Kimberly-Clark (KMB) increased its dividend for the 50th consecutive year at the start of 2022. As a result, it has joined the list of Dividend Kings.

The Dividend Kings are a group of just 45 stocks that have increased their dividends for at least 50 years in a row.

We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all 45 Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Kimberly-Clark is a global leader in its industry and should continue to grow its dividend each year, even during recessions.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

Kimberly-Clark traces its beginnings back to 1872. Four young businessmen, John A. Kimberly, Havilah Babcock, Charles B. Clark, and Frank C. Shattuck, came up with $30,000 of start-up capital to form Kimberly, Clark and Co.

Today, Kimberly-Clark is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

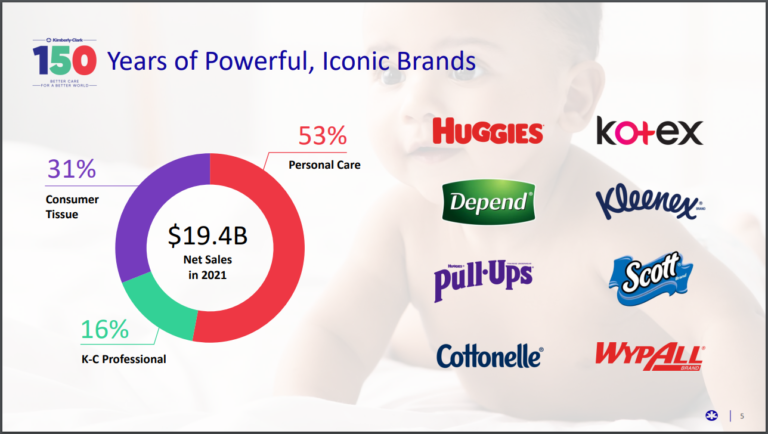

It operates through two segments that each house many popular brands: Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise) and the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), generating nearly $20 billion in annual revenue.

Kimberly-Clark reported second-quarter earnings on July 26th, 2022, and results were better than expected on both the top and bottom lines. Earnings-per-share came to $1.34 on an adjusted basis, which was three cents better than expected.

Total revenue was $5.1 billion, which was up 7% from the year-ago period and was $110 million better than estimates. Organic sales growth came to 9%, with net selling prices up 9%, and product mix increased sales by 1% and a 1% volume decline.

Management updated their 2022 outlook and expects net sales to increase by 2% to 4%, organic sales to increase by 5% to 7% (up from 4% to 6%), and adjusted earnings per share of $5.60 to $6.00.

Our 2022 adjusted EPS estimate stands at $5.65.

Growth Prospects

Kimberly-Clark has committed to elevating its core brands as one of the three pillars of growth in the coming years. It will do this by launching different product innovations via extensions of existing lines and entirely new products. The company will also continue to manage its revenue via pricing and mix as well as promotional strategies.

Finally, it will use its significant marketing expertise to go after under-penetrated categories to drive market share gains and, ultimately, higher revenue and profit.

The second growth pillar is accelerating growth in its developing and emerging (D&E) markets, which make up a significant portion of the company’s sales. The company will focus on its personal care and professional segments in particular, with its largest opportunities coming from places where it has low category penetration and frequency of usage.

Source: Investor Presentation

The company’s focus on D&E development in Latin America and China in particular, with smaller markets, also seeing a meaningful push. Kimberly-Clark plans to use its significant supply chain and marketing experience to pursue growth in areas where it underperforms today, which should help drive some incremental growth.

Kimberly-Clark also continues to pursue cost savings. It has grown its earnings-per-share thanks to share repurchases and cost reduction programs. With operating margins rising steadily over time, increasing profitability is working to offset somewhat weak revenue numbers. Kimberly-Clark’s management team has extended this initiative to 2022, aiming for another $1.5 billion of cumulative savings over the three-year period.

Overall, we expect 5% annual EPS growth over the next five years.

Competitive Advantages & Recession Performance

Kimberly-Clark’s most important competitive advantages are its brands and global scale. The company enjoys a leadership position across its brand portfolio and, indeed, across the world.

It retains its competitive advantages through marketing and innovation. Kimberly-Clark spends over $1 billion annually on advertising, research, and development. This allows the company to stay ahead of the competition. Given its commitment to its growth pillars, we expect this will only increase over time.

In addition, Kimberly-Clark’s global reach provides the company with the efficiency to keep costs low. The FORCE (Focused On Reducing Costs Everywhere) program is an example of its ability to manage costs, even as revenue grows, and has seen years of success in reducing operating costs.

Kimberly-Clark remains highly profitable, even during recessions. For example, it performed well through the Great Recession of 2007-2009. Its earnings-per-share through the Great Recession are shown below:

- 2007 earnings-per-share of $4.25

- 2008 earnings-per-share of $4.06 (4.5% decline)

- 2009 earnings-per-share of $4.52 (11% increase)

- 2010 earnings-per-share of $4.45 (1.5% decline)

As you can see, while Kimberly-Clark did see earnings decline in 2008 and 2010, it also registered a double-digit growth rate in 2009. The reason for its strong performance over the course of the recession is that the company sells products that consumers need regardless of economic conditions.

Consumers will always need personal care products, regardless of the condition of the economy. This gives Kimberly-Clark a certain level of product demand each year, even during recessions.

Valuation & Expected Returns

Based on our adjusted earnings-per-share estimate of $5.65 for the fiscal year 2022, Kimberly-Clark trades for a price-to-earnings ratio of 20.0.

Excluding outlier years, Kimberly-Clark has traded at an average price-to-earnings ratio of about 18.0 over the last decade. This is also our estimate of fair value for the stock. The valuation has moderated somewhat of late, but shares still trade in excess of our estimate of fair value.

If the stock valuation declines to 18.0 over the next five years, it would reduce annual returns by 2.1% per year. In addition, future returns will be generated from earnings growth and dividends. Given the company’s strong brands and growth catalysts, average annual earnings growth of 5% is a reasonable expectation. The stock also has a 4.1% dividend yield. In total, we see annual returns of 6.7% over the next five years.

Given the strong yield, 50-year history of dividend increases, and moderate growth expectations, we rate the stock a hold for dividend growth investors. The stock is not a buy right now due to the high valuation.

Final Thoughts

Kimberly-Clark is a high-quality company with a diverse portfolio of strong brands. It has positive growth prospects moving forward, and it is an extremely reliable dividend stock. Emerging markets, cost reductions, and share repurchases will highlight future earnings growth.

Kimberly-Clark has increased its dividend for 50 years in a row and currently has a dividend yield of 4.1%. It, therefore, meets our definition of a blue-chip stock, and it should continue to deliver steady dividend increases each year.

Kimberly-Clark (KMB) increased its dividend for the 50th consecutive year at the start of 2022. As a result, it has joined the list of Dividend Kings.

The Dividend Kings are a group of just 45 stocks that have increased their dividends for at least 50 years in a row.

We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all 45 Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Kimberly-Clark is a global leader in its industry and should continue to grow its dividend each year, even during recessions.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

Kimberly-Clark traces its beginnings back to 1872. Four young businessmen, John A. Kimberly, Havilah Babcock, Charles B. Clark, and Frank C. Shattuck, came up with $30,000 of start-up capital to form Kimberly, Clark and Co.

Today, Kimberly-Clark is a global consumer products company that operates in 175 countries and sells disposable consumer goods, including paper towels, diapers, and tissues.

It operates through two segments that each house many popular brands: Personal Care Segment (Huggies, Pull-Ups, Kotex, Depend, Poise) and the Consumer Tissue segment (Kleenex, Scott, Cottonelle, and Viva), generating nearly $20 billion in annual revenue.

Source: Investor Presentation

Kimberly-Clark reported second-quarter earnings on July 26th, 2022, and results were better than expected on both the top and bottom lines. Earnings-per-share came to $1.34 on an adjusted basis, which was three cents better than expected.

Total revenue was $5.1 billion, which was up 7% from the year-ago period and was $110 million better than estimates. Organic sales growth came to 9%, with net selling prices up 9%, and product mix increased sales by 1% and a 1% volume decline.

Management updated their 2022 outlook and expects net sales to increase by 2% to 4%, organic sales to increase by 5% to 7% (up from 4% to 6%), and adjusted earnings per share of $5.60 to $6.00.

Our 2022 adjusted EPS estimate stands at $5.65.

Growth Prospects

Kimberly-Clark has committed to elevating its core brands as one of the three pillars of growth in the coming years. It will do this by launching different product innovations via extensions of existing lines and entirely new products. The company will also continue to manage its revenue via pricing and mix as well as promotional strategies.

Finally, it will use its significant marketing expertise to go after under-penetrated categories to drive market share gains and, ultimately, higher revenue and profit.

The second growth pillar is accelerating growth in its developing and emerging (D&E) markets, which make up a significant portion of the company’s sales. The company will focus on its personal care and professional segments in particular, with its largest opportunities coming from places where it has low category penetration and frequency of usage.

Source: Investor Presentation

The company’s focus on D&E development in Latin America and China in particular, with smaller markets, also seeing a meaningful push. Kimberly-Clark plans to use its significant supply chain and marketing experience to pursue growth in areas where it underperforms today, which should help drive some incremental growth.

Kimberly-Clark also continues to pursue cost savings. It has grown its earnings-per-share thanks to share repurchases and cost reduction programs. With operating margins rising steadily over time, increasing profitability is working to offset somewhat weak revenue numbers. Kimberly-Clark’s management team has extended this initiative to 2022, aiming for another $1.5 billion of cumulative savings over the three-year period.

Overall, we expect 5% annual EPS growth over the next five years.

Competitive Advantages & Recession Performance

Kimberly-Clark’s most important competitive advantages are its brands and global scale. The company enjoys a leadership position across its brand portfolio and, indeed, across the world.

It retains its competitive advantages through marketing and innovation. Kimberly-Clark spends over $1 billion annually on advertising, research, and development. This allows the company to stay ahead of the competition. Given its commitment to its growth pillars, we expect this will only increase over time.

In addition, Kimberly-Clark’s global reach provides the company with the efficiency to keep costs low. The FORCE (Focused On Reducing Costs Everywhere) program is an example of its ability to manage costs, even as revenue grows, and has seen years of success in reducing operating costs.

Kimberly-Clark remains highly profitable, even during recessions. For example, it performed well through the Great Recession of 2007-2009. Its earnings-per-share through the Great Recession are shown below:

As you can see, while Kimberly-Clark did see earnings decline in 2008 and 2010, it also registered a double-digit growth rate in 2009. The reason for its strong performance over the course of the recession is that the company sells products that consumers need regardless of economic conditions.

Consumers will always need personal care products, regardless of the condition of the economy. This gives Kimberly-Clark a certain level of product demand each year, even during recessions.

Valuation & Expected Returns

Based on our adjusted earnings-per-share estimate of $5.65 for the fiscal year 2022, Kimberly-Clark trades for a price-to-earnings ratio of 20.0.

Excluding outlier years, Kimberly-Clark has traded at an average price-to-earnings ratio of about 18.0 over the last decade. This is also our estimate of fair value for the stock. The valuation has moderated somewhat of late, but shares still trade in excess of our estimate of fair value.

If the stock valuation declines to 18.0 over the next five years, it would reduce annual returns by 2.1% per year. In addition, future returns will be generated from earnings growth and dividends. Given the company’s strong brands and growth catalysts, average annual earnings growth of 5% is a reasonable expectation. The stock also has a 4.1% dividend yield. In total, we see annual returns of 6.7% over the next five years.

Given the strong yield, 50-year history of dividend increases, and moderate growth expectations, we rate the stock a hold for dividend growth investors. The stock is not a buy right now due to the high valuation.

Final Thoughts

Kimberly-Clark is a high-quality company with a diverse portfolio of strong brands. It has positive growth prospects moving forward, and it is an extremely reliable dividend stock. Emerging markets, cost reductions, and share repurchases will highlight future earnings growth.

Kimberly-Clark has increased its dividend for 50 years in a row and currently has a dividend yield of 4.1%. It, therefore, meets our definition of a blue-chip stock, and it should continue to deliver steady dividend increases each year.

Originally Posted on suredividend.com