Key takeaways

- Southern Company is currently a buy and at fair value

- The company's dividend has increased consistently and is an opportunity for income investors

- The company has more risk than other utilities due to its nuclear plant project and weather effects

- EPS growth looks to continue as the U.S. southern region continues its population growth

- Southern Company will be a long term buy if it finishes its delayed nuclear plant project next year

Is Southern Company (SO) a Buy or Sell?

We assess Southern Company to be a buying opportunity based on our process for analyzing utilities. For retail investors, this may be a good time to dollar-cost average into a position in SO.

As of November 2022, Southern Company is looking to be a buy. The 1-year price movements indicate that investors have been using Southern Company as a hedge against a falling market. The utility was in the over-valued range multiple times in 2022. With fears resonating across the market, it looks unlikely that Southern Company will fall into a under-valued range as investors continue to buy SO to hedge against a falling market.

Southern Company (SO) Target Prices

For Q4 2022, Southern company has the following price targets:

- Over-Valued: $73.41

- Fair-Value: $66.74

- Under-Valued: $60.06

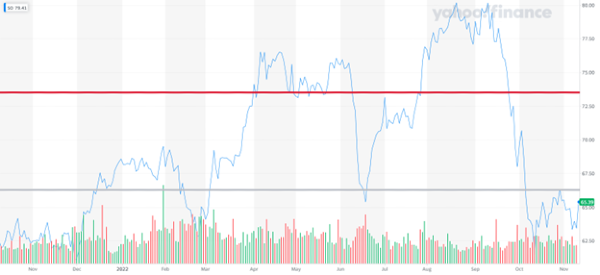

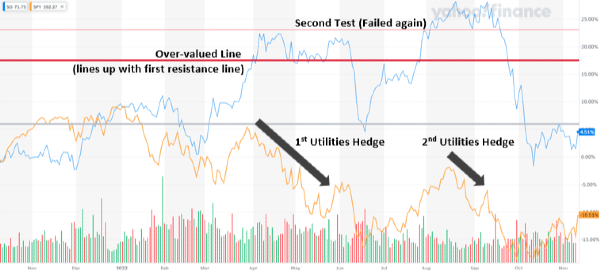

Looking at the price graph for Southern Company in 2022 you can see that Southern Company's price has been correcting back below our over-valued ceiling of $73.41.

Source: Yahoo! Finance, in red: our over-valuation line, in gray: our fair-value line

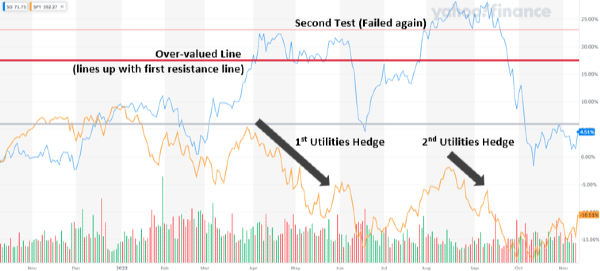

When you compare Southern Company to the SPY (representing the overall market), you see clearly when investors tried to use SO as a hedge against a precipitating market:

During the Spring, investors held onto Southern Company as the overall market fell. However, once the general market re-tested upwards momentum and again collapsed, SO also collapsed but only back down to its fair-market value (in gray).

Market participants are keeping SO at its fair market value to keep a hedge against a further precipitating market. However, if the market does collapse further, expect Southern Company to test its under-valued target at $60.06. Barring any surprises at Southern Company’s next quarterly report (and this is a real risk, see below), we expect SO to hold a $60 resistance line.

The $66 resistance line should be held if the market doesn’t have any sudden volatility. A huge surge upwards will ensure investors leave utilities to jump into riskier growth stocks. If the market falls further, Southern Company will likely also retreat into its under-valued resistance line.

Risks in Forecast

Book Value per Share, non-trivial risk

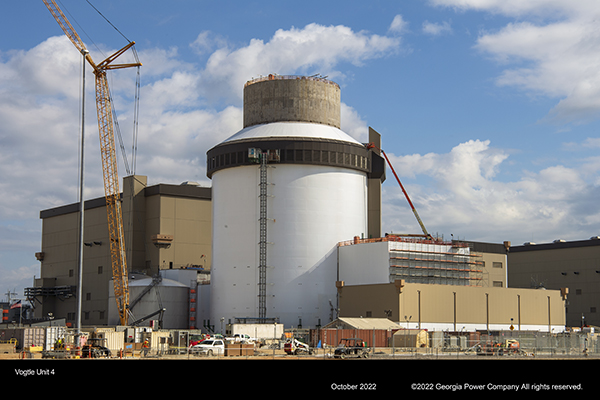

Southern Company has a looming risk within their total assets: Plant Vogtle Units 3 and 4. These are the first nuclear plants to be built in the United States in 30 years [1].

Reuters reported that Southern Company executives did not revise their 2023 goal for the Vogtle reactors[2]. This comes after being years behind schedule and billions over budget. Executives expect the plant to be done in 2023 without further significant cost overruns.

The total stockholder equity at the end of 2021 was $32.2 Billion. Construction work in progress (which is assumed to be mostly Plant Vogtle) was at $8.7 Billion. That means that Plant Vogtle may be up to 25% of stock-holder equity! The worst-case scenario is that delays continue like they do. If that happens, then the valuation of those construction assets may need to be written down. This will be a catastrophic blow to investors as Southern Company’s intrinsic value will be cut and its price may follow suit.

This year, two of the Vogtle partners in the project said they wanted to freeze their spending on the project[2]. This is a worrisome proposition, but it does look like Southern Company will take on the remainder of the project and get the project to the finish line.

We’ve taken this risk in consideration by lowering Southern Company’s book value per share down 2% in our evaluations. This assumes the plants will be complete in 2023, those assets don’t need a write-down, and losses will only be low over-run costs.

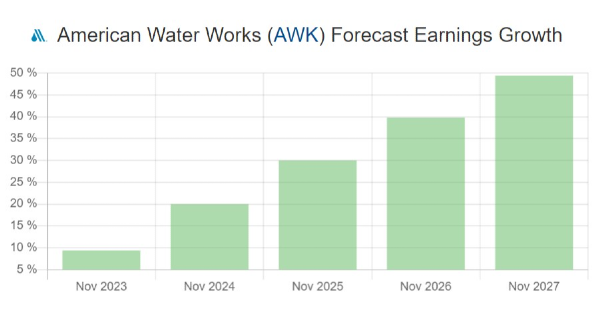

EPS Growth

Southern Company is a highly diversified company, and we feel confident it has the capacity to support its customer base regardless of the Vogtle Plants. Southern Company has a median year over year (YoY) growth of 6.38%. We expect this growth to continue into the next decade if not accelerate.

We expect revenue growth to increase due to the continued population growth in the south where Southern Company runs the majority of its operations. The south saw a 38.1% increase in population in 2022 and a 38.3% increase in population growth in 2021[3]. Even if this growth slows, this should still accelerate Southern Company’s revenue growth. Regardless of the company’s inefficiencies, this revenue growth alone should be enough to sustain a 6.38% earnings growth for the next decade.

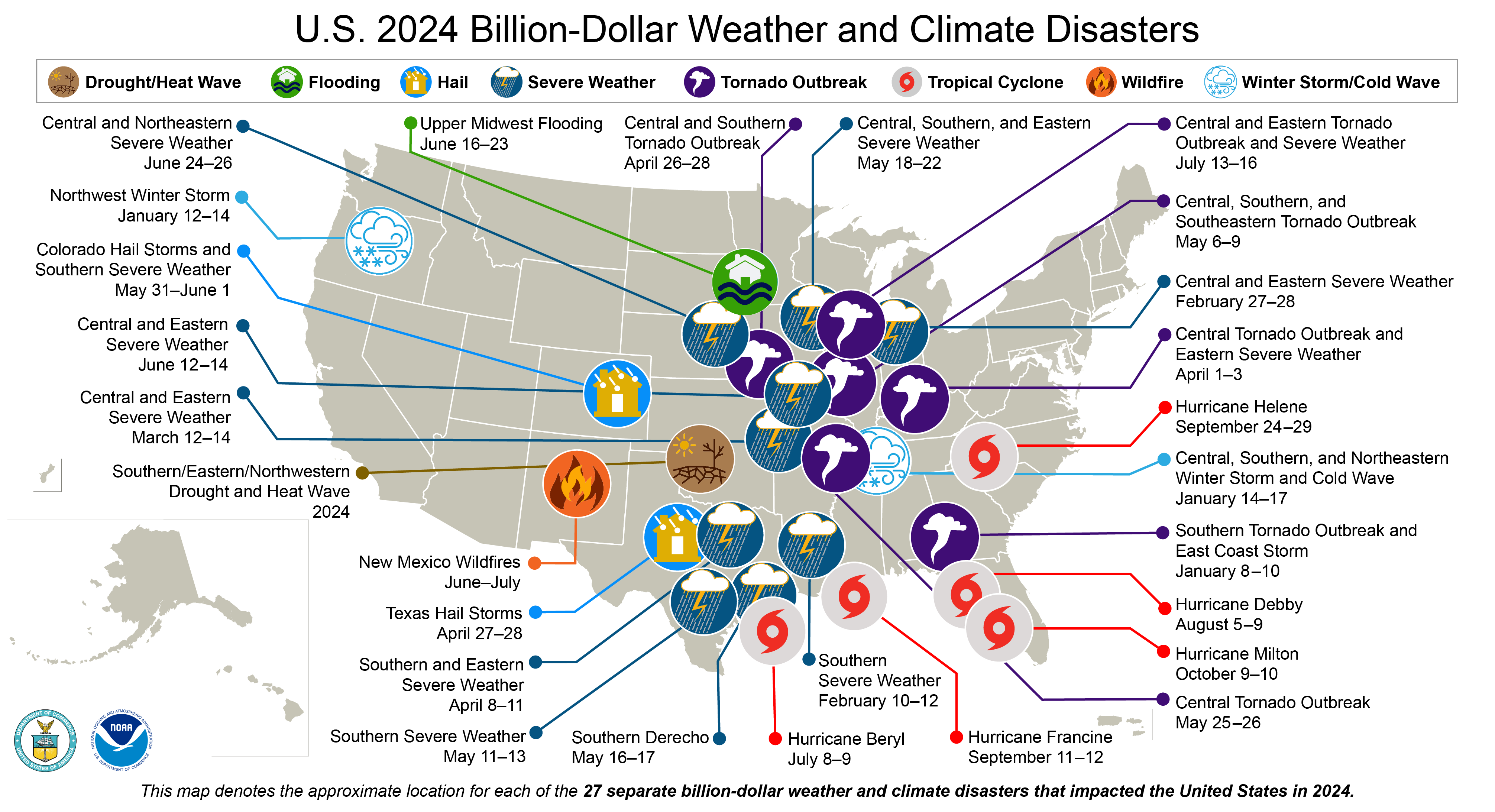

Conservatively, we do not expect EPS growth to accelerate. Other factors, including an increase in property damage due to weather events[4], are adding risk to Southern Company’s operations.

Is Southern Company (SO) a Good Dividend Stock?

Southern Company currently stands with a 4.29% dividend yield. This is a great rate to jump into. However, there is a risk that Southern Company may need to dampen dividend growth or even cut them as they face the start of Plant Vogtle.

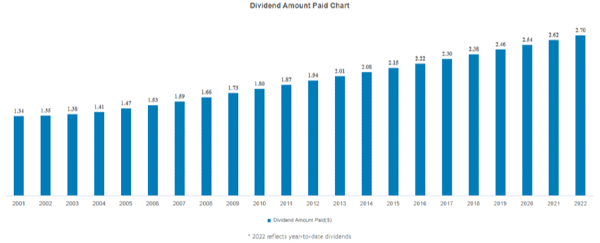

Dividend History

Southern Company’s dividend history has proven the Company is dedicated to continued dividend growth.

From looking at Southern Company’s historical dividends, it looks unlikely that they will cut their dividend anytime soon.

Dividend Payout Ratio

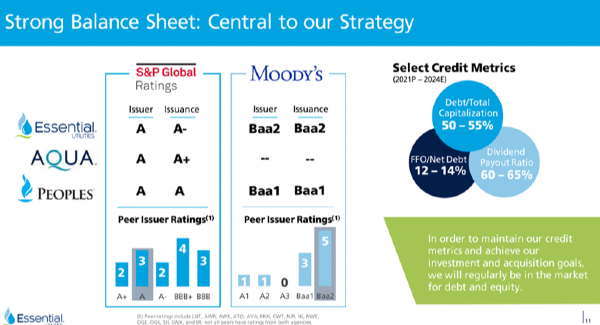

On the other hand, the dividend payout ratio currently stands at 86% in 2022. The top electric utilities and water utilities typically have dividend payout ratios around 60% to 65%. Southern Company needs to get Plant Vogtle running in 2023 so that they can focus their resources and attention on other parts of their business. If they do not, they may not be able to achieve further earnings growth, which can lead to stagnating dividends.

Bottom Line

We’re rating Southern Company (SO) a buy for income investors, dividend growth investors, and neutral for value investors. Southern Company is currently hovering around it’s fair market value but could drop further if a market route occurs.

Southern Company is facing a major risk with its Plant Vogtle project, but if it can finish in 2023 it will be in a very strong position. Population growth is heavily favoring Southern Company in the next decade.

The Top Stocks

Our community writes analysis everyday which we assess using our in house algorithms. Find the top stocks in the topic you're interested in here:

References

1). Georgia Power – Plant Vogtle

2). Southern Co trims cost estimate for Georgia Vogtle reactors, sees them on in 2023

3). U.S. Regional Population Growth from U.S. Census

Key takeaways

Is Southern Company (SO) a Buy or Sell?

We assess Southern Company to be a buying opportunity based on our process for analyzing utilities. For retail investors, this may be a good time to dollar-cost average into a position in SO.

As of November 2022, Southern Company is looking to be a buy. The 1-year price movements indicate that investors have been using Southern Company as a hedge against a falling market. The utility was in the over-valued range multiple times in 2022. With fears resonating across the market, it looks unlikely that Southern Company will fall into a under-valued range as investors continue to buy SO to hedge against a falling market.

Southern Company (SO) Target Prices

For Q4 2022, Southern company has the following price targets:

Looking at the price graph for Southern Company in 2022 you can see that Southern Company's price has been correcting back below our over-valued ceiling of $73.41.

Source: Yahoo! Finance, in red: our over-valuation line, in gray: our fair-value line

When you compare Southern Company to the SPY (representing the overall market), you see clearly when investors tried to use SO as a hedge against a precipitating market:

Source: Yahoo! Finance, view interactive chart

During the Spring, investors held onto Southern Company as the overall market fell. However, once the general market re-tested upwards momentum and again collapsed, SO also collapsed but only back down to its fair-market value (in gray).

Market participants are keeping SO at its fair market value to keep a hedge against a further precipitating market. However, if the market does collapse further, expect Southern Company to test its under-valued target at $60.06. Barring any surprises at Southern Company’s next quarterly report (and this is a real risk, see below), we expect SO to hold a $60 resistance line.

The $66 resistance line should be held if the market doesn’t have any sudden volatility. A huge surge upwards will ensure investors leave utilities to jump into riskier growth stocks. If the market falls further, Southern Company will likely also retreat into its under-valued resistance line.

Risks in Forecast

Book Value per Share, non-trivial risk

Source: Georgia Southern Webpage

Southern Company has a looming risk within their total assets: Plant Vogtle Units 3 and 4. These are the first nuclear plants to be built in the United States in 30 years [1].

Reuters reported that Southern Company executives did not revise their 2023 goal for the Vogtle reactors[2]. This comes after being years behind schedule and billions over budget. Executives expect the plant to be done in 2023 without further significant cost overruns.

The total stockholder equity at the end of 2021 was $32.2 Billion. Construction work in progress (which is assumed to be mostly Plant Vogtle) was at $8.7 Billion. That means that Plant Vogtle may be up to 25% of stock-holder equity! The worst-case scenario is that delays continue like they do. If that happens, then the valuation of those construction assets may need to be written down. This will be a catastrophic blow to investors as Southern Company’s intrinsic value will be cut and its price may follow suit. This year, two of the Vogtle partners in the project said they wanted to freeze their spending on the project[2]. This is a worrisome proposition, but it does look like Southern Company will take on the remainder of the project and get the project to the finish line.

We’ve taken this risk in consideration by lowering Southern Company’s book value per share down 2% in our evaluations. This assumes the plants will be complete in 2023, those assets don’t need a write-down, and losses will only be low over-run costs.

EPS Growth

Southern Company is a highly diversified company, and we feel confident it has the capacity to support its customer base regardless of the Vogtle Plants. Southern Company has a median year over year (YoY) growth of 6.38%. We expect this growth to continue into the next decade if not accelerate. We expect revenue growth to increase due to the continued population growth in the south where Southern Company runs the majority of its operations. The south saw a 38.1% increase in population in 2022 and a 38.3% increase in population growth in 2021[3]. Even if this growth slows, this should still accelerate Southern Company’s revenue growth. Regardless of the company’s inefficiencies, this revenue growth alone should be enough to sustain a 6.38% earnings growth for the next decade.

Conservatively, we do not expect EPS growth to accelerate. Other factors, including an increase in property damage due to weather events[4], are adding risk to Southern Company’s operations.

Source: NOAA

Is Southern Company (SO) a Good Dividend Stock?

Southern Company currently stands with a 4.29% dividend yield. This is a great rate to jump into. However, there is a risk that Southern Company may need to dampen dividend growth or even cut them as they face the start of Plant Vogtle.

Dividend History

Southern Company’s dividend history has proven the Company is dedicated to continued dividend growth.

Source: Southern Company Investor Relations

From looking at Southern Company’s historical dividends, it looks unlikely that they will cut their dividend anytime soon.

Dividend Payout Ratio

On the other hand, the dividend payout ratio currently stands at 86% in 2022. The top electric utilities and water utilities typically have dividend payout ratios around 60% to 65%. Southern Company needs to get Plant Vogtle running in 2023 so that they can focus their resources and attention on other parts of their business. If they do not, they may not be able to achieve further earnings growth, which can lead to stagnating dividends.

Bottom Line

We’re rating Southern Company (SO) a buy for income investors, dividend growth investors, and neutral for value investors. Southern Company is currently hovering around it’s fair market value but could drop further if a market route occurs. Southern Company is facing a major risk with its Plant Vogtle project, but if it can finish in 2023 it will be in a very strong position. Population growth is heavily favoring Southern Company in the next decade.

The Top Stocks

Our community writes analysis everyday which we assess using our in house algorithms. Find the top stocks in the topic you're interested in here:

The Top Utility Stocks to Invest in Now

The Best Safe Stocks to Invest in Now

The Best Stocks New Investors Should Try

References

1). Georgia Power – Plant Vogtle

2). Southern Co trims cost estimate for Georgia Vogtle reactors, sees them on in 2023

3). U.S. Regional Population Growth from U.S. Census