Specialty retail stocks offer targeted exposure to consumer trends, brand loyalty, and niche product categories. Check out the top picks ranked by the StockBossUp community, with daily updates based on investor performance.

The Top Specialty Retail Stocks

Specialty retail stocks represent companies that focus on specific product categories. These businesses often serve loyal customer bases and offer curated experiences. From beauty and wellness to home goods and sporting gear, specialty retailers thrive on differentiation.

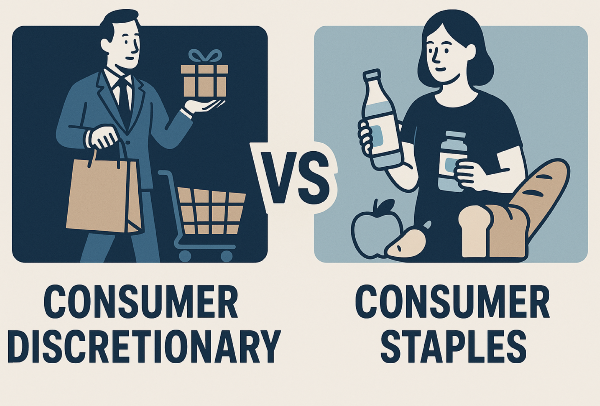

This industry belongs to the consumer discretionary sector. That means performance often rises and falls with consumer confidence. When people feel secure, they spend more on lifestyle purchases. When the economy slows, they may cut back.

StockBossUp ranks specialty retail stocks using a community-driven system. The rankings come from top investors who consistently outperform. These rankings update daily, giving readers a fresh look at which stocks stand out.

Sometimes you may see only a few stocks listed—or none at all. That doesn’t mean the industry is weak. It often means the community is not ranking many stocks in this industry a Buy. When sentiment is cautious, fewer stocks rise to the top.

What Makes Specialty Retail Stocks Unique

Specialty retailers focus on narrow product categories. This allows them to build strong brands and loyal customers. They often offer higher margins than general retailers because of product differentiation.

These companies also face unique risks. Inventory management is critical. If they misjudge demand, they may face markdowns. Seasonality can affect sales, especially in apparel and home goods.

Digital transformation is key. Many specialty retailers invest in e-commerce, mobile apps, and loyalty programs. Those that blend online and in-store experiences often perform better.

Specialty Retail Categories

| Category |

Focus Area |

Investor Notes |

| Apparel & Footwear |

Fashion, performance gear |

Sensitive to trends |

| Home & Lifestyle |

Furniture, décor, kitchenware |

Seasonal demand |

| Beauty & Wellness |

Cosmetics, skincare, fragrance |

High margins, loyal customers |

| Hobby & Recreation |

Sports, gaming, crafts |

Passion-driven purchases |

Top Specialty Retail Stocks to Watch

Below are examples of well-known specialty retail companies. These are not recommendations. They show the types of businesses investors often follow.

1. Ulta Beauty

Ulta Beauty (ULTA)

Ulta offers cosmetics, skincare, and salon services. It has strong loyalty programs and exclusive product lines. Investors watch its margins and store expansion.

2. Tractor Supply Company

Tractor Supply (TSCO)

Tractor Supply serves rural communities with farm, pet, and home products. Its niche focus and steady demand make it a favorite among value investors.

3. Williams-Sonoma

Williams-Sonoma (WSM)

Williams-Sonoma sells premium kitchenware and home furnishings. It owns brands like Pottery Barn and West Elm. Investors track its e-commerce growth and design trends.

4. Dick’s Sporting Goods

Dick’s (DKS)

Dick’s offers sporting goods, apparel, and outdoor gear. It benefits from fitness trends and youth sports. Store layout and inventory control are key factors.

5. Bath & Body Works

Bath & Body Works (BBWI)

BBWI sells fragrance, skincare, and home scents. It has strong seasonal sales and brand recognition. Investors watch its product launches and margin trends.

Trends Driving Specialty Retail Stock Performance

Omnichannel retail is growing. Customers want seamless experiences across online and in-store. Retailers that invest in tech and logistics often gain an edge.

Personalization matters. Loyalty programs, targeted ads, and curated product bundles help increase engagement. Companies that use data well can boost repeat purchases.

Sustainability is rising. Customers want ethical sourcing, eco-friendly packaging, and transparent supply chains. Brands that meet these goals build trust.

Experiential retail is expanding. In-store events, workshops, and interactive displays attract foot traffic. Retailers that offer more than just products often see stronger loyalty.

Key Metrics for Specialty Retail Stocks

| Metric |

Why It Matters |

Impact on Investors |

| Same-Store Sales |

Tracks organic growth |

Higher numbers signal demand |

| Operating Margin |

Measures efficiency |

Strong margins attract capital |

| Inventory Turnover |

Shows product movement |

High turnover reduces markdowns |

| Loyalty Program Size |

Indicates customer retention |

Larger programs boost stability |

Evaluating Specialty Retail Stocks Like a Pro

Start with revenue and same-store sales. These show whether a company is growing organically. Look at margins to see how well it controls costs.

Check inventory turnover. Companies that move products quickly avoid markdowns. Slow turnover may signal weak demand or poor planning.

Brand strength matters. Loyal customers help companies weather downturns. Marketing, product quality, and service all support brand value.

Balance sheets reveal financial health. Companies with strong cash flow and low debt can invest more. Those with weak finances may struggle during slow periods.

Why Specialty Retail Stocks Fit in a Consumer Discretionary Portfolio

Specialty retail stocks rise and fall with consumer spending. When people feel confident, they spend more on lifestyle products. When the economy slows, they may cut back.

These stocks offer exposure to fashion, wellness, and hobbies. They complement other cyclical holdings like travel, restaurants, and entertainment.

Some companies also offer defensive traits. Beauty and wellness brands often see steady demand. That helps balance risk in a portfolio.

Using StockBossUp to Find the Best Picks

StockBossUp ranks specialty retail stocks based on top investor performance. These rankings update daily. That means you always see the most current views.

If the list shows only a few stocks, it may mean the community is cautious. When few stocks are rated a Buy, it reflects lower confidence. This can help investors avoid weak sectors.

You can explore each stock’s profile, review investor notes, and compare performance. This helps you make informed decisions based on real data and community insight.

Conclusion

Specialty retail stocks offer targeted exposure to consumer trends. They benefit from brand loyalty, curated experiences, and niche product categories. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, you can stay ahead of trends in this dynamic industry.

Specialty retail stocks offer targeted exposure to consumer trends, brand loyalty, and niche product categories. Check out the top picks ranked by the StockBossUp community, with daily updates based on investor performance.

The Top Specialty Retail Stocks

Specialty retail stocks represent companies that focus on specific product categories. These businesses often serve loyal customer bases and offer curated experiences. From beauty and wellness to home goods and sporting gear, specialty retailers thrive on differentiation.

This industry belongs to the consumer discretionary sector. That means performance often rises and falls with consumer confidence. When people feel secure, they spend more on lifestyle purchases. When the economy slows, they may cut back.

StockBossUp ranks specialty retail stocks using a community-driven system. The rankings come from top investors who consistently outperform. These rankings update daily, giving readers a fresh look at which stocks stand out.

Sometimes you may see only a few stocks listed—or none at all. That doesn’t mean the industry is weak. It often means the community is not ranking many stocks in this industry a Buy. When sentiment is cautious, fewer stocks rise to the top.

What Makes Specialty Retail Stocks Unique

Specialty retailers focus on narrow product categories. This allows them to build strong brands and loyal customers. They often offer higher margins than general retailers because of product differentiation.

These companies also face unique risks. Inventory management is critical. If they misjudge demand, they may face markdowns. Seasonality can affect sales, especially in apparel and home goods.

Digital transformation is key. Many specialty retailers invest in e-commerce, mobile apps, and loyalty programs. Those that blend online and in-store experiences often perform better.

Specialty Retail Categories

Top Specialty Retail Stocks to Watch

Below are examples of well-known specialty retail companies. These are not recommendations. They show the types of businesses investors often follow.

1. Ulta Beauty

Ulta Beauty (ULTA)

Ulta offers cosmetics, skincare, and salon services. It has strong loyalty programs and exclusive product lines. Investors watch its margins and store expansion.

2. Tractor Supply Company

Tractor Supply (TSCO)

Tractor Supply serves rural communities with farm, pet, and home products. Its niche focus and steady demand make it a favorite among value investors.

3. Williams-Sonoma

Williams-Sonoma (WSM)

Williams-Sonoma sells premium kitchenware and home furnishings. It owns brands like Pottery Barn and West Elm. Investors track its e-commerce growth and design trends.

4. Dick’s Sporting Goods

Dick’s (DKS)

Dick’s offers sporting goods, apparel, and outdoor gear. It benefits from fitness trends and youth sports. Store layout and inventory control are key factors.

5. Bath & Body Works

Bath & Body Works (BBWI)

BBWI sells fragrance, skincare, and home scents. It has strong seasonal sales and brand recognition. Investors watch its product launches and margin trends.

Trends Driving Specialty Retail Stock Performance

Omnichannel retail is growing. Customers want seamless experiences across online and in-store. Retailers that invest in tech and logistics often gain an edge.

Personalization matters. Loyalty programs, targeted ads, and curated product bundles help increase engagement. Companies that use data well can boost repeat purchases.

Sustainability is rising. Customers want ethical sourcing, eco-friendly packaging, and transparent supply chains. Brands that meet these goals build trust.

Experiential retail is expanding. In-store events, workshops, and interactive displays attract foot traffic. Retailers that offer more than just products often see stronger loyalty.

Key Metrics for Specialty Retail Stocks

Evaluating Specialty Retail Stocks Like a Pro

Start with revenue and same-store sales. These show whether a company is growing organically. Look at margins to see how well it controls costs.

Check inventory turnover. Companies that move products quickly avoid markdowns. Slow turnover may signal weak demand or poor planning.

Brand strength matters. Loyal customers help companies weather downturns. Marketing, product quality, and service all support brand value.

Balance sheets reveal financial health. Companies with strong cash flow and low debt can invest more. Those with weak finances may struggle during slow periods.

Why Specialty Retail Stocks Fit in a Consumer Discretionary Portfolio

Specialty retail stocks rise and fall with consumer spending. When people feel confident, they spend more on lifestyle products. When the economy slows, they may cut back.

These stocks offer exposure to fashion, wellness, and hobbies. They complement other cyclical holdings like travel, restaurants, and entertainment.

Some companies also offer defensive traits. Beauty and wellness brands often see steady demand. That helps balance risk in a portfolio.

Using StockBossUp to Find the Best Picks

StockBossUp ranks specialty retail stocks based on top investor performance. These rankings update daily. That means you always see the most current views.

If the list shows only a few stocks, it may mean the community is cautious. When few stocks are rated a Buy, it reflects lower confidence. This can help investors avoid weak sectors.

You can explore each stock’s profile, review investor notes, and compare performance. This helps you make informed decisions based on real data and community insight.

Conclusion

Specialty retail stocks offer targeted exposure to consumer trends. They benefit from brand loyalty, curated experiences, and niche product categories. Community rankings on StockBossUp make it easier to see which companies top investors favor. With daily updates and clear insights, you can stay ahead of trends in this dynamic industry.