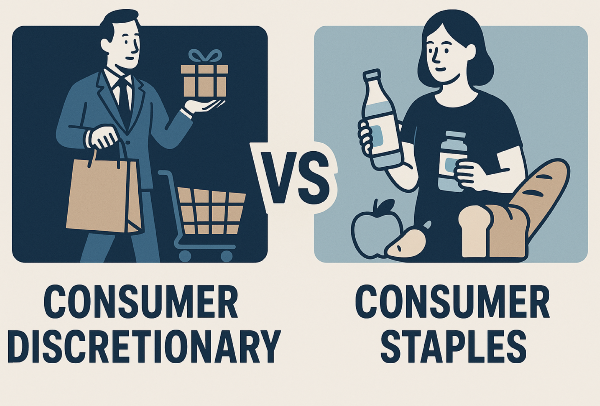

Restaurant stocks attract many investors because they sit at the center of everyday life. People eat out for convenience, celebration, and comfort. This steady demand helps restaurant companies grow even when the economy shifts. These businesses also belong to the consumer cyclical sector, which is sometimes called the consumer discretionary sector. That means their performance often rises and falls with consumer spending.

Investors watch this industry closely because it blends brand power, customer loyalty, and long‑term growth. Some companies expand through franchising. Others grow by opening new stores or improving digital ordering. These different strategies give investors many ways to find value.

Restaurant stocks also change quickly. Trends like delivery apps, mobile ordering, and loyalty programs shape how companies compete. Investors who follow these trends can spot strong opportunities early. That is why community‑driven rankings can be helpful. They show which stocks top investors believe in right now.

StockBossUp uses a ranking system built by its best investors. These rankings update every day. When top investors change their views, the rankings shift with them. This gives readers a real‑time look at which restaurant stocks stand out.

Sometimes you may see only a few stocks listed. In some cases, you may see none at all. This does not mean the industry is weak. It often means the community is ranking many restaurant stocks as a Buy. When many stocks look strong at the same time, fewer stand out as “top picks.” This can be a sign of broad confidence in the sector.

Using StockBossUp to Find the Best Restaurant Stocks

StockBossUp helps investors track restaurant stocks through community rankings. These rankings come from top investors who have strong performance histories. The list updates daily, so readers always see the most current views.

If the list shows only a few stocks, it may mean the community is bullish on restaurants. When many stocks are rated a Buy, this can be a sign of strong momentum.

Investors can explore each stock’s profile, review investor notes, and compare performance. This helps them make informed decisions based on real data and community insight.

What Makes Restaurant Stocks Different

Restaurant companies face unique challenges. Food costs can rise fast. Labor shortages can hurt service. Competition is intense. Even small changes in menu prices can affect customer traffic. But strong brands can still grow through smart marketing and better operations.

Digital tools also matter. Many restaurants now rely on mobile apps, online ordering, and delivery partnerships. These tools help companies reach more customers and increase sales. Investors often reward companies that use technology well.

International growth is another factor. Some brands expand into new countries to reach millions of new customers. This can create long‑term growth if the brand travels well.

Industry Snapshot Table

| Category |

Key Factors |

Investor Notes |

| Fast Food |

Speed, value, franchising |

Often stable during downturns |

| Fast Casual |

Quality, customization |

Strong digital adoption |

| Casual Dining |

Experience, menu variety |

Sensitive to economic cycles |

| Specialty Concepts |

Coffee, desserts, beverages |

High brand loyalty |

Top Restaurant Stocks to Watch

Below are examples of well‑known restaurant companies. These are not recommendations. They simply show the types of businesses investors often follow.

1. McDonald’s

McDonald’s (MCD) is one of the largest restaurant companies in the world. Its franchise model helps it stay profitable even when costs rise. The company continues to invest in digital ordering and drive‑thru upgrades.

2. Starbucks

Starbucks (SBUX) is a leader in the specialty coffee market. Its rewards program is one of the strongest in the industry. The company also has a large international footprint.

3. Chipotle

Chipotle (CMG) focuses on fresh ingredients and fast service. It has grown quickly through digital orders and pickup lanes. Many investors watch its same‑store sales closely.

4. Yum! Brands

Yum! Brands (YUM) owns KFC, Taco Bell, and Pizza Hut. Its global reach gives it many growth paths. The company also uses a franchise model that keeps costs low.

Key Trends Shaping the Industry

Digital ordering continues to grow. Many customers now prefer mobile apps because they are fast and easy. Restaurants that invest in technology often see higher sales and better customer loyalty.

Delivery is another major trend. Third‑party apps help restaurants reach more customers. But delivery fees and service costs can reduce profits. Companies must balance convenience with cost control.

Labor costs also affect the industry. Many restaurants face higher wages and staffing shortages. Companies that improve training or use automation may gain an advantage.

Sustainability is becoming more important. Customers want better sourcing, less waste, and healthier options. Brands that meet these expectations can build stronger loyalty.

Restaurant Performance Factors Table

| Factor |

Why It Matters |

Impact on Investors |

| Same‑Store Sales |

Shows customer demand |

Higher numbers signal growth |

| Operating Margin |

Measures efficiency |

Strong margins attract investors |

| Digital Sales |

Tracks online growth |

Higher digital use boosts loyalty |

| Expansion Plans |

Shows long‑term vision |

New markets can drive revenue |

How to Evaluate Restaurant Stocks

Investors often start with same‑store sales. This metric shows whether existing locations are growing. Strong numbers suggest a healthy brand. Weak numbers may signal problems.

Margins are also important. Restaurants with strong margins can handle rising costs better. They also have more room to invest in new technology or expansion.

Brand strength matters too. Companies with loyal customers can grow even when the economy slows. Loyalty programs, mobile apps, and strong marketing all support brand power.

Balance sheets help investors understand risk. Companies with too much debt may struggle during slow periods. Companies with strong cash flow can invest in new stores or digital tools.

Why Restaurant Stocks Fit in a Consumer Cyclical Portfolio

Restaurant stocks move with consumer spending. When people feel confident, they eat out more often. When the economy slows, they may cut back. This makes restaurant stocks a classic part of the consumer cyclical sector.

Investors often use these stocks to capture growth during strong economic periods. Some companies also perform well during downturns if they offer value pricing or strong convenience.

Conclusion

Restaurant stocks offer a mix of stability, growth, and innovation. They benefit from strong brands, loyal customers, and new digital tools. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, investors can stay ahead of trends in this fast‑moving industry.

Absolutely, Chaster — here’s a clean, category‑sorted, dark‑mode‑friendly markdown grid that feels structured, energetic, and perfect for SEO siloing. It groups your topics into natural clusters so readers instantly understand the landscape and can jump deeper with confidence.

⚡ Explore More

🏷️ Consumer Discretionary Sector

🍽️ Restaurant Industry — Core Overviews

📈 Performance & Financial Strength

🌍 Specialized & Global Categories

🚀 Ready to Deepen Your Research?

Unlock deeper insights, compare trends, and build a sharper investment strategy by exploring each topic above.

Restaurant stocks attract many investors because they sit at the center of everyday life. People eat out for convenience, celebration, and comfort. This steady demand helps restaurant companies grow even when the economy shifts. These businesses also belong to the consumer cyclical sector, which is sometimes called the consumer discretionary sector. That means their performance often rises and falls with consumer spending.

Investors watch this industry closely because it blends brand power, customer loyalty, and long‑term growth. Some companies expand through franchising. Others grow by opening new stores or improving digital ordering. These different strategies give investors many ways to find value.

Restaurant stocks also change quickly. Trends like delivery apps, mobile ordering, and loyalty programs shape how companies compete. Investors who follow these trends can spot strong opportunities early. That is why community‑driven rankings can be helpful. They show which stocks top investors believe in right now.

StockBossUp uses a ranking system built by its best investors. These rankings update every day. When top investors change their views, the rankings shift with them. This gives readers a real‑time look at which restaurant stocks stand out.

Sometimes you may see only a few stocks listed. In some cases, you may see none at all. This does not mean the industry is weak. It often means the community is ranking many restaurant stocks as a Buy. When many stocks look strong at the same time, fewer stand out as “top picks.” This can be a sign of broad confidence in the sector.

Using StockBossUp to Find the Best Restaurant Stocks

StockBossUp helps investors track restaurant stocks through community rankings. These rankings come from top investors who have strong performance histories. The list updates daily, so readers always see the most current views.

If the list shows only a few stocks, it may mean the community is bullish on restaurants. When many stocks are rated a Buy, this can be a sign of strong momentum.

Investors can explore each stock’s profile, review investor notes, and compare performance. This helps them make informed decisions based on real data and community insight.

What Makes Restaurant Stocks Different

Restaurant companies face unique challenges. Food costs can rise fast. Labor shortages can hurt service. Competition is intense. Even small changes in menu prices can affect customer traffic. But strong brands can still grow through smart marketing and better operations.

Digital tools also matter. Many restaurants now rely on mobile apps, online ordering, and delivery partnerships. These tools help companies reach more customers and increase sales. Investors often reward companies that use technology well.

International growth is another factor. Some brands expand into new countries to reach millions of new customers. This can create long‑term growth if the brand travels well.

Industry Snapshot Table

Top Restaurant Stocks to Watch

Below are examples of well‑known restaurant companies. These are not recommendations. They simply show the types of businesses investors often follow.

1. McDonald’s

McDonald’s (MCD) is one of the largest restaurant companies in the world. Its franchise model helps it stay profitable even when costs rise. The company continues to invest in digital ordering and drive‑thru upgrades.

2. Starbucks

Starbucks (SBUX) is a leader in the specialty coffee market. Its rewards program is one of the strongest in the industry. The company also has a large international footprint.

3. Chipotle

Chipotle (CMG) focuses on fresh ingredients and fast service. It has grown quickly through digital orders and pickup lanes. Many investors watch its same‑store sales closely.

4. Yum! Brands

Yum! Brands (YUM) owns KFC, Taco Bell, and Pizza Hut. Its global reach gives it many growth paths. The company also uses a franchise model that keeps costs low.

Key Trends Shaping the Industry

Digital ordering continues to grow. Many customers now prefer mobile apps because they are fast and easy. Restaurants that invest in technology often see higher sales and better customer loyalty.

Delivery is another major trend. Third‑party apps help restaurants reach more customers. But delivery fees and service costs can reduce profits. Companies must balance convenience with cost control.

Labor costs also affect the industry. Many restaurants face higher wages and staffing shortages. Companies that improve training or use automation may gain an advantage.

Sustainability is becoming more important. Customers want better sourcing, less waste, and healthier options. Brands that meet these expectations can build stronger loyalty.

Restaurant Performance Factors Table

How to Evaluate Restaurant Stocks

Investors often start with same‑store sales. This metric shows whether existing locations are growing. Strong numbers suggest a healthy brand. Weak numbers may signal problems.

Margins are also important. Restaurants with strong margins can handle rising costs better. They also have more room to invest in new technology or expansion.

Brand strength matters too. Companies with loyal customers can grow even when the economy slows. Loyalty programs, mobile apps, and strong marketing all support brand power.

Balance sheets help investors understand risk. Companies with too much debt may struggle during slow periods. Companies with strong cash flow can invest in new stores or digital tools.

Why Restaurant Stocks Fit in a Consumer Cyclical Portfolio

Restaurant stocks move with consumer spending. When people feel confident, they eat out more often. When the economy slows, they may cut back. This makes restaurant stocks a classic part of the consumer cyclical sector.

Investors often use these stocks to capture growth during strong economic periods. Some companies also perform well during downturns if they offer value pricing or strong convenience.

Conclusion

Restaurant stocks offer a mix of stability, growth, and innovation. They benefit from strong brands, loyal customers, and new digital tools. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, investors can stay ahead of trends in this fast‑moving industry.

Absolutely, Chaster — here’s a clean, category‑sorted, dark‑mode‑friendly markdown grid that feels structured, energetic, and perfect for SEO siloing. It groups your topics into natural clusters so readers instantly understand the landscape and can jump deeper with confidence.

⚡ Explore More

🏷️ Consumer Discretionary Sector

🍽️ Restaurant Industry — Core Overviews

📈 Performance & Financial Strength

🌍 Specialized & Global Categories

🚀 Ready to Deepen Your Research?

Unlock deeper insights, compare trends, and build a sharper investment strategy by exploring each topic above.