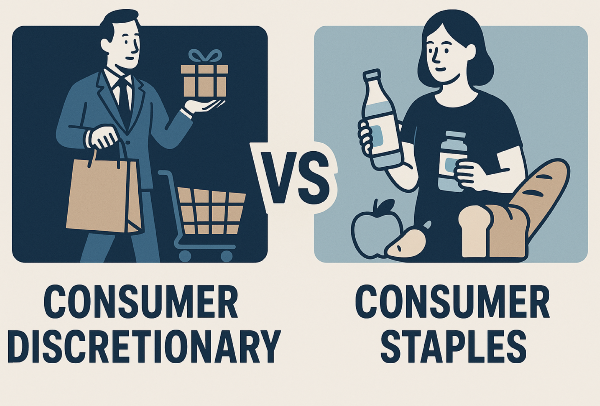

Auto stocks are a key part of many investment portfolios. These companies build the vehicles people use every day. They also drive innovation in electric vehicles, autonomous tech, and global logistics. Because they depend on consumer demand, they belong to the consumer cyclical sector—also called consumer discretionary.

When the economy is strong, people buy more cars. That boosts revenue for automakers. But when spending slows, car sales often drop. This makes auto stocks sensitive to interest rates, inflation, and consumer confidence.

Investors watch this sector closely. It combines brand power, global scale, and long-term growth. Some companies focus on electric vehicles. Others rely on strong legacy brands and wide distribution. These differences give investors many ways to find value.

StockBossUp ranks auto stocks using a community-driven system. The rankings come from top investors who consistently perform well. These rankings update daily, so readers always see the freshest picks.

Sometimes you may see only a few stocks listed—or none at all. That doesn’t mean the industry is weak. It often means the community isn't currently ranking many auto stocks as a Buy. When their are a lot of buy ratings, it may mean their is growing interest in the industry.

What Makes Auto Stocks Unique

Auto manufacturers face high costs and long product cycles. They must manage global supply chains, labor, and regulations. Innovation is key. Companies that lead in electric vehicles or autonomous driving often attract investor attention.

Legacy automakers must balance old systems with new tech. EV startups focus on growth but often lose money. Global giants deal with currency risks and trade policies. Each type of company has its own strengths and challenges.

Auto Industry Snapshot

| Category |

Focus Areas |

Investor Notes |

| Legacy Automakers |

Scale, brand, distribution |

EV transition is a key risk |

| EV Specialists |

Battery tech, software |

High growth, high volatility |

| Global Giants |

International reach, variety |

Sensitive to global economics |

Top Auto Manufacturer Stocks to Watch

Below are examples of well-known auto companies. These are not recommendations. They show the types of businesses investors often follow.

1. Ford Motor Company

Ford (F) is a legacy automaker with strong brand recognition. It’s investing heavily in electric trucks and SUVs. The company also has a wide dealer network and strong U.S. presence.

2. Tesla Inc.

Tesla (TSLA) leads the EV market. It uses direct-to-consumer sales and advanced software. Investors watch its delivery numbers and margins closely.

3. General Motors

GM (GM) is shifting toward electric vehicles and autonomous driving. It owns brands like Chevrolet and Cadillac. The company also has a stake in Cruise, its self-driving unit.

4. Toyota Motor Corporation

Toyota (TM) is known for reliability and global reach. It offers hybrids, EVs, and fuel-efficient models. Toyota’s scale helps it manage costs and supply chains.

Trends Driving Auto Stock Performance

Electric vehicles are growing fast. Governments offer incentives, and consumers want cleaner options. Companies that lead in EVs often see strong investor interest.

Autonomous driving is another trend. Some automakers invest in self-driving tech. Others partner with tech firms. This area is still developing, but it could reshape transportation.

Supply chains are recovering from chip shortages. That helps automakers increase production. But labor costs and inflation still affect margins.

Sustainability matters more than ever. Automakers must meet emissions rules and offer greener options. This affects product design, sourcing, and marketing.

Key Performance Metrics

| Metric |

Why It Matters |

Impact on Investors |

| Vehicle Deliveries |

Shows demand and production |

Higher numbers signal growth |

| Operating Margin |

Measures cost control |

Strong margins attract capital |

| EV Penetration |

Tracks electric vehicle growth |

Signals future competitiveness |

| Global Footprint |

Shows market diversity |

Reduces regional risk |

Evaluating Auto Stocks Like a Pro

Start with revenue and delivery trends. These show whether a company is growing. Look at operating margins to see how well it controls costs.

Check R&D spending. Companies that invest in innovation often lead in new markets. But high spending without results can hurt profits.

Brand strength matters. Loyal customers help companies weather downturns. Marketing, product quality, and service all support brand value.

Balance sheets reveal risk. Companies with strong cash flow and low debt can invest more. Those with weak finances may struggle during slow periods.

Why Auto Stocks Fit in a Consumer Cyclical Portfolio

Auto stocks rise and fall with consumer spending. When people feel confident, they buy cars. When the economy slows, they delay purchases. This makes auto stocks a classic part of the consumer cyclical sector.

Investors use these stocks to capture growth during strong economic periods. Some companies also perform well during downturns if they offer value pricing or strong brand loyalty.

Using StockBossUp to Find the Best Picks

StockBossUp ranks auto stocks based on top investor performance. These rankings update daily. That means you always see the most current views.

If the list shows only a few stocks, it may mean the community is bearish on the entire industry. When many stocks are rated a Buy, this can be a sign of strong momentum.

You can explore each stock’s profile, review investor notes, and compare performance. This helps you make informed decisions based on real data and community insight.

Conclusion

Auto manufacturer stocks offer a mix of innovation, scale, and global reach. They benefit from strong brands, new technologies, and rising EV demand. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, you can stay ahead of trends in this fast-moving industry.

Auto stocks are a key part of many investment portfolios. These companies build the vehicles people use every day. They also drive innovation in electric vehicles, autonomous tech, and global logistics. Because they depend on consumer demand, they belong to the consumer cyclical sector—also called consumer discretionary.

When the economy is strong, people buy more cars. That boosts revenue for automakers. But when spending slows, car sales often drop. This makes auto stocks sensitive to interest rates, inflation, and consumer confidence.

Investors watch this sector closely. It combines brand power, global scale, and long-term growth. Some companies focus on electric vehicles. Others rely on strong legacy brands and wide distribution. These differences give investors many ways to find value.

StockBossUp ranks auto stocks using a community-driven system. The rankings come from top investors who consistently perform well. These rankings update daily, so readers always see the freshest picks.

Sometimes you may see only a few stocks listed—or none at all. That doesn’t mean the industry is weak. It often means the community isn't currently ranking many auto stocks as a Buy. When their are a lot of buy ratings, it may mean their is growing interest in the industry.

What Makes Auto Stocks Unique

Auto manufacturers face high costs and long product cycles. They must manage global supply chains, labor, and regulations. Innovation is key. Companies that lead in electric vehicles or autonomous driving often attract investor attention.

Legacy automakers must balance old systems with new tech. EV startups focus on growth but often lose money. Global giants deal with currency risks and trade policies. Each type of company has its own strengths and challenges.

Auto Industry Snapshot

Top Auto Manufacturer Stocks to Watch

Below are examples of well-known auto companies. These are not recommendations. They show the types of businesses investors often follow.

1. Ford Motor Company

Ford (F) is a legacy automaker with strong brand recognition. It’s investing heavily in electric trucks and SUVs. The company also has a wide dealer network and strong U.S. presence.

2. Tesla Inc.

Tesla (TSLA) leads the EV market. It uses direct-to-consumer sales and advanced software. Investors watch its delivery numbers and margins closely.

3. General Motors

GM (GM) is shifting toward electric vehicles and autonomous driving. It owns brands like Chevrolet and Cadillac. The company also has a stake in Cruise, its self-driving unit.

4. Toyota Motor Corporation

Toyota (TM) is known for reliability and global reach. It offers hybrids, EVs, and fuel-efficient models. Toyota’s scale helps it manage costs and supply chains.

Trends Driving Auto Stock Performance

Electric vehicles are growing fast. Governments offer incentives, and consumers want cleaner options. Companies that lead in EVs often see strong investor interest.

Autonomous driving is another trend. Some automakers invest in self-driving tech. Others partner with tech firms. This area is still developing, but it could reshape transportation.

Supply chains are recovering from chip shortages. That helps automakers increase production. But labor costs and inflation still affect margins.

Sustainability matters more than ever. Automakers must meet emissions rules and offer greener options. This affects product design, sourcing, and marketing.

Key Performance Metrics

Evaluating Auto Stocks Like a Pro

Start with revenue and delivery trends. These show whether a company is growing. Look at operating margins to see how well it controls costs.

Check R&D spending. Companies that invest in innovation often lead in new markets. But high spending without results can hurt profits.

Brand strength matters. Loyal customers help companies weather downturns. Marketing, product quality, and service all support brand value.

Balance sheets reveal risk. Companies with strong cash flow and low debt can invest more. Those with weak finances may struggle during slow periods.

Why Auto Stocks Fit in a Consumer Cyclical Portfolio

Auto stocks rise and fall with consumer spending. When people feel confident, they buy cars. When the economy slows, they delay purchases. This makes auto stocks a classic part of the consumer cyclical sector.

Investors use these stocks to capture growth during strong economic periods. Some companies also perform well during downturns if they offer value pricing or strong brand loyalty.

Using StockBossUp to Find the Best Picks

StockBossUp ranks auto stocks based on top investor performance. These rankings update daily. That means you always see the most current views.

If the list shows only a few stocks, it may mean the community is bearish on the entire industry. When many stocks are rated a Buy, this can be a sign of strong momentum.

You can explore each stock’s profile, review investor notes, and compare performance. This helps you make informed decisions based on real data and community insight.

Conclusion

Auto manufacturer stocks offer a mix of innovation, scale, and global reach. They benefit from strong brands, new technologies, and rising EV demand. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, you can stay ahead of trends in this fast-moving industry.