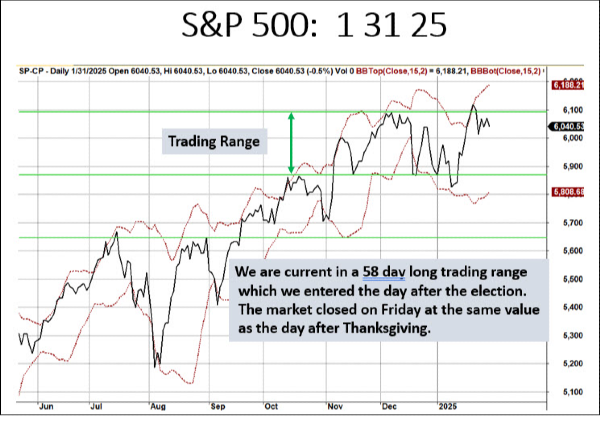

The stock market has faced significant turmoil recently, with the S&P 500 suffering its worst performance in 2025 so far. Despite widespread losses across sectors, healthcare has emerged as a strong performer. Novo Nordisk (NYSE: NVO), a high-quality pharmaceutical company, has caught the spotlight after its stock price dipped to 52-week lows. But with both Wall Street and Seeking Alpha rating it as a buy, this downturn could be a golden opportunity for investors.

Why Novo Nordisk Stock is Down

Novo Nordisk recently released clinical trial results for its next-generation weight-loss drug, KriSema, which were lower than expected. The trial showed a 15.7% weight loss in obese or overweight adults with type 2 diabetes over 68 weeks. While notable, this result fell short of the initially projected 25% weight loss and below previous trial results showing 22.7%. This shortfall triggered a sharp selloff in the stock, reflecting market disappointment over the drug's lower-than-forecasted efficacy.

Institutional Confidence and Market Performance

Despite the recent decline, institutional investors have shown strong confidence in Novo Nordisk. Over the last year, institutions sold $4 billion worth of shares but purchased nearly 50% more during the same period. Similarly, in the most recent quarter, buying activity outpaced selling, signaling sustained bullish sentiment.

Historically, Novo Nordisk has been a strong performer:

- 10-Year Growth: Up 235%, vastly outperforming the S&P 500.

- 52-Week Performance: Down 39%, presenting an attractive entry point.

Compelling Valuation Metrics

Novo Nordisk's current valuation reflects significant undervaluation:

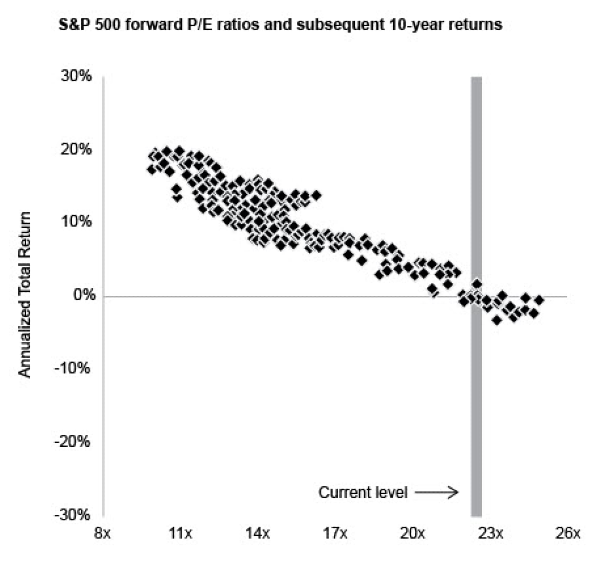

- Forward P/E: 20.3, well below its five-year average of 30.4.

- Dividend Yield: At 2.01%, it surpasses the five-year average of 1.41%, another strong undervaluation signal.

- Discount to Historical Valuation: Trading at a notable discount compared to its historical averages.

While the forward P/E is at a 22% premium to the sector, Novo Nordisk’s consistent double-digit growth justifies this valuation.

Strong Financial Performance

Novo Nordisk’s financial metrics remain robust, highlighting its strength even amid short-term challenges:

Full-Year 2024 Results:

- Revenue: Up 25% year-over-year.

- Gross Margin: Improved to 84.7%.

- Operating Profit: Increased by 25%.

- Net Income: Grew 21%.

Key Revenue Drivers:

- GLP-1 Revenue: Up 12% year-over-year.

- Obesity Revenue: Increased by an impressive 91%, the fastest-growing segment.

Novo Nordisk also generates substantial cash from operations, totaling $17 billion in 2024, far exceeding its own five-year average and significantly outperforming the sector median.

Dominance in Diabetes and Obesity Treatments

Novo Nordisk is a global leader in diabetes and obesity treatments, consistently expanding its market share. For example, its GLP-1 segment now commands a 63% market share, up from 58% in 2021, while competitor Eli Lilly saw its share decline from 38% to 34%. Novo Nordisk has also nearly tripled its global patient reach over the last three years, bolstered by its innovative product lineup.

Capital Allocation and Shareholder Returns

Novo Nordisk's disciplined capital allocation is another key strength:

- Dividend Aristocrat Status: Over 25 years of consistent dividend increases at a 21% annualized rate.

- Share Buybacks: The company has consistently reduced its share count over the past decade, returning excess cash to shareholders.

2025 Outlook and Beyond

Looking ahead, Novo Nordisk projects continued double-digit growth in revenue (16–24%) and operating profit. Its commitment to innovation, coupled with a strong balance sheet and growing market share, positions the company well for sustained success.

Conclusion: Novo Nordisk’s recent selloff, driven by trial results, has created an attractive buying opportunity. With compelling undervaluation signals, robust financial performance, and market leadership in key therapeutic areas, the stock is poised for long-term growth. As always, investors should conduct their own research and consider their individual risk tolerance before making investment decisions.

https://youtu.be/r0jUekoFyVk?si=F-7VH-TdgFJsqFwF

The stock market has faced significant turmoil recently, with the S&P 500 suffering its worst performance in 2025 so far. Despite widespread losses across sectors, healthcare has emerged as a strong performer. Novo Nordisk (NYSE: NVO), a high-quality pharmaceutical company, has caught the spotlight after its stock price dipped to 52-week lows. But with both Wall Street and Seeking Alpha rating it as a buy, this downturn could be a golden opportunity for investors.

Why Novo Nordisk Stock is Down

Novo Nordisk recently released clinical trial results for its next-generation weight-loss drug, KriSema, which were lower than expected. The trial showed a 15.7% weight loss in obese or overweight adults with type 2 diabetes over 68 weeks. While notable, this result fell short of the initially projected 25% weight loss and below previous trial results showing 22.7%. This shortfall triggered a sharp selloff in the stock, reflecting market disappointment over the drug's lower-than-forecasted efficacy.

Institutional Confidence and Market Performance

Despite the recent decline, institutional investors have shown strong confidence in Novo Nordisk. Over the last year, institutions sold $4 billion worth of shares but purchased nearly 50% more during the same period. Similarly, in the most recent quarter, buying activity outpaced selling, signaling sustained bullish sentiment.

Historically, Novo Nordisk has been a strong performer:

Compelling Valuation Metrics

Novo Nordisk's current valuation reflects significant undervaluation:

While the forward P/E is at a 22% premium to the sector, Novo Nordisk’s consistent double-digit growth justifies this valuation.

Strong Financial Performance

Novo Nordisk’s financial metrics remain robust, highlighting its strength even amid short-term challenges:

Full-Year 2024 Results:

Key Revenue Drivers:

Novo Nordisk also generates substantial cash from operations, totaling $17 billion in 2024, far exceeding its own five-year average and significantly outperforming the sector median.

Dominance in Diabetes and Obesity Treatments

Novo Nordisk is a global leader in diabetes and obesity treatments, consistently expanding its market share. For example, its GLP-1 segment now commands a 63% market share, up from 58% in 2021, while competitor Eli Lilly saw its share decline from 38% to 34%. Novo Nordisk has also nearly tripled its global patient reach over the last three years, bolstered by its innovative product lineup.

Capital Allocation and Shareholder Returns

Novo Nordisk's disciplined capital allocation is another key strength:

2025 Outlook and Beyond

Looking ahead, Novo Nordisk projects continued double-digit growth in revenue (16–24%) and operating profit. Its commitment to innovation, coupled with a strong balance sheet and growing market share, positions the company well for sustained success.

Conclusion: Novo Nordisk’s recent selloff, driven by trial results, has created an attractive buying opportunity. With compelling undervaluation signals, robust financial performance, and market leadership in key therapeutic areas, the stock is poised for long-term growth. As always, investors should conduct their own research and consider their individual risk tolerance before making investment decisions.

https://youtu.be/r0jUekoFyVk?si=F-7VH-TdgFJsqFwF