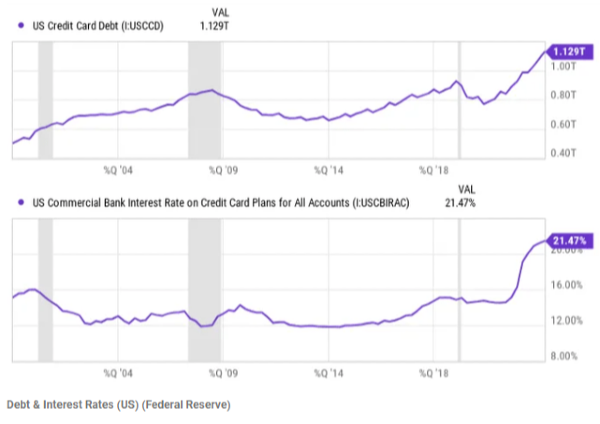

May 24, 2024– I’ve been harping on this for what seems like a year now. The stock market always “looks forward”, whether it be right or wrong, it always tries to “get a jump” on the economy and corporate earnings. Thus, interest rates are high on the list of “what’s happening next” for both the economy and earnings.

Since the FED controls the interbank loan rate and hence interest rates in general, that’s the thing to watch, or actually, anticipate. And since this FED is determined to deal with inflation, the inflation rate (and job growth) are big factors that drive the decisions.

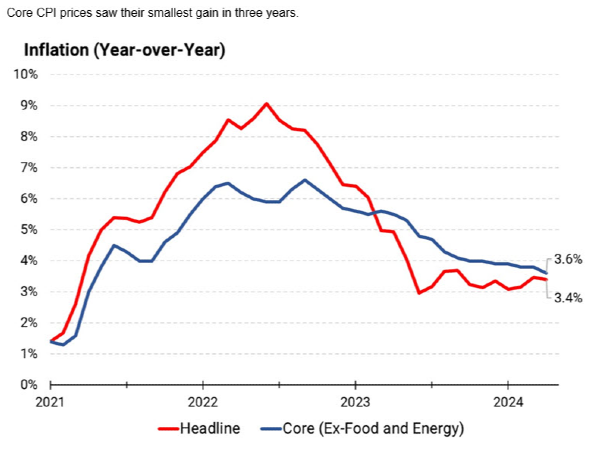

So . . . I present the chart below on the inflation rate over the past 3 years.

The FED’s stated goal is to get very close to a 2% inflation rate and they are getting there. Many folks confuse high prices with inflation. Inflation is the rate of change of price, not the level of prices. How long will this take? Longer; but no one really knows. The tricky balance is to slow consumer demand without screwing up job growth, and that’s not easy.

Secondary to all of this is that China is selling US Treasury Bonds big time and buying gold. That does not help to lower interest rates. But corporate earnings are generally pretty good (an excuse to raise prices?).

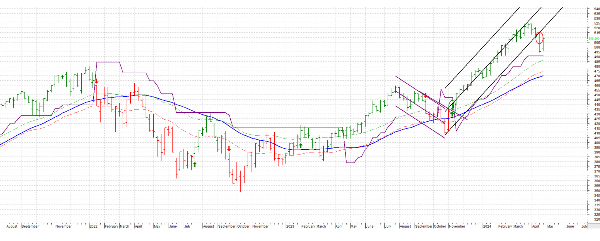

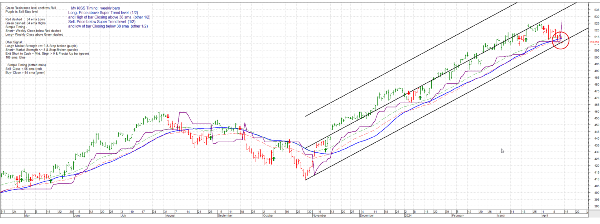

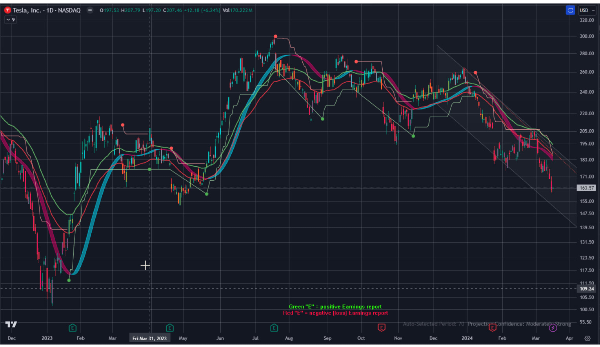

I have slowly reentered this market, but don’t expect the rapid price appreciation of the past 2 years going forward. Plus, it will be more of a stock pickers market. Just using the letters “AI” seemed to be a golden touch, but now companies have to deliver and competition is high.

Have a good holiday weekend (those in the US) and take care. ……….. Tom ………..

May 24, 2024– I’ve been harping on this for what seems like a year now. The stock market always “looks forward”, whether it be right or wrong, it always tries to “get a jump” on the economy and corporate earnings. Thus, interest rates are high on the list of “what’s happening next” for both the economy and earnings.

Since the FED controls the interbank loan rate and hence interest rates in general, that’s the thing to watch, or actually, anticipate. And since this FED is determined to deal with inflation, the inflation rate (and job growth) are big factors that drive the decisions. So . . . I present the chart below on the inflation rate over the past 3 years.

The FED’s stated goal is to get very close to a 2% inflation rate and they are getting there. Many folks confuse high prices with inflation. Inflation is the rate of change of price, not the level of prices. How long will this take? Longer; but no one really knows. The tricky balance is to slow consumer demand without screwing up job growth, and that’s not easy.

Secondary to all of this is that China is selling US Treasury Bonds big time and buying gold. That does not help to lower interest rates. But corporate earnings are generally pretty good (an excuse to raise prices?).

I have slowly reentered this market, but don’t expect the rapid price appreciation of the past 2 years going forward. Plus, it will be more of a stock pickers market. Just using the letters “AI” seemed to be a golden touch, but now companies have to deliver and competition is high.

Have a good holiday weekend (those in the US) and take care. ……….. Tom ………..