Internet retail stocks have reshaped how people shop. From mobile apps to global marketplaces, these companies offer convenience, speed, and variety. They belong to the consumer discretionary sector, meaning their performance often reflects consumer confidence and spending habits.

Investors watch this space closely. Internet retailers scale quickly, reach global audiences, and adapt to trends faster than traditional stores. But they also face intense competition, rising costs, and shifting customer expectations.

StockBossUp ranks internet retail stocks using a community-driven system. These rankings come from top investors who consistently outperform. The list updates daily, giving readers a fresh look at which stocks stand out.

Sometimes you may see only a few stocks listed—or none at all. That doesn’t mean the industry is weak. It often means the community is not ranking many stocks in this industry a Buy. When sentiment is cautious, fewer stocks rise to the top.

What Makes Internet Retail Stocks Unique

Internet retailers operate with fewer physical locations. This lowers overhead and allows faster expansion. Many use data to personalize shopping, improve logistics, and boost customer loyalty.

These companies often serve global markets. That brings opportunity but also risk. Currency shifts, regulations, and shipping delays can affect performance.

Customer acquisition is key. Brands spend heavily on ads, influencers, and search rankings. Those with strong loyalty programs or subscription models may spend less to retain users.

Internet Retail Categories

| Category |

Focus Area |

Investor Notes |

| Marketplaces |

Sellers, logistics, scale |

High volume, low margin |

| Direct-to-Consumer Brands |

Brand control, loyalty |

Marketing-driven growth |

| Subscription Retailers |

Recurring revenue |

Retention is critical |

| Niche Platforms |

Specialty products |

Often high engagement |

Top Internet Retail Stocks to Watch

Below are examples of well-known internet retail companies. These are not recommendations. They show the types of businesses investors often follow.

1. Amazon

Amazon (AMZN)

Amazon is the largest online marketplace. It offers fast delivery, a wide product range, and strong logistics. Investors watch its cloud business and retail margins closely.

2. Alibaba

Alibaba (BABA)

Alibaba dominates e-commerce in China. It runs marketplaces, payment systems, and cloud services. Global expansion and regulatory risks affect its outlook.

3. Etsy

Etsy (ETSY)

Etsy focuses on handmade and vintage goods. Its niche appeal and loyal customer base help it stand out. Marketing and seller support drive growth.

4. Chewy

Chewy (CHWY)

Chewy sells pet products online. It offers auto-ship options and strong customer service. Investors watch its margins and repeat order rates.

5. Wayfair

Wayfair (W)

Wayfair sells furniture and home goods. It relies on logistics and supplier partnerships. Profitability and customer retention are key metrics.

Trends Driving Internet Retail Stock Performance

Mobile shopping continues to grow. Many customers use apps for fast browsing and checkout. Retailers that optimize mobile experiences often see higher conversion rates.

AI helps personalize shopping. Algorithms suggest products, adjust prices, and improve search. This boosts engagement and sales.

Logistics innovation matters. Fast delivery and easy returns improve customer satisfaction. Companies that invest in fulfillment often gain an edge.

Sustainability is rising. Customers want ethical sourcing, low-waste packaging, and carbon-neutral shipping. Brands that meet these goals build loyalty.

Social commerce is expanding. Influencers and live shopping events drive traffic. Retailers that tap into these trends may grow faster.

Key Metrics for Internet Retail Stocks

| Metric |

Why It Matters |

Impact on Investors |

| GMV (Gross Merch. Value) |

Shows total sales volume |

Higher GMV signals scale |

| Active Users |

Tracks engagement |

More users mean more revenue |

| Gross Margin |

Measures profitability |

Strong margins support growth |

| Fulfillment Cost |

Affects delivery efficiency |

Lower costs improve margins |

Evaluating Internet Retail Stocks Like a Pro

Start with revenue and user growth. These show whether a company is expanding. Look at gross margins to see how well it manages costs.

Check customer retention. Subscription models and loyalty programs help reduce churn. High repeat order rates signal strong brand value.

Marketing spend matters. Companies that spend too much may struggle to turn a profit. Look for efficient customer acquisition strategies.

Balance sheets reveal financial health. Companies with strong cash flow and low debt can invest more. Those with weak finances may face pressure.

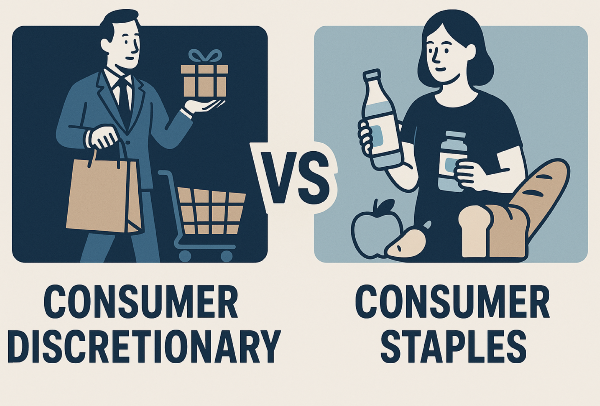

Why Internet Retail Stocks Fit in a Consumer Discretionary Portfolio

Internet retail stocks rise and fall with consumer spending. When people feel confident, they shop more online. When the economy slows, they may cut back.

These stocks offer exposure to digital trends and global markets. They complement other cyclical holdings like travel, apparel, and restaurants.

Some companies also offer defensive traits. Subscription models and essential goods can provide steady revenue. This helps balance risk in a portfolio.

Using StockBossUp to Find the Best Picks

StockBossUp ranks internet retail stocks based on top investor performance. These rankings update daily. That means you always see the most current views.

If the list shows only a few stocks, it may mean the community is cautious. When few stocks are rated a Buy, it reflects lower confidence. This can help investors avoid weak sectors.

You can explore each stock’s profile, review investor notes, and compare performance. This helps you make informed decisions based on real data and community insight.

Conclusion

Internet retail stocks offer scale, innovation, and global reach. They benefit from mobile shopping, AI tools, and fast logistics. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, you can stay ahead of trends in this fast-moving industry.

Internet retail stocks have reshaped how people shop. From mobile apps to global marketplaces, these companies offer convenience, speed, and variety. They belong to the consumer discretionary sector, meaning their performance often reflects consumer confidence and spending habits.

Investors watch this space closely. Internet retailers scale quickly, reach global audiences, and adapt to trends faster than traditional stores. But they also face intense competition, rising costs, and shifting customer expectations.

StockBossUp ranks internet retail stocks using a community-driven system. These rankings come from top investors who consistently outperform. The list updates daily, giving readers a fresh look at which stocks stand out.

Sometimes you may see only a few stocks listed—or none at all. That doesn’t mean the industry is weak. It often means the community is not ranking many stocks in this industry a Buy. When sentiment is cautious, fewer stocks rise to the top.

What Makes Internet Retail Stocks Unique

Internet retailers operate with fewer physical locations. This lowers overhead and allows faster expansion. Many use data to personalize shopping, improve logistics, and boost customer loyalty.

These companies often serve global markets. That brings opportunity but also risk. Currency shifts, regulations, and shipping delays can affect performance.

Customer acquisition is key. Brands spend heavily on ads, influencers, and search rankings. Those with strong loyalty programs or subscription models may spend less to retain users.

Internet Retail Categories

Top Internet Retail Stocks to Watch

Below are examples of well-known internet retail companies. These are not recommendations. They show the types of businesses investors often follow.

1. Amazon

Amazon (AMZN)

Amazon is the largest online marketplace. It offers fast delivery, a wide product range, and strong logistics. Investors watch its cloud business and retail margins closely.

2. Alibaba

Alibaba (BABA)

Alibaba dominates e-commerce in China. It runs marketplaces, payment systems, and cloud services. Global expansion and regulatory risks affect its outlook.

3. Etsy

Etsy (ETSY)

Etsy focuses on handmade and vintage goods. Its niche appeal and loyal customer base help it stand out. Marketing and seller support drive growth.

4. Chewy

Chewy (CHWY)

Chewy sells pet products online. It offers auto-ship options and strong customer service. Investors watch its margins and repeat order rates.

5. Wayfair

Wayfair (W)

Wayfair sells furniture and home goods. It relies on logistics and supplier partnerships. Profitability and customer retention are key metrics.

Trends Driving Internet Retail Stock Performance

Mobile shopping continues to grow. Many customers use apps for fast browsing and checkout. Retailers that optimize mobile experiences often see higher conversion rates.

AI helps personalize shopping. Algorithms suggest products, adjust prices, and improve search. This boosts engagement and sales.

Logistics innovation matters. Fast delivery and easy returns improve customer satisfaction. Companies that invest in fulfillment often gain an edge.

Sustainability is rising. Customers want ethical sourcing, low-waste packaging, and carbon-neutral shipping. Brands that meet these goals build loyalty.

Social commerce is expanding. Influencers and live shopping events drive traffic. Retailers that tap into these trends may grow faster.

Key Metrics for Internet Retail Stocks

Evaluating Internet Retail Stocks Like a Pro

Start with revenue and user growth. These show whether a company is expanding. Look at gross margins to see how well it manages costs.

Check customer retention. Subscription models and loyalty programs help reduce churn. High repeat order rates signal strong brand value.

Marketing spend matters. Companies that spend too much may struggle to turn a profit. Look for efficient customer acquisition strategies.

Balance sheets reveal financial health. Companies with strong cash flow and low debt can invest more. Those with weak finances may face pressure.

Why Internet Retail Stocks Fit in a Consumer Discretionary Portfolio

Internet retail stocks rise and fall with consumer spending. When people feel confident, they shop more online. When the economy slows, they may cut back.

These stocks offer exposure to digital trends and global markets. They complement other cyclical holdings like travel, apparel, and restaurants.

Some companies also offer defensive traits. Subscription models and essential goods can provide steady revenue. This helps balance risk in a portfolio.

Using StockBossUp to Find the Best Picks

StockBossUp ranks internet retail stocks based on top investor performance. These rankings update daily. That means you always see the most current views.

If the list shows only a few stocks, it may mean the community is cautious. When few stocks are rated a Buy, it reflects lower confidence. This can help investors avoid weak sectors.

You can explore each stock’s profile, review investor notes, and compare performance. This helps you make informed decisions based on real data and community insight.

Conclusion

Internet retail stocks offer scale, innovation, and global reach. They benefit from mobile shopping, AI tools, and fast logistics. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, you can stay ahead of trends in this fast-moving industry.