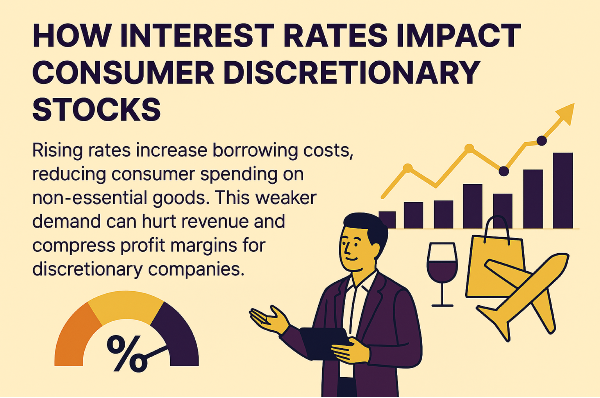

Interest rates shape how people spend, borrow, and invest. For consumer discretionary stocks, rate changes can shift demand quickly. These stocks include companies that sell non‑essential goods and services. When borrowing costs rise, consumers often cut back. That change affects revenue, margins, and stock prices.

Read More: How to Analyze Consumer Discretionary Stocks

What Are Consumer Discretionary Stocks?

Consumer discretionary stocks represent companies that sell optional products. These include retail, travel, entertainment, luxury, and automotive brands. Unlike staples, these goods are not essential. People buy them when they feel confident and financially secure.

Discretionary stocks tend to rise during economic growth. They often fall during slowdowns. That makes them sensitive to interest rate changes.

Read More: What are Consumer Discretionary Stocks?

Understanding Interest Rates

Interest rates reflect the cost of borrowing money. Central banks, like the Federal Reserve, adjust rates to control inflation and support growth. When inflation rises, the Fed may hike rates. When growth slows, it may cut them.

There are several types of interest rates that affect consumers:

- Federal funds rate

- Mortgage rates

- Credit card and personal loan rates

- Corporate borrowing rates

Each one influences how much people and businesses spend.

Interest Rate Impact on Consumer Discretionary Stocks

| Interest Rate Type |

Effect on Consumers |

Impact on Discretionary Stocks |

| Federal Funds Rate |

Influences overall borrowing costs and economic sentiment |

Drives broad demand shifts; affects valuations and investor sentiment |

| Mortgage Rates |

Raises cost of home buying and refinancing |

Hurts home improvement, furniture, and renovation-related spending |

| Credit Card & Personal Loan Rates |

Makes everyday financing more expensive |

Reduces spending on apparel, travel, and entertainment |

| Corporate Borrowing Rates |

Increases cost of capital for businesses |

Limits expansion, marketing, and inventory investment; compresses margins |

The Consumer Impact of Rising Rates

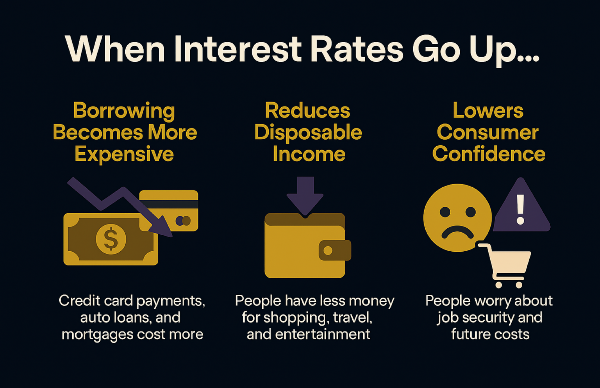

When interest rates go up, borrowing becomes more expensive. Credit card payments rise. Auto loans and mortgages cost more. That makes consumers less likely to finance big purchases.

Higher rates also reduce disposable income. As debt payments grow, people have less money for shopping, travel, and entertainment. This shift often leads to weaker demand for discretionary goods.

Consumer confidence can also fall. Rate hikes may signal economic trouble. People worry about job security and future costs. That fear leads to cautious spending.

Business Impact on Discretionary Companies

Companies also feel the pressure. Higher rates increase the cost of capital. Businesses pay more to borrow for expansion, marketing, or inventory. That can slow growth.

Inventory builds up when demand drops. To move products, companies may offer discounts. This hurts profit margins. Lower margins can lead to weaker earnings and falling stock prices.

Valuations also change. Investors use higher discount rates to value future cash flows. That lowers price targets and compresses PE multiples.

Rate Hike Effects on Discretionary Companies

| Impact Area |

Effect of Rising Rates |

| Borrowing Costs |

Increase, reducing expansion |

| Inventory |

Builds up, leading to markdowns |

| Margins |

Shrink due to discounting |

| Valuation |

PE multiples contract |

Historical Performance Trends

Discretionary stocks often fall during rate hike cycles. Past examples show retail and travel stocks pulling back when rates rise. In contrast, consumer staples tend to hold steady.

When rates fall, discretionary stocks usually rebound. Lower borrowing costs boost demand. These stocks often lead early in economic recoveries.

Over time, discretionary stocks show strong correlation with rate cycles. They also tend to be more volatile than staples.

Sub-Sector Sensitivity Breakdown

Not all discretionary stocks react the same. Retail and e‑commerce feel rate hikes quickly. Big‑ticket items like furniture or electronics often see sharp declines. Discount retailers may gain share as consumers trade down.

Travel and leisure also suffer. Higher rates make financing vacations harder. Airline and hotel bookings may drop.

Automotive and luxury goods are highly sensitive. Cars often require financing. Luxury purchases depend on consumer confidence. Brands with strong loyalty may hold up better.

Also Read: How Consumer Discretionary Stocks Perform in Different Market Cycles

Case Studies: Rate-Driven Stock Moves

Home improvement retailers like Home Depot (HD) and Lowe’s (LOW) often feel rate hikes through mortgage activity. When rates rise, fewer people renovate or buy homes. That hurts sales.

Travel stocks like Delta Air Lines (DAL) and Marriott (MAR) tend to rebound when rates fall. Lower costs boost bookings and discretionary travel.

Luxury brands like Tesla (TSLA) and LVMH see demand shift with borrowing costs. Rate hikes can slow high‑end purchases.

Stock Examples and Rate Sensitivity**

| Company |

Ticker |

Rate Impact |

Result |

| Home Depot |

HD |

Rate hike |

Lower renovation demand |

| Delta Air Lines |

DAL |

Rate cut |

Travel rebound |

| Tesla |

TSLA |

Rate hike |

Luxury slowdown |

Investor Strategies

Investors can time entries around rate cycles. Discretionary stocks often lead in early recoveries. Watching Fed signals and inflation data helps spot turning points.

Balancing growth and value is key. Growth stocks may struggle in high‑rate periods. Value stocks often perform better when rates rise.

Hedging helps manage risk. Staples and utilities can offset discretionary volatility. Sector rotation strategies also help protect portfolios.

Tools for Tracking Rate Impact

Several tools help investors monitor interest rate trends:

- FedWatch Tool

- Treasury yield curve

- Consumer credit data

- Retail sales reports

- Personal consumption data

These indicators show how rates affect spending and sentiment.

Tools for Tracking Interest Rate Impact

| Tool Name |

Description |

Link |

| FedWatch Tool |

Tracks market expectations for Federal Reserve rate changes |

FedWatch Tool |

| Treasury Yield Curve |

Shows yields across different maturities to signal economic trends |

Treasury Yield Curve |

| Consumer Credit Data |

Measures household debt levels and borrowing behavior |

Consumer Credit Data |

| Retail Sales Reports |

Tracks monthly consumer spending across categories |

Retail Sales Reports |

| Personal Consumption Data |

Measures total consumer spending and trends in discretionary vs. staple goods |

Personal Consumption Data |

Conclusion

Interest rates have a major impact on consumer discretionary stocks. They shape borrowing, spending, and investing behavior. Rising rates often hurt demand and margins. Falling rates can spark recovery.

Investors who track rate cycles can make smarter decisions. By watching both macro trends and company data, they can stay ahead of market moves.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

Interest rates shape how people spend, borrow, and invest. For consumer discretionary stocks, rate changes can shift demand quickly. These stocks include companies that sell non‑essential goods and services. When borrowing costs rise, consumers often cut back. That change affects revenue, margins, and stock prices.

What Are Consumer Discretionary Stocks?

Consumer discretionary stocks represent companies that sell optional products. These include retail, travel, entertainment, luxury, and automotive brands. Unlike staples, these goods are not essential. People buy them when they feel confident and financially secure.

Discretionary stocks tend to rise during economic growth. They often fall during slowdowns. That makes them sensitive to interest rate changes.

Understanding Interest Rates

Interest rates reflect the cost of borrowing money. Central banks, like the Federal Reserve, adjust rates to control inflation and support growth. When inflation rises, the Fed may hike rates. When growth slows, it may cut them.

There are several types of interest rates that affect consumers:

Each one influences how much people and businesses spend.

Interest Rate Impact on Consumer Discretionary Stocks

The Consumer Impact of Rising Rates

When interest rates go up, borrowing becomes more expensive. Credit card payments rise. Auto loans and mortgages cost more. That makes consumers less likely to finance big purchases.

Higher rates also reduce disposable income. As debt payments grow, people have less money for shopping, travel, and entertainment. This shift often leads to weaker demand for discretionary goods.

Consumer confidence can also fall. Rate hikes may signal economic trouble. People worry about job security and future costs. That fear leads to cautious spending.

Business Impact on Discretionary Companies

Companies also feel the pressure. Higher rates increase the cost of capital. Businesses pay more to borrow for expansion, marketing, or inventory. That can slow growth.

Inventory builds up when demand drops. To move products, companies may offer discounts. This hurts profit margins. Lower margins can lead to weaker earnings and falling stock prices.

Valuations also change. Investors use higher discount rates to value future cash flows. That lowers price targets and compresses PE multiples.

Rate Hike Effects on Discretionary Companies

Historical Performance Trends

Discretionary stocks often fall during rate hike cycles. Past examples show retail and travel stocks pulling back when rates rise. In contrast, consumer staples tend to hold steady.

When rates fall, discretionary stocks usually rebound. Lower borrowing costs boost demand. These stocks often lead early in economic recoveries.

Over time, discretionary stocks show strong correlation with rate cycles. They also tend to be more volatile than staples.

Sub-Sector Sensitivity Breakdown

Not all discretionary stocks react the same. Retail and e‑commerce feel rate hikes quickly. Big‑ticket items like furniture or electronics often see sharp declines. Discount retailers may gain share as consumers trade down.

Travel and leisure also suffer. Higher rates make financing vacations harder. Airline and hotel bookings may drop.

Automotive and luxury goods are highly sensitive. Cars often require financing. Luxury purchases depend on consumer confidence. Brands with strong loyalty may hold up better.

Case Studies: Rate-Driven Stock Moves

Home improvement retailers like Home Depot (HD) and Lowe’s (LOW) often feel rate hikes through mortgage activity. When rates rise, fewer people renovate or buy homes. That hurts sales.

Travel stocks like Delta Air Lines (DAL) and Marriott (MAR) tend to rebound when rates fall. Lower costs boost bookings and discretionary travel.

Luxury brands like Tesla (TSLA) and LVMH see demand shift with borrowing costs. Rate hikes can slow high‑end purchases.

Stock Examples and Rate Sensitivity**

Investor Strategies

Investors can time entries around rate cycles. Discretionary stocks often lead in early recoveries. Watching Fed signals and inflation data helps spot turning points.

Balancing growth and value is key. Growth stocks may struggle in high‑rate periods. Value stocks often perform better when rates rise.

Hedging helps manage risk. Staples and utilities can offset discretionary volatility. Sector rotation strategies also help protect portfolios.

Tools for Tracking Rate Impact

Several tools help investors monitor interest rate trends:

These indicators show how rates affect spending and sentiment.

Tools for Tracking Interest Rate Impact

Conclusion

Interest rates have a major impact on consumer discretionary stocks. They shape borrowing, spending, and investing behavior. Rising rates often hurt demand and margins. Falling rates can spark recovery.

Investors who track rate cycles can make smarter decisions. By watching both macro trends and company data, they can stay ahead of market moves.

Recommended Reading on Consumer Discretionary Investing

Continue building your expertise with these related analyses and sector guides. Each resource expands on key themes discussed in this article and supports a deeper understanding of consumer discretionary dynamics.

The Top Consumer Discretionary Stocks

A dynamic list of leading companies within the sector, highlighting notable performers and long‑term growth drivers. A majority of top investors on StockBossUp rated each company on this list a buy.

What Are Consumer Discretionary Stocks?

An introduction to the sector’s core characteristics and market role.

How Consumer Discretionary Stocks Perform in Different Market Cycles

A review of how economic conditions influence sector performance.

Consumer Discretionary vs Consumer Staples: Key Differences

A comparison of spending patterns, risk profiles, and investment considerations.

How to Analyze Consumer Discretionary Companies

A structured approach to evaluating business models and financial strength.

The Role of Consumer Sentiment in Discretionary Stock Performance

Insight into how consumer confidence and behavioral trends shape demand.

How Interest Rates Impact Consumer Discretionary Stocks

An examination of rate sensitivity and macroeconomic pressures.

Are Consumer Discretionary Stocks Good for Long Term Investors?

A long term perspective on growth potential and sector volatility.

How to Build a Portfolio of Consumer Discretionary Stocks

Practical guidance for constructing and managing sector exposure.

Best ETFs for Consumer Discretionary Exposure

A review of leading ETFs offering diversified access to the sector.

How to Classify a Stock as Consumer Discretionary

A clear explanation of classification standards and sector placement.