Investing in the telecom sector can be a promising opportunity due to the relentless demand for connectivity and the ongoing advancements in technology. The industry is expected to benefit from the rollout of 5G, increased adoption of smart home devices, and the expansion of fiber networks. These developments can drive revenue growth and create new business opportunities for telecom companies. Additionally, the sector’s essential nature ensures a steady demand for services, making it a relatively stable investment compared to more volatile industries.

However, potential investors should also be aware of the challenges facing the telecom industry. High capital expenditures, intense competition, and regulatory pressures can impact profitability. Moreover, the sector is experiencing a shift towards more competition from cloud providers and other tech firms, which could erode traditional revenue streams. Therefore, while the telecom sector offers growth potential, investors should carefully consider these risks and conduct thorough research before making investment decisions.

What are Telecom Stocks?

Telecom stocks represent companies that provide the means for people to communicate digitally. This includes infrastructure such as towers, cables, and technology, as well as software and hardware. Examples of telecommunications stock companies include Internet service providers, phone service providers, and cell and radio tower owners and operators. Telecom companies provide the technology that links our increasingly connected world, offering phone, internet, and television services, along with the infrastructure to support them.

The telecommunications sector is often attractive to relatively conservative investors seeking dividend income, but plenty of telecom companies are also significantly growing.

Why Invest in Telecom Stocks?

Investing in telecom stocks can be a smart move due to their strong cash flow, which indicates a company’s ability to adapt to changing market conditions. The shift to remote work and improved technology has made telecommunications companies more attractive to investors.

Telecom companies are unique among equities, exhibiting characteristics of both income and growth stocks. Their plans for growth and expansion are important factors to consider when evaluating telecom stocks. By investing in telecom stocks, investors can benefit from both steady income through dividends and potential capital appreciation, making them a versatile addition to any investment portfolio.

Getting Started with Telecom Investing

Investing in the telecom sector can be a lucrative opportunity for both beginners and seasoned investors. The telecom industry encompasses companies that provide communication services, including wireless, broadband, and satellite services. To get started, it’s essential to understand the key players in the market, such as AT&T, Verizon, and T-Mobile, as well as emerging companies in the 5G space. Researching these companies’ financial health, growth prospects, and competitive advantages will help you make informed investment decisions. Additionally, consider the impact of regulatory changes and technological advancements on the industry, as these factors can significantly influence stock performance.

How do you Evaluate Telecom Stocks?

Read More: Examples Assessments of Telecom Stocks

Identify Top Telecom Companies

Look for companies well-positioned to profit from prevailing trends in the sector. These companies often lead in innovation and market share. Start with these top telecommunication stocks:

2. Analyze Competitive Advantages

Focus on dominant telecom companies that leverage their competitive advantages. These may include extensive infrastructure, strong brand recognition, and technological leadership.

Dominant telecom companies leverage their competitive advantages to maintain and grow their market positions. Extensive infrastructure, such as widespread network coverage and advanced technology, allows these companies to offer reliable and high-speed services to a large customer base. Strong brand recognition further enhances customer loyalty and trust, making it difficult for new entrants to compete. Technological leadership, including early adoption of innovations like 5G, positions these companies at the forefront of industry advancements, attracting both consumers and enterprises seeking cutting-edge solutions.

Additionally, these competitive advantages enable telecom companies to capitalize on economies of scale, reducing operational costs and increasing profitability. Their established market presence and financial strength also provide the resources needed for continuous investment in research and development, ensuring they stay ahead of industry trends. As a result, investing in telecom stocks with these competitive advantages can offer long-term growth potential and stability for investors.

3. Assess Fiscal Discipline

Evaluate the company’s financial health. Check for good fiscal discipline, including manageable debt levels, strong cash flow, and profitability.

When assessing the fiscal discipline of telecommunications stocks, it’s crucial to evaluate the company’s financial health. Start by examining their debt levels; a company with manageable debt is less likely to face financial distress. Look for a healthy debt-to-equity ratio, which indicates that the company is not overly reliant on borrowed funds. Additionally, strong cash flow is a key indicator of fiscal discipline. Companies with consistent and robust cash flow can easily cover their operating expenses and invest in growth opportunities without resorting to excessive borrowing.

Profitability is another essential factor to consider. A profitable company demonstrates effective cost management and revenue generation, which are signs of good fiscal discipline. Analyze metrics such as net profit margin and return on equity to gauge profitability. Companies that consistently deliver strong financial performance are better positioned to weather economic downturns and capitalize on market opportunities. By focusing on these financial health indicators, investors can identify telecom stocks with solid fiscal discipline and long-term growth potential.

Some telecom stocks that exhibit good fiscal discipline include Verizon Communications and Comcast.

Verizon Communications is the largest wireless carrier in the U.S. and is known for its excellent free cash flow and superior gross margins](https://www.fool.com/investing/stock-market/market-sectors/communication/telecom-stocks/). The company maintains manageable debt levels and consistently generates cash flow that exceeds its dividend payments, making it a reliable choice for investors seeking fiscal discipline.

Comcast is the largest pay-TV and home internet service provider in the U.S. and stands out for its strong financial performance. The company brings in hundreds of thousands of new internet subscribers every year and has a solid revenue base from its cable communications business.

Read More: Example Assessments of Telecom Stocks

4. Adaptability to Market Conditions

Consider the company’s ability to adapt to changing market conditions. Look for flexibility in their business model and responsiveness to technological advancements.

By diversifying their service offerings and revenue streams, telecom firms can mitigate risks and capitalize on new opportunities. For instance, companies that invest in both traditional services like voice and data, as well as emerging technologies such as 5G and IoT, are better positioned to weather market fluctuations and maintain steady growth.

Responsiveness to technological advancements is another key factor in a telecom company’s adaptability. Staying ahead of the curve with cutting-edge technologies not only enhances service quality but also attracts and retains customers. Telecom companies that prioritize innovation and invest in research and development can swiftly integrate new technologies into their operations, ensuring they remain competitive.

5. Growth and Expansion Plans

Review the company’s plans for growth and expansion. This includes investments in new technologies, market expansion, and strategic partnerships.

Telecom companies are aggressively pursuing growth and expansion through significant investments in new technologies, market expansion, and strategic partnerships. A key focus is on the deployment of 5G networks, which promises faster speeds and lower latency, enabling new applications and services. Companies are also exploring the potential of edge computing and the Internet of Things (IoT) to enhance connectivity and create new revenue streams. Additionally, telecom providers are expanding their market presence by entering new geographic regions and targeting underserved areas, aiming to increase their customer base and market share.

Strategic partnerships play a crucial role in telecom companies’ growth strategies. Collaborations with technology firms, cloud service providers, and content creators are helping telecom companies offer more comprehensive and innovative services. These partnerships enable telecom providers to leverage the expertise and resources of their partners, accelerating the development and deployment of new technologies.

6. Dividend Yield

Evaluate the dividend yield, as it can be an indicator of financial stability and shareholder value. A consistent and attractive dividend yield is often a positive sign.

Evaluating the dividend yield in the telecommunications sector is crucial for investors seeking financial stability and shareholder value. A consistent and attractive dividend yield often signals a company’s robust financial health and commitment to returning value to shareholders. Telecom companies like Verizon Communications and AT&T, known for their reliable dividend payouts, can be attractive options for income-focused investors. These companies typically have predictable earnings and strong cash flows, which support their ability to maintain and grow dividends over time.

However, it’s essential to consider the broader context when assessing telecom dividend yields. Factors such as market volatility, regulatory changes, and technological advancements can impact a company’s ability to sustain its dividend payments. For instance, the rollout of 5G networks requires significant capital investment, which might affect short-term dividend yields but could lead to long-term growth and higher future dividends.

Risks and Challenges in Telecom Investing

Investing in the telecom sector presents several risks and challenges. The industry is highly capital-intensive, requiring substantial investments in infrastructure and technology to stay competitive. Companies must continuously innovate to keep up with advancements and consumer demands. This constant need for innovation can strain financial resources, especially for smaller players who may struggle to generate sufficient cash flow. Additionally, the costs associated with expanding networks and services can be prohibitive, making it essential for companies to be large enough to absorb these expenses.

Another significant challenge is the rise of edge computing, which is driving the need for denser communications networks. While cloud computing is about hosting applications in a core data centers, edge computing is about hosting applications closer to end users.

This technological shift requires telecom companies to invest in new infrastructure and adapt their existing networks to handle increased data traffic and lower latency requirements. The pressure to meet these demands can be overwhelming, particularly for companies that are already stretched thin financially.

Current State and Future Prospects

The telecom industry is experiencing significant growth driven by the increasing demand for faster internet and the proliferation of internet-connected devices. Wireless carriers in the U.S. and globally are rapidly expanding their 5G networks to meet the needs of both consumers and enterprises. This expansion is not only enhancing connectivity but also driving investments in related sectors such as cloud computing and cybersecurity.

Looking ahead, analysts predict that product innovation and a rise in mergers and acquisitions will continue to propel the telecom industry forward. These developments are expected to foster sustained growth and success, making telecom investing an attractive opportunity for investors.

Final Thoughts

Investing in the telecom sector presents a compelling opportunity due to the sector’s essential nature and the continuous advancements in technology. The rollout of 5G, increased adoption of smart home devices, and the expansion of fiber networks are poised to drive revenue growth and create new business opportunities. However, potential investors must also be mindful of the challenges, such as high capital expenditures, intense competition, and regulatory pressures, which can impact profitability.

Cover Image by Chaitawat Pawapoowadon from Pixabay

Investing in the telecom sector can be a promising opportunity due to the relentless demand for connectivity and the ongoing advancements in technology. The industry is expected to benefit from the rollout of 5G, increased adoption of smart home devices, and the expansion of fiber networks. These developments can drive revenue growth and create new business opportunities for telecom companies. Additionally, the sector’s essential nature ensures a steady demand for services, making it a relatively stable investment compared to more volatile industries.

However, potential investors should also be aware of the challenges facing the telecom industry. High capital expenditures, intense competition, and regulatory pressures can impact profitability. Moreover, the sector is experiencing a shift towards more competition from cloud providers and other tech firms, which could erode traditional revenue streams. Therefore, while the telecom sector offers growth potential, investors should carefully consider these risks and conduct thorough research before making investment decisions.

What are Telecom Stocks?

Image by Erich Westendarp from Pixabay

Telecom stocks represent companies that provide the means for people to communicate digitally. This includes infrastructure such as towers, cables, and technology, as well as software and hardware. Examples of telecommunications stock companies include Internet service providers, phone service providers, and cell and radio tower owners and operators. Telecom companies provide the technology that links our increasingly connected world, offering phone, internet, and television services, along with the infrastructure to support them. The telecommunications sector is often attractive to relatively conservative investors seeking dividend income, but plenty of telecom companies are also significantly growing.

Why Invest in Telecom Stocks?

Investing in telecom stocks can be a smart move due to their strong cash flow, which indicates a company’s ability to adapt to changing market conditions. The shift to remote work and improved technology has made telecommunications companies more attractive to investors. Telecom companies are unique among equities, exhibiting characteristics of both income and growth stocks. Their plans for growth and expansion are important factors to consider when evaluating telecom stocks. By investing in telecom stocks, investors can benefit from both steady income through dividends and potential capital appreciation, making them a versatile addition to any investment portfolio.

Getting Started with Telecom Investing

Investing in the telecom sector can be a lucrative opportunity for both beginners and seasoned investors. The telecom industry encompasses companies that provide communication services, including wireless, broadband, and satellite services. To get started, it’s essential to understand the key players in the market, such as AT&T, Verizon, and T-Mobile, as well as emerging companies in the 5G space. Researching these companies’ financial health, growth prospects, and competitive advantages will help you make informed investment decisions. Additionally, consider the impact of regulatory changes and technological advancements on the industry, as these factors can significantly influence stock performance.

How do you Evaluate Telecom Stocks?

Identify Top Telecom Companies

Look for companies well-positioned to profit from prevailing trends in the sector. These companies often lead in innovation and market share. Start with these top telecommunication stocks:

2. Analyze Competitive Advantages

Focus on dominant telecom companies that leverage their competitive advantages. These may include extensive infrastructure, strong brand recognition, and technological leadership.

Dominant telecom companies leverage their competitive advantages to maintain and grow their market positions. Extensive infrastructure, such as widespread network coverage and advanced technology, allows these companies to offer reliable and high-speed services to a large customer base. Strong brand recognition further enhances customer loyalty and trust, making it difficult for new entrants to compete. Technological leadership, including early adoption of innovations like 5G, positions these companies at the forefront of industry advancements, attracting both consumers and enterprises seeking cutting-edge solutions. Additionally, these competitive advantages enable telecom companies to capitalize on economies of scale, reducing operational costs and increasing profitability. Their established market presence and financial strength also provide the resources needed for continuous investment in research and development, ensuring they stay ahead of industry trends. As a result, investing in telecom stocks with these competitive advantages can offer long-term growth potential and stability for investors.

3. Assess Fiscal Discipline

Image by Kris from Pixabay

Evaluate the company’s financial health. Check for good fiscal discipline, including manageable debt levels, strong cash flow, and profitability.

When assessing the fiscal discipline of telecommunications stocks, it’s crucial to evaluate the company’s financial health. Start by examining their debt levels; a company with manageable debt is less likely to face financial distress. Look for a healthy debt-to-equity ratio, which indicates that the company is not overly reliant on borrowed funds. Additionally, strong cash flow is a key indicator of fiscal discipline. Companies with consistent and robust cash flow can easily cover their operating expenses and invest in growth opportunities without resorting to excessive borrowing. Profitability is another essential factor to consider. A profitable company demonstrates effective cost management and revenue generation, which are signs of good fiscal discipline. Analyze metrics such as net profit margin and return on equity to gauge profitability. Companies that consistently deliver strong financial performance are better positioned to weather economic downturns and capitalize on market opportunities. By focusing on these financial health indicators, investors can identify telecom stocks with solid fiscal discipline and long-term growth potential.

Some telecom stocks that exhibit good fiscal discipline include Verizon Communications and Comcast.

Verizon Communications is the largest wireless carrier in the U.S. and is known for its excellent free cash flow and superior gross margins](https://www.fool.com/investing/stock-market/market-sectors/communication/telecom-stocks/). The company maintains manageable debt levels and consistently generates cash flow that exceeds its dividend payments, making it a reliable choice for investors seeking fiscal discipline.

Comcast is the largest pay-TV and home internet service provider in the U.S. and stands out for its strong financial performance. The company brings in hundreds of thousands of new internet subscribers every year and has a solid revenue base from its cable communications business.

4. Adaptability to Market Conditions

Consider the company’s ability to adapt to changing market conditions. Look for flexibility in their business model and responsiveness to technological advancements.

By diversifying their service offerings and revenue streams, telecom firms can mitigate risks and capitalize on new opportunities. For instance, companies that invest in both traditional services like voice and data, as well as emerging technologies such as 5G and IoT, are better positioned to weather market fluctuations and maintain steady growth. Responsiveness to technological advancements is another key factor in a telecom company’s adaptability. Staying ahead of the curve with cutting-edge technologies not only enhances service quality but also attracts and retains customers. Telecom companies that prioritize innovation and invest in research and development can swiftly integrate new technologies into their operations, ensuring they remain competitive.

5. Growth and Expansion Plans

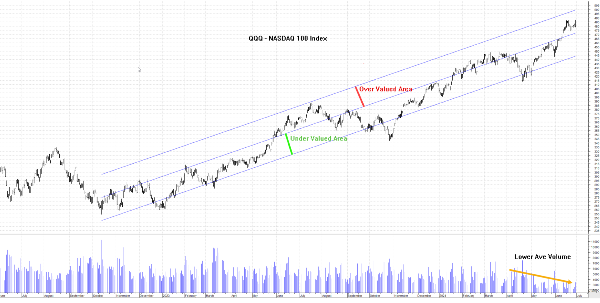

Image by Tom from Pixabay

Review the company’s plans for growth and expansion. This includes investments in new technologies, market expansion, and strategic partnerships.

Telecom companies are aggressively pursuing growth and expansion through significant investments in new technologies, market expansion, and strategic partnerships. A key focus is on the deployment of 5G networks, which promises faster speeds and lower latency, enabling new applications and services. Companies are also exploring the potential of edge computing and the Internet of Things (IoT) to enhance connectivity and create new revenue streams. Additionally, telecom providers are expanding their market presence by entering new geographic regions and targeting underserved areas, aiming to increase their customer base and market share.

Strategic partnerships play a crucial role in telecom companies’ growth strategies. Collaborations with technology firms, cloud service providers, and content creators are helping telecom companies offer more comprehensive and innovative services. These partnerships enable telecom providers to leverage the expertise and resources of their partners, accelerating the development and deployment of new technologies.

6. Dividend Yield

Evaluate the dividend yield, as it can be an indicator of financial stability and shareholder value. A consistent and attractive dividend yield is often a positive sign.

Evaluating the dividend yield in the telecommunications sector is crucial for investors seeking financial stability and shareholder value. A consistent and attractive dividend yield often signals a company’s robust financial health and commitment to returning value to shareholders. Telecom companies like Verizon Communications and AT&T, known for their reliable dividend payouts, can be attractive options for income-focused investors. These companies typically have predictable earnings and strong cash flows, which support their ability to maintain and grow dividends over time.

However, it’s essential to consider the broader context when assessing telecom dividend yields. Factors such as market volatility, regulatory changes, and technological advancements can impact a company’s ability to sustain its dividend payments. For instance, the rollout of 5G networks requires significant capital investment, which might affect short-term dividend yields but could lead to long-term growth and higher future dividends.

Risks and Challenges in Telecom Investing

Image by zonyajeffrey from Pixabay

Investing in the telecom sector presents several risks and challenges. The industry is highly capital-intensive, requiring substantial investments in infrastructure and technology to stay competitive. Companies must continuously innovate to keep up with advancements and consumer demands. This constant need for innovation can strain financial resources, especially for smaller players who may struggle to generate sufficient cash flow. Additionally, the costs associated with expanding networks and services can be prohibitive, making it essential for companies to be large enough to absorb these expenses. Another significant challenge is the rise of edge computing, which is driving the need for denser communications networks. While cloud computing is about hosting applications in a core data centers, edge computing is about hosting applications closer to end users.

This technological shift requires telecom companies to invest in new infrastructure and adapt their existing networks to handle increased data traffic and lower latency requirements. The pressure to meet these demands can be overwhelming, particularly for companies that are already stretched thin financially.

Current State and Future Prospects

The telecom industry is experiencing significant growth driven by the increasing demand for faster internet and the proliferation of internet-connected devices. Wireless carriers in the U.S. and globally are rapidly expanding their 5G networks to meet the needs of both consumers and enterprises. This expansion is not only enhancing connectivity but also driving investments in related sectors such as cloud computing and cybersecurity. Looking ahead, analysts predict that product innovation and a rise in mergers and acquisitions will continue to propel the telecom industry forward. These developments are expected to foster sustained growth and success, making telecom investing an attractive opportunity for investors.

Final Thoughts

Investing in the telecom sector presents a compelling opportunity due to the sector’s essential nature and the continuous advancements in technology. The rollout of 5G, increased adoption of smart home devices, and the expansion of fiber networks are poised to drive revenue growth and create new business opportunities. However, potential investors must also be mindful of the challenges, such as high capital expenditures, intense competition, and regulatory pressures, which can impact profitability.