Consumer discretionary companies sell products people want but don’t need. These include clothes, cars, vacations, and entertainment. When the economy is strong, people spend more on these items. When times are tough, spending slows down.

Investors must look at different factors when analyzing these companies. Unlike consumer staples, discretionary stocks are more sensitive to economic changes. This guide breaks down how to evaluate them step by step.

Key Takeaways: Analyzing Consumer Discretionary Companies

| Category |

Insight |

| Sector Definition |

Sells non-essential goods like apparel, travel, and entertainment |

| Economic Sensitivity |

Highly cyclical; tied to consumer confidence and macro indicators |

| Revenue Metrics |

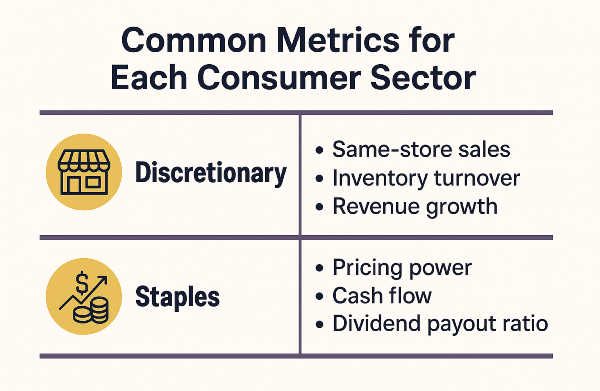

Focus on same-store sales, seasonal trends, and sector-relative growth |

| Profitability |

Margins reveal pricing power and cost control; watch supply chain risks |

| Brand Strength |

Loyalty and innovation drive resilience and pricing power |

| Valuation |

Use P/E, P/S, EV/EBITDA to compare peers and spot mispricing |

| Financial Health |

Favor low debt, strong free cash flow, and liquidity ratios |

| Competitive Edge |

Assess market share, partnerships, and tech adoption |

| E-Commerce |

Track online sales, app ratings, and omnichannel strategy |

| ESG & Sentiment |

Sustainability and reputation impact consumer loyalty |

| Insider Activity |

Buying signals confidence; institutional ownership shows conviction |

Understanding the Sector

The consumer discretionary sector includes many industries. These range from retail and travel to media and auto makers. All of them depend on how much money people have left after paying for essentials.

Common Sub-Industries

- Apparel and luxury goods

- Hotels and restaurants

- Automobiles and parts

- Entertainment and streaming

- E-commerce and retail

These companies often grow fast during good times. But they can also fall quickly during recessions.

Read More: What are Consumer Discretionary Stocks?

Economic Sensitivity

Consumer discretionary stocks rise when people feel confident. They fall when people cut back on spending. That’s why it’s important to track economic indicators.

Key Indicators to Watch

- Consumer Confidence Index

- Retail sales reports

- Interest rates

- Inflation and wage growth

These signals help investors predict demand. If confidence drops, discretionary sales may follow.

Read More: How Consumer Discretionary Stocks Perform in Different Market Cycles

Revenue Growth and Demand Trends

Strong revenue growth is a good sign. It shows people are buying more. But growth must be compared to the sector average. Seasonal trends also matter. For example, holiday shopping boosts retail sales.

Same-store sales are another key metric. They show how existing stores are performing. If these numbers fall, it may signal trouble.

Table 1: Sample Revenue Growth Comparison

| Company |

Revenue Growth (YoY) |

Sector Average |

| Nike |

10.2% |

6.5% |

| Marriott |

8.7% |

6.5% |

| Ford |

4.1% |

6.5% |

Profitability and Margins

Margins play a major role in how consumer discretionary stocks perform. Strong margins signal pricing power, efficient operations, and the ability to stay profitable even when demand swings. Companies with durable margins can invest more in marketing, product launches, and innovation—key drivers of growth in a sector that depends on consumer enthusiasm.

Pressure on margins hits discretionary companies fast. Rising input costs, supply chain disruptions, and shipping delays can erode profits and weaken competitive position. When consumers pull back, companies with thin margins often struggle first. That’s why comparing margins across competitors is essential: the firms with the most resilient margins usually have stronger brands, better cost control, or more flexible supply chains.

Brand Strength and Loyalty

Strong brands are especially important in the consumer discretionary sector because they help companies maintain demand even when shoppers pull back. A trusted brand can charge higher prices, keep customers loyal, and stand out in crowded markets where trends shift quickly. During economic slowdowns, companies with loyal followings often see smaller sales declines because customers are willing to stick with the names they trust.

Brand health shows up in real‑time signals like social media engagement, customer reviews, and repeat‑purchase behavior. These indicators help investors spot which companies are gaining momentum and which are losing relevance.

Innovation is equally critical. Discretionary companies must constantly refresh products to stay competitive—new menu items, seasonal fashion lines, or updated product features can spark demand and keep a brand top‑of‑mind. Companies that innovate consistently tend to outperform because they adapt faster to changing tastes and consumer trends.

Valuation Metrics

Valuation tells you if a stock is cheap or expensive. Common ratios include price-to-earnings (P/E), price-to-sales (P/S), and EV/EBITDA. These numbers change with the economy.

Growth stocks often have high P/E ratios. Value stocks may have lower ones. Comparing a company’s valuation to its peers helps spot deals or risks.

Valuation Snapshot Examples

| Company |

P/E Ratio |

P/S Ratio |

EV/EBITDA |

| Starbucks |

28.5 |

4.2 |

16.1 |

| Target |

17.3 |

0.8 |

9.4 |

| Tesla |

42.7 |

6.1 |

22.3 |

Here are expanded, sharper, and more consumer‑discretionary‑focused versions of each section. The tone stays crisp, SEO‑friendly, and easy to read.

Financial Health

Financial health is especially important for consumer discretionary companies because their sales rise and fall with the economy. When demand drops, only the companies with strong balance sheets can keep investing, maintain operations, and avoid painful cutbacks. Low debt, steady cash flow, and healthy liquidity ratios give these companies the flexibility to survive slowdowns and ramp up quickly when spending rebounds.

Rising interest rates hit discretionary companies harder than staples because many rely on financing for inventory, expansion, and marketing. High‑debt companies face higher borrowing costs, which can squeeze profits during already‑weak demand cycles. Strong free cash flow becomes a major advantage—it allows companies to fund new products, upgrade stores, and invest in digital tools without relying on expensive debt.

Competitive Positioning

Competitive positioning has an outsized impact on consumer discretionary stocks because customers have endless alternatives. Companies with strong distribution networks, exclusive brand partnerships, or large-scale operations can capture more market share when consumer spending rises and protect themselves when it falls.

Porter’s Five Forces is especially useful here. Threats from new entrants, shifting buyer preferences, and substitute products can change quickly in discretionary categories. E‑commerce disruptors often grow fast by offering lower prices, faster delivery, or trendier products. Legacy brands that fail to adapt risk losing relevance, while companies that innovate or build strong ecosystems tend to outperform.

Technology and E-Commerce

Technology is a major driver of success in consumer discretionary because shoppers expect convenience, speed, and personalization. Companies with strong online sales growth, high mobile app engagement, and seamless omnichannel experiences often gain market share—especially during periods when consumers shift more spending online.

Digital strength also helps discretionary companies manage volatility. Better data, smarter logistics, and automated inventory systems allow them to react faster to changing demand. Amazon’s dominance shows how powerful tech and logistics can be in this sector. Traditional retailers that invest in digital tools, faster delivery, and integrated shopping experiences are the ones most likely to stay competitive.

E-Commerce Metrics Examples

| Company |

Online Sales Growth |

Mobile App Rating |

Omnichannel Score |

| Walmart |

12.5% |

4.6/5 |

High |

| Ulta Beauty |

18.3% |

4.8/5 |

Medium |

| Macy’s |

6.2% |

4.2/5 |

Low |

ESG and Consumer Sentiment

ESG and consumer sentiment have an outsized impact on consumer discretionary stocks because shoppers can easily switch brands when values don’t align. In this sector, reputation directly affects sales. Companies that prioritize sustainability, ethical sourcing, and responsible labor practices often win more loyalty—especially among younger consumers who spend heavily on discretionary categories like apparel, beauty, and entertainment.

Negative press hits discretionary companies harder than staples because their products are not essential. A scandal, poor working conditions, or environmental backlash can quickly push customers toward competitors. Social sentiment, online reviews, and viral moments can shift demand almost overnight. Investors who track ESG scores and brand perception gain early insight into which companies are strengthening their image and which are at risk of losing relevance.

Insider Activity and Ownership

Insider activity carries extra weight in consumer discretionary stocks because the sector is highly sensitive to demand swings and competitive pressure. When insiders buy shares, it often signals confidence in upcoming product launches, brand momentum, or improving consumer trends. Insider selling, on the other hand, may hint at concerns about slowing demand, rising costs, or competitive threats.

Institutional ownership also matters. Large investors tend to favor discretionary companies with strong brands, stable margins, and clear growth strategies. High institutional conviction can support stock stability during volatile periods. Activist investors frequently target discretionary brands that are underperforming or failing to innovate. Their involvement can lead to major strategy shifts, leadership changes, or portfolio restructuring—moves that often trigger meaningful stock movement.

Conclusion

Analyzing consumer discretionary companies takes a mix of tools. Revenue growth, margins, brand strength, and valuation all matter. By watching economic signals and company metrics, investors can make smarter choices.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

Consumer discretionary companies sell products people want but don’t need. These include clothes, cars, vacations, and entertainment. When the economy is strong, people spend more on these items. When times are tough, spending slows down.

Investors must look at different factors when analyzing these companies. Unlike consumer staples, discretionary stocks are more sensitive to economic changes. This guide breaks down how to evaluate them step by step.

Key Takeaways: Analyzing Consumer Discretionary Companies

Understanding the Sector

The consumer discretionary sector includes many industries. These range from retail and travel to media and auto makers. All of them depend on how much money people have left after paying for essentials.

Common Sub-Industries

These companies often grow fast during good times. But they can also fall quickly during recessions.

Economic Sensitivity

Consumer discretionary stocks rise when people feel confident. They fall when people cut back on spending. That’s why it’s important to track economic indicators.

Key Indicators to Watch

These signals help investors predict demand. If confidence drops, discretionary sales may follow.

Revenue Growth and Demand Trends

Strong revenue growth is a good sign. It shows people are buying more. But growth must be compared to the sector average. Seasonal trends also matter. For example, holiday shopping boosts retail sales.

Same-store sales are another key metric. They show how existing stores are performing. If these numbers fall, it may signal trouble.

Table 1: Sample Revenue Growth Comparison

Profitability and Margins

Margins play a major role in how consumer discretionary stocks perform. Strong margins signal pricing power, efficient operations, and the ability to stay profitable even when demand swings. Companies with durable margins can invest more in marketing, product launches, and innovation—key drivers of growth in a sector that depends on consumer enthusiasm.

Pressure on margins hits discretionary companies fast. Rising input costs, supply chain disruptions, and shipping delays can erode profits and weaken competitive position. When consumers pull back, companies with thin margins often struggle first. That’s why comparing margins across competitors is essential: the firms with the most resilient margins usually have stronger brands, better cost control, or more flexible supply chains.

Brand Strength and Loyalty

Strong brands are especially important in the consumer discretionary sector because they help companies maintain demand even when shoppers pull back. A trusted brand can charge higher prices, keep customers loyal, and stand out in crowded markets where trends shift quickly. During economic slowdowns, companies with loyal followings often see smaller sales declines because customers are willing to stick with the names they trust.

Brand health shows up in real‑time signals like social media engagement, customer reviews, and repeat‑purchase behavior. These indicators help investors spot which companies are gaining momentum and which are losing relevance.

Innovation is equally critical. Discretionary companies must constantly refresh products to stay competitive—new menu items, seasonal fashion lines, or updated product features can spark demand and keep a brand top‑of‑mind. Companies that innovate consistently tend to outperform because they adapt faster to changing tastes and consumer trends.

Valuation Metrics

Valuation tells you if a stock is cheap or expensive. Common ratios include price-to-earnings (P/E), price-to-sales (P/S), and EV/EBITDA. These numbers change with the economy.

Growth stocks often have high P/E ratios. Value stocks may have lower ones. Comparing a company’s valuation to its peers helps spot deals or risks.

Valuation Snapshot Examples

Here are expanded, sharper, and more consumer‑discretionary‑focused versions of each section. The tone stays crisp, SEO‑friendly, and easy to read.

Financial Health

Financial health is especially important for consumer discretionary companies because their sales rise and fall with the economy. When demand drops, only the companies with strong balance sheets can keep investing, maintain operations, and avoid painful cutbacks. Low debt, steady cash flow, and healthy liquidity ratios give these companies the flexibility to survive slowdowns and ramp up quickly when spending rebounds.

Rising interest rates hit discretionary companies harder than staples because many rely on financing for inventory, expansion, and marketing. High‑debt companies face higher borrowing costs, which can squeeze profits during already‑weak demand cycles. Strong free cash flow becomes a major advantage—it allows companies to fund new products, upgrade stores, and invest in digital tools without relying on expensive debt.

Competitive Positioning

Competitive positioning has an outsized impact on consumer discretionary stocks because customers have endless alternatives. Companies with strong distribution networks, exclusive brand partnerships, or large-scale operations can capture more market share when consumer spending rises and protect themselves when it falls.

Porter’s Five Forces is especially useful here. Threats from new entrants, shifting buyer preferences, and substitute products can change quickly in discretionary categories. E‑commerce disruptors often grow fast by offering lower prices, faster delivery, or trendier products. Legacy brands that fail to adapt risk losing relevance, while companies that innovate or build strong ecosystems tend to outperform.

Technology and E-Commerce

Technology is a major driver of success in consumer discretionary because shoppers expect convenience, speed, and personalization. Companies with strong online sales growth, high mobile app engagement, and seamless omnichannel experiences often gain market share—especially during periods when consumers shift more spending online.

Digital strength also helps discretionary companies manage volatility. Better data, smarter logistics, and automated inventory systems allow them to react faster to changing demand. Amazon’s dominance shows how powerful tech and logistics can be in this sector. Traditional retailers that invest in digital tools, faster delivery, and integrated shopping experiences are the ones most likely to stay competitive.

E-Commerce Metrics Examples

ESG and Consumer Sentiment

ESG and consumer sentiment have an outsized impact on consumer discretionary stocks because shoppers can easily switch brands when values don’t align. In this sector, reputation directly affects sales. Companies that prioritize sustainability, ethical sourcing, and responsible labor practices often win more loyalty—especially among younger consumers who spend heavily on discretionary categories like apparel, beauty, and entertainment.

Negative press hits discretionary companies harder than staples because their products are not essential. A scandal, poor working conditions, or environmental backlash can quickly push customers toward competitors. Social sentiment, online reviews, and viral moments can shift demand almost overnight. Investors who track ESG scores and brand perception gain early insight into which companies are strengthening their image and which are at risk of losing relevance.

Insider Activity and Ownership

Insider activity carries extra weight in consumer discretionary stocks because the sector is highly sensitive to demand swings and competitive pressure. When insiders buy shares, it often signals confidence in upcoming product launches, brand momentum, or improving consumer trends. Insider selling, on the other hand, may hint at concerns about slowing demand, rising costs, or competitive threats.

Institutional ownership also matters. Large investors tend to favor discretionary companies with strong brands, stable margins, and clear growth strategies. High institutional conviction can support stock stability during volatile periods. Activist investors frequently target discretionary brands that are underperforming or failing to innovate. Their involvement can lead to major strategy shifts, leadership changes, or portfolio restructuring—moves that often trigger meaningful stock movement.

Conclusion

Analyzing consumer discretionary companies takes a mix of tools. Revenue growth, margins, brand strength, and valuation all matter. By watching economic signals and company metrics, investors can make smarter choices.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

The Top Consumer Discretionary Stocks

A dynamic list of leading companies within the sector, highlighting notable performers and long‑term growth drivers. A majority of top investors on StockBossUp rated each company on this list a buy.

What Are Consumer Discretionary Stocks?

An introduction to the sector’s core characteristics and market role.

How Consumer Discretionary Stocks Perform in Different Market Cycles

A review of how economic conditions influence sector performance.

Consumer Discretionary vs Consumer Staples: Key Differences

A comparison of spending patterns, risk profiles, and investment considerations.

How to Analyze Consumer Discretionary Companies

A structured approach to evaluating business models and financial strength.

The Role of Consumer Sentiment in Discretionary Stock Performance

Insight into how consumer confidence and behavioral trends shape demand.

How Interest Rates Impact Consumer Discretionary Stocks

An examination of rate sensitivity and macroeconomic pressures.

Are Consumer Discretionary Stocks Good for Long Term Investors?

A long term perspective on growth potential and sector volatility.

How to Build a Portfolio of Consumer Discretionary Stocks

Practical guidance for constructing and managing sector exposure.

Best ETFs for Consumer Discretionary Exposure

A review of leading ETFs offering diversified access to the sector.

How to Classify a Stock as Consumer Discretionary

A clear explanation of classification standards and sector placement.