The semiconductor sector is beginning to show signs of recovery, with industry leaders like Nvidia up 7% and Broadcom gaining 3%. While the market has experienced widespread declines over the past week, some semiconductor companies are stabilizing, and Taiwan Semiconductor Manufacturing Company (TSMC) stands out as an exceptional opportunity. With rare unanimous "Strong Buy" ratings from Seeking Alpha, Wall Street, and Quant, TSMC offers both long-term growth potential and value. Here’s why this global chip powerhouse deserves your attention.

Market Position and Performance Highlights

TSMC is the world’s largest and most advanced semiconductor foundry, producing cutting-edge chips for leading brands such as Apple, Nvidia, and AMD. As pioneers of the pure-play foundry model since 1987, they focus exclusively on manufacturing rather than chip design, maintaining a dominant position in global technology.

Key performance metrics showcase TSMC's strength:

- Year-to-date: Down 11%, but still up 27% over the last 12 months.

- Long-term performance: Outperformed the S&P over the past decade with a 64% gain.

- 52-week range: Trades in the mid-to-lower end, presenting potential for upside.

Strong Fundamentals and Undervaluation

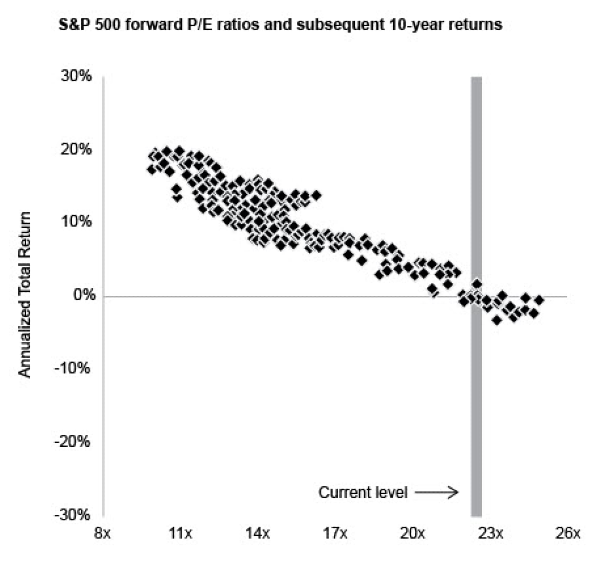

TSMC's forward price-to-earnings (P/E) ratio sits between 19 and 20—below its five-year average of 22.1. This undervaluation suggests an attractive entry point for investors. Additionally, the stock trades at a 16–17% discount to its historical valuation across multiple metrics, with institutional investors clearly optimistic, buying $20.3 billion worth of shares in the last year alone.

Despite trading at a discount, TSMC boasts financial and operational advantages, including:

- Revenue Growth: Up 37% year-over-year in the most recent quarter.

- Profit Margins: Gross margins improved by six percentage points, while operating profits climbed 7%.

- Market Dominance: TSMC controls 62% of the global chip foundry market, far outpacing its nearest competitor, Samsung, at 13%.

Diverse Revenue Streams and High-Performance Computing Leadership

TSMC derives the bulk of its revenue from high-performance computing (HPC), which accounts for 53% of total revenue and grew 10% year-over-year. Their strategic focus on HPC positions them as a leader in enabling faster and more efficient semiconductors. Other revenue segments include:

- Smartphones: While down 8% year-on-year, smartphone revenue remains a key contributor.

- Operating Efficiency: Enhanced efficiencies have driven margin expansion across all divisions.

Financial Resilience and Dividend Strength

TSMC’s financial resilience is evident from its impressive balance sheet and cash flow generation:

- Free Cash Flow: Up nearly 200% year-over-year.

- Debt Position: Net debt is effectively zero, indicating the company’s ability to cover all liabilities immediately.

- Dividends: TSMC pays a 1.4% dividend yield and has consistently increased payouts over the last two decades.

Growth Potential and Strategic Investments

Looking ahead, TSMC anticipates double-digit growth in earnings per share (EPS) over the next three to five years, outpacing sector averages. Recent developments include:

- U.S. Expansion: A $100 billion investment in U.S. chip manufacturing plants, reinforcing TSMC’s role as a global leader.

- Strategic Partnerships: Proposed collaborations with Nvidia, Broadcom, and AMD for Intel Foundry operations.

TSMC’s ability to innovate and invest strategically ensures its continued leadership in an industry that is increasingly critical to global technology.

Conclusion

TSMC is not just a semiconductor giant; it’s a foundational pillar of the global tech ecosystem. With compelling valuation metrics, robust financial health, and a leadership position in high-performance computing, TSMC offers a rare combination of growth, stability, and value.

Investors seeking exposure to the semiconductor space should seriously consider TSMC as a cornerstone of their portfolio. As always, conduct thorough due diligence before making investment decisions.

https://youtu.be/5sgKOf6bsyQ?si=qj6G_YaITpUBRNER

The semiconductor sector is beginning to show signs of recovery, with industry leaders like Nvidia up 7% and Broadcom gaining 3%. While the market has experienced widespread declines over the past week, some semiconductor companies are stabilizing, and Taiwan Semiconductor Manufacturing Company (TSMC) stands out as an exceptional opportunity. With rare unanimous "Strong Buy" ratings from Seeking Alpha, Wall Street, and Quant, TSMC offers both long-term growth potential and value. Here’s why this global chip powerhouse deserves your attention.

Market Position and Performance Highlights

TSMC is the world’s largest and most advanced semiconductor foundry, producing cutting-edge chips for leading brands such as Apple, Nvidia, and AMD. As pioneers of the pure-play foundry model since 1987, they focus exclusively on manufacturing rather than chip design, maintaining a dominant position in global technology.

Key performance metrics showcase TSMC's strength:

Strong Fundamentals and Undervaluation

TSMC's forward price-to-earnings (P/E) ratio sits between 19 and 20—below its five-year average of 22.1. This undervaluation suggests an attractive entry point for investors. Additionally, the stock trades at a 16–17% discount to its historical valuation across multiple metrics, with institutional investors clearly optimistic, buying $20.3 billion worth of shares in the last year alone.

Despite trading at a discount, TSMC boasts financial and operational advantages, including:

Diverse Revenue Streams and High-Performance Computing Leadership

TSMC derives the bulk of its revenue from high-performance computing (HPC), which accounts for 53% of total revenue and grew 10% year-over-year. Their strategic focus on HPC positions them as a leader in enabling faster and more efficient semiconductors. Other revenue segments include:

Financial Resilience and Dividend Strength

TSMC’s financial resilience is evident from its impressive balance sheet and cash flow generation:

Growth Potential and Strategic Investments

Looking ahead, TSMC anticipates double-digit growth in earnings per share (EPS) over the next three to five years, outpacing sector averages. Recent developments include:

TSMC’s ability to innovate and invest strategically ensures its continued leadership in an industry that is increasingly critical to global technology.

Conclusion

TSMC is not just a semiconductor giant; it’s a foundational pillar of the global tech ecosystem. With compelling valuation metrics, robust financial health, and a leadership position in high-performance computing, TSMC offers a rare combination of growth, stability, and value.

Investors seeking exposure to the semiconductor space should seriously consider TSMC as a cornerstone of their portfolio. As always, conduct thorough due diligence before making investment decisions.

https://youtu.be/5sgKOf6bsyQ?si=qj6G_YaITpUBRNER