systems. The company manufactures, and markets specialty chemicals for agricultural, commercial, and consumer uses in the United States and internationally. It manufactures and formulates chemicals, including insecticides, fungicides, herbicides, soil health, plant nutrition, molluscicides, growth regulators, soil fumigants, and biorationals in liquid, powder, and granular forms for crops, turf and ornamental plants, and human and animal health protection.

CVR Partners (UAN) – CVR Partners is a growth-oriented company focused on producing nitrogen fertilizer to help serve the needs of a growing population.

Forestry Materials

Though forest materials go beyond lumber, it is lumber that is the most common forest product. It’s used for building houses, furniture, and various structures. The next largest product is paper and Pulp. These products include newspapers, books, packaging materials, and stationery.

Wood-Based Panels is another product segment inside forestry products. These include plywood, particleboard, and fiberboard. They’re used in construction, furniture, and cabinetry.

Though more of an energy source, wood Pellets is another forest material. Pellets are a renewable energy source that is used for heating and energy production, Finally, forest-Based Chemicals are Extracted from wood. These chemicals are used in adhesives, paints, and pharmaceuticals.

Best Way to Invest in Forestry Materials

Like fertilizer stocks, investments in forestry may rise and fall cyclically. This is due to the cyclical nature of construction which takes up the majority of the forestry products in terms of timber. The construction mega-cycle, like the farming-cycle, is a multi-year cycle of rise and fall in demand.

Stocks with Exposure to Forestry Material

Rayonier Inc. (RYN) – Though technically a real estate company, Rayonier is a leading timberland real estate investment trust with assets located in some of the most productive softwood timber growing regions in the United States and New Zealand. As of December 31, 2023, Rayonier owned or leased under long-term agreements approximately 2.7 million acres of timberlands located in the U.S. South (1.85 million acres), U.S. Pacific Northwest (418,000 acres) and New Zealand (421,000 acres).

Weyerhaeuser Co. (WY) – Technically another real estate company, Weyerhaeuser Company is one of the world's largest private owners of timberlands, began operations in 1900.

PotlatchDeltic Corporation (PCH) - potlatchdeltic is a leading real estate investment trust (reit) that owns 1.8 million acres of timberlands in alabama, arkansas, idaho, louisiana, minnesota and mississippi.

West Fraser Timber Co. Ltd. (WFG) - West Fraser Timber Co. Ltd., a diversified wood products company, engages in manufacturing, selling, marketing, and distributing lumber, engineered wood products, pulp, newsprint, wood chips, and other residuals and renewable energy.

UFP Industries, Inc. (UFPI) - UFP Industries, Inc., through its subsidiaries, designs, manufactures, and markets wood and non-wood composites, and other materials in North America, Europe, Asia, and Australia. It operates through Retail, Packaging, and Construction segments.

iShares Global Timber & Forestry ETF (WOOD) - The iShares Global Timber & Forestry ETF seeks to track the investment results of an index composed of global equities in or related to the timber and forestry industry.

Industrial Chemicals and Gases

The industrial chemical and gas industry is a critical sector that provides essential materials for a wide range of applications, from manufacturing to healthcare. Industrial chemicals encompass a wide variety of substances used in numerous processes and products. They are the workhorses of the manufacturing world, playing a crucial role in creating everything from the plastic components in your smartphone to the detergent that cleans your clothes.

For instance, sulfuric acid is a powerhouse in the industry, involved in making fertilizers to feed crops and batteries to power vehicles. Then there’s ethylene, a key ingredient in plastics, which shapes countless items we use daily. Nitrogen, a seemingly simple gas, is essential for making steel strong and preserving the freshness of the food we eat. These chemicals are not just ingredients; they’re also tools. They can clean, preserve, and transform materials in ways that allow for innovation and efficiency in production. The industrial chemical industry contributes to a vast array of products that support our modern lifestyle.

Industrial gases encompass a variety of substances that are manufactured for use across different industries. They include elemental gases like nitrogen and oxygen, as well as noble gases such as argon and helium. Additionally, compounds like carbon dioxide and acetylene are also classified under industrial gases. These gases are integral to sectors ranging from healthcare and food to electronics and aerospace, where they serve various purposes including refrigeration, welding, and as medical anesthetics

How to Invest in Industrial Chemicals and gases

This material sub-sector is heavily influenced by the industrial sector. View them as growth stocks with dividend potential. These stocks tend to follow the market, like the industrial sector, and are not influenced by other mega-cycles like construction or farming.

These stocks are great dividend growth stocks. Linde PLC has grown their dividend and stock value consistently over decades

Stocks with exposure to Industrial Chemicals and Gas

Air Products & Chemicals (APD) is a global leader in industrial gases and chemicals, serving customers across industries like electronics, food and beverage, manufacturing, and more. They are also at the forefront of clean energy technologies, including hydrogen fuel and carbon capture.

Dow Inc. (DOW) has a history dating back to 1897. Dow is a major chemical producer with a diverse product portfolio that includes coatings, plastics, and silicones.

Celanese Corporation (CE) is a technology and specialty materials company that manufactures a wide range of chemical products used in various industries, from automotive to medical applications.

Huntsman Corporation (HUN) is known for its innovation in the chemical industry, producing a variety of chemical products for markets such as automotive, construction, and textiles.

The Bottom Line

The basic materials industry caters to various other sectors including manufacturing, agriculture, and technology. Materials are also used for different investing strategies. Precious metals help investors hedge against the market while many timber stocks are managed similarly to a real estate fund. The materials sector has a wide range of options for different investment strategies. From the speculative nature of rare earth elements to the income strategies around timber production, an investor looking through material stocks has a lot of directions to go.