Expertise Provided by Mark Robertson

Introduction

Imagine a world where cars, aeroplanes and even the buildings we inhabit and work in do not exist. This is what the industrial sector encompasses. It plays a role in our economy by supplying the goods and services that enable our daily lives.

Think of it as a factory that churns out the components of everything we rely on. Whether it's the steel beams supporting towering skyscrapers or the tiny chips fueling our smartphones, the industrial sector is at the core of it all. Given their demand, investing in companies can be a wise choice for those seeking to grow their wealth.

Investing in stocks brings forth advantages. These companies are often established and diverse entities boasting financial standings. Moreover, they frequently distribute dividends, offering investors an income stream. Additionally, industrial stocks can hedge against inflation since these companies can pass on increased costs to their customers.

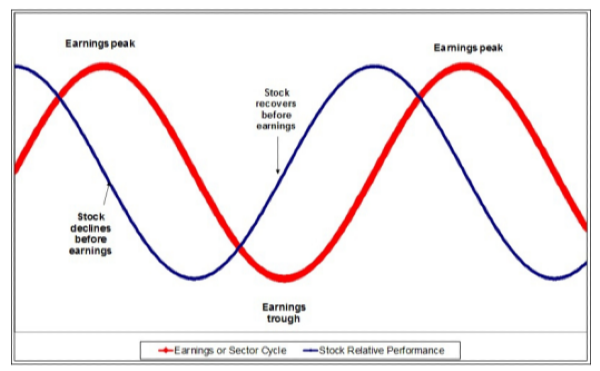

Nevertheless, it is crucial to recognize that industrial stocks are also subject to fluctuations. This implies that their performance closely mirrors that of the economy. During times of prosperity, industrial stocks typically outshine market sectors.

However, if the economy experiences a slowdown, industrial stocks might not perform well.

Source: Edward Jones

Source: Edward Jones

Advantages of investing in industrial stocks

Big companies that have businesses and lots of money are usually ready for tough times.

Dividends: Industrial companies often give out dividends. This can be a source of income for investors.

Inflation protection: Investing in stocks can serve as a means to safeguard your money from the impact of inflation. As prices rise, industrial firms have the potential to raise prices for their goods and services, thus helping maintain the value of their stocks.

Global Presence: Industrial companies have a reach and operate across various countries. By investing in stocks, you gain exposure to the economy. This can be advantageous as it allows you to diversify your portfolio and mitigate risk.

Risks of investing in industrial stocks

Cyclical Stocks: Like a Rollercoaster Ride

Think of a roller coaster car racing along the tracks going up and down. It's similar to how cyclical stocks behave. Their performance is closely tied to the fluctuations of the economy. When the economy is thriving, these stocks often increase in value. However, when the economy falters or slips into a recession, these stocks can experience a decline.

Interest Rates: A Bumpy Road

Imagine interest rates as the velocity of a roller coaster. When interest rates rise, it's akin to the coaster picking up speed, which can result in an experience for industrial businesses. This is because higher interest rates increase the cost of borrowing money for these companies, thus potentially impacting their profits negatively.

Competition: A Tight Squeeze

Industrial companies are similar to participants in a race constantly vying against one another domestically and internationally. This intense competition challenges these companies to maintain prices and ensure outcomes.

When Should You Invest in Industrial Stocks?

The best time to invest in stocks is usually when the economy grows. Businesses tend to invest in equipment and infrastructure when the economy grows.

Industrial stocks also tend to perform well when the economy is recovering. Businesses are trying to make up for lost investment after a recession.

Do Industrial Stocks Do Well in Inflation?

Inflation can benefit stocks as it tends to increase prices for goods and services. However, it's crucial to acknowledge that inflation can also pose challenges for companies if their costs rise faster than their prices.

Overall, investing in stocks can be a choice for those seeking high returns and dividend income. It's essential to have an understanding of the associated risks before venturing into this sector.

Which industrial stocks are the best to buy?

When deciding which individual industrial stocks to invest in, it's crucial to take the following factors into account;

1. Financial stability: Focus on companies with balance sheets and consistent cash flow.

2. Competitive edge: Seek out companies with an advantage over their competitors. This edge might stem from brand recognition, technological prowess or cost leadership.

3. Leadership quality: I prefer companies with a reputable management team.

4. Valuation: Search for companies that have stock prices at a reasonable level.

Considering these aspects will help you make decisions when selecting stocks for investment.

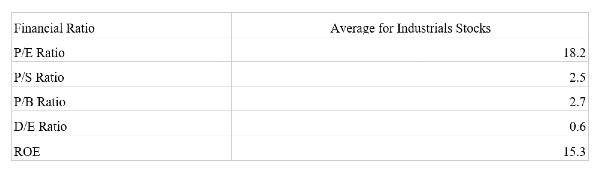

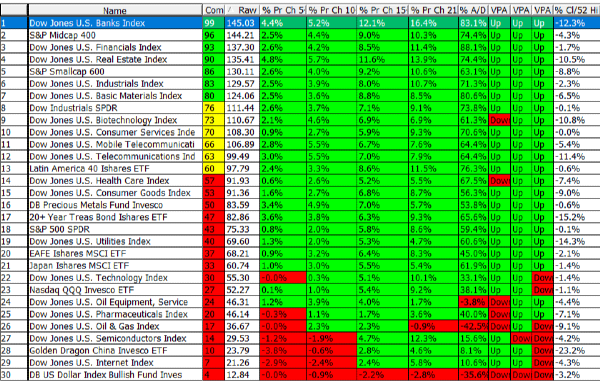

Financial Ratios

Source: Yahoo Finance

Source: Yahoo Finance

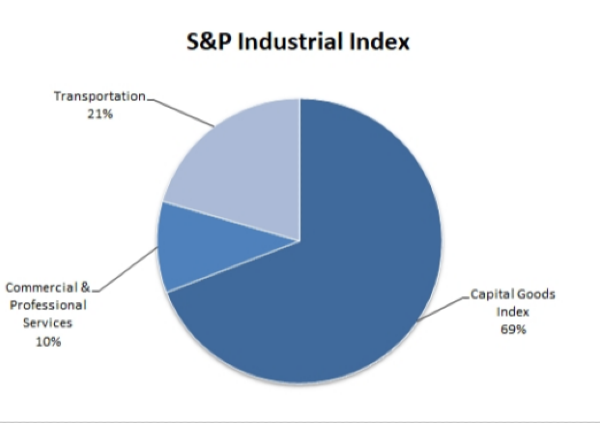

Segments of Industries

Source: Edward Jones

Source: Edward Jones

There are three categories that industrials fall into; capital goods, transportation and commercial services.

Capital Goods

Capital goods companies are important in the sector. They make and distribute many essential products. Businesses across various industries need these. Usually, these products are big and expensive. They include things like aeroplanes, tractors, and excavators.

The performance of capital goods companies often serves as an indicator of the health of the economy. When businesses are thriving, they tend to invest in capital goods equipment. On the other hand, during times, companies may choose to postpone or cancel their investments in such equipment.

There are categories of capital goods companies. Some of the encountered categories include;

- Companies involved in the production of machinery and equipment.

- Companies engaged in the manufacturing of transportation equipment.

- Companies that specialize in the production of electrical equipment.

- Manufacturers dedicated to producing electronic equipment.

- Firms focused on creating fabricated metal products.

Capital goods companies play a role in the economy by supplying the necessary products for business operations and producing goods and services. This makes them vital for progress and advancement.

Investing in capital goods companies offers advantages;

- Capital goods companies serve as a hedge against inflation.

- These companies can generate an income flow through dividends, which is advantageous for investors.

- Capital goods companies can also benefit from long-term economic growth.

However, there are some risks associated with investing in capital goods companies;

- Their earnings can be volatile due to the nature of these industries.

- Changes in interest rates have an impact on capital goods companies performance.

- Global economic conditions can also influence these businesses.

Considering their role in the economy, capital goods companies are often regarded as long-term investments. Investors who invest in these enterprises for the run can enjoy their growth potential and ability to provide an income stream.

Transportation

Transportation companies impact the economy by offering vital services for businesses to facilitate the movement of goods and individuals worldwide.

Investing in transportation companies can offer many advantages. Some of the encountered benefits include;

Transportation companies are often considered a safeguard against inflation. It can offer investors a consistent income stream in the form of dividends. Additionally, these companies stand to gain from term expansion.

However, it's essential to acknowledge that investing in transportation companies does come with risks. Some risks include the cyclical nature of their earnings, making them susceptible to volatility. Moreover, fluctuations in fuel prices and global economic conditions can also impact transportation companies.

Commercial Services

Of all the businesses in the Industrial Sector, only one out of every ten focuses on services such as cleaning, security, and equipment rental. These companies provide a range of services. Since commercial services play a role in the industrial sector, this report must include more information. However, we focus on companies that excel in their respective fields and offer more intricate services. None of the companies within the commercial services segment have been given a Buy rating.

Here are some of the best industrial stocks to buy in November 2023:

Boeing is a well-known company in the aerospace and defense industry. They specialize in producing military aircraft, rocket engines, and satellite systems.

Caterpillar is a manufacturer that focuses on construction and mining equipment. They are also involved in the production of diesel and natural gas engines.

General Electric is a company that works in many different industries, like aerospace and healthcare. They also work in power generation.

Honeywell is known for its expertise in building technologies. They also excel in aerospace products and performance materials manufacturing.

3M is a well-known technology company that makes things like glue, tape, and sandpaper.

These companies have established themselves as leaders in their fields. They achieved consistent success over an extended period.

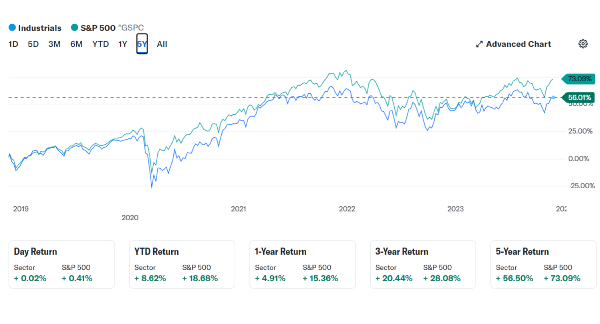

Source: Yahoo Finance

Source: Yahoo Finance

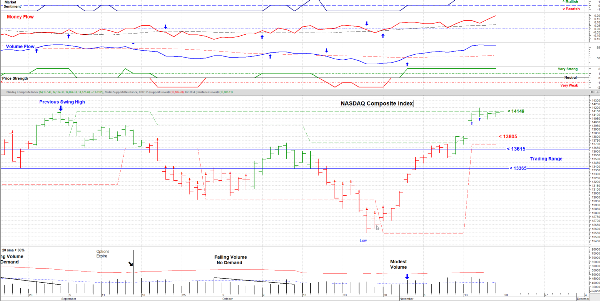

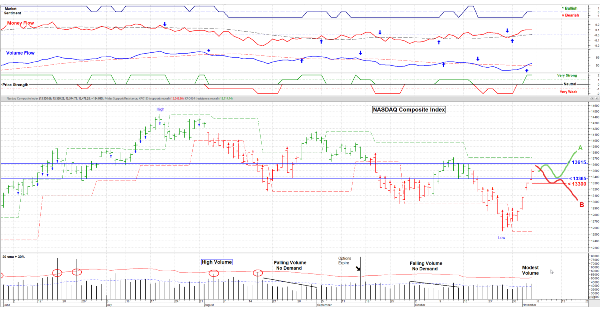

The image shows a chart of the Industrials sector of the S&P 500 index. The chart shows that the sector has outperformed the broader S&P 500 index over the past year, returning 28.08% compared to 20.44%. The chart also shows that the sector has performed well over the past three, five, and ten years

Conclusion

Imagine you set up a lemonade stand. You purchase cups, lemons, sugar, and ice. After mixing everything, you sell lemonade to people on hot days—the profits you earn come from your beverage sales.

Investing in stocks is similar to running a lemonade stand. Companies like Caterpillar and 3M manufacture machinery, tools, and other items that companies utilize to produce their goods. When the economy thrives, there is a demand for machinery and tools, resulting in increased profits for companies. Conversely, during downturns, companies require machines and tools, which leads to decreased earnings for these industrial businesses.

Therefore, when you invest in stocks, you are investing in the state of the economy. If the economy flourishes, your stock values will rise accordingly. However, if the economy falters, your stock values will decline.

Before investing in stocks, assessing your comfort level with risk is essential. If you find yourself uncomfortable with taking risks, it may be advisable to refrain from investing in stocks.

Additional tips for investing in industrial stocks

- Diversify your investment by including a mix of stocks. This approach can help minimize the level of risk.

- Regularly update your portfolio to match your investment goals and risk tolerance.

- Keep a long-term perspective when investing. Industrial stocks can go up and down in the short term, but they have generally performed well over time.

Read more about Industrial Stocks in our ongoing sector series:

The Top Industrial Stocks

Are Industrials a Good Investment?

The Best Industrial ETFs

How do you Evaluate Industrial Stocks?

What is the Manufacturing Sector

Industrial Stocks with Dividends

Why Invest in Manufacturing Stocks

Important Manufacturing Sector Ratios

Why are Industrial Stocks Doing Well

What Affects the Industrial Industry?

Expertise Provided by Mark Robertson

Introduction

Imagine a world where cars, aeroplanes and even the buildings we inhabit and work in do not exist. This is what the industrial sector encompasses. It plays a role in our economy by supplying the goods and services that enable our daily lives.

Think of it as a factory that churns out the components of everything we rely on. Whether it's the steel beams supporting towering skyscrapers or the tiny chips fueling our smartphones, the industrial sector is at the core of it all. Given their demand, investing in companies can be a wise choice for those seeking to grow their wealth.

Investing in stocks brings forth advantages. These companies are often established and diverse entities boasting financial standings. Moreover, they frequently distribute dividends, offering investors an income stream. Additionally, industrial stocks can hedge against inflation since these companies can pass on increased costs to their customers.

Nevertheless, it is crucial to recognize that industrial stocks are also subject to fluctuations. This implies that their performance closely mirrors that of the economy. During times of prosperity, industrial stocks typically outshine market sectors. However, if the economy experiences a slowdown, industrial stocks might not perform well.

Advantages of investing in industrial stocks

Big companies that have businesses and lots of money are usually ready for tough times.

Dividends: Industrial companies often give out dividends. This can be a source of income for investors. Inflation protection: Investing in stocks can serve as a means to safeguard your money from the impact of inflation. As prices rise, industrial firms have the potential to raise prices for their goods and services, thus helping maintain the value of their stocks. Global Presence: Industrial companies have a reach and operate across various countries. By investing in stocks, you gain exposure to the economy. This can be advantageous as it allows you to diversify your portfolio and mitigate risk.

Risks of investing in industrial stocks

Cyclical Stocks: Like a Rollercoaster Ride

Think of a roller coaster car racing along the tracks going up and down. It's similar to how cyclical stocks behave. Their performance is closely tied to the fluctuations of the economy. When the economy is thriving, these stocks often increase in value. However, when the economy falters or slips into a recession, these stocks can experience a decline.

Interest Rates: A Bumpy Road

Imagine interest rates as the velocity of a roller coaster. When interest rates rise, it's akin to the coaster picking up speed, which can result in an experience for industrial businesses. This is because higher interest rates increase the cost of borrowing money for these companies, thus potentially impacting their profits negatively.

Competition: A Tight Squeeze

Industrial companies are similar to participants in a race constantly vying against one another domestically and internationally. This intense competition challenges these companies to maintain prices and ensure outcomes.

When Should You Invest in Industrial Stocks?

The best time to invest in stocks is usually when the economy grows. Businesses tend to invest in equipment and infrastructure when the economy grows.

Industrial stocks also tend to perform well when the economy is recovering. Businesses are trying to make up for lost investment after a recession.

Do Industrial Stocks Do Well in Inflation?

Inflation can benefit stocks as it tends to increase prices for goods and services. However, it's crucial to acknowledge that inflation can also pose challenges for companies if their costs rise faster than their prices.

Overall, investing in stocks can be a choice for those seeking high returns and dividend income. It's essential to have an understanding of the associated risks before venturing into this sector.

Which industrial stocks are the best to buy?

When deciding which individual industrial stocks to invest in, it's crucial to take the following factors into account;

1. Financial stability: Focus on companies with balance sheets and consistent cash flow.

2. Competitive edge: Seek out companies with an advantage over their competitors. This edge might stem from brand recognition, technological prowess or cost leadership.

3. Leadership quality: I prefer companies with a reputable management team.

4. Valuation: Search for companies that have stock prices at a reasonable level.

Considering these aspects will help you make decisions when selecting stocks for investment.

Financial Ratios

Segments of Industries

There are three categories that industrials fall into; capital goods, transportation and commercial services.

Capital Goods

Capital goods companies are important in the sector. They make and distribute many essential products. Businesses across various industries need these. Usually, these products are big and expensive. They include things like aeroplanes, tractors, and excavators.

The performance of capital goods companies often serves as an indicator of the health of the economy. When businesses are thriving, they tend to invest in capital goods equipment. On the other hand, during times, companies may choose to postpone or cancel their investments in such equipment.

There are categories of capital goods companies. Some of the encountered categories include;

Capital goods companies play a role in the economy by supplying the necessary products for business operations and producing goods and services. This makes them vital for progress and advancement.

Investing in capital goods companies offers advantages;

However, there are some risks associated with investing in capital goods companies;

Considering their role in the economy, capital goods companies are often regarded as long-term investments. Investors who invest in these enterprises for the run can enjoy their growth potential and ability to provide an income stream.

Transportation

Transportation companies impact the economy by offering vital services for businesses to facilitate the movement of goods and individuals worldwide.

Investing in transportation companies can offer many advantages. Some of the encountered benefits include;

Transportation companies are often considered a safeguard against inflation. It can offer investors a consistent income stream in the form of dividends. Additionally, these companies stand to gain from term expansion.

However, it's essential to acknowledge that investing in transportation companies does come with risks. Some risks include the cyclical nature of their earnings, making them susceptible to volatility. Moreover, fluctuations in fuel prices and global economic conditions can also impact transportation companies.

Commercial Services

Of all the businesses in the Industrial Sector, only one out of every ten focuses on services such as cleaning, security, and equipment rental. These companies provide a range of services. Since commercial services play a role in the industrial sector, this report must include more information. However, we focus on companies that excel in their respective fields and offer more intricate services. None of the companies within the commercial services segment have been given a Buy rating.

Here are some of the best industrial stocks to buy in November 2023:

Boeing is a well-known company in the aerospace and defense industry. They specialize in producing military aircraft, rocket engines, and satellite systems.

Caterpillar is a manufacturer that focuses on construction and mining equipment. They are also involved in the production of diesel and natural gas engines.

General Electric is a company that works in many different industries, like aerospace and healthcare. They also work in power generation.

Honeywell is known for its expertise in building technologies. They also excel in aerospace products and performance materials manufacturing.

3M is a well-known technology company that makes things like glue, tape, and sandpaper.

These companies have established themselves as leaders in their fields. They achieved consistent success over an extended period.

The image shows a chart of the Industrials sector of the S&P 500 index. The chart shows that the sector has outperformed the broader S&P 500 index over the past year, returning 28.08% compared to 20.44%. The chart also shows that the sector has performed well over the past three, five, and ten years

Conclusion

Imagine you set up a lemonade stand. You purchase cups, lemons, sugar, and ice. After mixing everything, you sell lemonade to people on hot days—the profits you earn come from your beverage sales.

Investing in stocks is similar to running a lemonade stand. Companies like Caterpillar and 3M manufacture machinery, tools, and other items that companies utilize to produce their goods. When the economy thrives, there is a demand for machinery and tools, resulting in increased profits for companies. Conversely, during downturns, companies require machines and tools, which leads to decreased earnings for these industrial businesses.

Therefore, when you invest in stocks, you are investing in the state of the economy. If the economy flourishes, your stock values will rise accordingly. However, if the economy falters, your stock values will decline.

Before investing in stocks, assessing your comfort level with risk is essential. If you find yourself uncomfortable with taking risks, it may be advisable to refrain from investing in stocks.

Additional tips for investing in industrial stocks

Read more about Industrial Stocks in our ongoing sector series:

The Top Industrial Stocks

Are Industrials a Good Investment?

The Best Industrial ETFs

How do you Evaluate Industrial Stocks?

What is the Manufacturing Sector

Industrial Stocks with Dividends

Why Invest in Manufacturing Stocks

Important Manufacturing Sector Ratios

Why are Industrial Stocks Doing Well

What Affects the Industrial Industry?