Is Verizon (VZ) a Good Dividend Stock

Despite the recent uptick, the bear market is still growling in 2022. The Nasdaq and S&P 500 Index are down more than 20% each, while the Dow 30 is doing somewhat better. Consequently, many high-quality stocks’ stock prices have also declined, along with valuations. One such stock is Verizon Communications (VZ), trading near its 52-week low and the lowest price in a decade. But is the stock a value trap, or is Verizon a good dividend stock?

Is Verizon a Good Dividend Stock?

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter*. It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

Overview of Verizon

Verizon is an American multinational telecommunications conglomerate and a Dow Jones Industrial Average (DJIA) corporate component. In its present form, the company is the result of Bell Atlantic’s acquisition of NYNEX, the merger between Bell Atlantic and Vodaphone, followed by the merger with GTE. Since then, Verizon has acquired MCI Worldcom, Alltel, and smaller wireless companies. Verizon also acquired AOL and parts of Yahoo, which were sold in 2021. In addition, Verizon has been slowly divesting its legacy wireline operations but still retains millions of connections in the northeast.

The company is headquartered in Midtown Manhattan, New York City, but is incorporated in Delaware. Today, the company has about 120 million wireless connections, including 91 million postpaid, four million prepaid customers, and around 25 million data devices. In addition, Verizon serves the broadband market with about 6.7 million FiOS and other connections. The company also has approximately 25 million fixed-line telecom connections. The company sold its AOL and Yahoo businesses in 2021.

Total revenue was $133,613 million in 2021, and the past 12 months made Verizon the No. 2 telecommunications company by revenue after AT&T(T).

Verizon stock has lagged the overall market as it is down approximately (-31%), and simultaneously the dividend yield has leaped to over 7% this year. This is why we will discuss Verizon as a good dividend stock for those investors looking for income now.

Verizon Dividend History, Growth, and Yield

We will now look at Verizon’s dividend history, growth, and yield. We will then determine if it’s a good buy at the current price.

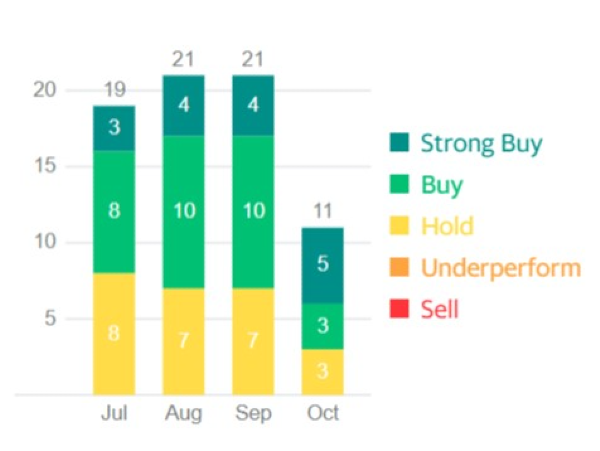

Dividend Growth

Verizon has been growing its dividend for 18 consecutive years, making Verizon a Dividend Contender. Verizon is a blue-chip stock and has reliably paid its dividend. The company has had an average dividend growth rate of 2.54% CAGR in the last ten years. Over the past five years, Verizon’s dividend growth rate has been 2.11% CAGR, as seen in the chart from Portfolio Insight*. Hence, the main appeal of owning this stock is the high dividend yield.

So, the dividend growth rate has slowed down compared to its last 10-year average. This fact is concerning for a dividend growth investor. We want companies to grow their dividends faster than inflation and have a higher dividend growth history as dividend growth investors. The slower 5-year dividend growth shows that earnings and overall company growth are also slowing. However, as long as the dividend increase at the rate of inflation or higher, we are happy dividend investors.

Also, this is a critical point about the company’s dividend that is very significant. Verizon continued to pay its dividend during the most challenging period in the last 100 years. Most businesses and industrials were cutting or suspending their dividend payments the previous year during the COVID-19 pandemic; Verizon continued to pay its dividend. The company increased its dividend by ~ 2% in September this year. The dividend was raised this year from $0.6275 to $0.64 per share. That tells us everything I need to know about the dividend policy and dividend safety focus, but we do not like the slower growth compared to its five-year average.

Dividend Yield

The company has a stellar dividend yield of 7.21% as of this writing. This value is a good starting yield for dividend growth investors—especially those investors who are leaving the bond market looking for higher yields. Verizon’s high dividend yields and poor stock price appreciation has placed it on the Dogs of the Dow 2021 and Dogs of the Dow 2022 lists.

Income-driven investors may want a 4.5% yield or higher. So, Verizon does meet that criterion, and it is a good dividend stock for them.

Source: Portfolio Insight*

Verizon’s current dividend yield is almost three percentage points higher than its 5-year average dividend yield of 4.58%. We like to look at this metric because it gives us a good idea if a company we are researching is undervalued or overvalued based on the current and 5-year average yield. The reason is that price and dividend yield are inversely related. If the price goes higher, then the dividend yield goes lower. Vice versa as well.

Dividend Safety

Is the dividend safe? We should always ask this question if we are looking for an undervalued dividend growth stock. Sometimes undervalued dividend stocks can present us with a “value trap,” and the stock price can continue to decline.

Hence, looking at the dividend payout ratio based on earnings and free cash flow (FCF) is essential. Analysts predict that Verizon will earn $5.128 per share for the Fiscal Year (FY) 2022. Analysts are relatively accurate when estimating Verizon’s future earnings. The company is expected to pay out $2.61 per share in dividends for the year. The dividend payment gives us a payout ratio of 47% based on earnings. A 47% dividend coverage with a dividend yield of over 7.0% is reasonably safe.

On a free cash flow (FCF) basis, Verizon has a dividend payout ratio of ~54%. This percentage is based on an operating cash flow (OCF) of $39,539 million in 2021 and capital expenditures of $20,286 million. FCF is $19,253 million. The dividend required $10,445 million. Thus, the dividend is well covered by both earnings and free cash flow. Good dividend safety is one reason why Verizon is a good dividend stock.

Capital expenditures have been reasonable for the past few years and are not getting out of control, ranging between $16.6 billion and $20.2 billion over the past 5-years. However, with the rollout of 5G technologies, capital expenditures will likely grow in the future. However, dividend safety should not be significantly impacted.

Verizon Revenue and Earnings Growth / Balance Sheet Strength

This section will examine how well Verizon has grown its earnings and revenue. When evaluating a company, these two metrics are at the top of my list to consider. Without revenue growth, a company can’t have sustainable earnings growth and continue paying a rising dividend.

For the past ten years, Verizon has had revenue increasing at a Compound Annual Growth Rate (CAGR) of 1.88%, which is a meager growth rate considering the size of Verizon. Earnings per share, however, tell a different story. It has increased during the past ten years at a pace of 9.63% and 6.86% in the last 5-years. Growing income and flat revenue mean that the management has increased operating and net profit margins and is running a lean and better company.

However, the company’s earnings growth has slowed over the past five years. We see now why the dividend growth rate has also slowed down. This fact tells us that the management team is being conservative with the dividend growth policy, which is a good thing.

Last year’s EPS increased from $4.90 per share in 2020 to $5.39 per share in 2021, increasing ~10%. The growth rate is pretty good considering the tumultuous past two years the market had with the COVID-19 pandemic. In addition, while many companies cut the dividend or decreased earnings, Verizon increased its dividend and earnings. Also, analysts expect Verizon to make $5.18 per share for 2022, a 3.96% decrease compared to 2021 because of difficulties with subscriber growth and costs with the 5G rollout.

Also, the company has a solid balance sheet. Currently, Verizon has an S&P credit rating of BBB+ and a Moody’s credit rating of Baa1, which are lower-medium investment-grade ratings. In addition, the company has a long-term debt/cap ratio of 65%, which is high but reasonable considering that this sector is very capital-intensive. And the interest coverage ratio of 8.2X, which is very good. Thus, the company is in an excellent position and will continue to cover the dividends and pay its debt.

One concern is that total debt is rising. Telecommunications companies must continuously invest in their network and buy new spectrum. At the end of Q3 2022, Verizon had $15,739 million in current long-term debt and $135,191 million in long-term debt. This debt is offset by only $2,147 million in cash, cash equivalents, and short-term securities. As a result, the leverage ratio is about 3.26X. In general, leverage ratios below 2.5X are better, but Verizon has a high cash flow and can meet its financial obligations.

Affiliate

Dividend Power has partnered with Sure Dividend, one of the best newsletters for dividend stock investing. The newsletter comes out monthly and highlights their top 10 picks. A lot of effort goes into analyzing hundreds of stocks, doing much of the work for you. They have over 9,000 subscribers, and it grows every month.

Sign up for the Sure Dividend Newsletter*. You can also use the Sure Dividend coupon code DP41off. The regular price for Sure Dividend Newsletter* is $199 per year and the reduced price through this offer is $158 per year. There is a 7-day free trial and refund grace period as well. So, there is no risk.

If you are interested in higher-yielding stocks from the Sure Retirement Newsletter*, the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Retirement Newsletter* is $199 and the reduced price through this offer is $158 per year.

If you are interested in buying and holding stocks with a rising income from the Sure Passive Income Newsletter*, the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Passive Income Newsletter* is $199 and the reduced price through this offer is $158 per year.

Verizon’s Valuation

One of the valuation metrics that we like to look for is the dividend yield compared to the past few years histories. We also want to look for a lower price-to-earnings ratio (PE ratio) based on the past 5-year or 10-year averages. Furthermore, we like to use the Gordon Growth Model, a variation of the Dividend Discount Model (DDM). We employ the Gordon Growth Model because a business ultimately equals the sum of future cash flows that that business can provide.

Let’s first look at the PE ratio. Verizon has a PE ratio of ~7.0X based on FY 2022 earnings of $5.18 per share. The PE multiple is very low compared to the past 5-year PE average of roughly 12X. If Verizon were to vert back to a PE ratio of 12X, we would obtain a price of $62.02 per share.

Now let’s look at the dividend yield. As we mentioned, the dividend yield currently is 7.21%. There is a potential upside based on Verizon’s 5-year dividend yield average of 4.58%. For example, if Verizon were to return to its dividend yield 5-year average, the price target would be $59.96.

The last item I like to look at to determine a fair price is the Gordon Growth Model analysis. We factored in a 9% discount rate and a long-term dividend growth rate of 3%. We use a 9% discount rate because of the higher current dividend yield. The projected dividend growth rate is a little higher than its 10-year average. This gives us a fair price target of $43.33 per share.

If we average the three fair price targets of $62.02, $59.96, and $43.33, we obtain a reasonable, fair value estimate of $55.10 per share. This gives Verizon a possible upside of 52.3% from the current price of $36.18.

Conclusion on Is Verizon a Good Dividend Stock

Verizon is not a growth stock that will make you rich in a decade if you put all your money into this stock. However, Verizon is a solid, stable stock that will provide you with an 8% – 10% annual return for the foreseeable future. In addition, the company has an excellent dividend yield, and the dividend will likely continue to grow. Moreover, dividend safety is acceptable. Hence, Verizon is a good dividend stock for investors looking for a high-yield defensive stock.

Thanks for reading Is Verizon a Good Dividend Stock!

Disclosure: Long VZ

You can also read Walgreens Boots Alliance (WBA) – An Undervalued Dividend Aristocrat by the author.

Author Bio: My name is Felix Martinez, and I am a Dividend Growth Investor who has been investing in dividend growth stocks for the past seven years. I also run a YouTube channel called FiscalVoyage. I have written for SeekingAlpha.com as well as SureDividend.com. I focus on undervalued dividend growth stocks that have the potential for capital return and dividend income. Make sure to follow me on my YouTube Channel. See you there.

Is Verizon (VZ) a Good Dividend Stock

Despite the recent uptick, the bear market is still growling in 2022. The Nasdaq and S&P 500 Index are down more than 20% each, while the Dow 30 is doing somewhat better. Consequently, many high-quality stocks’ stock prices have also declined, along with valuations. One such stock is Verizon Communications (VZ), trading near its 52-week low and the lowest price in a decade. But is the stock a value trap, or is Verizon a good dividend stock?

Is Verizon a Good Dividend Stock?

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter*. It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

Overview of Verizon

Verizon is an American multinational telecommunications conglomerate and a Dow Jones Industrial Average (DJIA) corporate component. In its present form, the company is the result of Bell Atlantic’s acquisition of NYNEX, the merger between Bell Atlantic and Vodaphone, followed by the merger with GTE. Since then, Verizon has acquired MCI Worldcom, Alltel, and smaller wireless companies. Verizon also acquired AOL and parts of Yahoo, which were sold in 2021. In addition, Verizon has been slowly divesting its legacy wireline operations but still retains millions of connections in the northeast.

The company is headquartered in Midtown Manhattan, New York City, but is incorporated in Delaware. Today, the company has about 120 million wireless connections, including 91 million postpaid, four million prepaid customers, and around 25 million data devices. In addition, Verizon serves the broadband market with about 6.7 million FiOS and other connections. The company also has approximately 25 million fixed-line telecom connections. The company sold its AOL and Yahoo businesses in 2021.

Total revenue was $133,613 million in 2021, and the past 12 months made Verizon the No. 2 telecommunications company by revenue after AT&T(T).

Verizon stock has lagged the overall market as it is down approximately (-31%), and simultaneously the dividend yield has leaped to over 7% this year. This is why we will discuss Verizon as a good dividend stock for those investors looking for income now.

Verizon Dividend History, Growth, and Yield

We will now look at Verizon’s dividend history, growth, and yield. We will then determine if it’s a good buy at the current price.

Dividend Growth

Verizon has been growing its dividend for 18 consecutive years, making Verizon a Dividend Contender. Verizon is a blue-chip stock and has reliably paid its dividend. The company has had an average dividend growth rate of 2.54% CAGR in the last ten years. Over the past five years, Verizon’s dividend growth rate has been 2.11% CAGR, as seen in the chart from Portfolio Insight*. Hence, the main appeal of owning this stock is the high dividend yield.

Source: Portfolio Insight*

So, the dividend growth rate has slowed down compared to its last 10-year average. This fact is concerning for a dividend growth investor. We want companies to grow their dividends faster than inflation and have a higher dividend growth history as dividend growth investors. The slower 5-year dividend growth shows that earnings and overall company growth are also slowing. However, as long as the dividend increase at the rate of inflation or higher, we are happy dividend investors.

Also, this is a critical point about the company’s dividend that is very significant. Verizon continued to pay its dividend during the most challenging period in the last 100 years. Most businesses and industrials were cutting or suspending their dividend payments the previous year during the COVID-19 pandemic; Verizon continued to pay its dividend. The company increased its dividend by ~ 2% in September this year. The dividend was raised this year from $0.6275 to $0.64 per share. That tells us everything I need to know about the dividend policy and dividend safety focus, but we do not like the slower growth compared to its five-year average.

Dividend Yield

The company has a stellar dividend yield of 7.21% as of this writing. This value is a good starting yield for dividend growth investors—especially those investors who are leaving the bond market looking for higher yields. Verizon’s high dividend yields and poor stock price appreciation has placed it on the Dogs of the Dow 2021 and Dogs of the Dow 2022 lists.

Income-driven investors may want a 4.5% yield or higher. So, Verizon does meet that criterion, and it is a good dividend stock for them.

Source: Portfolio Insight*

Verizon’s current dividend yield is almost three percentage points higher than its 5-year average dividend yield of 4.58%. We like to look at this metric because it gives us a good idea if a company we are researching is undervalued or overvalued based on the current and 5-year average yield. The reason is that price and dividend yield are inversely related. If the price goes higher, then the dividend yield goes lower. Vice versa as well.

Dividend Safety

Is the dividend safe? We should always ask this question if we are looking for an undervalued dividend growth stock. Sometimes undervalued dividend stocks can present us with a “value trap,” and the stock price can continue to decline.

Hence, looking at the dividend payout ratio based on earnings and free cash flow (FCF) is essential. Analysts predict that Verizon will earn $5.128 per share for the Fiscal Year (FY) 2022. Analysts are relatively accurate when estimating Verizon’s future earnings. The company is expected to pay out $2.61 per share in dividends for the year. The dividend payment gives us a payout ratio of 47% based on earnings. A 47% dividend coverage with a dividend yield of over 7.0% is reasonably safe.

On a free cash flow (FCF) basis, Verizon has a dividend payout ratio of ~54%. This percentage is based on an operating cash flow (OCF) of $39,539 million in 2021 and capital expenditures of $20,286 million. FCF is $19,253 million. The dividend required $10,445 million. Thus, the dividend is well covered by both earnings and free cash flow. Good dividend safety is one reason why Verizon is a good dividend stock.

Capital expenditures have been reasonable for the past few years and are not getting out of control, ranging between $16.6 billion and $20.2 billion over the past 5-years. However, with the rollout of 5G technologies, capital expenditures will likely grow in the future. However, dividend safety should not be significantly impacted.

Verizon Revenue and Earnings Growth / Balance Sheet Strength

This section will examine how well Verizon has grown its earnings and revenue. When evaluating a company, these two metrics are at the top of my list to consider. Without revenue growth, a company can’t have sustainable earnings growth and continue paying a rising dividend.

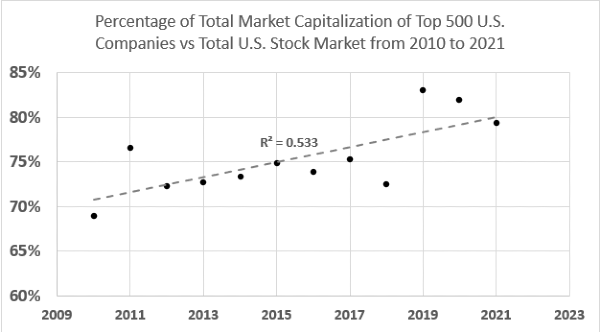

For the past ten years, Verizon has had revenue increasing at a Compound Annual Growth Rate (CAGR) of 1.88%, which is a meager growth rate considering the size of Verizon. Earnings per share, however, tell a different story. It has increased during the past ten years at a pace of 9.63% and 6.86% in the last 5-years. Growing income and flat revenue mean that the management has increased operating and net profit margins and is running a lean and better company.

Source: Portfolio Insight*

However, the company’s earnings growth has slowed over the past five years. We see now why the dividend growth rate has also slowed down. This fact tells us that the management team is being conservative with the dividend growth policy, which is a good thing.

Last year’s EPS increased from $4.90 per share in 2020 to $5.39 per share in 2021, increasing ~10%. The growth rate is pretty good considering the tumultuous past two years the market had with the COVID-19 pandemic. In addition, while many companies cut the dividend or decreased earnings, Verizon increased its dividend and earnings. Also, analysts expect Verizon to make $5.18 per share for 2022, a 3.96% decrease compared to 2021 because of difficulties with subscriber growth and costs with the 5G rollout.

Also, the company has a solid balance sheet. Currently, Verizon has an S&P credit rating of BBB+ and a Moody’s credit rating of Baa1, which are lower-medium investment-grade ratings. In addition, the company has a long-term debt/cap ratio of 65%, which is high but reasonable considering that this sector is very capital-intensive. And the interest coverage ratio of 8.2X, which is very good. Thus, the company is in an excellent position and will continue to cover the dividends and pay its debt.

One concern is that total debt is rising. Telecommunications companies must continuously invest in their network and buy new spectrum. At the end of Q3 2022, Verizon had $15,739 million in current long-term debt and $135,191 million in long-term debt. This debt is offset by only $2,147 million in cash, cash equivalents, and short-term securities. As a result, the leverage ratio is about 3.26X. In general, leverage ratios below 2.5X are better, but Verizon has a high cash flow and can meet its financial obligations.

Affiliate

Dividend Power has partnered with Sure Dividend, one of the best newsletters for dividend stock investing. The newsletter comes out monthly and highlights their top 10 picks. A lot of effort goes into analyzing hundreds of stocks, doing much of the work for you. They have over 9,000 subscribers, and it grows every month.

Sign up for the Sure Dividend Newsletter*. You can also use the Sure Dividend coupon code DP41off. The regular price for Sure Dividend Newsletter* is $199 per year and the reduced price through this offer is $158 per year. There is a 7-day free trial and refund grace period as well. So, there is no risk.

If you are interested in higher-yielding stocks from the Sure Retirement Newsletter*, the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Retirement Newsletter* is $199 and the reduced price through this offer is $158 per year.

If you are interested in buying and holding stocks with a rising income from the Sure Passive Income Newsletter*, the same coupon code, DP41off, gives ~25% or $41 off. The regular price of the Sure Passive Income Newsletter* is $199 and the reduced price through this offer is $158 per year.

Verizon’s Valuation

One of the valuation metrics that we like to look for is the dividend yield compared to the past few years histories. We also want to look for a lower price-to-earnings ratio (PE ratio) based on the past 5-year or 10-year averages. Furthermore, we like to use the Gordon Growth Model, a variation of the Dividend Discount Model (DDM). We employ the Gordon Growth Model because a business ultimately equals the sum of future cash flows that that business can provide.

Let’s first look at the PE ratio. Verizon has a PE ratio of ~7.0X based on FY 2022 earnings of $5.18 per share. The PE multiple is very low compared to the past 5-year PE average of roughly 12X. If Verizon were to vert back to a PE ratio of 12X, we would obtain a price of $62.02 per share.

Now let’s look at the dividend yield. As we mentioned, the dividend yield currently is 7.21%. There is a potential upside based on Verizon’s 5-year dividend yield average of 4.58%. For example, if Verizon were to return to its dividend yield 5-year average, the price target would be $59.96.

The last item I like to look at to determine a fair price is the Gordon Growth Model analysis. We factored in a 9% discount rate and a long-term dividend growth rate of 3%. We use a 9% discount rate because of the higher current dividend yield. The projected dividend growth rate is a little higher than its 10-year average. This gives us a fair price target of $43.33 per share.

If we average the three fair price targets of $62.02, $59.96, and $43.33, we obtain a reasonable, fair value estimate of $55.10 per share. This gives Verizon a possible upside of 52.3% from the current price of $36.18.

Conclusion on Is Verizon a Good Dividend Stock

Verizon is not a growth stock that will make you rich in a decade if you put all your money into this stock. However, Verizon is a solid, stable stock that will provide you with an 8% – 10% annual return for the foreseeable future. In addition, the company has an excellent dividend yield, and the dividend will likely continue to grow. Moreover, dividend safety is acceptable. Hence, Verizon is a good dividend stock for investors looking for a high-yield defensive stock.

Thanks for reading Is Verizon a Good Dividend Stock!

Disclosure: Long VZ

You can also read Walgreens Boots Alliance (WBA) – An Undervalued Dividend Aristocrat by the author.

Author Bio: My name is Felix Martinez, and I am a Dividend Growth Investor who has been investing in dividend growth stocks for the past seven years. I also run a YouTube channel called FiscalVoyage. I have written for SeekingAlpha.com as well as SureDividend.com. I focus on undervalued dividend growth stocks that have the potential for capital return and dividend income. Make sure to follow me on my YouTube Channel. See you there.

Originally Posted on dividendpower.org