Dominion Energy Stock has witnessed many ups and downs this year, dropping to its lowest level. However, the fundamentals of this stock are robust and support an attractive dividend yield of 4% and dividend growth of 6% for its shareholders.

On the other hand, the stock price has declined considerably, confusing many investors if they should buy, sell or hold the stock. Dominion Energy rumors regarding the Atlantic Coast Pipeline deal also made this stock suspicious, bringing down the price to the lower level.

Read Also: Next Era Energy (NEE) Stock, Sempra Energy Stock (SRE) and its SRE Stock Forecast, Edison International Stock (EIX), Dominion Energy Stock (D) and NRG Energy Stock

Is Dominion Energy Stock (D) a good investment?

Dominion stock has a market capitalization of $57.78 billion and a P/E ratio of 26.15, which is higher than the market average of 16.2 and the industry average of 26.0. The large market cap makes this stock attractive, as many analysts have predicted that the price of D stock will reach $83.71 by September 2022. Moreover, analysts are expecting a dividend growth of 6%.

Dominion Energy - D Stock Forecast, Price & News

Dominion Energy's stock forecast is very bright and optimistic despite the sharp fall in the price of Dominion stock. Currently, D stock is trading at $69.41, up from its lowest price of $61.70. The stock market capitalization is $57.78 billion, and a dividend yield of 3.85%.

Dominion Energy stock is committed to providing sustainable and affordable energy solutions to approximately 7 million people in 15 states. Based in Virginia, this large-cap utility company expects the third quarter earnings to be between $0.98 to $1.13 per share in their earnings guidance.

Read also about Tesla (TSLA) Alphabet (GOOG), and Netflix (NFLX) stocks

Latest Earnings Reports and Dominion Stock Dividend

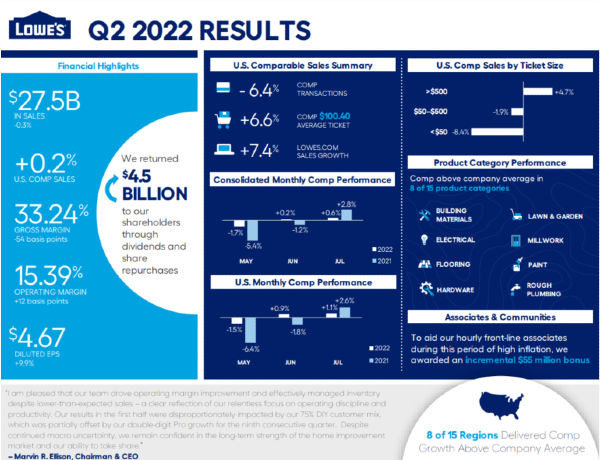

The full-year earnings guidance is reported at $3.95 to $4.95. Dominion company relies on the operating earnings as the utility sector fundamentals depend on them. The second-quarter operating earnings were higher by 4.77% and grew from $628 million in 2021 to $658 million in 2022.

The net income accelerated from $285 million in 2021 to $453 million in the second quarter. Dominion third-quarter earnings report will be announced on November 4.

Read Also: Visa (V) and Bank of America (BAC)

Dominion energy (D) Stock News Headlines

Atlantic Coast Pipeline deal has been canceled by the significant utility players in this deal. Dominion Energy Inc. and Duke Energy Inc have canceled the ACP contract after a nerve-wracking fight between the dealers of this venture.

***You can also read my previous analysis on Dominion Stock if you want to know Why is Dominion Energy Stock Dropping.

Anticipated to be highly profitable to meet the demands of Virginia and North Carolina, this deal would have produced and transmitted 1.5 billion cubic feet of natural gas daily.

However, this looming deal's cancellation finally ended without any decisive result. Consequently, it has raised questions about meeting the increased demand for natural gas in Virginia and North Carolina.

Over this uncertainty, Dominion Energy's stock price fell sharply.

To combat this challenge, Dominion Energy stock is negotiating with local utility providers to produce electricity from renewable energy sources as an alternative to natural gas.

This will be a more sustainable solution, ultimately making the Dominion stock more favorable for ESG investors and eliminating the unsustainable natural gas by 2050.

Should I Buy Dominion Energy Inc Stock?

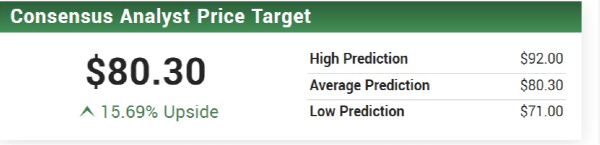

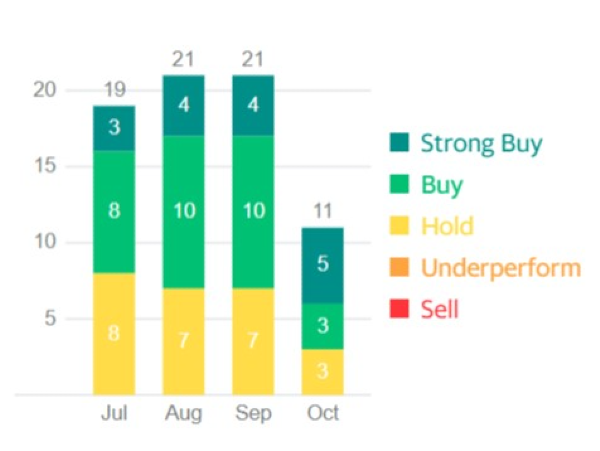

Most analysts have given a buy-and-hold rating consensus for Dominion Energy Stock. According to the Market Beat, Dominion Stock has a hold rating with a price target of $80.30. Suppose you're looking for a dividend-paying stock with higher price targets and an increase in valuation. In that case, Dominion Energy Stock is the best stock for you.

What are the Top Utility Stocks to Buy Right now?

Top Utility Stocks to Buy Right Now when the market is recovering from the recessionary situation and seemingly unrestraiend inflation era. Utility stocks never disappoint an investor in this uncertainty when the markets are crashing due to the low consumer' and investors' sentiments.

- Sempra Energy Stock

- NRG Energy Stock

- Next Era Energy NEE) Stock

- Dominion Energy Stock

- SunRun Energy Stock

Frequently Asked Questions

Is Dominion Energy a good stock to buy?

Dominion Energy Stock Price is at its lowest level. Currently, it is trading for $69.41, which is below the fair value of this stock. The fair value of D stock is $126.73. So, Dominion Energy Stock is an excellent stock to invest in due to analysts' higher dividend yield expectations and increased price targets.

Will Dominion stock go up

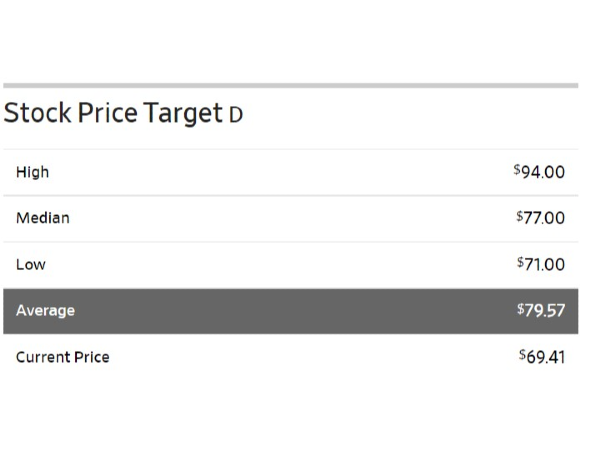

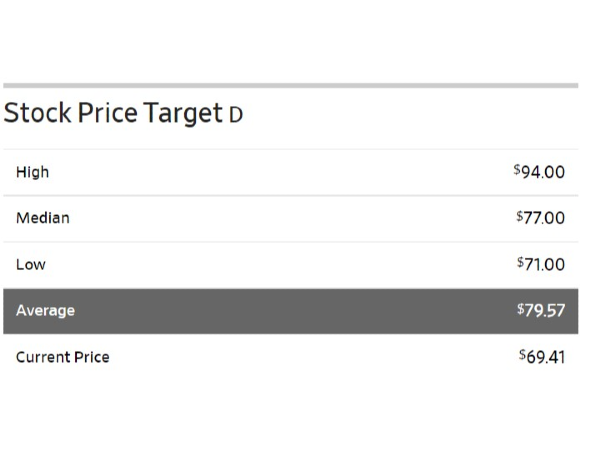

Dominion stock has started to recover from its bottom position and is expected to increase in the upcoming quarters. Analysts have set the price target of this stock at a median price of $77.00, with a high price target of $94.00 and the lowest price target of $71.00. With analysts at the WSJ having set these price targets, Dominion stock may go up in the upcoming weeks"

Is Dominion Resources a buy sell, or hold?

Dominion Energy Stock is a potential buy due to its low prices relative to its target prices. Dominion Energy Stock is a buy due to its lowest price. The 52-week lowest price of D share was $61.70. So, the analysts have seen the potential of growth in the price targets in the upcoming quarters with a higher dividend yield of 4%. So, it is a buy stock with a hold position.

How do I buy stock in Dominion Energy?

You can select a trading platform or a brokerage firm. After this, you need to analyze your investment objectives and budget. Then, open your account and make a payment. Analyze the Dominion Energy Stock and buy now or later according to the best price and time. Invest wisely. For more information, you can read A Guide To Investment Costs For Beginner Investors

Does D pay a dividend?

D Pays a dividend yield of 3.79%. The dividend yield growth estimates are around 6%, with a current dividend of 4%. Dominion Energy pays a dividend every quarter. D pays a dividend yield of 3.79% as of second quarter 2022. The upcoming division of Dominion utility stock will be announced on November 4, 2022.

The bottom Line

Finally, we conclude that Dominion Energy's is a great opportunity for investors based on forecasted price targets, making a price increase next year possible. So, it's an excellent opportunity for investors to enjoy the higher price of Dominion Energy stock and the higher dividend yield of 4% in the upcoming quarter.

Dominion Energy stock has been paying dividends to its shareholders since the establishment of this utility corporation. The dividend yields are also increasing steadily. Moreover, the stock price has dropped to its lowest level. So, it's the best time to buy this stock and enjoy the higher dividend yields for many years.

Read Also: Are Utility Stocks in a Recession - Are Utility Stocks a Good Buy Now?

Dominion Energy Stock has witnessed many ups and downs this year, dropping to its lowest level. However, the fundamentals of this stock are robust and support an attractive dividend yield of 4% and dividend growth of 6% for its shareholders.

On the other hand, the stock price has declined considerably, confusing many investors if they should buy, sell or hold the stock. Dominion Energy rumors regarding the Atlantic Coast Pipeline deal also made this stock suspicious, bringing down the price to the lower level.

Read Also: Next Era Energy (NEE) Stock, Sempra Energy Stock (SRE) and its SRE Stock Forecast, Edison International Stock (EIX), Dominion Energy Stock (D) and NRG Energy Stock

Is Dominion Energy Stock (D) a good investment?

Dominion stock has a market capitalization of $57.78 billion and a P/E ratio of 26.15, which is higher than the market average of 16.2 and the industry average of 26.0. The large market cap makes this stock attractive, as many analysts have predicted that the price of D stock will reach $83.71 by September 2022. Moreover, analysts are expecting a dividend growth of 6%.

Dominion Energy - D Stock Forecast, Price & News

Dominion Energy's stock forecast is very bright and optimistic despite the sharp fall in the price of Dominion stock. Currently, D stock is trading at $69.41, up from its lowest price of $61.70. The stock market capitalization is $57.78 billion, and a dividend yield of 3.85%.

Dominion Energy stock is committed to providing sustainable and affordable energy solutions to approximately 7 million people in 15 states. Based in Virginia, this large-cap utility company expects the third quarter earnings to be between $0.98 to $1.13 per share in their earnings guidance.

Read also about Tesla (TSLA) Alphabet (GOOG), and Netflix (NFLX) stocks

Latest Earnings Reports and Dominion Stock Dividend

The full-year earnings guidance is reported at $3.95 to $4.95. Dominion company relies on the operating earnings as the utility sector fundamentals depend on them. The second-quarter operating earnings were higher by 4.77% and grew from $628 million in 2021 to $658 million in 2022.

The net income accelerated from $285 million in 2021 to $453 million in the second quarter. Dominion third-quarter earnings report will be announced on November 4.

Read Also: Visa (V) and Bank of America (BAC)

Dominion energy (D) Stock News Headlines

Atlantic Coast Pipeline deal has been canceled by the significant utility players in this deal. Dominion Energy Inc. and Duke Energy Inc have canceled the ACP contract after a nerve-wracking fight between the dealers of this venture.

***You can also read my previous analysis on Dominion Stock if you want to know Why is Dominion Energy Stock Dropping.

Anticipated to be highly profitable to meet the demands of Virginia and North Carolina, this deal would have produced and transmitted 1.5 billion cubic feet of natural gas daily.

However, this looming deal's cancellation finally ended without any decisive result. Consequently, it has raised questions about meeting the increased demand for natural gas in Virginia and North Carolina. Over this uncertainty, Dominion Energy's stock price fell sharply.

To combat this challenge, Dominion Energy stock is negotiating with local utility providers to produce electricity from renewable energy sources as an alternative to natural gas.

This will be a more sustainable solution, ultimately making the Dominion stock more favorable for ESG investors and eliminating the unsustainable natural gas by 2050.

Should I Buy Dominion Energy Inc Stock?

Most analysts have given a buy-and-hold rating consensus for Dominion Energy Stock. According to the Market Beat, Dominion Stock has a hold rating with a price target of $80.30. Suppose you're looking for a dividend-paying stock with higher price targets and an increase in valuation. In that case, Dominion Energy Stock is the best stock for you.

What are the Top Utility Stocks to Buy Right now?

Top Utility Stocks to Buy Right Now when the market is recovering from the recessionary situation and seemingly unrestraiend inflation era. Utility stocks never disappoint an investor in this uncertainty when the markets are crashing due to the low consumer' and investors' sentiments.

Frequently Asked Questions

Is Dominion Energy a good stock to buy?

Dominion Energy Stock Price is at its lowest level. Currently, it is trading for $69.41, which is below the fair value of this stock. The fair value of D stock is $126.73. So, Dominion Energy Stock is an excellent stock to invest in due to analysts' higher dividend yield expectations and increased price targets.

Will Dominion stock go up

Dominion stock has started to recover from its bottom position and is expected to increase in the upcoming quarters. Analysts have set the price target of this stock at a median price of $77.00, with a high price target of $94.00 and the lowest price target of $71.00. With analysts at the WSJ having set these price targets, Dominion stock may go up in the upcoming weeks"

Is Dominion Resources a buy sell, or hold?

Dominion Energy Stock is a potential buy due to its low prices relative to its target prices. Dominion Energy Stock is a buy due to its lowest price. The 52-week lowest price of D share was $61.70. So, the analysts have seen the potential of growth in the price targets in the upcoming quarters with a higher dividend yield of 4%. So, it is a buy stock with a hold position.

How do I buy stock in Dominion Energy?

You can select a trading platform or a brokerage firm. After this, you need to analyze your investment objectives and budget. Then, open your account and make a payment. Analyze the Dominion Energy Stock and buy now or later according to the best price and time. Invest wisely. For more information, you can read A Guide To Investment Costs For Beginner Investors

Does D pay a dividend?

D Pays a dividend yield of 3.79%. The dividend yield growth estimates are around 6%, with a current dividend of 4%. Dominion Energy pays a dividend every quarter. D pays a dividend yield of 3.79% as of second quarter 2022. The upcoming division of Dominion utility stock will be announced on November 4, 2022.

The bottom Line

Finally, we conclude that Dominion Energy's is a great opportunity for investors based on forecasted price targets, making a price increase next year possible. So, it's an excellent opportunity for investors to enjoy the higher price of Dominion Energy stock and the higher dividend yield of 4% in the upcoming quarter.

Dominion Energy stock has been paying dividends to its shareholders since the establishment of this utility corporation. The dividend yields are also increasing steadily. Moreover, the stock price has dropped to its lowest level. So, it's the best time to buy this stock and enjoy the higher dividend yields for many years.

Read Also: Are Utility Stocks in a Recession - Are Utility Stocks a Good Buy Now?