Should you Buy McDonald's Stock?

Why McDonalds Could be a Strong Investment Opportunity

McDonald’s is one of the world’s largest fast-food chains, and is recognized all over the world. In fact, they operated 41,822 locations globally in 2023. As of 2018, McDonald’s was operating in 120 different countries. This global recognition and scale have led people to wonder, is McDonald’s worth investing in? There are many factors to consider, but there is reason to believe McDonald’s is a strong opportunity for investors.

Financial Performance and Growth

In 2023, McDonald’s revenue was $25.494 billion, their highest revenue in the past decade, and bucking a trend of stagnating revenue growth since 2017. This, along with Q1 representing the 13th consecutive quarter of increased comparable sales, indicates that the struggles of McDonald’s in previous years may finally be behind us. The 5% increase in Q1 2024 versus 2023 is also a positive indicator that there is still growth opportunity for McDonald’s.

Brand Recognition and Loyalty

One other key reason McDonald’s can continue to grow is the recognition of the company. A survey by Statista showed that 92% of respondents were aware of McDonald’s as a brand. Especially interesting is the loyalty of customers of McDonald’s. App data indicates that over a 90 day period, over 150 million people logged into their loyalty app. This loyalty drives repeat business, and McDonald’s targeted 250 million loyalty rewards customers and $45 billion in sales to these customers by the end of 2027.

This goes hand-in-hand with McDonald’s goal of reaching 50 thousand locations by the end of 2027. Their belief is that if they have a more robust loyalty rewards program, they can continue this growth that they have been experiencing over the past several years. This will be the key as they aim to increase from $20 billion in loyalty sales to their aforementioned goal of $45 billion.

Stock Performance and Valuation

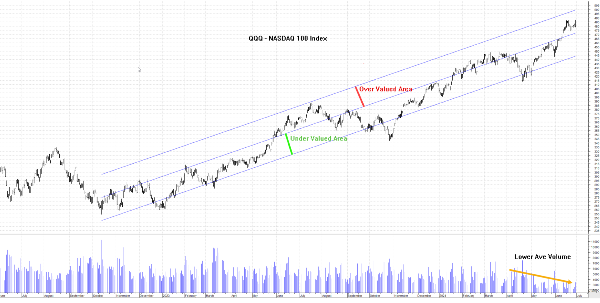

While there are certainly indicators of growth for McDonald’s, how does their stock performance hold up? So far, the year-to-date performance has not really jumped out at people, actually decreasing over the start of the year, but there is somewhat more to the story. In January 2024, McDonald’s stock hit an all-time high at closing of $298.82. This shows that even as recently as 6 months ago, McDonald’s was performing at a very high level.

In the months following, however, their stock price faltered, and closed as low as $245.82 just a few weeks ago on July 9th. The stock has increased steadily since then, however, and many are attributing increased promotional events to the ongoing cost of living struggles many are facing. Even with customers being more financially conservative at times this year, McDonald’s stock continues to increase as it historically has.

GuruFocus places the intrinsic value of McDonalds based on their free-cash-flow at $78.95. This does come well below the current trading price of $266.44, but does represent a better price-to-projected-FCF range than it has in recent times.

While the intrinsic value does not blow me away, the price predictions and targets for McDonald’s are certainly more interesting. CoinCodex showed the 2025 price forecast for McDonald’s at $301.82. This shows there is still projected room for growth, and the longer-term forecasts are even more positive. This goes hand-in-hand with McDonald’s plans for continued expansion, both in the US as well as globally.

One last factor to consider is their strong history of not decreasing their dividend payout. McDonald’s has increased their dividend every year since 1977, when they initially began paying out dividends to investors. This consistency with increasing their dividend is compelling to long-term investors who can reinvest the dividends over time.

Conclusions

While the recent stock performance of McDonald’s has been inconsistent this year, there are certainly reasons to be optimistic when evaluating their stock. With a stellar history of increasing their dividend as well as their plan for expansion, the future appears bright for those who invest in McDonald’s, and I believe that they present a solid opportunity for investors. The consistency with which they have continued to open new stores and increase revenue has me optimistic that they will continue to grow as they have through several different periods of economic difficulty. This is why I believe McDonald’s stock is a buy at the current price.

Should you Buy McDonald's Stock?

Why McDonalds Could be a Strong Investment Opportunity

McDonald’s is one of the world’s largest fast-food chains, and is recognized all over the world. In fact, they operated 41,822 locations globally in 2023. As of 2018, McDonald’s was operating in 120 different countries. This global recognition and scale have led people to wonder, is McDonald’s worth investing in? There are many factors to consider, but there is reason to believe McDonald’s is a strong opportunity for investors.

Financial Performance and Growth

In 2023, McDonald’s revenue was $25.494 billion, their highest revenue in the past decade, and bucking a trend of stagnating revenue growth since 2017. This, along with Q1 representing the 13th consecutive quarter of increased comparable sales, indicates that the struggles of McDonald’s in previous years may finally be behind us. The 5% increase in Q1 2024 versus 2023 is also a positive indicator that there is still growth opportunity for McDonald’s.

Brand Recognition and Loyalty

One other key reason McDonald’s can continue to grow is the recognition of the company. A survey by Statista showed that 92% of respondents were aware of McDonald’s as a brand. Especially interesting is the loyalty of customers of McDonald’s. App data indicates that over a 90 day period, over 150 million people logged into their loyalty app. This loyalty drives repeat business, and McDonald’s targeted 250 million loyalty rewards customers and $45 billion in sales to these customers by the end of 2027.

This goes hand-in-hand with McDonald’s goal of reaching 50 thousand locations by the end of 2027. Their belief is that if they have a more robust loyalty rewards program, they can continue this growth that they have been experiencing over the past several years. This will be the key as they aim to increase from $20 billion in loyalty sales to their aforementioned goal of $45 billion.

Stock Performance and Valuation

While there are certainly indicators of growth for McDonald’s, how does their stock performance hold up? So far, the year-to-date performance has not really jumped out at people, actually decreasing over the start of the year, but there is somewhat more to the story. In January 2024, McDonald’s stock hit an all-time high at closing of $298.82. This shows that even as recently as 6 months ago, McDonald’s was performing at a very high level.

In the months following, however, their stock price faltered, and closed as low as $245.82 just a few weeks ago on July 9th. The stock has increased steadily since then, however, and many are attributing increased promotional events to the ongoing cost of living struggles many are facing. Even with customers being more financially conservative at times this year, McDonald’s stock continues to increase as it historically has.

GuruFocus places the intrinsic value of McDonalds based on their free-cash-flow at $78.95. This does come well below the current trading price of $266.44, but does represent a better price-to-projected-FCF range than it has in recent times.

While the intrinsic value does not blow me away, the price predictions and targets for McDonald’s are certainly more interesting. CoinCodex showed the 2025 price forecast for McDonald’s at $301.82. This shows there is still projected room for growth, and the longer-term forecasts are even more positive. This goes hand-in-hand with McDonald’s plans for continued expansion, both in the US as well as globally.

One last factor to consider is their strong history of not decreasing their dividend payout. McDonald’s has increased their dividend every year since 1977, when they initially began paying out dividends to investors. This consistency with increasing their dividend is compelling to long-term investors who can reinvest the dividends over time.

Conclusions

While the recent stock performance of McDonald’s has been inconsistent this year, there are certainly reasons to be optimistic when evaluating their stock. With a stellar history of increasing their dividend as well as their plan for expansion, the future appears bright for those who invest in McDonald’s, and I believe that they present a solid opportunity for investors. The consistency with which they have continued to open new stores and increase revenue has me optimistic that they will continue to grow as they have through several different periods of economic difficulty. This is why I believe McDonald’s stock is a buy at the current price.