Unveiling Coca-Cola: The Ninth Best-Performing Stock and Its Future Prospects

https://youtu.be/qQOKcxT83kw?si=rFhv0voJlyCJ7tdN

Intro

The best-performing Consumer Staples stock ever returned 12 million percent. That means a dollar invested would have turned into $123,000. It's the ninth best-performing stock ever. You're dying to know which stock it is, aren't you? Well, hold your horses there, Tanto. I'll tell you about the stock in a second. But first, a story. One of my biggest passions isn't climbing corporate ladders or collecting degrees like merit badges. It's having adventures. I have been to more than two-thirds of the world's countries, including places like Yemen, Iraq, Somalia, and North Korea. And you know what I found most remarkable about the Hermit Kingdom? It wasn't the cute traffic girls, the empty roads, or the friendly soldiers. It was the fact that Coca-Cola, a defining American brand, can even be found in the DPRK. I took this photo at a pizza shop in Pyongyang, and that wasn't their only Coke product; they also had Sprite.

Coca-Cola's Strong Brand

So, just some knee-jerk thoughts on Coca-Cola. At least, what I think when I hear that name. Isn't that a company Warren Buffett invested in? Isn't all their growth behind them? How many cans of Coke can people possibly drink? And Coke is certainly being threatened by new emerging brands. There's probably not much growth left in the stock. Well, Coke seems to have a plan for all that. What you need to remember when you think about Coca-Cola is that it's more than just the drink Coca-Cola. They have a broad range of products under their brand umbrella.

Coca-Cola has around 200 brands sold in 200 countries and territories. This is a significant reduction from their previous 400 brands, allowing them to focus on scaling effectively. They group their brands into several categories: traditional sparkling soft drinks, juice and dairy, water sports, coffee, tea, and emerging products.

Coca-Cola's Growth Opportunities

Looking at the company's growth, it's not overly impressive at first glance. There has been a turnaround recently, especially in the past three years, showing some trajectory of revenue growth. The company's strategy is to convert more people into regular Coke drinkers. For instance, in the United States, nearly 90% of the population drinks commercial beverages, yet only about 30% drink a Coca-Cola product at least once per week.

Emerging markets also hold significant potential. About 80% of the population in these markets doesn't consume commercial beverages, representing a vast opportunity for growth. The total addressable market in North America alone is $380 billion, with Coca-Cola holding a 50% share in sparkling soft drinks. Their growth strategy involves gaining market share in various segments, including energy drinks, water sports, and teas.

Coca-Cola Earnings

Analyzing Coca-Cola's revenue segments reveals that Bottling Investments account for 17% of revenues but only 4% of their profit. They have significantly reduced their exposure to bottling from 52% in 2015 to 17% last year. Latin America accounts for 12% of revenues but 22% of profit, showing a strong performance in that region.

Coca-Cola's ability to continue growing its dividend over time is noteworthy. They have consistently covered their dividend payments with free cash flow, even during challenging years like 2018. The company has been reinvesting in growth through acquisitions, adding brands like Topo Chico to their portfolio.

KO Stock and Technology

The future growth of Coca-Cola relies heavily on leveraging technology like AI. They have shifted their digital spend and are pioneering AI to create engaging brand experiences. This innovation extends beyond just new drink offerings to different packaging solutions and equipment, such as machines that can mix drinks on the fly.

One of the Best-Performing Stocks

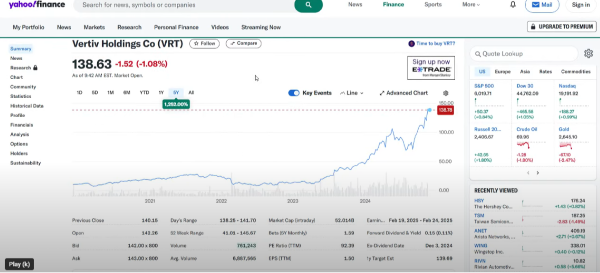

Coca-Cola is the ninth best-performing stock ever, based on annualized return. However, this is not the only reason to invest. Coca-Cola is a dividend champion, having paid and increased its dividend for over 60 years in a row. Although recent dividend increases have been modest, with a five-year growth rate barely outpacing inflation, the company's long-term commitment to dividends is impressive.

Coca-Cola Dividend History

The most recent eight years show consistent dividend increases, with a ten-year growth rate of 5%. Despite a low yield of 2.78%, the stock's price stability makes it a reliable investment. Coca-Cola's beta of 0.61 indicates lower volatility, making it a steady performer in the stock market.

Conclusion

Coca-Cola remains a strong investment due to its robust brand, strategic growth opportunities, technological innovation, and remarkable dividend history. While the company's growth may not be explosive, its stability and consistent dividend payments make it a reliable choice for investors.

https://youtu.be/qQOKcxT83kw?si=rFhv0voJlyCJ7tdN

Unveiling Coca-Cola: The Ninth Best-Performing Stock and Its Future Prospects

https://youtu.be/qQOKcxT83kw?si=rFhv0voJlyCJ7tdN

Intro

The best-performing Consumer Staples stock ever returned 12 million percent. That means a dollar invested would have turned into $123,000. It's the ninth best-performing stock ever. You're dying to know which stock it is, aren't you? Well, hold your horses there, Tanto. I'll tell you about the stock in a second. But first, a story. One of my biggest passions isn't climbing corporate ladders or collecting degrees like merit badges. It's having adventures. I have been to more than two-thirds of the world's countries, including places like Yemen, Iraq, Somalia, and North Korea. And you know what I found most remarkable about the Hermit Kingdom? It wasn't the cute traffic girls, the empty roads, or the friendly soldiers. It was the fact that Coca-Cola, a defining American brand, can even be found in the DPRK. I took this photo at a pizza shop in Pyongyang, and that wasn't their only Coke product; they also had Sprite.

Coca-Cola's Strong Brand

So, just some knee-jerk thoughts on Coca-Cola. At least, what I think when I hear that name. Isn't that a company Warren Buffett invested in? Isn't all their growth behind them? How many cans of Coke can people possibly drink? And Coke is certainly being threatened by new emerging brands. There's probably not much growth left in the stock. Well, Coke seems to have a plan for all that. What you need to remember when you think about Coca-Cola is that it's more than just the drink Coca-Cola. They have a broad range of products under their brand umbrella.

Coca-Cola has around 200 brands sold in 200 countries and territories. This is a significant reduction from their previous 400 brands, allowing them to focus on scaling effectively. They group their brands into several categories: traditional sparkling soft drinks, juice and dairy, water sports, coffee, tea, and emerging products.

Coca-Cola's Growth Opportunities

Looking at the company's growth, it's not overly impressive at first glance. There has been a turnaround recently, especially in the past three years, showing some trajectory of revenue growth. The company's strategy is to convert more people into regular Coke drinkers. For instance, in the United States, nearly 90% of the population drinks commercial beverages, yet only about 30% drink a Coca-Cola product at least once per week.

Emerging markets also hold significant potential. About 80% of the population in these markets doesn't consume commercial beverages, representing a vast opportunity for growth. The total addressable market in North America alone is $380 billion, with Coca-Cola holding a 50% share in sparkling soft drinks. Their growth strategy involves gaining market share in various segments, including energy drinks, water sports, and teas.

Coca-Cola Earnings

Analyzing Coca-Cola's revenue segments reveals that Bottling Investments account for 17% of revenues but only 4% of their profit. They have significantly reduced their exposure to bottling from 52% in 2015 to 17% last year. Latin America accounts for 12% of revenues but 22% of profit, showing a strong performance in that region.

Coca-Cola's ability to continue growing its dividend over time is noteworthy. They have consistently covered their dividend payments with free cash flow, even during challenging years like 2018. The company has been reinvesting in growth through acquisitions, adding brands like Topo Chico to their portfolio.

KO Stock and Technology

The future growth of Coca-Cola relies heavily on leveraging technology like AI. They have shifted their digital spend and are pioneering AI to create engaging brand experiences. This innovation extends beyond just new drink offerings to different packaging solutions and equipment, such as machines that can mix drinks on the fly.

One of the Best-Performing Stocks

Coca-Cola is the ninth best-performing stock ever, based on annualized return. However, this is not the only reason to invest. Coca-Cola is a dividend champion, having paid and increased its dividend for over 60 years in a row. Although recent dividend increases have been modest, with a five-year growth rate barely outpacing inflation, the company's long-term commitment to dividends is impressive.

Coca-Cola Dividend History

The most recent eight years show consistent dividend increases, with a ten-year growth rate of 5%. Despite a low yield of 2.78%, the stock's price stability makes it a reliable investment. Coca-Cola's beta of 0.61 indicates lower volatility, making it a steady performer in the stock market.

Conclusion

Coca-Cola remains a strong investment due to its robust brand, strategic growth opportunities, technological innovation, and remarkable dividend history. While the company's growth may not be explosive, its stability and consistent dividend payments make it a reliable choice for investors.

https://youtu.be/qQOKcxT83kw?si=rFhv0voJlyCJ7tdN