Analyzing Portfolio Performance: Best and Worst Performers

A Snapshot of Current Holdings

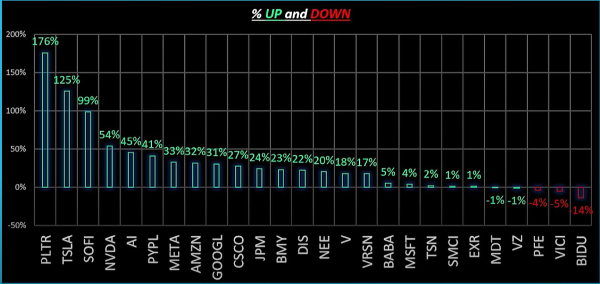

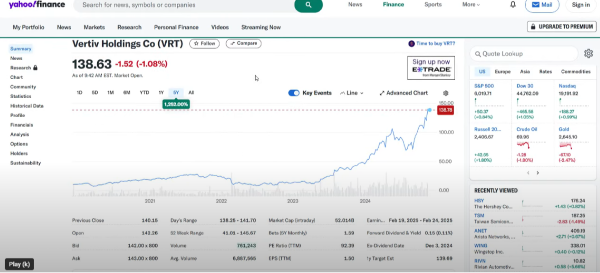

Here's an overview of the current holdings, courtesy of SoFi, with more detailed screenshots posted on our Discord. For simplicity, we'll use custom charts here to visualize the information. Currently, seven stocks make up over half of the entire portfolio:

- Google

- Amazon

- Palantir

- SoFi

- Microsoft

- Vici Properties (recent addition)

- Pfizer

Some might argue that SoFi and Pfizer are a bit high, and maybe safer stock choices could replace them. Instead of selling stocks (even the ones that have risen significantly), I prefer to diversify the portfolio by purchasing other stocks. This strategy helps balance the portfolio over time.

Future Buy Plans for January

Let's discuss the stocks I plan to buy in January. Some solid picks at their current valuations include:

- Medtronic

- Verizon

- Extra Space Storage

These stocks are currently cheap and offer excellent dividends. Similarly, Tyson Foods is another stock that needs to be more eye-catching at around 2% of the portfolio. I plan to add more in the coming month. Additionally, a little more of C3.ai would be beneficial for long-term exposure to AI, despite recent gains.

Double-Digit Gainers Leading the Charge

Our top performers, achieving remarkable gains, include:

- Palantir, Tesla, and SoFi: Excelling with 100-200% gains each.

- Nvidia and C3.ai: Up around 50%.

- Google and Amazon: Both major holdings have achieved 30% gains each.

These are stocks that have performed phenomenally well and contribute significantly to our portfolio’s growth.

Single-Digit Gainers and Stocks to Watch

Among the single-digit gainers, Microsoft, Tyson, and Extra Space Storage stand out. They are clear buys due to their small percentage gains and potential for growth. While Microsoft isn’t cheap, Tyson and Extra Space Storage offer low valuations and substantial dividends.

Evaluating the Losers

When looking at the underperformers, I am confident about increasing investments in them. Despite some different opinions, particularly about Baidu (due to it being a Chinese stock amid tariff concerns), it remains a long-term favorite. Other stocks like Medtronic, Verizon, Pfizer, and Vici Properties are at terrific valuations, making them excellent candidates for increasing holdings while prices are low.

Budget Update and Final Thoughts

Following the addition of another $100 for January's budget, the total account value has now exceeded $1,900, with around $400 held in cash. This leaves us with a cash ratio of just over 20% relative to our stock investments.

The plan is to maintain this proactive approach, balancing the portfolio and capitalizing on opportunities that arise. If you'd like to stay updated with detailed screenshots and insights, join us on Discord for in-depth discussions!

What are your thoughts on these investments?

Analyzing Portfolio Performance: Best and Worst Performers

A Snapshot of Current Holdings

Here's an overview of the current holdings, courtesy of SoFi, with more detailed screenshots posted on our Discord. For simplicity, we'll use custom charts here to visualize the information. Currently, seven stocks make up over half of the entire portfolio:

Some might argue that SoFi and Pfizer are a bit high, and maybe safer stock choices could replace them. Instead of selling stocks (even the ones that have risen significantly), I prefer to diversify the portfolio by purchasing other stocks. This strategy helps balance the portfolio over time.

Future Buy Plans for January

Let's discuss the stocks I plan to buy in January. Some solid picks at their current valuations include:

These stocks are currently cheap and offer excellent dividends. Similarly, Tyson Foods is another stock that needs to be more eye-catching at around 2% of the portfolio. I plan to add more in the coming month. Additionally, a little more of C3.ai would be beneficial for long-term exposure to AI, despite recent gains.

Double-Digit Gainers Leading the Charge

Our top performers, achieving remarkable gains, include:

These are stocks that have performed phenomenally well and contribute significantly to our portfolio’s growth.

Single-Digit Gainers and Stocks to Watch

Among the single-digit gainers, Microsoft, Tyson, and Extra Space Storage stand out. They are clear buys due to their small percentage gains and potential for growth. While Microsoft isn’t cheap, Tyson and Extra Space Storage offer low valuations and substantial dividends.

Evaluating the Losers

When looking at the underperformers, I am confident about increasing investments in them. Despite some different opinions, particularly about Baidu (due to it being a Chinese stock amid tariff concerns), it remains a long-term favorite. Other stocks like Medtronic, Verizon, Pfizer, and Vici Properties are at terrific valuations, making them excellent candidates for increasing holdings while prices are low.

Budget Update and Final Thoughts

Following the addition of another $100 for January's budget, the total account value has now exceeded $1,900, with around $400 held in cash. This leaves us with a cash ratio of just over 20% relative to our stock investments.

The plan is to maintain this proactive approach, balancing the portfolio and capitalizing on opportunities that arise. If you'd like to stay updated with detailed screenshots and insights, join us on Discord for in-depth discussions!

What are your thoughts on these investments?