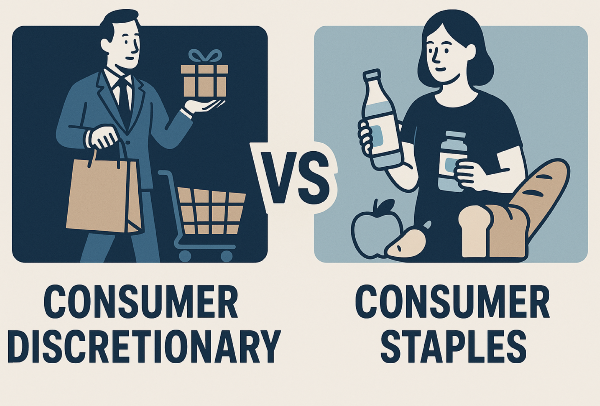

Auto parts companies play a key role in keeping vehicles on the road. They supply everything from brake pads to sensors. Some serve automakers directly. Others sell to repair shops and DIY customers. These businesses are part of the consumer discretionary sector, which means they often rise and fall with consumer spending.

StockBossUp ranks auto parts stocks using a community-driven system. The rankings come from top investors who have proven track records. These rankings update daily, so readers always see the freshest picks.

Sometimes you may see only a few stocks listed—or none at all. That doesn’t mean the industry is weak. It often means the community is not ranking many stocks in this industry a Buy. When sentiment is cautious, fewer stocks stand out as top picks.

What Makes Auto Parts Stocks Unique

Auto parts companies serve many types of customers. Some sell directly to automakers. Others focus on the aftermarket, where parts are used for repairs and upgrades. This gives investors different ways to find value.

OEM suppliers depend on vehicle production. If automakers slow down, their orders shrink. Aftermarket retailers rely on aging vehicles and DIY repairs. These businesses often do well when new car sales drop.

Technology also matters. Many parts now include sensors, chips, and software. Companies that lead in advanced driver-assistance systems (ADAS) or EV components may grow faster.

Auto Parts Industry Breakdown

| Category |

Focus Area |

Investor Notes |

| Aftermarket Retailers |

DIY, repair shops |

Steady demand from aging cars |

| OEM Suppliers |

Automaker contracts |

Sensitive to production cycles |

| Safety & Electronics |

ADAS, infotainment |

High-tech growth potential |

| Specialty Parts |

Performance, niche markets |

Often small but profitable |

Top Auto Parts Stocks to Watch

Below are examples of well-known auto parts companies. These are not recommendations. They show the types of businesses investors often follow.

1. O’Reilly Automotive

O’Reilly (ORLY)

O’Reilly sells parts to both professionals and DIY customers. It has thousands of stores across the U.S. and strong inventory systems.

2. AutoZone

AutoZone (AZO)

AutoZone is a leader in the aftermarket space. It focuses on customer service and fast delivery. The company also invests in digital tools.

3. Aptiv PLC

Aptiv (APTV)

Aptiv supplies advanced electronics and safety systems. It works with many automakers and focuses on EV and autonomous tech.

4. Magna International

Magna (MGA)

Magna is one of the largest OEM suppliers. It makes everything from seats to powertrains. The company has a global footprint.

5. Dorman Products

Dorman (DORM)

Dorman focuses on replacement parts and niche products. It serves the aftermarket and offers hard-to-find components.

Trends Driving Auto Parts Stock Performance

Electric vehicles are changing the parts market. EVs need fewer moving parts but more electronics. Companies that supply sensors, battery systems, and software may benefit.

ADAS is another growth area. These systems use cameras and radar to help drivers. Parts suppliers that support these features are seeing more demand.

Vehicle age is rising. Many cars on the road today are over 10 years old. That boosts demand for replacement parts and repairs.

Supply chains are shifting. Some companies are moving production closer to home. This helps reduce delays and improve margins.

Key Metrics for Auto Parts Stocks

| Metric |

Why It Matters |

Impact on Investors |

| Revenue Growth |

Shows demand and expansion |

Higher growth attracts capital |

| CPV (Content/Vehicle) |

Measures value per car |

Higher CPV signals innovation |

| Operating Margin |

Tracks cost control |

Strong margins boost profits |

| Customer Mix |

OEM vs. aftermarket |

Affects stability and risk |

Evaluating Auto Parts Stocks Like a Pro

Start with revenue and margin trends. These show whether a company is growing and managing costs. Look at CPV to see how much value each vehicle adds.

Check customer concentration. Companies that rely on one automaker may face more risk. Diversified customer bases offer more stability.

R&D spending matters. Innovation drives future growth. But high spending without results can hurt profits.

Balance sheets reveal financial health. Companies with strong cash flow and low debt can invest more. Those with weak finances may struggle during downturns.

Why Auto Parts Stocks Fit in a Consumer Discretionary Portfolio

Auto parts stocks rise and fall with consumer spending. When people drive more, parts wear out faster. When cars age, repairs increase. This makes the industry a classic part of the consumer discretionary sector.

Some companies also offer defensive traits. Aftermarket retailers often do well when new car sales drop. That gives investors a mix of growth and stability.

Using StockBossUp to Find the Best Picks

StockBossUp ranks auto parts stocks based on top investor performance. These rankings update daily. That means you always see the most current views.

If the list shows only a few stocks, it may mean the community is cautious. When few stocks are rated a Buy, it reflects lower confidence. This can help investors avoid weak sectors.

You can explore each stock’s profile, review investor notes, and compare performance. This helps you make informed decisions based on real data and community insight.

Conclusion

Auto parts stocks offer a mix of innovation, stability, and global reach. They benefit from aging vehicles, new technologies, and steady demand. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, you can stay ahead of trends in this evolving industry.

Auto parts companies play a key role in keeping vehicles on the road. They supply everything from brake pads to sensors. Some serve automakers directly. Others sell to repair shops and DIY customers. These businesses are part of the consumer discretionary sector, which means they often rise and fall with consumer spending.

StockBossUp ranks auto parts stocks using a community-driven system. The rankings come from top investors who have proven track records. These rankings update daily, so readers always see the freshest picks.

Sometimes you may see only a few stocks listed—or none at all. That doesn’t mean the industry is weak. It often means the community is not ranking many stocks in this industry a Buy. When sentiment is cautious, fewer stocks stand out as top picks.

What Makes Auto Parts Stocks Unique

Auto parts companies serve many types of customers. Some sell directly to automakers. Others focus on the aftermarket, where parts are used for repairs and upgrades. This gives investors different ways to find value.

OEM suppliers depend on vehicle production. If automakers slow down, their orders shrink. Aftermarket retailers rely on aging vehicles and DIY repairs. These businesses often do well when new car sales drop.

Technology also matters. Many parts now include sensors, chips, and software. Companies that lead in advanced driver-assistance systems (ADAS) or EV components may grow faster.

Auto Parts Industry Breakdown

Top Auto Parts Stocks to Watch

Below are examples of well-known auto parts companies. These are not recommendations. They show the types of businesses investors often follow.

1. O’Reilly Automotive

O’Reilly (ORLY)

O’Reilly sells parts to both professionals and DIY customers. It has thousands of stores across the U.S. and strong inventory systems.

2. AutoZone

AutoZone (AZO)

AutoZone is a leader in the aftermarket space. It focuses on customer service and fast delivery. The company also invests in digital tools.

3. Aptiv PLC

Aptiv (APTV)

Aptiv supplies advanced electronics and safety systems. It works with many automakers and focuses on EV and autonomous tech.

4. Magna International

Magna (MGA)

Magna is one of the largest OEM suppliers. It makes everything from seats to powertrains. The company has a global footprint.

5. Dorman Products

Dorman (DORM)

Dorman focuses on replacement parts and niche products. It serves the aftermarket and offers hard-to-find components.

Trends Driving Auto Parts Stock Performance

Electric vehicles are changing the parts market. EVs need fewer moving parts but more electronics. Companies that supply sensors, battery systems, and software may benefit.

ADAS is another growth area. These systems use cameras and radar to help drivers. Parts suppliers that support these features are seeing more demand.

Vehicle age is rising. Many cars on the road today are over 10 years old. That boosts demand for replacement parts and repairs.

Supply chains are shifting. Some companies are moving production closer to home. This helps reduce delays and improve margins.

Key Metrics for Auto Parts Stocks

Evaluating Auto Parts Stocks Like a Pro

Start with revenue and margin trends. These show whether a company is growing and managing costs. Look at CPV to see how much value each vehicle adds.

Check customer concentration. Companies that rely on one automaker may face more risk. Diversified customer bases offer more stability.

R&D spending matters. Innovation drives future growth. But high spending without results can hurt profits.

Balance sheets reveal financial health. Companies with strong cash flow and low debt can invest more. Those with weak finances may struggle during downturns.

Why Auto Parts Stocks Fit in a Consumer Discretionary Portfolio

Auto parts stocks rise and fall with consumer spending. When people drive more, parts wear out faster. When cars age, repairs increase. This makes the industry a classic part of the consumer discretionary sector.

Some companies also offer defensive traits. Aftermarket retailers often do well when new car sales drop. That gives investors a mix of growth and stability.

Using StockBossUp to Find the Best Picks

StockBossUp ranks auto parts stocks based on top investor performance. These rankings update daily. That means you always see the most current views.

If the list shows only a few stocks, it may mean the community is cautious. When few stocks are rated a Buy, it reflects lower confidence. This can help investors avoid weak sectors.

You can explore each stock’s profile, review investor notes, and compare performance. This helps you make informed decisions based on real data and community insight.

Conclusion

Auto parts stocks offer a mix of innovation, stability, and global reach. They benefit from aging vehicles, new technologies, and steady demand. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, you can stay ahead of trends in this evolving industry.