When volatility grips the stock market, as it has this past year, income investors should focus on quality dividend growth stocks. We believe the Dividend Aristocrats list, a group of 64 stocks in the S&P 500 Index that have each raised their dividends for at least 25 consecutive years, are among the highest-quality dividend growth stocks. One such stock is Procter & Gamble stock, a recession resistant Dividend Aristocrat.

Recessions are disastrous for many companies, particularly those that operate in cyclical sectors of the economy. However, the Consumer Staples sector should perform relatively well in a global recession, as consumers will always need certain products such as paper towels, laundry detergent, and toothpaste.

These products are daily essentials for most people. This will keep consumer staples manufacturers profitable, and allow them to continue paying dividends to shareholders over time. For this reason, those following a dividend growth investing strategy should continue to hold recession resistant Procter & Gamble (PG) stock. In fact, the stock made our list of five best dividend growth stocks.

Proctor & Gamble Stock: Recession Resistant Dividend Aristocrat

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter*. It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

Proctor & Gamble Business Overview

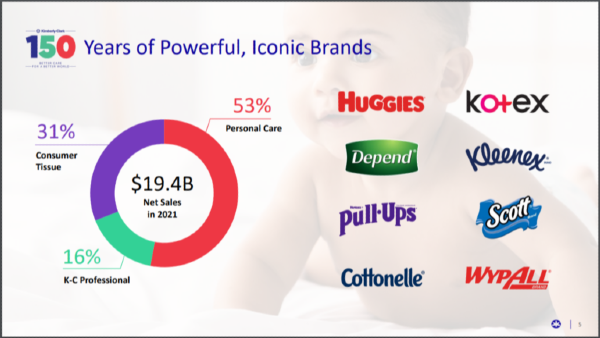

The Procter & Gamble Company is a consumer products giant that sells its products in more than 180 countries and generates over $80 billion in annual sales in fiscal year 2022. Some of its core brands include Gillette, Tide, Charmin, Crest, Pampers, Febreeze, Head & Shoulders, Bounty, Oral-B, Old Spice, and many more. Procter & Gamble has a market capitalization of approximately $319 billion.

The company, in its current form, is the result of a massive transformation that began several years ago. Procter & Gamble was one of the notable laggards that did not see a huge recovery in sales and earnings-per-share coming coming out of the Great Recession of 2008-2009. The company had become bloated, with dozens of underperforming brands across multiple categories.

Transformation

In response, Procter & Gamble embarked on an aggressive divestment program, designed to divest slow-growth brands that were not considered to be a part of the future growth of the company. For example, in 2016 it sold the Duracell battery brand to Berkshire Hathaway (BRK.B) for $4.7 billion, and also sold a collection of 43 beauty brands inlacing Clairol and Cover Girl to Coty (COTY) for $12.5 billion. In all, P&G reduced its total brand count by nearly two-thirds.

The result of these actions is that Procter & Gamble is a higher-growth company with stronger profit margins. Today, the company operates through five business segments in ten categories. The five business segments are Beauty; Grooming; Health Care; Fabric & Home Care;, and Baby, Feminine & Family Care. The ten categories are Personal Care, Oral Care, Hair Care, Skin & Personal Care, Grooming, Fabric Care, Home Care, Baby Care, Feminine Care, and Family Care. Many of the company’s brands are for the most part market leaders with a No. 1 or No. 2 position worldwide.

The results has been a company growing organic sales at a steady clip.

Proctor & Gamble Stock Price and Fundamentals

- Stock Price: $132.03

- Market Capitalization: $312.87B

- PE Ratio: 22.74X

- Dividend Rate (FWD): $3.65

- Dividend Yield (FWD): 2.77%

- Payout Ratio (FWD): 60%

Earnings Estimates

For fiscal year 2023, Proctor & Gamble expects 3% to 5% organic sales growth and 4% earnings per share growth. Furthermore, the firm expects to return about $9 billion in dividends and $6 to $8 billion in share repurchases.

Consensus forward is $5.81 per share for fiscal year 2023, same for FY 2022.

Proctor & Gamble Stock – Steady Dividend Growth and Solid Dividend Safety

Dividend Growth

Amazingly, the company has paid increasing dividends for 66 consecutive years, one of the longest active streaks of any company. This qualifies the company to be not just a member of the Dividend Aristocrats and Dividend Champions, but also a member of the exclusive Dividend Kings list as well. The Dividend Kings are an even more exclusive group of just 39 stocks that have raised their dividends for 50+ consecutive years.

According to Portfolio Insight*, Proctor & Gamble’s dividend growth has been ~4.94% in the past 5-years and ~5.16% in the trailing 10-years, making the stock a steady grower each year.

Dividend Safety

Proctor & Gamble’s dividend safety is excellent. With an expected dividend payout ratio of about 60% of adjusted earnings-per-share in the current fiscal year, the dividend is sufficiently covered alleviating concerns about dividend safety. The dividend of $8,843 million is covered by free cash flow (FCF) of $13,195 million.

We expect Procter & Gamble’s dividend to remain secure, even in a deep and prolonged recession. The company has strong interest coverage of more than 41X and a conservative leverage ratio of only 1.20X. Its credit rating is AA-/Aa3, high grade investment credit rating adding to the dividend safety.

Procter & Gamble is highly resistant to recessions, as its products are essential to consumers, even during an economic downturn. In the Great Recession, Procter & Gamble saw its earnings-per-share fall only 1.6% in 2009 and 1.4% in 2010. Moreover, sales and profits grow during the COVID-19 pandemic and are seemingly holding up during the challenges in 2022.

Procter & Gamble has significant competitive advantages, specifically its strong brands. It has a number of category-leading brands such as Crest, Tide, Gillette, Bounty, Febreeze, Old Spice, Pampers, and many more. These top-tier brands provide Procter & Gamble with consistent profits and cash flow adding to the dividend safety. In fact, we consider Proctor & Gamble stock to be one of the safest Dividend King stocks.

Final Thoughts on Proctor & Gamble Stock

There will not be many industries spared if a global recession occurs in the coming months. However, there are a few pockets of relative strength that will continue to provide shareholders with steady dividends, and even dividend growth.

Procter & Gamble is not the cheapest stock around, trading at price-to-earnings ratio of ~22.9X, but it deserves a premium valuation due to its world-class brands and durable competitive advantages. It will remain profitable in a recession, just as it did during the Great Recession of 2008-2009.

Procter & Gamble has a 2.75% dividend yield, which exceeds the dividend yield of the broader S&P 500 Index. And, it will continue to raise its dividend each year, as it has done for over 66 consecutive years. For these reasons, income investors should hold recession resistant Procter & Gamble stock.

Disclosure: Members of the Sure Dividend team are long PG.

Author Bio: Bob Ciura of the Sure Dividend team.

Related Articles on Dividend Power

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

When volatility grips the stock market, as it has this past year, income investors should focus on quality dividend growth stocks. We believe the Dividend Aristocrats list, a group of 64 stocks in the S&P 500 Index that have each raised their dividends for at least 25 consecutive years, are among the highest-quality dividend growth stocks. One such stock is Procter & Gamble stock, a recession resistant Dividend Aristocrat.

Recessions are disastrous for many companies, particularly those that operate in cyclical sectors of the economy. However, the Consumer Staples sector should perform relatively well in a global recession, as consumers will always need certain products such as paper towels, laundry detergent, and toothpaste.

These products are daily essentials for most people. This will keep consumer staples manufacturers profitable, and allow them to continue paying dividends to shareholders over time. For this reason, those following a dividend growth investing strategy should continue to hold recession resistant Procter & Gamble (PG) stock. In fact, the stock made our list of five best dividend growth stocks.

Proctor & Gamble Stock: Recession Resistant Dividend Aristocrat

Affiliate

If you are interested in investing in stocks that pay dividends I recommend signing up for the Sure Dividend Newsletter*. It is a good value and one of the best dividend stock newsletters available. There is a 7-day free trial and grace period so it is risk free. The service provides top 10 stock picks each month with discussion of advantages, valuation, and risks. I highly recommend them and use their insights for my own stock research.

Proctor & Gamble Business Overview

The Procter & Gamble Company is a consumer products giant that sells its products in more than 180 countries and generates over $80 billion in annual sales in fiscal year 2022. Some of its core brands include Gillette, Tide, Charmin, Crest, Pampers, Febreeze, Head & Shoulders, Bounty, Oral-B, Old Spice, and many more. Procter & Gamble has a market capitalization of approximately $319 billion.

The company, in its current form, is the result of a massive transformation that began several years ago. Procter & Gamble was one of the notable laggards that did not see a huge recovery in sales and earnings-per-share coming coming out of the Great Recession of 2008-2009. The company had become bloated, with dozens of underperforming brands across multiple categories.

Transformation

In response, Procter & Gamble embarked on an aggressive divestment program, designed to divest slow-growth brands that were not considered to be a part of the future growth of the company. For example, in 2016 it sold the Duracell battery brand to Berkshire Hathaway (BRK.B) for $4.7 billion, and also sold a collection of 43 beauty brands inlacing Clairol and Cover Girl to Coty (COTY) for $12.5 billion. In all, P&G reduced its total brand count by nearly two-thirds.

The result of these actions is that Procter & Gamble is a higher-growth company with stronger profit margins. Today, the company operates through five business segments in ten categories. The five business segments are Beauty; Grooming; Health Care; Fabric & Home Care;, and Baby, Feminine & Family Care. The ten categories are Personal Care, Oral Care, Hair Care, Skin & Personal Care, Grooming, Fabric Care, Home Care, Baby Care, Feminine Care, and Family Care. Many of the company’s brands are for the most part market leaders with a No. 1 or No. 2 position worldwide.

The results has been a company growing organic sales at a steady clip.

Proctor & Gamble Stock Price and Fundamentals

Source: Portfolio Insight* (as of November 3, 2022)

Source: Stock Rover*

Earnings Estimates

For fiscal year 2023, Proctor & Gamble expects 3% to 5% organic sales growth and 4% earnings per share growth. Furthermore, the firm expects to return about $9 billion in dividends and $6 to $8 billion in share repurchases.

Consensus forward is $5.81 per share for fiscal year 2023, same for FY 2022.

Proctor & Gamble Stock – Steady Dividend Growth and Solid Dividend Safety

Dividend Growth

Amazingly, the company has paid increasing dividends for 66 consecutive years, one of the longest active streaks of any company. This qualifies the company to be not just a member of the Dividend Aristocrats and Dividend Champions, but also a member of the exclusive Dividend Kings list as well. The Dividend Kings are an even more exclusive group of just 39 stocks that have raised their dividends for 50+ consecutive years.

According to Portfolio Insight*, Proctor & Gamble’s dividend growth has been ~4.94% in the past 5-years and ~5.16% in the trailing 10-years, making the stock a steady grower each year.

Source: Portfolio Insight*

Dividend Safety

Proctor & Gamble’s dividend safety is excellent. With an expected dividend payout ratio of about 60% of adjusted earnings-per-share in the current fiscal year, the dividend is sufficiently covered alleviating concerns about dividend safety. The dividend of $8,843 million is covered by free cash flow (FCF) of $13,195 million.

We expect Procter & Gamble’s dividend to remain secure, even in a deep and prolonged recession. The company has strong interest coverage of more than 41X and a conservative leverage ratio of only 1.20X. Its credit rating is AA-/Aa3, high grade investment credit rating adding to the dividend safety.

Procter & Gamble is highly resistant to recessions, as its products are essential to consumers, even during an economic downturn. In the Great Recession, Procter & Gamble saw its earnings-per-share fall only 1.6% in 2009 and 1.4% in 2010. Moreover, sales and profits grow during the COVID-19 pandemic and are seemingly holding up during the challenges in 2022.

Procter & Gamble has significant competitive advantages, specifically its strong brands. It has a number of category-leading brands such as Crest, Tide, Gillette, Bounty, Febreeze, Old Spice, Pampers, and many more. These top-tier brands provide Procter & Gamble with consistent profits and cash flow adding to the dividend safety. In fact, we consider Proctor & Gamble stock to be one of the safest Dividend King stocks.

Final Thoughts on Proctor & Gamble Stock

There will not be many industries spared if a global recession occurs in the coming months. However, there are a few pockets of relative strength that will continue to provide shareholders with steady dividends, and even dividend growth.

Procter & Gamble is not the cheapest stock around, trading at price-to-earnings ratio of ~22.9X, but it deserves a premium valuation due to its world-class brands and durable competitive advantages. It will remain profitable in a recession, just as it did during the Great Recession of 2008-2009.

Procter & Gamble has a 2.75% dividend yield, which exceeds the dividend yield of the broader S&P 500 Index. And, it will continue to raise its dividend each year, as it has done for over 66 consecutive years. For these reasons, income investors should hold recession resistant Procter & Gamble stock.

Disclosure: Members of the Sure Dividend team are long PG.

Author Bio: Bob Ciura of the Sure Dividend team.

Related Articles on Dividend Power

*This post contains affiliate links meaning that I earn a commission for any purchases that you make at the Affiliates website through these links. This will not incur additional costs for you. Please read my disclosure for more information.

Originally Posted on dividendpower.org