Investing in gym stocks

You should look into these Planet Fitness gym stock if you're trying to invest in the fitness sector. These businesses, which range from high-end health clubs to low-cost chains, are expanding quickly and might be successful.

More people in America now consider going to the gym a way of life. However, since 2020, when COVID-19 regulations have been in place, many people have chosen to use home exercise equipment, which has put a heavy burden on clubs.

One of the main sources of income for gyms all across the US, gym memberships, experienced a significant decline in the years 2020 to 2021. People started exercising at home to keep in shape, which has been good for some health-related businesses but disastrous for most pure-play gym stocks.

For instance, the home equipment market expanded by 170% within the first half of 2021, while downloads of exercise apps increased by 46% globally despite the ongoing epidemic.

Apple Watch shipments also saw a 20% increase during this period. On the other hand, health club centers, notably Town Sports International, declared bankruptcy. Because of this, the growth of the health industry has outpaced that of the gym industry. There is, however, hope.

Gym stocks may do better as the economy recovers from the worldwide pandemic. Check out the firm stock that could profit from a market recovery.

Read more about GameStop

How do you invest in fitness?

The first thing you should do is look at your finances if you're thinking to invest in a gym franchise of any kind. Before you start the application process, make sure you have the necessary funding.

Next, take a look at the several franchise options we have and choose the company that's best for you. Before you invest, read over the financial criteria, any geographical limits, and any prerequisites that could be necessary.

Once you've identified the business opportunity that's ideal for you, you must speak with the franchise company to learn more about the procedures for submitting an application. You might need to go through an interview procedure, show that you have the required funds, and meet with the franchising company before you can become a franchisee.

About Planet Fitness (NYSE:PLNT) Stocks

Based in Hampton, New Hampshire, Planet Fitness (NYSE:PLNT) is an American gym facility franchisor and operator. As per the firm, it operates 2,300+ clubs, making it one of the biggest health club franchises in terms of membership and number of locations.

There are franchises for this company in the US, Canada, Australia, Panama, Mexico, and the Dominican Republic. It bills itself as a "Judgement Free Zone" and targets new and infrequent gym goers. For its environment, it has received both praise and criticism. It is reportedly the fastest-growing health club facility franchise in the country.

On Friday, October 7, 2022, the PLNT price target dropped by -2.03%, from $62.15 to $60.89. The stock's last trading day saw 2.72% of its daily range between a low of $60.28 and a high of $61.92. In the previous two weeks, the price has increased by 8.97% in 7 of the past 10 days.

Despite declining prices, volume rose to 27 thousand shares yesterday. This could be a forewarning, and the risk will likely increase a little over the next few days. Nine hundred seventy-seven (977) thousand shares were purchased and sold for around $59.50 million.

On Friday, September 23, 2022, a buy signal was generated from a pivot bottom point, which has since increased by 8.97%. More growth is predicted until the discovery of a new top pivot. Additionally, the 3-month Moving Average Convergence Divergence has generated a buy signal (MACD).

Additionally, certain unfavorable signals were sent, and these could have an impact on the development shortly.

Since the long-term average is higher than the short-term average, the stock has a broad sell signal and a more pessimistic outlook. The long-term moving average at $66.10 will act as a barrier for the stock if it continues to rise.

The stock will receive some support from the short-term average of around $60.03 in the event of a decline. Another purchase signal will be given if the long-term average is broken. In contrast, another sell signal will be added if the short-term average is broken, strengthening the overall signal. Yesterday, volume increased while prices declined. The stock should be properly monitored, as this could be an early warning.

PLNT Stock - Frequently Asked Questions

For the three months ending June 30, 2022, Planet Fitness had long-term debt of $1.986 billion, up 13.74% from the previous period. The long-term debt of Planet Fitness in 2021 was $1.74 billion, a decrease of 0.64% from 2020.

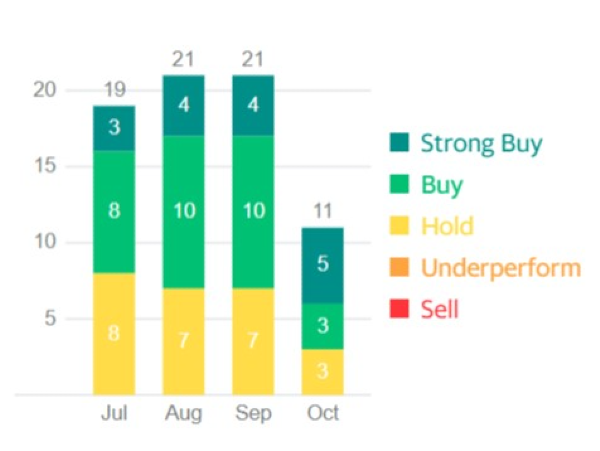

Buy is the general opinion following the rating of the company. Relying on 3 hold ratings, 9 buy ratings, and no sell ratings, the firm has an average rating score of 2.85.

The consensus price objective among the 17 analysts providing 12-month price projections for the business is $93, with the high estimate being $115 and the low estimate being $65. From the most recent price of 60.88, the median projection reflects a rise of +52.76%.

Are there any publicly traded gyms?

Numerous gyms have stock that is traded on the open market. The shares of some of the biggest and best-known gym chains in the world, such as Planet Fitness, Lifetime, and F45, are traded on significant exchanges.

Are gym stocks suitable for your portfolio?

The secret is to create a diverse portfolio that includes a variety of investments and makes sense given your attitude toward risk.

Equities (stocks in companies), corporate and government bonds, real estate, cash, and other assets make up a balanced investment portfolio.

So, to have better diversified portfolio gym stocks are ideal for investment. Keep in mind that overdiversification is also not recommended.

See more related: Nvidia Stock Price & Forecast

Investing in gym stocks

You should look into these Planet Fitness gym stock if you're trying to invest in the fitness sector. These businesses, which range from high-end health clubs to low-cost chains, are expanding quickly and might be successful.

More people in America now consider going to the gym a way of life. However, since 2020, when COVID-19 regulations have been in place, many people have chosen to use home exercise equipment, which has put a heavy burden on clubs.

One of the main sources of income for gyms all across the US, gym memberships, experienced a significant decline in the years 2020 to 2021. People started exercising at home to keep in shape, which has been good for some health-related businesses but disastrous for most pure-play gym stocks.

For instance, the home equipment market expanded by 170% within the first half of 2021, while downloads of exercise apps increased by 46% globally despite the ongoing epidemic. Apple Watch shipments also saw a 20% increase during this period. On the other hand, health club centers, notably Town Sports International, declared bankruptcy. Because of this, the growth of the health industry has outpaced that of the gym industry. There is, however, hope.

Gym stocks may do better as the economy recovers from the worldwide pandemic. Check out the firm stock that could profit from a market recovery.

Read more about GameStop

How do you invest in fitness?

The first thing you should do is look at your finances if you're thinking to invest in a gym franchise of any kind. Before you start the application process, make sure you have the necessary funding.

Next, take a look at the several franchise options we have and choose the company that's best for you. Before you invest, read over the financial criteria, any geographical limits, and any prerequisites that could be necessary.

Once you've identified the business opportunity that's ideal for you, you must speak with the franchise company to learn more about the procedures for submitting an application. You might need to go through an interview procedure, show that you have the required funds, and meet with the franchising company before you can become a franchisee.

About Planet Fitness (NYSE:PLNT) Stocks

Based in Hampton, New Hampshire, Planet Fitness (NYSE:PLNT) is an American gym facility franchisor and operator. As per the firm, it operates 2,300+ clubs, making it one of the biggest health club franchises in terms of membership and number of locations.

There are franchises for this company in the US, Canada, Australia, Panama, Mexico, and the Dominican Republic. It bills itself as a "Judgement Free Zone" and targets new and infrequent gym goers. For its environment, it has received both praise and criticism. It is reportedly the fastest-growing health club facility franchise in the country.

Planet Fitness - PLNT Stock Forecast, Price & News

On Friday, October 7, 2022, the PLNT price target dropped by -2.03%, from $62.15 to $60.89. The stock's last trading day saw 2.72% of its daily range between a low of $60.28 and a high of $61.92. In the previous two weeks, the price has increased by 8.97% in 7 of the past 10 days.

Despite declining prices, volume rose to 27 thousand shares yesterday. This could be a forewarning, and the risk will likely increase a little over the next few days. Nine hundred seventy-seven (977) thousand shares were purchased and sold for around $59.50 million.

On Friday, September 23, 2022, a buy signal was generated from a pivot bottom point, which has since increased by 8.97%. More growth is predicted until the discovery of a new top pivot. Additionally, the 3-month Moving Average Convergence Divergence has generated a buy signal (MACD).

Additionally, certain unfavorable signals were sent, and these could have an impact on the development shortly.

Since the long-term average is higher than the short-term average, the stock has a broad sell signal and a more pessimistic outlook. The long-term moving average at $66.10 will act as a barrier for the stock if it continues to rise.

The stock will receive some support from the short-term average of around $60.03 in the event of a decline. Another purchase signal will be given if the long-term average is broken. In contrast, another sell signal will be added if the short-term average is broken, strengthening the overall signal. Yesterday, volume increased while prices declined. The stock should be properly monitored, as this could be an early warning.

PLNT Stock - Frequently Asked Questions

Is Planet Fitness in debt?

For the three months ending June 30, 2022, Planet Fitness had long-term debt of $1.986 billion, up 13.74% from the previous period. The long-term debt of Planet Fitness in 2021 was $1.74 billion, a decrease of 0.64% from 2020.

Is Planet Fitness a good stock to Buy now?

Buy is the general opinion following the rating of the company. Relying on 3 hold ratings, 9 buy ratings, and no sell ratings, the firm has an average rating score of 2.85.

Will Planet Fitness stock go up?

The consensus price objective among the 17 analysts providing 12-month price projections for the business is $93, with the high estimate being $115 and the low estimate being $65. From the most recent price of 60.88, the median projection reflects a rise of +52.76%.

Are there any publicly traded gyms?

Numerous gyms have stock that is traded on the open market. The shares of some of the biggest and best-known gym chains in the world, such as Planet Fitness, Lifetime, and F45, are traded on significant exchanges.

Are gym stocks suitable for your portfolio?

The secret is to create a diverse portfolio that includes a variety of investments and makes sense given your attitude toward risk.

Equities (stocks in companies), corporate and government bonds, real estate, cash, and other assets make up a balanced investment portfolio.

So, to have better diversified portfolio gym stocks are ideal for investment. Keep in mind that overdiversification is also not recommended.

See more related: Nvidia Stock Price & Forecast